Santa Barbara, with its picturesque landscapes and desirable location, is a haven for homeowners and investors alike. However, like any other property ownership, it comes with its share of responsibilities, including the obligation to pay property taxes. Understanding how Santa Barbara property taxes work can be essential for both current and prospective property owners, as it directly impacts the overall cost of owning a property in this beautiful coastal city.

Overview of Property Taxes in Santa Barbara

Property taxes in Santa Barbara, as in the rest of California, are administered by the county. The Santa Barbara County Assessor’s office is responsible for assessing the value of properties, while the Santa Barbara County Treasurer-Tax Collector’s office handles the collection of taxes. The tax year runs from July 1 to June 30, with taxes typically due in two installments: the first installment is due on November 1 and delinquent if not paid by December 10, and the second installment is due on February 1 and delinquent if not paid by April 10.

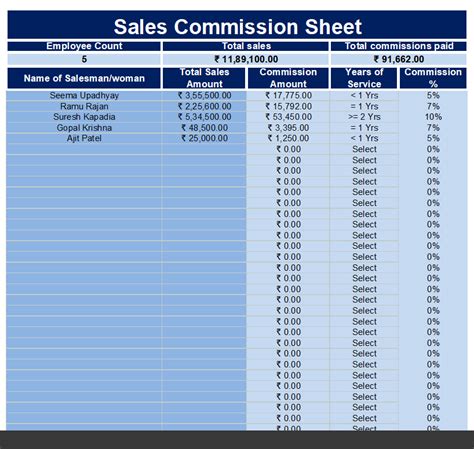

Calculation of Property Taxes

The calculation of property taxes in Santa Barbara involves several factors, primarily the assessed value of the property and the tax rate. In California, the assessed value is typically the purchase price of the property, and it can increase by no more than 2% per year unless there is a change in ownership or significant new construction. The overall tax rate includes not just the general property tax rate (which is 1% of the assessed value, as mandated by Proposition 13) but also any additional voter-approved taxes and fees for specific services like schools, water districts, and bond debt.

Proposition 13 and Its Impact

Proposition 13, passed in 1978, has a significant impact on how property taxes are calculated in California, including Santa Barbara. It limits the tax rate to 1% of the property’s assessed value and restricts annual increases in the assessed value to a maximum of 2% unless the property is sold or undergoes significant new construction. This proposition has been a topic of discussion regarding its effects on property tax revenue and the distribution of tax burdens between long-term and newer property owners.

Exemptions and Deductions

There are several exemptions and deductions available to property owners in Santa Barbara that can help reduce their tax liability. For example, the Homeowners’ Exemption can provide up to a 7,000 reduction in the assessed value of a primary residence, which translates to a 70 reduction in taxes (1% of $7,000). Other exemptions might be available for disabled veterans, seniors, or certain types of property use, such as for religious or charitable purposes.

Tax implications for Different Types of Properties

The impact of property taxes varies significantly depending on the type of property. For residential properties, the primary concern is often the direct financial impact of taxes on homeownership costs. For commercial properties, the approach might involve a more complex analysis, considering how property taxes affect the business’s bottom line, potential for rental income, and the overall investment return. Agricultural properties might have specific tax benefits or requirements, especially if they are used for qualifying agricultural purposes.

Strategies for Managing Property Tax Liability

Managing property tax liability in Santa Barbara involves understanding the tax system, taking advantage of available exemptions, and possibly considering strategies like owning property through a trust or other entities, which might offer tax benefits. Regularly reviewing the property’s assessed value to ensure it accurately reflects market conditions can also be beneficial, as overvaluation can lead to unnecessarily high taxes.

Future Outlook and Potential Changes

The landscape of property taxes in Santa Barbara and California is subject to change based on legislative actions and voter-approved initiatives. Discussions around reforming Proposition 13 or introducing new tax measures could potentially impact how property taxes are calculated and who bears the tax burden. Staying informed about these developments is crucial for property owners to anticipate and plan for any changes in their tax obligations.

Conclusion

Owning property in Santa Barbara is a significant investment, and understanding the nuances of property taxes is essential for managing this investment effectively. By grasping how taxes are calculated, exploring available exemptions, and staying abreast of potential changes in tax laws, property owners can better navigate the complexities of property taxation in this desirable location.

What is the deadline for paying the first installment of property taxes in Santa Barbara?

+The first installment of property taxes is due on November 1 and becomes delinquent if not paid by December 10.

How does Proposition 13 affect property taxes in Santa Barbara?

+Proposition 13 limits the tax rate to 1% of the property's assessed value and restricts annual increases in the assessed value to a maximum of 2% unless the property is sold or undergoes significant new construction.

Are there any exemptions available to help reduce property tax liability in Santa Barbara?

+Yes, several exemptions and deductions are available, including the Homeowners' Exemption, which can provide up to a $7,000 reduction in the assessed value of a primary residence.

Understanding the intricacies of Santa Barbara property taxes requires a comprehensive approach, considering not just the current tax laws and calculations but also potential future changes and how different strategies might mitigate tax liability. As with any significant financial commitment, seeking professional advice tailored to individual circumstances can provide invaluable insights and help in making informed decisions.