The world of federal tax credits can be a complex and daunting place, but understanding the benefits and how to claim them can make a significant difference in your tax savings. As the tax landscape continues to evolve, it’s essential to stay informed about the various credits available and how they can impact your financial situation. In this article, we’ll delve into the realm of federal tax credits, exploring the different types, eligibility requirements, and the process of claiming these valuable savings.

Understanding Federal Tax Credits

Federal tax credits are direct reductions to your tax liability, unlike deductions, which reduce your taxable income. These credits can be claimed for a variety of purposes, including education expenses, childcare costs, home improvements, and more. The key to maximizing your tax savings is to understand the different types of credits available and ensure you meet the eligibility requirements.

Types of Federal Tax Credits

- Earned Income Tax Credit (EITC): Designed for low-to-moderate-income working individuals and families, the EITC can provide a significant refund. The credit amount varies based on income, filing status, and the number of qualifying children.

- Child Tax Credit: This credit is available for families with qualifying children under the age of 17. The credit amount is $2,000 per child, with a portion being refundable.

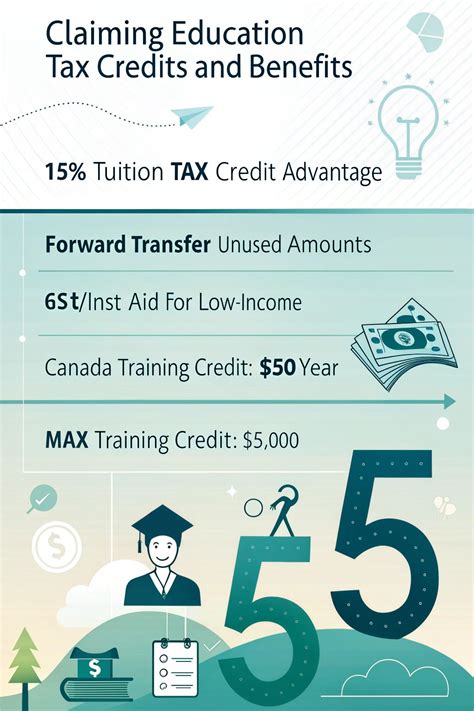

- American Opportunity Tax Credit (AOTC): The AOTC is a valuable credit for education expenses, covering up to $2,500 of qualified tuition and fees for higher education.

- Lifetime Learning Credit (LLC): The LLC is another education-related credit, offering up to $2,000 in tax savings for courses taken at an eligible educational institution.

- Residential Energy Efficient Property Credit: Homeowners can claim a credit for installing energy-efficient systems, such as solar panels or wind turbines, to reduce their energy consumption.

Eligibility Requirements and Claiming Process

To claim federal tax credits, you must meet specific eligibility requirements, which vary depending on the credit. Generally, you’ll need to:

- File a tax return: You must file a tax return to claim tax credits, even if you don’t owe taxes.

- Meet income requirements: Many credits have income limits, so it’s essential to review the eligibility criteria.

- Provide required documentation: You may need to provide documentation, such as receipts or records, to support your credit claim.

- Complete the relevant tax forms: You’ll need to complete the relevant tax forms, such as Form 5695 for the Residential Energy Efficient Property Credit.

It's crucial to carefully review the eligibility requirements and claim process for each tax credit to ensure you receive the maximum savings. Consult with a tax professional or the IRS website if you're unsure about any aspect of the process.

Tips for Maximizing Your Tax Savings

- Keep accurate records: Maintain detailed records of expenses and documentation to support your credit claims.

- Consult a tax professional: If you’re unsure about any aspect of the tax credit process, consider consulting a tax professional.

- Stay informed about tax law changes: Tax laws and credits can change, so it’s essential to stay up-to-date on any changes that may impact your eligibility.

- Claim all eligible credits: Don’t miss out on potential savings by failing to claim all eligible credits.

Frequently Asked Questions

What is the difference between a tax credit and a tax deduction?

+A tax credit directly reduces your tax liability, while a tax deduction reduces your taxable income. For example, a $1,000 tax credit would reduce your tax bill by $1,000, whereas a $1,000 tax deduction would reduce your taxable income by $1,000, resulting in a lower tax bill.

Can I claim multiple tax credits on my tax return?

+Yes, you can claim multiple tax credits on your tax return, but you must meet the eligibility requirements for each credit. Consult with a tax professional to ensure you're claiming all eligible credits and meeting the necessary requirements.

How do I know if I'm eligible for a specific tax credit?

+Review the eligibility requirements for each tax credit, and consult with a tax professional or the IRS website if you're unsure. You can also use tax preparation software to help guide you through the process and ensure you're claiming all eligible credits.

In conclusion, federal tax credits can provide significant savings for eligible individuals and families. By understanding the different types of credits, eligibility requirements, and claim process, you can maximize your tax savings and reduce your tax liability. Remember to keep accurate records, consult with a tax professional if needed, and stay informed about tax law changes to ensure you’re taking advantage of all eligible credits.