Filling out the California 568 form, also known as the Limited Liability Company (LLC) Return of Income, can seem daunting, but with a step-by-step guide, you can navigate through it with ease. This form is required for all LLCs that are classified as partnerships or are disregarded entities and are doing business in California or have California source income. Here’s a detailed guide to help you complete the California 568 form accurately.

Step 1: Gather Necessary Documents

Before you start filling out the form, ensure you have all the necessary documents and information. This includes: - Your LLC’s federal tax return (Form 1065 for partnerships or Form 1040 for single-member LLCs treated as disregarded entities) - All K-1 forms (for partnerships) - Any additional schedules or forms that were part of your federal tax return - California source income documentation

Step 2: Download the Form and Instructions

Visit the California Franchise Tax Board (FTB) website to download the California 568 form and its instructions. The form and instructions are subject to change, so it’s crucial to get the most current version for the tax year you’re filing for.

Step 3: Identify Your LLC’s Classification

Determine how your LLC is classified for tax purposes: - Partnership: If your LLC has more than one owner, it’s likely classified as a partnership. - Disregarded Entity: If your LLC is a single-member LLC and you haven’t elected to be taxed as a corporation, it’s usually treated as a disregarded entity.

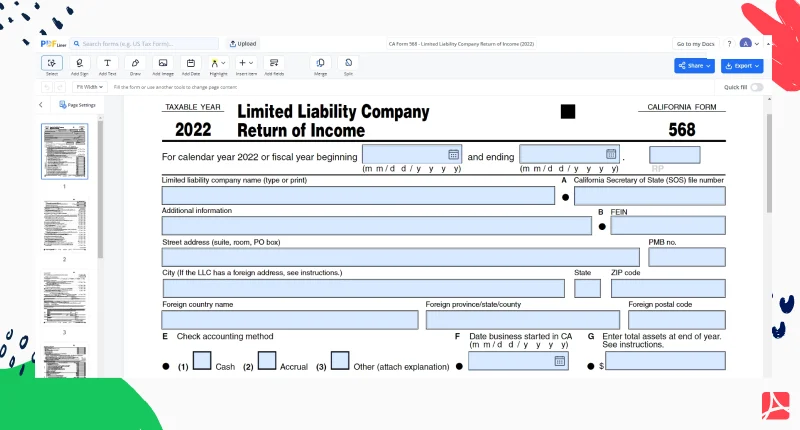

Step 4: Complete the Header Information

At the top of the form, you’ll need to fill in your LLC’s name, address, California Secretary of State (SOS) file number, and federal employer identification number (FEIN).

Step 5: Complete the Business Income Section

- If your LLC is classified as a partnership, you’ll report your business income on Schedule R. Transfer the ordinary business income from your federal Form 1065, Schedule K, Line 1.

- For single-member LLCs, report the business income on Schedule C (Form 1040) of your personal tax return, but you still need to complete the California 568 for state purposes.

Step 6: Calculate California Source Income

Determine what portion of your income is derived from California sources. This is crucial because California taxes income earned within the state. You may need to complete Schedule R-1 to apportion your income.

Step 7: Complete Schedules and Attachments

Depending on your LLC’s activities and income, you may need to complete additional schedules and forms, such as: - Schedule K (Shareholder’s Share of Income, Deductions, Credits, etc.) - Schedule K-1 (Shareholder’s Share of Income, Deductions, Credits, etc.) - Schedule R (Apportionment and Allocation of Income)

Step 8: Sign and Date the Form

Ensure the form is signed and dated. For partnerships, all general partners must sign, while for single-member LLCs, the owner or an authorized representative must sign.

Step 9: Submit the Form

The California 568 form must be filed by the 15th day of the 4th month after the close of the tax year. You can submit the form electronically through the CalFile program or by mail to the address listed in the instructions.

Step 10: Pay Any Tax Due

If you owe taxes, you can pay online, by phone, or by check. Make sure to follow the instructions for tax payments carefully to avoid any penalties or fees.

FAQ Section

What is the deadline for filing the California 568 form?

+The California 568 form must be filed by the 15th day of the 4th month after the close of the tax year.

Do I need to file the California 568 form if my LLC has no income?

+Yes, even if your LLC has no income, you are still required to file the California 568 form if you are doing business in California or have California source income.

Can I file the California 568 form electronically?

+Yes, you can file the California 568 form electronically through the CalFile program.

Conclusion

Filing the California 568 form requires careful attention to detail and a thorough understanding of your LLC’s tax situation. By following these steps and referring to the official instructions and tax professional advice when needed, you can ensure that your form is completed accurately and on time. Remember, tax laws and forms are subject to change, so it’s essential to stay updated on the latest requirements and regulations.