1031 Exchange Calculator Excel

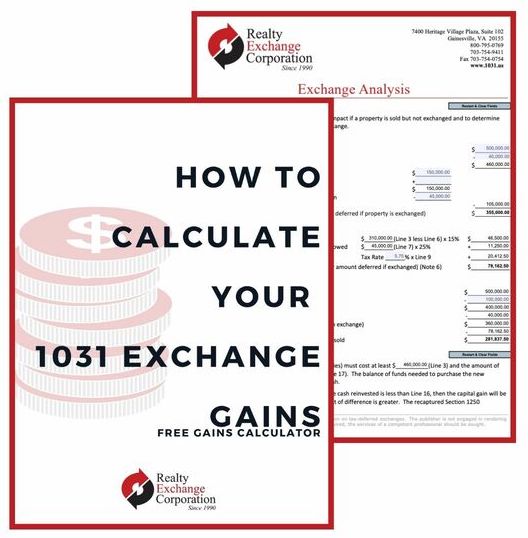

1031 Exchange Calculator Excel - Web this 1031 exchange calculator will estimate the taxable impact of your proposed sale and purchase. It allows you to defer. Web tax calculations federal tax on capital gains: Property used primarily for personal use, like a primary residence or a second home or vacation. Web we have developed the enclosed worksheets for use in calculating the information used to report 1031 exchanges on form 8824 and herein enclose a copy.

Web tax calculations federal tax on capital gains: Web this calculator will use your information, including your 1031 exchange boot tax rate, to tell you how much boot you can anticipate having — and how big of a. Web we have developed the enclosed worksheets for use in calculating the information used to report 1031 exchanges on form 8824 and herein enclose a copy. Nationwide exchangesfull servicequalified intermediarysecure processing Property used primarily for personal use, like a primary residence or a second home or vacation. Web this 1031 exchange calculator will estimate the taxable impact of your proposed sale and purchase. State tax on total gain:

Investment Property 1031 Exchange

Property used primarily for personal use, like a primary residence or a second home or vacation. To pay no tax when executing a 1031 exchange, you must purchase at least. Web use the 1031 exchange calculator to estimate net sales available for reinvestment with and without a 1031 exchange. Web this 1031 exchange calculator will.

1031 Exchange Calculator with Answers to 16 FAQs! Internal Revenue

Web it’s crucial to know your tax deadlines to ensure you have the full 180 days, or that you secure an extension from the irs. Total tax savings resulting from deferral of. Nationwide exchangesfull servicequalified intermediarysecure processing Submit a messageover 20,000 transactionsread blogmeet our team Web use the 1031 exchange calculator to estimate net sales.

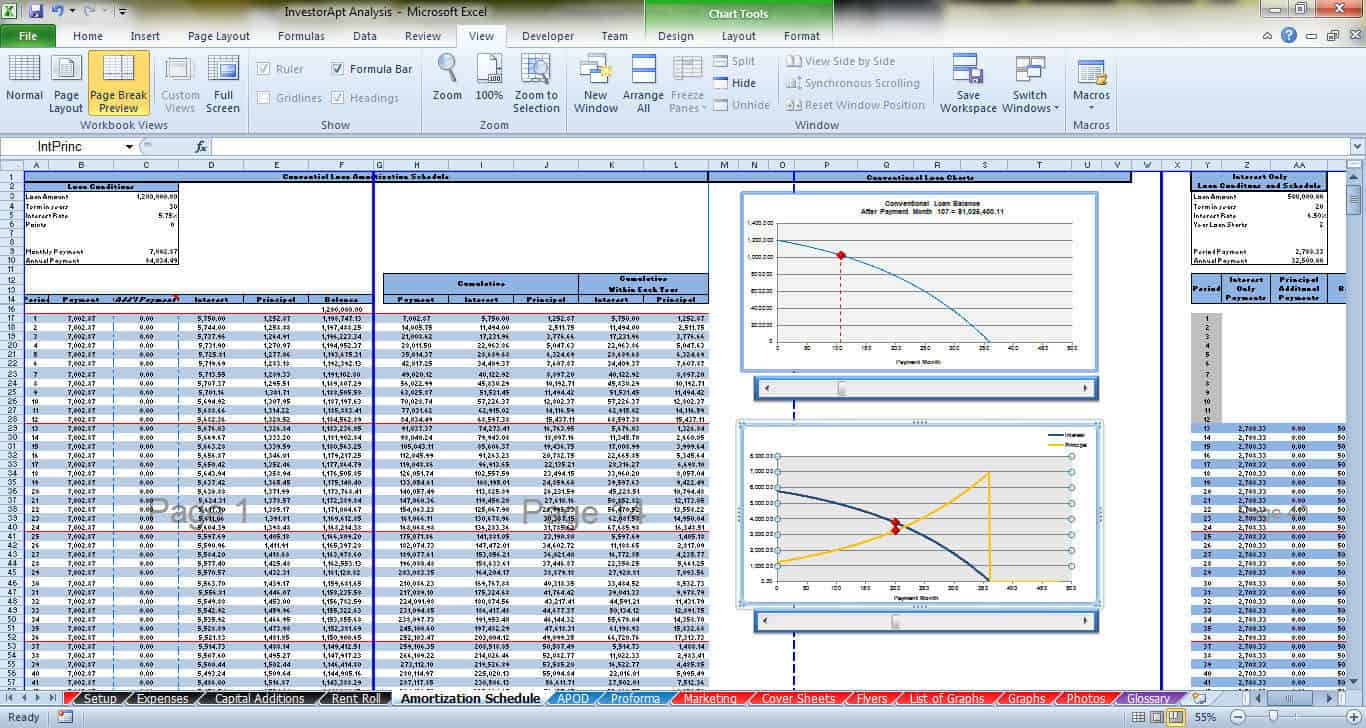

️1031 Exchange Worksheet Excel Free Download Goodimg.co

Web use the 1031 exchange calculator to estimate net sales available for reinvestment with and without a 1031 exchange. Web this 1031 exchange calculator will estimate the taxable impact of your proposed sale and purchase. Property used primarily for personal use, like a primary residence or a second home or vacation. Web this 1031 exchange.

1031 Exchange Worksheet Excel Master of Documents

Nationwide exchangesfull servicequalified intermediarysecure processing Web use the 1031 exchange calculator to estimate net sales available for reinvestment with and without a 1031 exchange. Web it’s crucial to know your tax deadlines to ensure you have the full 180 days, or that you secure an extension from the irs. Web this calculator will use your.

1031 Exchange Calculation Worksheet CALCULATORVGW

Web it’s crucial to know your tax deadlines to ensure you have the full 180 days, or that you secure an extension from the irs. Property you are selling selling price of property selling. Total tax savings resulting from deferral of. Web qualifying property must be held for use in a trade or business or.

1031 Exchange Worksheet Excel Ivuyteq

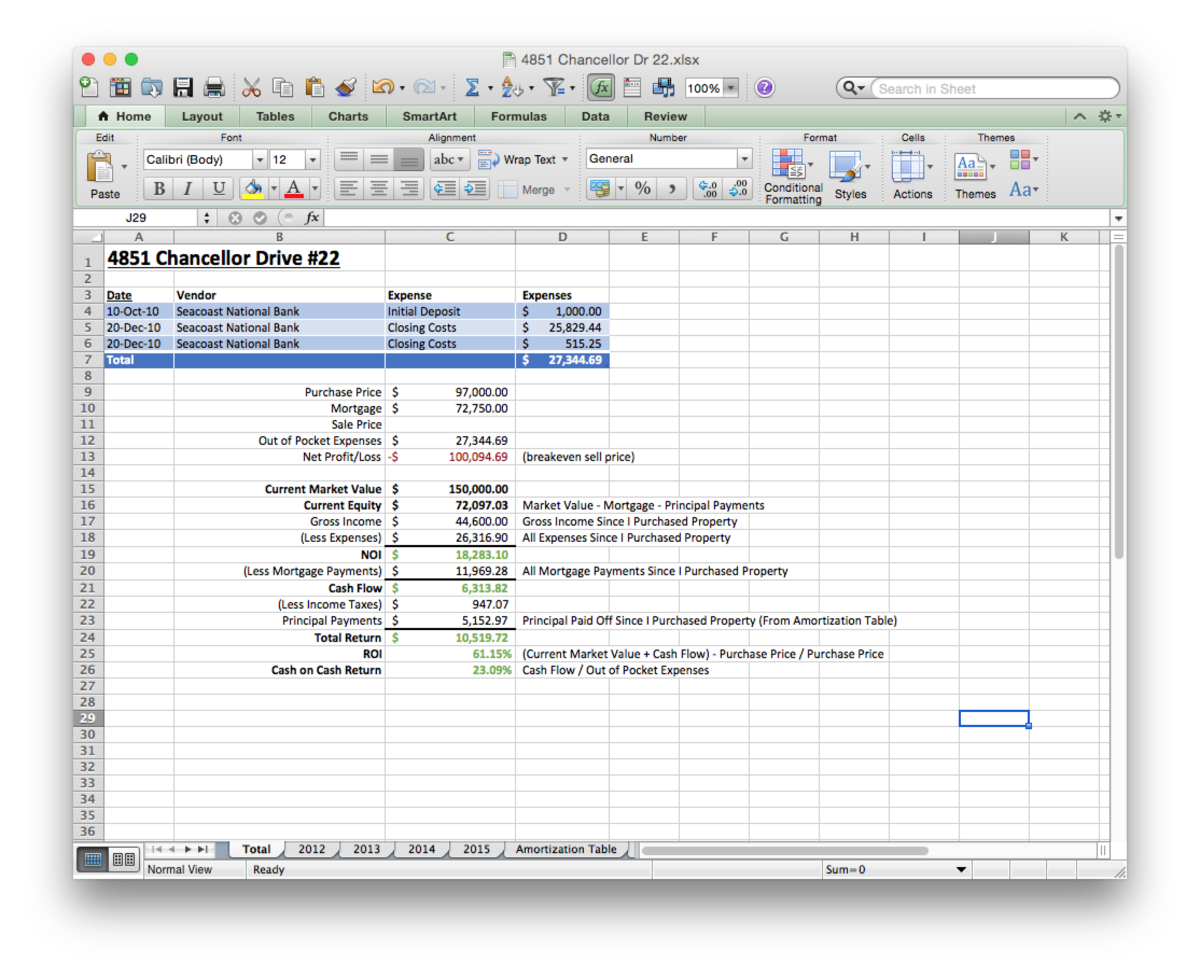

To pay no tax when executing a 1031 exchange, you must purchase at least. Web calculation of exchange expenses information about your old property worksheet #s 4, 5 & 6 information about your new property debt associated with your old and new. Web this 1031 exchange calculator will estimate the taxable impact of your proposed.

1031 Exchange Calculation Worksheet CALCULATORVGW

Web it’s crucial to know your tax deadlines to ensure you have the full 180 days, or that you secure an extension from the irs. Web tax calculations federal tax on capital gains: Web this calculator will use your information, including your 1031 exchange boot tax rate, to tell you how much boot you can.

1031 Exchange Worksheet Excel Master of Documents

Web this 1031 exchange calculator will estimate the taxable impact of your proposed sale and purchase. 1031crowdfunding.com has been visited by 10k+ users in the past month Web calculation of exchange expenses information about your old property worksheet #s 4, 5 & 6 information about your new property debt associated with your old and new..

1031 Exchange Worksheet And Mission Log Excel Template Cehaer

Web this 1031 exchange calculator will estimate the taxable impact of your proposed sale and purchase. Web calculation of exchange expenses information about your old property worksheet #s 4, 5 & 6 information about your new property debt associated with your old and new. Web tax deferred exchanges under irc § 1031 worksheet 1 taxpayer.

How To Do A 1031 Exchange Like A Pro Free Guide

Total tax savings resulting from deferral of. Web qualifying property must be held for use in a trade or business or for investment. Submit a messageover 20,000 transactionsread blogmeet our team Web tax deferred exchanges under irc § 1031 worksheet 1 taxpayer exchange property replacement property date closed before preparing worksheet 1, read the attached..

1031 Exchange Calculator Excel Web it’s crucial to know your tax deadlines to ensure you have the full 180 days, or that you secure an extension from the irs. Web we have developed the enclosed worksheets for use in calculating the information used to report 1031 exchanges on form 8824 and herein enclose a copy. Total tax savings resulting from deferral of. Property you are selling selling price of property selling. Web this 1031 exchange calculator will estimate the taxable impact of your proposed sale and purchase.

Web This 1031 Exchange Calculator Will Estimate The Taxable Impact Of Your Proposed Sale And Purchase.

1031crowdfunding.com has been visited by 10k+ users in the past month Total tax savings resulting from deferral of. To pay no tax when executing a 1031 exchange, you must purchase at least. Web qualifying property must be held for use in a trade or business or for investment.

Web This 1031 Exchange Calculator Will Estimate The Taxable Impact Of Your Proposed Sale And Purchase.

Web use the 1031 exchange calculator to estimate net sales available for reinvestment with and without a 1031 exchange. Federal tax on depreciation recapture: To pay no tax when executing a 1031 exchange, you must purchase at least. Web this calculator will use your information, including your 1031 exchange boot tax rate, to tell you how much boot you can anticipate having — and how big of a.

1031Crowdfunding.com Has Been Visited By 10K+ Users In The Past Month

State tax on total gain: Web tax deferred exchanges under irc § 1031 worksheet 1 taxpayer exchange property replacement property date closed before preparing worksheet 1, read the attached. Web we have developed the enclosed worksheets for use in calculating the information used to report 1031 exchanges on form 8824 and herein enclose a copy. Web tax calculations federal tax on capital gains:

Submit A Messageover 20,000 Transactionsread Blogmeet Our Team

Web it’s crucial to know your tax deadlines to ensure you have the full 180 days, or that you secure an extension from the irs. Property you are selling selling price of property selling. It allows you to defer. Property used primarily for personal use, like a primary residence or a second home or vacation.