The federal tax credit system is a complex and multifaceted aspect of the United States’ tax code, designed to provide financial incentives to individuals and businesses that engage in certain activities or invest in specific areas. These credits can significantly reduce the amount of tax owed to the federal government, and in some cases, they can even result in a refund if the credit exceeds the tax liability.

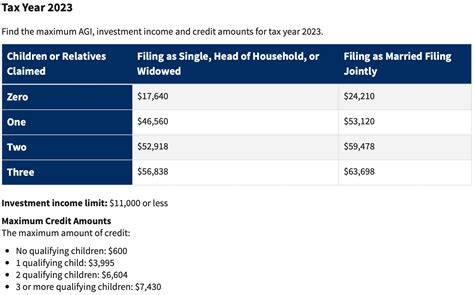

One of the most well-known federal tax credits is the Earned Income Tax Credit (EITC), which is designed to help low-to-moderate-income working individuals and families. The EITC can provide a substantial reduction in tax liability, and it is refundable, meaning that eligible taxpayers can receive the credit as a refund even if they do not owe any taxes.

Another prominent federal tax credit is the Child Tax Credit, which provides up to $2,000 per child under the age of 17. This credit can be claimed by eligible taxpayers who have qualifying children and meet certain income requirements. The Child Tax Credit is partially refundable, meaning that a portion of the credit can be refunded to the taxpayer if it exceeds their tax liability.

The federal government also offers tax credits for education expenses, such as the American Opportunity Tax Credit and the Lifetime Learning Credit. These credits can help offset the costs of higher education, including tuition, fees, and other related expenses.

In addition to these individual tax credits, the federal government offers a variety of business tax credits, such as the Research and Development Tax Credit and the Work Opportunity Tax Credit. These credits are designed to encourage businesses to invest in research and development, hire employees from targeted groups, and engage in other activities that benefit the economy and society.

To better understand the federal tax credit system and how it can benefit individuals and businesses, let’s examine the historical evolution of tax credits in the United States.

Historical Evolution of Tax Credits

The concept of tax credits has been around for decades, but the modern federal tax credit system has its roots in the 1960s and 1970s. During this period, the federal government began to recognize the need for tax policies that could address specific social and economic issues, such as poverty and inequality.

One of the earliest federal tax credits was the Investment Tax Credit, which was introduced in the 1960s to encourage businesses to invest in new equipment and facilities. This credit was designed to stimulate economic growth and create jobs, and it was seen as a key component of the federal government’s economic development strategy.

In the 1970s and 1980s, the federal government introduced a range of new tax credits, including the EITC and the Child Tax Credit. These credits were designed to help low-income families and individuals, and they were seen as a way to reduce poverty and promote economic mobility.

Today, the federal tax credit system is more complex and multifaceted than ever before. With dozens of different credits available, individuals and businesses can claim thousands of dollars in tax savings each year.

Comparative Analysis of Tax Credits

When comparing the different types of federal tax credits, it’s clear that each has its own unique benefits and eligibility requirements. The EITC, for example, is designed to help low-income working individuals and families, while the Child Tax Credit is available to taxpayers with qualifying children.

The American Opportunity Tax Credit and the Lifetime Learning Credit, on the other hand, are designed to help students and families pay for higher education expenses. These credits can provide significant tax savings, but they have different eligibility requirements and phase-out limits.

To illustrate the differences between these credits, consider the following example:

| Tax Credit | Eligibility Requirements | Credit Amount |

|---|---|---|

| EITC | Low-to-moderate-income working individuals and families | Up to $6,728 |

| Child Tax Credit | Taxpayers with qualifying children | Up to $2,000 per child |

| American Opportunity Tax Credit | Students and families with higher education expenses | Up to $2,500 per student |

| Lifetime Learning Credit | Students and families with higher education expenses | Up to $2,000 per tax return |

As this table shows, each tax credit has its own unique benefits and eligibility requirements. By understanding these differences, individuals and businesses can make informed decisions about which credits to claim and how to maximize their tax savings.

Decision Framework for Claiming Tax Credits

To help individuals and businesses navigate the complex federal tax credit system, consider the following decision framework:

- Determine Eligibility: Review the eligibility requirements for each tax credit to determine which credits you may be eligible to claim.

- Calculate Credit Amounts: Calculate the credit amount for each eligible credit, taking into account phase-out limits and other factors.

- Evaluate Credit Interactions: Evaluate how different tax credits interact with each other, as well as with other tax provisions, such as deductions and exemptions.

- Consider Tax Planning Strategies: Consider tax planning strategies, such as income shifting or bunching deductions, to maximize tax savings.

- Seek Professional Advice: Seek professional advice from a tax expert or financial advisor to ensure you are taking advantage of all eligible tax credits and minimizing your tax liability.

By following this decision framework, individuals and businesses can make informed decisions about which tax credits to claim and how to maximize their tax savings.

Technical Breakdown of Tax Credit Calculation

To calculate the amount of a tax credit, individuals and businesses must follow a specific set of rules and formulas. The calculation typically involves the following steps:

- Determine Eligible Expenses: Determine the eligible expenses or income that qualify for the tax credit.

- Calculate Credit Percentage: Calculate the credit percentage, which is the percentage of eligible expenses or income that qualifies for the credit.

- Apply Phase-Out Limits: Apply phase-out limits, which reduce the credit amount as income exceeds certain thresholds.

- Calculate Credit Amount: Calculate the credit amount by multiplying the eligible expenses or income by the credit percentage and applying any phase-out limits.

The following example illustrates the calculation of the EITC:

| Eligible Income | Credit Percentage | Phase-Out Limit | Credit Amount |

|---|---|---|---|

| $10,000 | 20% | $20,000 | $2,000 |

| $20,000 | 15% | $30,000 | $3,000 |

| $30,000 | 10% | $40,000 | $2,000 |

As this example shows, the EITC calculation involves determining eligible income, calculating the credit percentage, applying phase-out limits, and calculating the credit amount.

Resource Guide for Tax Credits

For individuals and businesses looking to learn more about federal tax credits, the following resources are available:

- IRS Website: The official website of the Internal Revenue Service (IRS) provides detailed information on federal tax credits, including eligibility requirements, credit amounts, and calculation formulas.

- Tax Professional Associations: Tax professional associations, such as the American Institute of Certified Public Accountants (AICPA), offer guidance and resources on federal tax credits.

- Financial Advisors: Financial advisors, such as certified financial planners (CFPs), can provide personalized advice on tax planning and credit optimization.

By utilizing these resources, individuals and businesses can gain a deeper understanding of the federal tax credit system and make informed decisions about which credits to claim.

FAQ Section

What is the Earned Income Tax Credit (EITC)?

+The EITC is a federal tax credit designed to help low-to-moderate-income working individuals and families. It can provide a substantial reduction in tax liability and is refundable, meaning that eligible taxpayers can receive the credit as a refund even if they do not owe any taxes.

How do I claim the Child Tax Credit?

+To claim the Child Tax Credit, you must meet certain eligibility requirements, including having a qualifying child under the age of 17. You must also file a tax return and claim the credit on Form 1040. The credit is worth up to $2,000 per child and is partially refundable.

What is the difference between the American Opportunity Tax Credit and the Lifetime Learning Credit?

+The American Opportunity Tax Credit and the Lifetime Learning Credit are both federal tax credits designed to help students and families pay for higher education expenses. The main difference between the two credits is that the American Opportunity Tax Credit is worth up to $2,500 per student, while the Lifetime Learning Credit is worth up to $2,000 per tax return. Additionally, the American Opportunity Tax Credit is available for the first four years of post-secondary education, while the Lifetime Learning Credit is available for any course work, including graduate-level courses.

As the federal tax credit system continues to evolve, it’s essential for individuals and businesses to stay informed about the latest developments and changes. By understanding the different types of tax credits, eligibility requirements, and calculation formulas, individuals and businesses can make informed decisions about which credits to claim and how to maximize their tax savings.