1031 Exchange Boot Calculator

1031 Exchange Boot Calculator - Web 12/16/2019 partial 1031 exchange boot calculator | partial 1031 exchange boot examples | how is boot taxed? Web realty exchange corporation has created this simple capital gains calculator and analysis form to estimate the tax impact if a property is sold and not exchanged, and to. A simple rule to remember watch on boot is “unlike” property received in. Web learn how to calculate boot, or the leftover sale proceeds subject to tax, in a partial 1031 exchange and how to avoid it. Web you have your eye on a replacement property for $1 million.

| how to avoid boot | partial 1031 exchange boot faqs. Web calculate exchange rates effortlessly with our 1031 exchange calculator. Web boot in 1031 exchanges. Web 12/16/2019 partial 1031 exchange boot calculator | partial 1031 exchange boot examples | how is boot taxed? Property you are selling selling price of property selling. Any boot received is taxable (to the extent of gain. The following calculator is a useful tool to determine the required amount of debt and equity in the new property.

1031 Exchange Calculation Worksheet CALCULATORVGW

Use the boot calculator to estimate your. Web learn what boot is and how it’s taxed in a 1031 exchange. Web what is a 1031 exchange “boot,” and what should you do to avoid one? Web to avoid the receipt of boot, the exchanger should: Web learn how to calculate boot, or the leftover sale.

Put Your 1031 Exchange Boot to Work 1031 Crowdfunding

Web partial exchange boot calculator is a pivotal tool for real estate investors engaged in partial 1031 exchanges. The following calculator is a useful tool to determine the required amount of debt and equity in the new property. Web boot in 1031 exchanges. Easily estimate tax savings on various exchanges, even with cash out. Web.

1031 Exchange Calculator with Answers to 16 FAQs! Internal Revenue

Web if there is no 1031 exchange, it is the difference between the net sales price and the adjusted cost basis. Web november 3, 2022 / by david moore / blogcasts, news what is boot in a 1031 exchange? Web 12/16/2019 partial 1031 exchange boot calculator | partial 1031 exchange boot examples | how is.

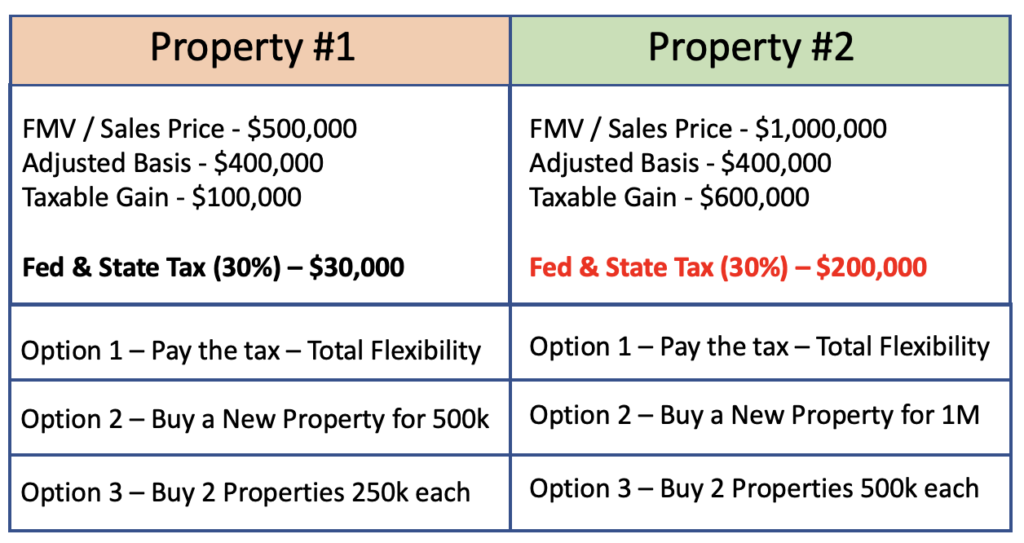

When and How to use the 1031 Exchange Mark J. Kohler

Use the boot calculator to estimate your. Web calculating boot can be complex, but our partial 1031 exchange boot calculator simplifies this task by helping determine the amount of boot and the associated tax rate. Web to avoid the receipt of boot, the exchanger should: Web if there is no 1031 exchange, it is the.

1031 Exchange Full Guide Casaplorer

Web use the 1031 exchange calculator to estimate net sales available for reinvestment with and without a 1031 exchange. Web this 1031 exchange calculator will estimate the taxable impact of your proposed sale and purchase. We’ll provide examples of a 1031 exchange boot and also explain boot types and how to avoid. Any boot received.

How To Do A 1031 Exchange Like A Pro Free Guide

Web november 3, 2022 / by david moore / blogcasts, news what is boot in a 1031 exchange? Web calculate exchange rates effortlessly with our 1031 exchange calculator. Web use the 1031 exchange calculator to estimate net sales available for reinvestment with and without a 1031 exchange. Easily estimate tax savings on various exchanges, even.

1031 Exchange Calculator with Answers to 16 FAQs! Internal Revenue

Web learn how to calculate boot, or the leftover sale proceeds subject to tax, in a partial 1031 exchange and how to avoid it. Any boot received is taxable (to the extent of gain. Web realty exchange corporation has created this simple capital gains calculator and analysis form to estimate the tax impact if a.

How Is Boot Taxed in a 1031 Exchange? [Examples, Avoidance Methods]

| how to avoid boot | partial 1031 exchange boot faqs. To pay no tax when executing a 1031 exchange, you must purchase at least. Web you have your eye on a replacement property for $1 million. You can use the $400,000 from the sale and take out a mortgage for $600,000, satisfying the 1031.

1031 Exchange Boot Guide to Mortgage Boots 1031 Crowdfunding

Web realty exchange corporation has created this simple capital gains calculator and analysis form to estimate the tax impact if a property is sold and not exchanged, and to. | how to avoid boot | partial 1031 exchange boot faqs. Web learn how to calculate boot, or the leftover sale proceeds subject to tax, in.

What is "Boot" in a 1031 Exchange? YouTube

Meet our teamover 30 years experienceover 20,000 transactionssubmit a message Usually, boot is in the form of cash, an installment note, debt relief or. Web use the 1031 exchange calculator to estimate net sales available for reinvestment with and without a 1031 exchange. Web calculating boot can be complex, but our partial 1031 exchange boot.

1031 Exchange Boot Calculator Easily estimate tax savings on various exchanges, even with cash out. It allows you to defer. Meet our teamover 30 years experienceover 20,000 transactionssubmit a message Web november 3, 2022 / by david moore / blogcasts, news what is boot in a 1031 exchange? Use the boot calculator to estimate your.

Web Calculate Exchange Rates Effortlessly With Our 1031 Exchange Calculator.

Web partial exchange boot calculator is a pivotal tool for real estate investors engaged in partial 1031 exchanges. You can use the $400,000 from the sale and take out a mortgage for $600,000, satisfying the 1031 exchange. Click here to open boot. We’ll provide examples of a 1031 exchange boot and also explain boot types and how to avoid.

Web Learn How To Calculate Boot, Or The Leftover Sale Proceeds Subject To Tax, In A Partial 1031 Exchange And How To Avoid It.

Web boot in 1031 exchanges. Usually, boot is in the form of cash, an installment note, debt relief or. Web november 3, 2022 / by david moore / blogcasts, news what is boot in a 1031 exchange? Any boot received is taxable (to the extent of gain.

To Pay No Tax When Executing A 1031 Exchange, You Must Purchase At Least.

Web what is a 1031 exchange “boot,” and what should you do to avoid one? Meet our teamover 30 years experienceover 20,000 transactionssubmit a message Web to avoid the receipt of boot, the exchanger should: | how to avoid boot | partial 1031 exchange boot faqs.

Web Learn What Boot Is And How It’s Taxed In A 1031 Exchange.

Property you are selling selling price of property selling. Web this 1031 exchange calculator will estimate the taxable impact of your proposed sale and purchase. The following calculator is a useful tool to determine the required amount of debt and equity in the new property. It allows you to defer.

![How Is Boot Taxed in a 1031 Exchange? [Examples, Avoidance Methods]](https://propertycashin.com/wp-content/uploads/2020/07/How-Is-a-Boot-Taxed-in-a-1031-Exchange.jpg)