Living on a tight budget can be challenging, but with the right mindset and strategies, it’s possible to cut back on unnecessary expenses and make the most of your hard-earned money. The concept of being “penny wise” refers to the practice of being extremely frugal and mindful of every penny spent. In this article, we’ll explore 12 practical tips to help you save money and adopt a more penny-wise approach to personal finance.

First and foremost, it’s essential to understand that saving money is not just about cutting back on expenses, but also about making conscious financial decisions that align with your long-term goals. This might involve sacrificing some comforts in the short term, but the benefits of having a safety net and achieving financial stability far outweigh the temporary sacrifices.

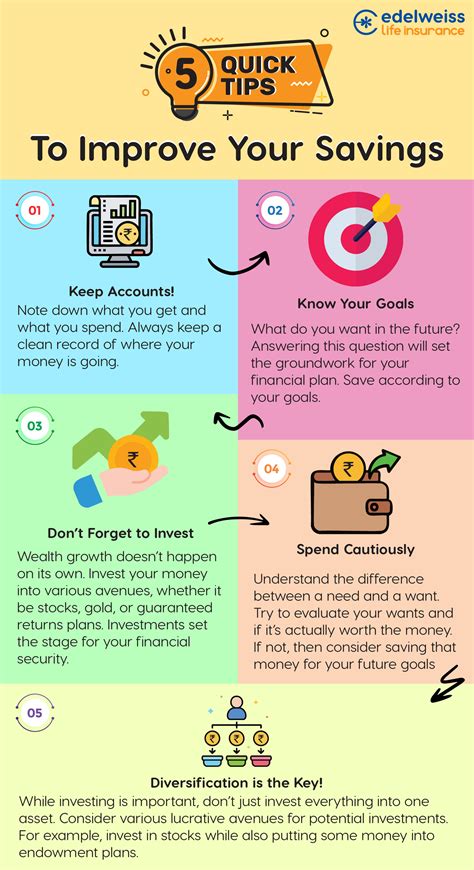

One of the most effective ways to start saving money is to track your expenses diligently. For one month, write down every single transaction you make, no matter how small, in a notebook or use an app to log your spending. This exercise will help you identify areas where you can cut back and make adjustments to your spending habits. You might be surprised at how much you’re spending on things like dining out, subscription services, or impulse purchases.

Another crucial aspect of saving money is to create a budget that works for you. Based on your income, expenses, and financial goals, allocate your money into categories such as rent, utilities, groceries, transportation, and entertainment. Be sure to prioritize your needs over your wants and make adjustments as needed. A budgeting app or spreadsheet can help you stay organized and on track.

Now, let’s dive into the 12 penny-wise tips to save money:

Cook at home: Eating out can be a significant expense, especially if you do it frequently. Cooking at home not only saves you money, but it also allows you to prepare healthy meals and avoid processed foods. Plan your meals, make a grocery list, and shop smart to reduce food waste and save on groceries.

Cancel subscription services: Take a close look at your subscription services such as streaming platforms, gym memberships, and magazine subscriptions. Cancel any services that you don’t use regularly or that don’t provide significant value to your life. Consider alternatives like public libraries, free workout videos, or community events.

Use the 50/30/20 rule: Allocate 50% of your income towards necessary expenses like rent, utilities, and groceries. Use 30% for discretionary spending like entertainment, hobbies, and travel. And, put 20% towards saving and debt repayment. This rule will help you prioritize your spending and make progress towards your financial goals.

Avoid impulse purchases: Create a 30-day waiting period for non-essential purchases to help you determine if the item is something you truly need or if the desire to buy was just an impulsive want. This waiting period can help you avoid wasting money on things that don’t add value to your life.

Shop smart: Plan your shopping trips, use coupons, and look for discounts on items you need. Consider buying generic or store-brand products, which are often cheaper and of similar quality to name-brand products. Avoid shopping when you’re feeling emotional or hungry, as this can lead to impulse purchases.

Use cashback and rewards: Use cashback credit cards or sign up for rewards programs that offer cash or discounts on items you regularly purchase. Just be sure to pay your balance in full each month to avoid interest charges.

Save on transportation: Consider carpooling, using public transportation, or biking to work to save on fuel, maintenance, and parking costs. If you need to own a car, look for fuel-efficient models and maintain your vehicle regularly to reduce repair costs.

Use energy-efficient appliances: Replace traditional incandescent bulbs with LED bulbs, and use energy-efficient appliances to reduce your utility bills. These small changes can add up to significant savings over time.

Avoid bank fees: Choose a bank with low or no fees, and avoid using out-of-network ATMs to save on charges. Consider using a credit union or online bank, which often offer lower fees and better interest rates.

Use the envelope system: Divide your expenses into categories and place the corresponding budgeted amount into an envelope for each category. This visual system can help you stick to your budget and avoid overspending.

Save on entertainment: Look for free or low-cost entertainment options like parks, museums, or community events. Use streaming services or borrow books and movies from the library instead of buying them. Consider hosting potluck dinners or game nights with friends instead of going out to expensive restaurants or bars.

Take advantage of sales tax holidays: If your state offers sales tax holidays, plan your purchases strategically to save on taxes. Stock up on essentials like clothing, school supplies, or home goods during these periods to reduce your expenses.

In conclusion, adopting a penny-wise approach to personal finance requires discipline, patience, and creativity. By implementing these 12 tips, you’ll be well on your way to saving money, reducing waste, and achieving financial stability. Remember, every small change you make can add up to significant savings over time, so start today and watch your pennies grow into dollars.

What is the first step in creating a budget?

+The first step in creating a budget is to track your expenses for one month to identify areas where you can cut back and make adjustments to your spending habits.

How can I avoid impulse purchases?

+Create a 30-day waiting period for non-essential purchases to help you determine if the item is something you truly need or if the desire to buy was just an impulsive want.

What are some ways to save on entertainment?

+Look for free or low-cost entertainment options like parks, museums, or community events. Use streaming services or borrow books and movies from the library instead of buying them. Consider hosting potluck dinners or game nights with friends instead of going out to expensive restaurants or bars.

How can I make the most of sales tax holidays?

+Plan your purchases strategically to save on taxes. Stock up on essentials like clothing, school supplies, or home goods during these periods to reduce your expenses.

What is the 50/30/20 rule, and how can it help me save money?

+The 50/30/20 rule is a budgeting guideline that allocates 50% of your income towards necessary expenses, 30% towards discretionary spending, and 20% towards saving and debt repayment. This rule can help you prioritize your spending and make progress towards your financial goals.

How can I avoid bank fees?

+Choose a bank with low or no fees, and avoid using out-of-network ATMs to save on charges. Consider using a credit union or online bank, which often offer lower fees and better interest rates.

In addition to these tips, it’s essential to stay informed about personal finance and continue to educate yourself on ways to save money and achieve financial stability. By being penny-wise and making conscious financial decisions, you can build a secure financial future and enjoy peace of mind. Remember, saving money is a journey, and every small step you take can lead to significant progress over time.