In the realm of financial planning and retirement security, annuities play a vital role for many individuals and businesses. Among the array of companies offering annuity products, Mutual of America stands out for its unique blend of financial strength, extensive product lineup, and commitment to customer satisfaction. Understanding how Mutual of America works, particularly in relation to its annuity benefits, is crucial for anyone considering their services.

Introduction to Mutual of America

Mutual of America is a leading provider of retirement plan services and products, including annuities. Founded in 1945, the company has built a reputation for reliability, flexibility, and a customer-centric approach. As a mutual company, Mutual of America is owned by its policyholders, which distinguishes it from publicly traded companies. This structure allows the company to focus on long-term relationships and policyholder benefits rather than short-term profits for shareholders.

Annuity Products Offered by Mutual of America

Mutual of America offers a range of annuity products designed to meet various financial goals and risk tolerance levels. These include:

- Fixed Annuities: Provide a guaranteed interest rate for a specified period, offering a predictable income stream.

- Variable Annuities: Allow policyholders to invest in a variety of assets, potentially higher returns but also come with investment risks.

- Indexed Annuities: Combine features of fixed and variable annuities, with interest rates tied to the performance of a specific market index.

- Immediate Annuities: Begin paying out income immediately or shortly after purchase, often used to create a guaranteed income stream in retirement.

- Deferred Annuities: Allow policyholders to accumulate funds over time before initiating income payments, useful for long-term retirement planning.

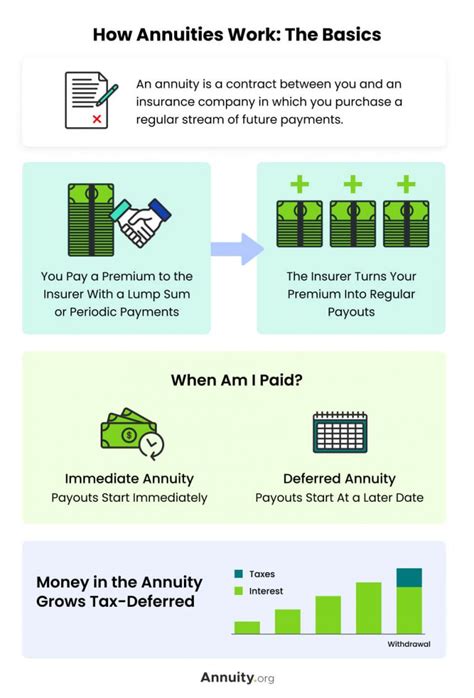

How Mutual of America Annuities Work

The process of purchasing and benefiting from a Mutual of America annuity involves several steps:

- Selection: Potential policyholders select an annuity product that aligns with their financial objectives, risk tolerance, and time horizon.

- Purchase: The annuity is purchased with either a lump sum or a series of payments, known as premiums.

- Accumulation Phase: For deferred annuities, the funds grow over time, either at a fixed interest rate, through investments, or based on the performance of a specific index.

- Distribution Phase: Upon reaching the designated start date, the annuity begins making payments to the policyholder, providing a steady income stream.

Benefits of Mutual of America Annuities

Mutual of America’s annuity products come with several benefits, including:

- Guaranteed Income: Many annuities offer a guaranteed income stream for life, helping to alleviate concerns about outliving one’s assets in retirement.

- Tax-Deferred Growth: Earnings within the annuity grow tax-deferred, meaning policyholders won’t pay taxes until they withdraw the funds.

- Flexibility: Variety in product offerings allows policyholders to choose annuities that align closely with their unique financial situations and goals.

- Legacy Planning: Some annuities can include a death benefit, ensuring that beneficiaries receive a payment upon the policyholder’s passing.

Considerations and Next Steps

When considering Mutual of America for annuity benefits, it’s essential to weigh the pros and cons, including fees, surrender charges, and potential investment risks. Consulting with a financial advisor can provide personalized guidance tailored to one’s specific needs and circumstances. Additionally, reviewing the terms and conditions of the annuity contract carefully, including any riders or add-ons, is crucial for making an informed decision.

In conclusion, Mutual of America’s annuity products offer a range of benefits for individuals and businesses seeking to build retirement security. By understanding how these annuities work and considering the various options available, policyholders can make informed decisions that help achieve their long-term financial goals.

Frequently Asked Questions

What types of annuities does Mutual of America offer?

+Mutual of America offers a variety of annuities, including fixed, variable, indexed, immediate, and deferred annuities, designed to meet different financial goals and risk tolerances.

How do I purchase an annuity from Mutual of America?

+Purchasing an annuity from Mutual of America typically involves selecting the appropriate product, determining the purchase amount, and completing the application process, which may include a medical examination for certain products.

Are Mutual of America annuities suitable for everyone?

+No, annuities are not suitable for everyone. They are most beneficial for individuals seeking guaranteed income, tax-deferred savings, and legacy planning benefits. It's essential to consult with a financial advisor to determine if an annuity aligns with your financial situation and goals.

How do I contact Mutual of America for more information on their annuity products?

+Mutual of America can be reached through their official website, where you can find contact information, including phone numbers, email addresses, and physical locations of their offices. Additionally, you can consult with a financial advisor who is familiar with Mutual of America's products.

By exploring the features, benefits, and considerations of Mutual of America’s annuity products, individuals can make informed decisions that enhance their retirement security and achieve their long-term financial objectives.