1031 Exchange Calculation Worksheet

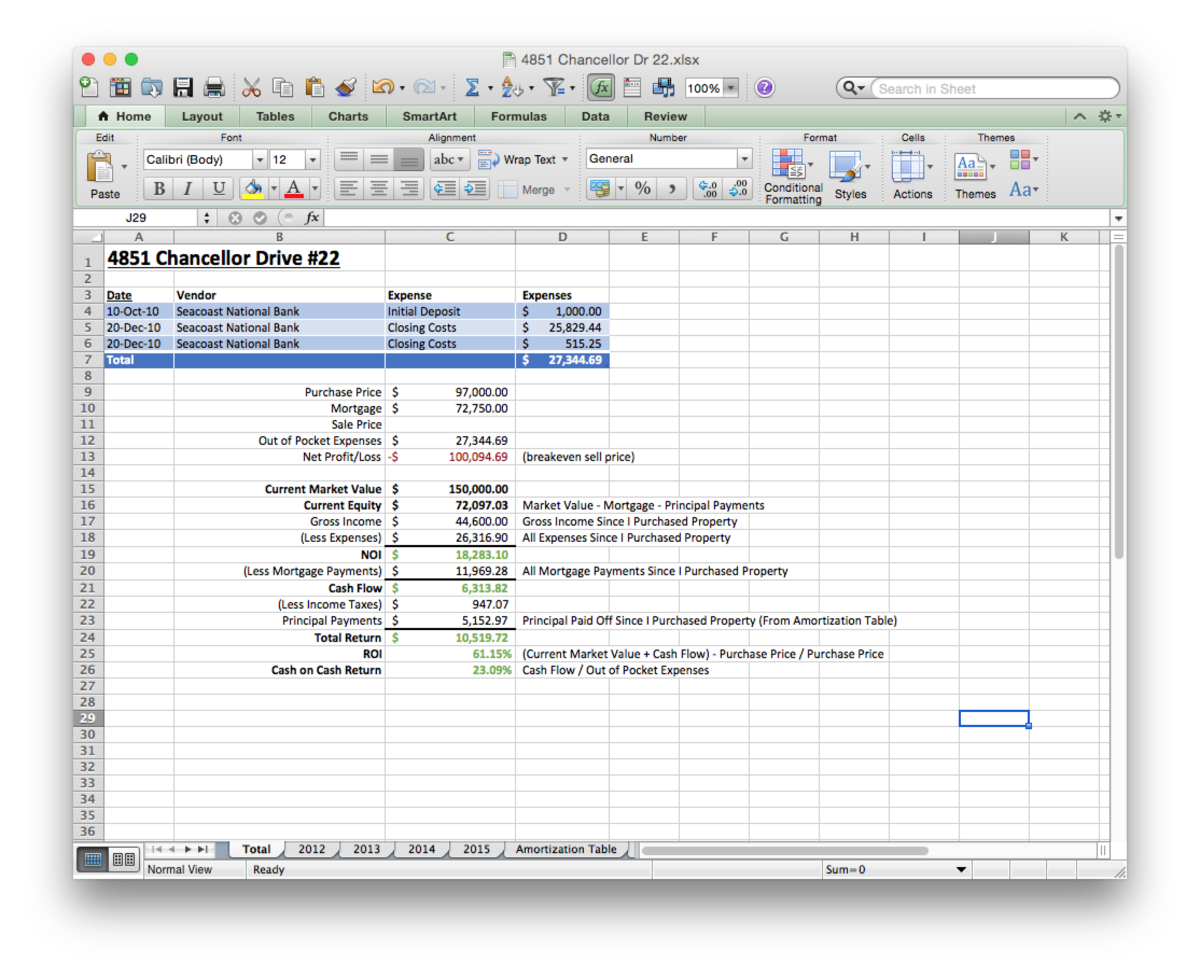

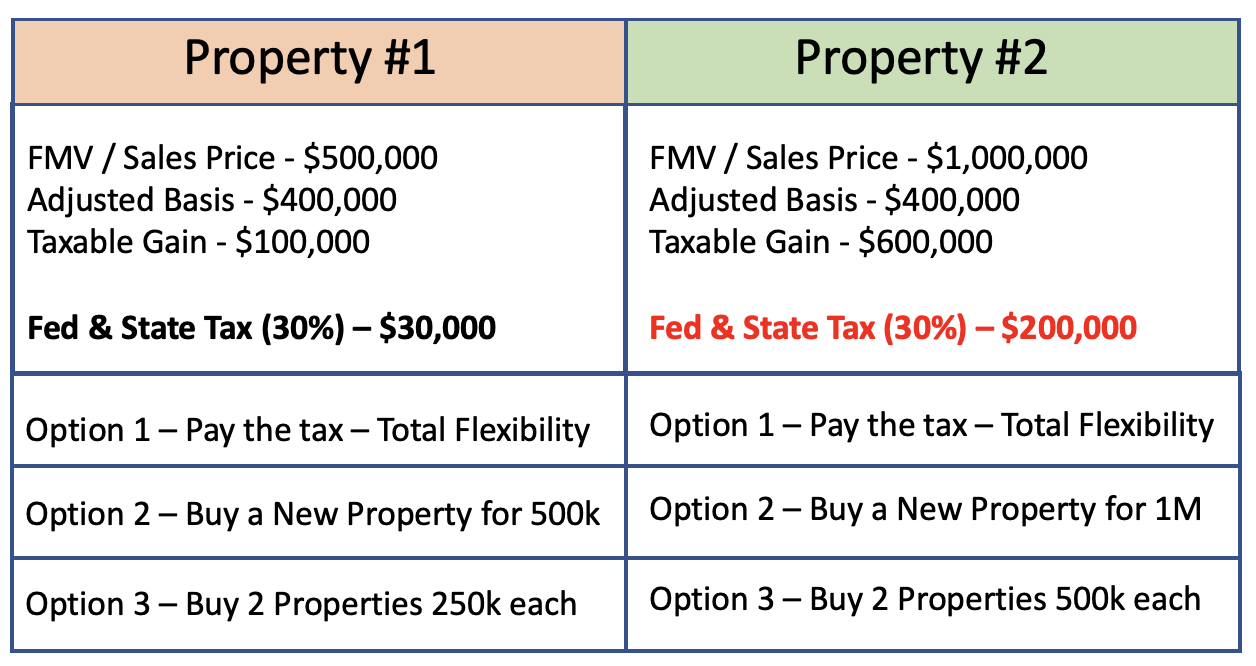

1031 Exchange Calculation Worksheet - Web understanding 1031 exchanges. Web a 1031 exchange is a real estate investing tool that allows investors to exchange an investment property for another property of equal or higher value and defer. Web this calculator will use your information, including your 1031 exchange boot tax rate, to tell you how much boot you can anticipate having — and how big of a. Web estimate the taxable impact of your proposed sale and purchase of investment real estate with this calculator. Web purchase price, exchange property less depreciation taken to date of sale less deferred gain from previous 1031 exchange (if any) net cash paid (same as line 3 above) net.

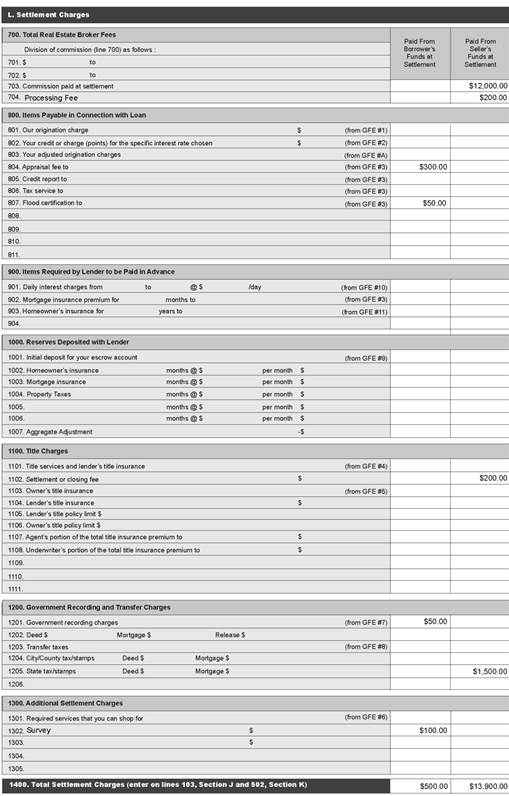

Enter the values of the properties, liabilities, cash, and recognized. Web under the tax cuts and jobs act, section 1031 now applies only to exchanges of real property and not to exchanges of personal or intangible property. This course will be an overview of: Note that you can see all of the calculations so. Web this 1031 exchange calculator will estimate the taxable impact of your proposed sale and purchase. Web the simplest type of section 1031 exchange is a simultaneous swap of one property for another. Mechanics of section 1031 exchanges section 1031 definitions and rules for.

1031 Exchange Worksheet Excel Master of Documents

1031crowdfunding.com has been visited by 10k+ users in the past month To pay no tax when executing a 1031 exchange, you must purchase at least. Web the 1031 exchange calculator above provides a simple estimation of potential taxes related to the sale of investment property and net sales proceeds available for. Mechanics of section 1031.

1031 Exchange Calculation Worksheet Ivuyteq

Deferred exchanges are more complex but allow flexibility. Web the 1031 exchange calculator above provides a simple estimation of potential taxes related to the sale of investment property and net sales proceeds available for. Web the simplest type of section 1031 exchange is a simultaneous swap of one property for another. Use part iii to.

1031 and 1033 EXERCISE In the following 1031

Enter the values of the properties, liabilities, cash, and recognized. Web this 1031 exchange calculator will estimate the taxable impact of your proposed sale and purchase. 1031crowdfunding.com has been visited by 10k+ users in the past month Web under the tax cuts and jobs act, section 1031 now applies only to exchanges of real property.

How To Do A 1031 Exchange Like A Pro Free Guide

Web understanding 1031 exchanges. Web this calculator will use your information, including your 1031 exchange boot tax rate, to tell you how much boot you can anticipate having — and how big of a. The basis for the new asset. This course will be an overview of: Enter the values of the properties, liabilities, cash,.

When and How to use the 1031 Exchange Mark J. Kohler

This course will be an overview of: Web the simplest type of section 1031 exchange is a simultaneous swap of one property for another. Web under the tax cuts and jobs act, section 1031 now applies only to exchanges of real property and not to exchanges of personal or intangible property. Web this 1031 exchange.

Section 1031 Exchange Calculation Worksheet

Your basis in your home is determined by reference to a previous owner's basis, and. Web enter the following information and our calculator will provide you an idea of how a 1031 exchange will work in your situation. Use part iii to figure the amount of gain required to be reported on the tax return.

1031 Exchange Calculator with Answers to 16 FAQs! Internal Revenue

Use part iii to figure the amount of gain required to be reported on the tax return in the current. Your basis in your home is determined by reference to a previous owner's basis, and. Web a 1031 exchange is a real estate investing tool that allows investors to exchange an investment property for another.

1031 Exchange Calculation Worksheet CALCULATORVGW

1031crowdfunding.com has been visited by 10k+ users in the past month Deferred exchanges are more complex but allow flexibility. Web the 1031 exchange calculator above provides a simple estimation of potential taxes related to the sale of investment property and net sales proceeds available for. Note that you can see all of the calculations so..

1031 Exchange Worksheet Excel Master of Documents

This course will be an overview of: Web estimate the taxable impact of your proposed sale and purchase of investment real estate with this calculator. Web under the tax cuts and jobs act, section 1031 now applies only to exchanges of real property and not to exchanges of personal or intangible property. Enter the values.

️1031 Exchange Worksheet Excel Free Download Goodimg.co

Web this calculator will use your information, including your 1031 exchange boot tax rate, to tell you how much boot you can anticipate having — and how big of a. Deferred exchanges are more complex but allow flexibility. Web estimate the taxable impact of your proposed sale and purchase of investment real estate with this.

1031 Exchange Calculation Worksheet 1031crowdfunding.com has been visited by 10k+ users in the past month Deferred exchanges are more complex but allow flexibility. 1031crowdfunding.com has been visited by 10k+ users in the past month Web the simplest type of section 1031 exchange is a simultaneous swap of one property for another. Web under the tax cuts and jobs act, section 1031 now applies only to exchanges of real property and not to exchanges of personal or intangible property.

Web Estimate The Taxable Impact Of Your Proposed Sale And Purchase Of Investment Real Estate With This Calculator.

To pay no tax when executing a 1031 exchange, you must purchase at least. Web this calculator will use your information, including your 1031 exchange boot tax rate, to tell you how much boot you can anticipate having — and how big of a. Web purchase price, exchange property less depreciation taken to date of sale less deferred gain from previous 1031 exchange (if any) net cash paid (same as line 3 above) net. Enter the values of the properties, liabilities, cash, and recognized.

1031Crowdfunding.com Has Been Visited By 10K+ Users In The Past Month

Web under the tax cuts and jobs act, section 1031 now applies only to exchanges of real property and not to exchanges of personal or intangible property. Web enter the following information and our calculator will provide you an idea of how a 1031 exchange will work in your situation. The basis for the new asset. Use part iii to figure the amount of gain required to be reported on the tax return in the current.

Web The 1031 Exchange Calculator Above Provides A Simple Estimation Of Potential Taxes Related To The Sale Of Investment Property And Net Sales Proceeds Available For.

Web understanding 1031 exchanges. Your basis in your home is determined by reference to a previous owner's basis, and. Web the simplest type of section 1031 exchange is a simultaneous swap of one property for another. Web this 1031 exchange calculator will estimate the taxable impact of your proposed sale and purchase.

Web A 1031 Exchange Is A Real Estate Investing Tool That Allows Investors To Exchange An Investment Property For Another Property Of Equal Or Higher Value And Defer.

Mechanics of section 1031 exchanges section 1031 definitions and rules for. Deferred exchanges are more complex but allow flexibility. Note that you can see all of the calculations so. This course will be an overview of: