Retirement planning is a crucial aspect of financial security, and understanding the Social Security budget is essential for making informed decisions about your future. The Social Security program is a vital component of the US social safety net, providing financial assistance to millions of Americans. However, the program’s budget and future solvency have been subjects of debate and concern. In this article, we will delve into the world of Social Security, exploring its budget, benefits, and strategies for planning a secure retirement.

Understanding the Social Security Budget

The Social Security budget is a complex entity, with various components and funding sources. The program is primarily funded through payroll taxes, also known as Federal Insurance Contributions Act (FICA) taxes. These taxes are paid by employees and employers, with the tax rate being 6.2% for employees and 6.2% for employers. Self-employed individuals pay a total of 12.4% in FICA taxes. The tax revenue is then deposited into the Social Security trust funds, which are used to pay benefits to eligible recipients.

The Social Security trust funds consist of two main components: the Old-Age and Survivors Insurance (OASI) trust fund and the Disability Insurance (DI) trust fund. The OASI trust fund provides benefits to retired workers, their spouses, and children, as well as to survivors of deceased workers. The DI trust fund provides benefits to disabled workers and their families. The trust funds are managed by the Social Security Administration (SSA) and are invested in special-issue US Treasury bonds, which earn interest and help to finance the program.

Social Security Benefits: What You Need to Know

Social Security benefits are an essential part of retirement planning, providing a guaranteed source of income for eligible recipients. To qualify for benefits, workers must have earned a certain number of credits, which are based on their earnings history. The number of credits required for eligibility varies depending on the type of benefit being applied for. For example, to qualify for retirement benefits, workers typically need to have earned at least 40 credits, with a maximum of four credits per year.

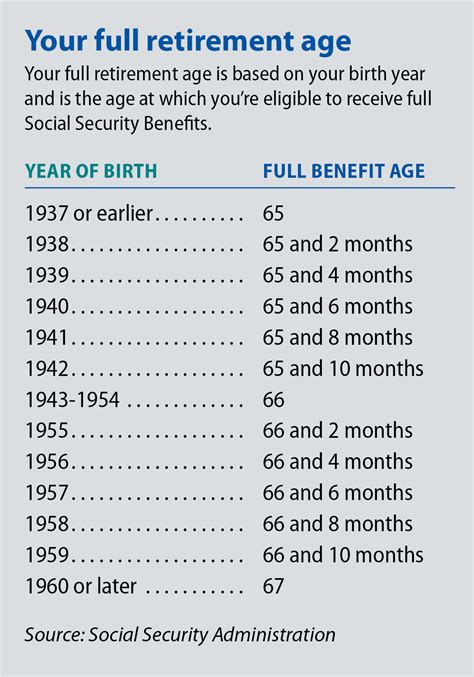

The amount of benefits received depends on the worker’s earnings history and the age at which they choose to retire. Workers can retire as early as age 62, but this will result in reduced benefits. On the other hand, delaying retirement until after full retirement age (which varies depending on birth year) can result in increased benefits. The full retirement age is currently 67 for workers born in 1960 or later.

Strategies for Planning a Secure Retirement

Planning a secure retirement requires a comprehensive approach, taking into account various factors such as savings, investments, and Social Security benefits. Here are some strategies to help you plan a secure retirement:

- Start saving early: The earlier you start saving for retirement, the more time your money has to grow. Take advantage of tax-advantaged retirement accounts such as 401(k) or IRA.

- Maximize your earnings: Increase your earnings potential by pursuing higher-paying jobs, developing new skills, or starting a side business.

- Invest wisely: Invest your retirement savings in a diversified portfolio of stocks, bonds, and other assets to maximize returns.

- Delay retirement: Delaying retirement can result in increased Social Security benefits and a longer period of retirement savings.

- Consider alternative sources of income: Consider alternative sources of income, such as part-time work or rental properties, to supplement your retirement income.

It's essential to have a clear understanding of your retirement goals and create a personalized plan to achieve them. Consider consulting with a financial advisor to get expert guidance on retirement planning.

Comparative Analysis of Retirement Planning Strategies

Different retirement planning strategies can have varying effects on your financial security. Here’s a comparative analysis of some popular strategies:

| Strategy | Pros | Cons |

|---|---|---|

| Early retirement | More time to enjoy retirement, potential for increased Social Security benefits | Reduced benefits, potential for outliving savings |

| Delayed retirement | Increased Social Security benefits, longer period of retirement savings | Potential for burnout, reduced time to enjoy retirement |

| Aggressive investing | Potential for higher returns, increased wealth | Higher risk of losses, potential for reduced retirement savings |

| Conservative investing | Lower risk of losses, potential for stable returns | Lower potential for returns, potential for reduced retirement savings |

Case Study: Real-World Applications of Retirement Planning

Meet Jane, a 55-year-old marketing executive who is planning for retirement. Jane has been saving for retirement through her 401(k) account and has a modest investment portfolio. She is considering delaying her retirement to increase her Social Security benefits and has started exploring alternative sources of income, such as freelance writing.

Jane’s situation highlights the importance of creating a personalized retirement plan, taking into account individual circumstances and goals. By delaying her retirement and exploring alternative sources of income, Jane can increase her financial security and enjoy a more fulfilling retirement.

Future Trends Projection: The Evolution of Retirement Planning

The retirement planning landscape is evolving, with changing demographics, advances in technology, and shifting workforce trends. Here are some future trends that may impact retirement planning:

- Increased focus on sustainability: Retirement planning will likely involve a greater emphasis on sustainable investing and environmentally responsible practices.

- Growing importance of technology: Technology will play a more significant role in retirement planning, with increased use of digital tools and platforms for managing finances and investments.

- Shift towards lifelong learning: Retirement planning will involve a greater focus on lifelong learning and skill development, as workers adapt to changing workforce trends and technological advancements.

Technical Breakdown: Understanding Social Security Calculations

Social Security benefits are calculated using a complex formula, taking into account the worker’s earnings history and age at retirement. The formula involves the following steps:

- Calculating average indexed monthly earnings (AIME): The SSA calculates the worker’s AIME by indexing their earnings to the national average wage index.

- Applying the benefit formula: The SSA applies a formula to the AIME to determine the worker’s primary insurance amount (PIA).

- Adjusting for age: The SSA adjusts the PIA based on the worker’s age at retirement, with earlier retirement resulting in reduced benefits.

Myth vs. Reality: Common Misconceptions About Social Security

There are several common misconceptions about Social Security, including:

- Myth: Social Security is going bankrupt: Reality: While the Social Security trust funds are projected to be depleted by 2035, the program will still generate revenue through payroll taxes and can be strengthened through reforms.

- Myth: You can’t collect Social Security benefits if you’re still working: Reality: You can collect Social Security benefits while still working, but your benefits may be reduced if you earn above a certain threshold.

Understanding the facts about Social Security is essential for making informed decisions about your retirement. Don't rely on misconceptions or myths – get the facts and plan accordingly.

Decision Framework: Making Informed Choices About Retirement Planning

Retirement planning involves making informed choices about your financial security. Here’s a decision framework to help you make the right choices:

- Define your goals: Determine your retirement goals, including your desired lifestyle and income requirements.

- Assess your financial situation: Evaluate your current financial situation, including your savings, investments, and debt.

- Explore your options: Research and explore different retirement planning strategies, including Social Security benefits, investments, and alternative sources of income.

- Create a plan: Develop a personalized retirement plan, taking into account your goals, financial situation, and options.

- Monitor and adjust: Regularly monitor your progress and adjust your plan as needed to ensure you’re on track to meet your retirement goals.

FAQ Section

What is the full retirement age for Social Security benefits?

+The full retirement age for Social Security benefits varies depending on your birth year. For workers born in 1960 or later, the full retirement age is 67.

How are Social Security benefits calculated?

+Social Security benefits are calculated using a formula that takes into account your earnings history and age at retirement. The formula involves calculating your average indexed monthly earnings (AIME) and applying a benefit formula to determine your primary insurance amount (PIA).

Can I collect Social Security benefits while still working?

+Yes, you can collect Social Security benefits while still working. However, your benefits may be reduced if you earn above a certain threshold.

In conclusion, understanding the Social Security budget and benefits is essential for planning a secure retirement. By creating a personalized plan, taking into account your goals, financial situation, and options, you can ensure a fulfilling and financially secure retirement. Remember to stay informed about changes to the Social Security program and adapt your plan accordingly to maximize your benefits and retirement income.