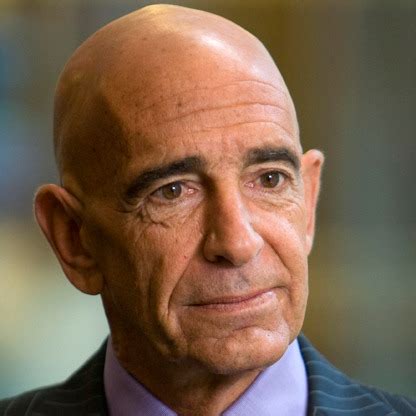

The investment landscape is a complex and ever-evolving entity, with various players contributing to its growth and development. Among these players is Thomas Barrack Jr., a renowned American investor and founder of Colony Capital, a global investment firm. Barrack’s career is a testament to his exceptional investment acumen and strategic prowess, which have enabled him to navigate the intricate world of investments with remarkable success.

To understand Barrack’s investment strategies, it’s essential to delve into his background and the experiences that have shaped his approach to investing. Born in 1947, Barrack grew up in a modest household, where he developed a strong work ethic and an entrepreneurial spirit. He attended the University of Southern California, where he earned a bachelor’s degree in sociology, and later received his Juris Doctor from the University of Southern California Gould School of Law. Barrack’s early career was marked by stints in law and real estate, which eventually led him to establish Colony Capital in 1991.

Early Investment Strategies

Barrack’s investment strategies have been influenced by his early experiences in real estate and law. He began his career by investing in distressed assets, such as foreclosed properties, and later expanded his portfolio to include a range of assets, including real estate, private equity, and debt. Barrack’s approach to investing has always been characterized by a willingness to take calculated risks and a focus on identifying undervalued assets with significant potential for growth.

One of Barrack’s earliest investment strategies was to focus on opportunistic investing, where he would identify distressed assets and acquire them at discounted prices. This approach allowed him to generate significant returns, as he would later sell the assets at a profit once they had been renovated or repositioned. Barrack’s success in opportunistic investing was largely due to his ability to identify hidden gems, which he would then polish and sell at a significant markup.

Diversification and Expansion

As Colony Capital grew, Barrack expanded his investment strategies to include a range of assets, such as private equity, debt, and real estate investment trusts (REITs). He also diversified his portfolio by investing in various sectors, including healthcare, technology, and finance. This diversification strategy allowed Barrack to mitigate risk and generate returns across different market cycles.

Barrack’s expansion into private equity was a significant milestone in his career, as it enabled him to invest in growth companies and participate in their success. He has invested in several high-profile companies, including Accor, the French hospitality giant, and Chobani, the Greek yogurt manufacturer. Barrack’s private equity investments have been marked by a focus on growth, innovation, and strategic partnerships.

Real Estate Investment Strategies

Real estate has always been a significant component of Barrack’s investment portfolio, and he has developed a range of strategies to capitalize on opportunities in this sector. One of his most successful strategies has been to invest in distressed real estate assets, such as foreclosed properties, and then renovate and reposition them for resale or rental.

Barrack has also been an early adopter of innovative real estate investment strategies, such as real estate crowdfunding and blockchain-based property investing. These strategies have enabled him to democratize access to real estate investing and provide investors with greater transparency and liquidity.

Lessons from Barrack’s Career

Thomas Barrack Jr.’s career offers several lessons for investors and entrepreneurs. His ability to adapt to changing market conditions, his willingness to take calculated risks, and his focus on identifying undervalued assets have been key to his success. Additionally, his commitment to diversification, innovation, and strategic partnerships has allowed him to generate returns across different market cycles.

For investors, Barrack’s career highlights the importance of developing a long-term perspective, being open to new opportunities, and continuously learning and adapting. It also emphasizes the need to focus on fundamentals, such as cash flow, growth potential, and risk management, when evaluating investment opportunities.

FAQ Section

What is Thomas Barrack Jr.'s investment philosophy?

+Thomas Barrack Jr.'s investment philosophy is centered around identifying undervalued assets with significant potential for growth. He focuses on opportunistic investing, diversification, and strategic partnerships to generate returns across different market cycles.

What are some of the key sectors that Thomas Barrack Jr. has invested in?

+Thomas Barrack Jr. has invested in a range of sectors, including real estate, private equity, healthcare, technology, and finance. He has also invested in companies across various industries, such as hospitality, food manufacturing, and energy.

How has Thomas Barrack Jr. adapted to changing market conditions throughout his career?

+Thomas Barrack Jr. has adapted to changing market conditions by being open to new opportunities, continuously learning and adapting, and focusing on long-term fundamentals. He has also been willing to take calculated risks and pivot his investment strategies as needed to respond to shifting market trends.

What are some of the most important lessons that investors can learn from Thomas Barrack Jr.'s career?

+Some of the most important lessons that investors can learn from Thomas Barrack Jr.'s career include the importance of developing a long-term perspective, being open to new opportunities, and continuously learning and adapting. Additionally, investors should focus on fundamentals, such as cash flow, growth potential, and risk management, when evaluating investment opportunities.

How has Thomas Barrack Jr. contributed to the development of innovative investment strategies?

+Thomas Barrack Jr. has contributed to the development of innovative investment strategies by being an early adopter of new technologies and approaches, such as real estate crowdfunding and blockchain-based property investing. He has also been a pioneer in the use of data analytics and machine learning to inform investment decisions.

In conclusion, Thomas Barrack Jr.’s career is a testament to his exceptional investment acumen and strategic prowess. His ability to adapt to changing market conditions, his willingness to take calculated risks, and his focus on identifying undervalued assets have been key to his success. As investors and entrepreneurs, we can learn valuable lessons from Barrack’s career, including the importance of developing a long-term perspective, being open to new opportunities, and continuously learning and adapting. By applying these lessons and staying focused on fundamentals, we can navigate the complex world of investments and achieve our financial goals.