Understanding the intricacies of federal tax credits can significantly impact the size of your refund. These credits are designed to reduce your tax liability, dollar for dollar, potentially leading to a larger refund or a reduced tax bill. However, navigating the complex landscape of tax credits, deductions, and exemptions can be daunting. This guide is crafted to help you maximize your refund by leveraging the most beneficial federal tax credits available.

Introduction to Federal Tax Credits

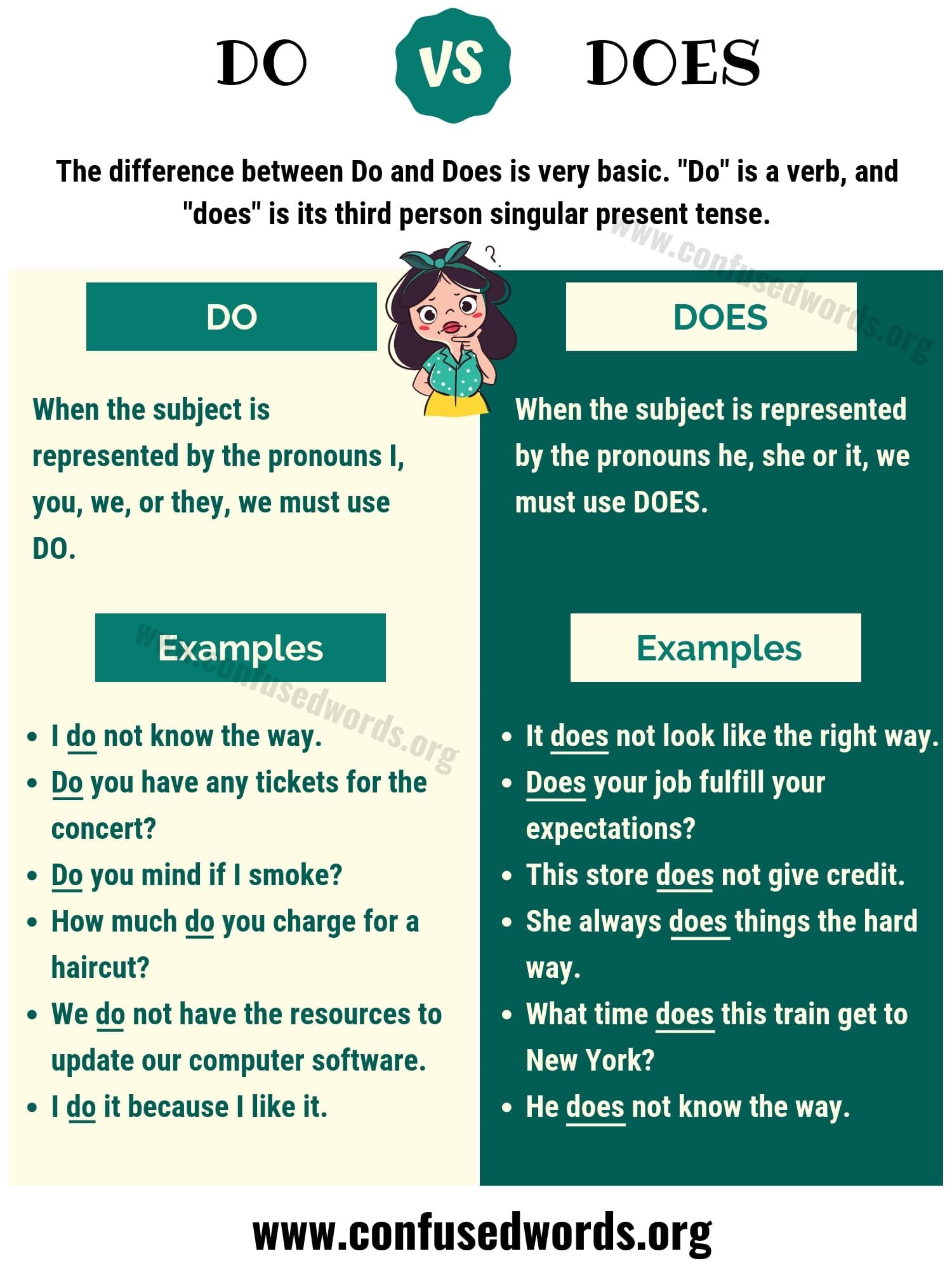

Before diving into the specifics, it’s essential to differentiate between tax deductions and tax credits. Deductions reduce your taxable income, which in turn reduces your tax liability. On the other hand, tax credits directly reduce the amount of tax you owe, making them generally more valuable. For instance, if you owe 1,000 in taxes and claim a 200 credit, your tax bill would be reduced to $800.

Overview of Key Federal Tax Credits

Several federal tax credits can significantly impact your refund. Here are some of the most impactful ones:

Earned Income Tax Credit (EITC): This credit is designed for low-to-moderate-income working individuals and families. The EITC can be substantial and, in many cases, results in a refund even if no taxes are owed.

Child Tax Credit: Aimed at families with qualifying children under the age of 17, this credit can provide up to 2,000 per child, with up to 1,400 being refundable.

American Opportunity Tax Credit (AOTC) and Lifetime Learning Credit (LLC): These credits are targeted at taxpayers who are pursuing higher education. The AOTC offers up to 2,500 per eligible student, while the LLC provides up to 2,000 per tax return.

Savers Credit: Also known as the Retirement Savings Contributions Credit, it’s designed for low-to-moderate-income workers who are saving for retirement through a qualified retirement account.

Child and Dependent Care Credit: This credit is for expenses related to the care of a child or other qualifying individuals that enable you to work or look for work.

Premium Tax Credit (PTC): If you purchased health insurance through the Health Insurance Marketplace, you might be eligible for this credit, which helps make your insurance premiums more affordable.

Strategic Planning for Tax Credits

To maximize your refund, consider the following strategies:

Adjust Your Withholding: If you consistently receive a large refund, you might want to adjust your withholding to have less tax withheld from your paycheck each month. This approach allows you to keep more of your money throughout the year rather than lending it to the government interest-free.

Stay Informed: Tax laws and credits can change annually. Staying informed about new credits or changes to existing ones can help you plan more effectively.

Contribute to Retirement Plans: Utilize tax-deferred retirement plans like 401(k), IRA, or Roth IRA. Not only can these reduce your taxable income, but contributions might also qualify you for the Savers Credit.

Keep Detailed Records: Maintaining detailed records of expenses related to childcare, education, and healthcare can help ensure you don’t miss out on any eligible credits.

Consult a Tax Professional: Given the complexity of tax law, consulting with a professional can provide personalized advice and help you navigate the system more efficiently.

Leveraging Tax Credits for Maximum Refund

To maximize your refund through federal tax credits, consider the following steps:

Identify Eligible Credits: Review the list of federal tax credits and determine which ones you might be eligible for based on your income, family size, education expenses, and other factors.

Gather Necessary Documents: Ensure you have all the required documents and receipts to support your claim for each credit.

Claim Credits Strategically: Some credits have income limits or phase-out ranges. Understanding how these credits interact with your income level can help you strategize your claim effectively.

File Electronically: Filing your taxes electronically with tax software can help identify credits you might be eligible for and ensure accuracy in your return.

Consider Amending Returns: If you realize you missed a credit in a previous year, you might be able to file an amended return to claim it.

Conclusion

Federal tax credits offer a powerful way to reduce your tax liability and maximize your refund. By understanding which credits you are eligible for and planning strategically, you can make the most of these incentives. Remember, the key to maximizing your refund through federal tax credits is a combination of staying informed, maintaining detailed records, and seeking professional advice when needed.

Frequently Asked Questions

What is the difference between a tax deduction and a tax credit?

+A tax deduction reduces your taxable income, while a tax credit directly reduces the amount of tax you owe, dollar for dollar.

Can I claim more than one tax credit on my tax return?

+Yes, you can claim multiple tax credits if you meet the eligibility criteria for each. However, some credits may have interactions or limitations, so it's essential to understand these before claiming.

How do I know if I am eligible for a particular tax credit?

+Eligibility for tax credits is based on specific criteria such as income level, family size, education expenses, etc. Reviewing the criteria for each credit or consulting with a tax professional can help determine your eligibility.

By leveraging these insights and strategies, you can more effectively navigate the federal tax credit system and maximize your refund. Remember, understanding and planning are key to making the most of these valuable incentives.