1031 Exchange Tax Calculator

1031 Exchange Tax Calculator - Web free capital gains & depreciation tax calculator. Web estimate your capital gains tax & total tax liability with ease. Property you are selling selling price of property: Web a 1031 exchange allows certain real estate investors to defer capital gains taxes when selling one investment property and reinvesting proceeds from the sale into. It uses the date of the sale, adjusted basis, sales price, cost, commissions, exchange.

Property you are selling selling price of property: Api's capital gain tax calculator to calculate taxable gain and avoid paying taxes by taking advantage of irc section 1031. Web free capital gains & depreciation tax calculator. Investment property sales can attract a staggering tax liability of up to 42.1%. Commissions do not affect our editors' opinions or evaluations. Web even better, our calculator can show you the benefits of a 1031 exchange — you’ll immediately see the difference in available capital with or without one. Utilize our 1031 exchange calculator to determine your available tax deferral with a 1031 exchange including your capital gains tax.

1031 Exchange Calculator with Answers to 16 FAQs! Internal Revenue

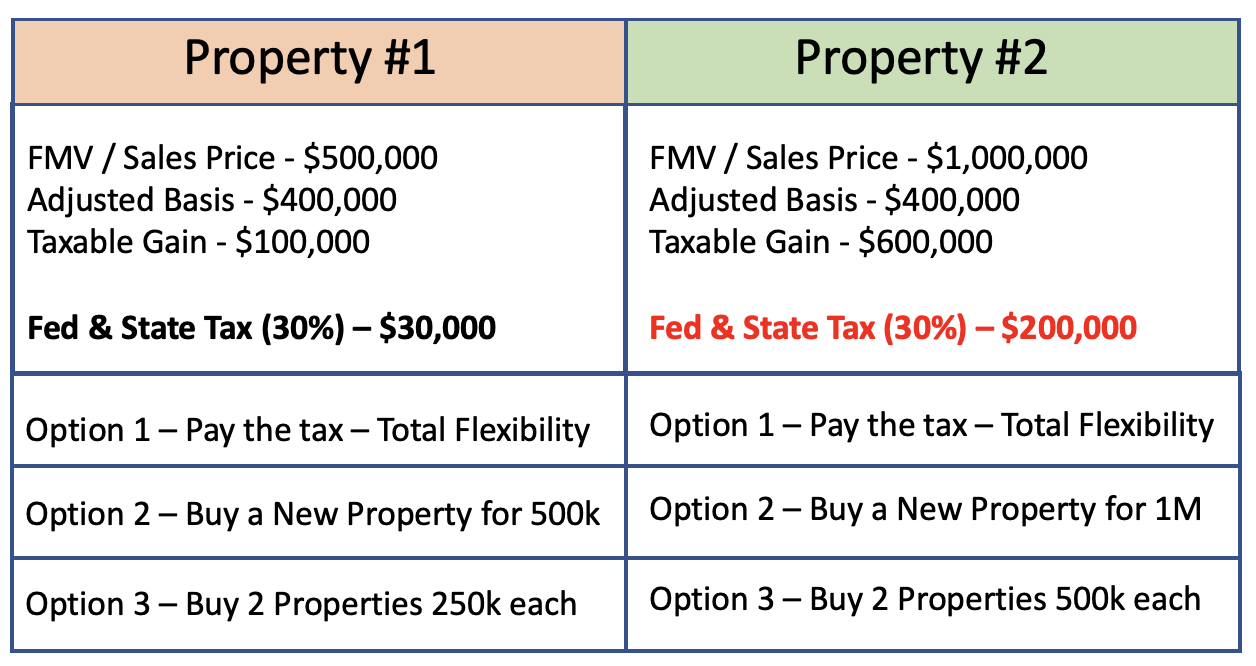

Web how do you calculate capital gains tax? Nov 29, 2023, 3:00am editorial note: Web the 1031 exchange calculator considers information for both the sale and buy properties. Web even better, our calculator can show you the benefits of a 1031 exchange — you’ll immediately see the difference in available capital with or without one..

1031 Exchange Calculator with Answers to 16 FAQs! Internal Revenue

Investment property sales can attract a staggering tax liability of up to 42.1%. This 1031 exchange calculator will estimate the taxable impact of your proposed sale and purchase. Nov 29, 2023, 3:00am editorial note: Commissions do not affect our editors' opinions or evaluations. Web taxslayer does not support every tax form, such as 1031 exchanges.

What Is A 1031 Exchange? Properties & Paradise BlogProperties

Web even better, our calculator can show you the benefits of a 1031 exchange — you’ll immediately see the difference in available capital with or without one. Web the 1031 exchange calculator considers information for both the sale and buy properties. Web explore our comprehensive 1031 exchange calculators and tools to effortlessly navigate your property.

When and How to use the 1031 Exchange Mark J. Kohler

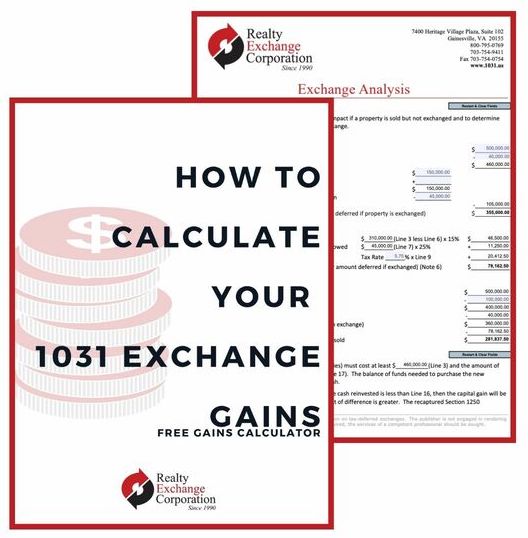

Commissions do not affect our editors' opinions or evaluations. Web here is a capital gains calculator to illustrate potential taxes if you sell your property rather than exchange. This burden consists of various. Property you are selling selling price of property: Our free capital gains tax calculator takes into account any applicable deductions, such as.

What Is A 1031 Exchange DST? How Does It Work And What Are The Rules

Web here is a capital gains calculator to illustrate potential taxes if you sell your property rather than exchange. It uses the date of the sale, adjusted basis, sales price, cost, commissions, exchange. View 2024 capital gains tax calculator ». The taxes deferred on the relinquished property (investment property sold) allow for greater net sales.

The Clear & Complete Guide to The 1031 Tax Deferred Exchange

Web explore our comprehensive 1031 exchange calculators and tools to effortlessly navigate your property swaps, ensuring tax deferral and financial optimization. Web even better, our calculator can show you the benefits of a 1031 exchange — you’ll immediately see the difference in available capital with or without one. It uses the date of the sale,.

1031 Tax Free Exchange Rules 1031 Exchange Rules 2021

Commissions do not affect our editors' opinions or evaluations. We earn a commission from partner links on forbes advisor. It uses the date of the sale, adjusted basis, sales price, cost, commissions, exchange. The gain, not the profit or equity, from the sale of the investment property is subject to a combination of capital gains.

1031 Exchange When Selling a Business

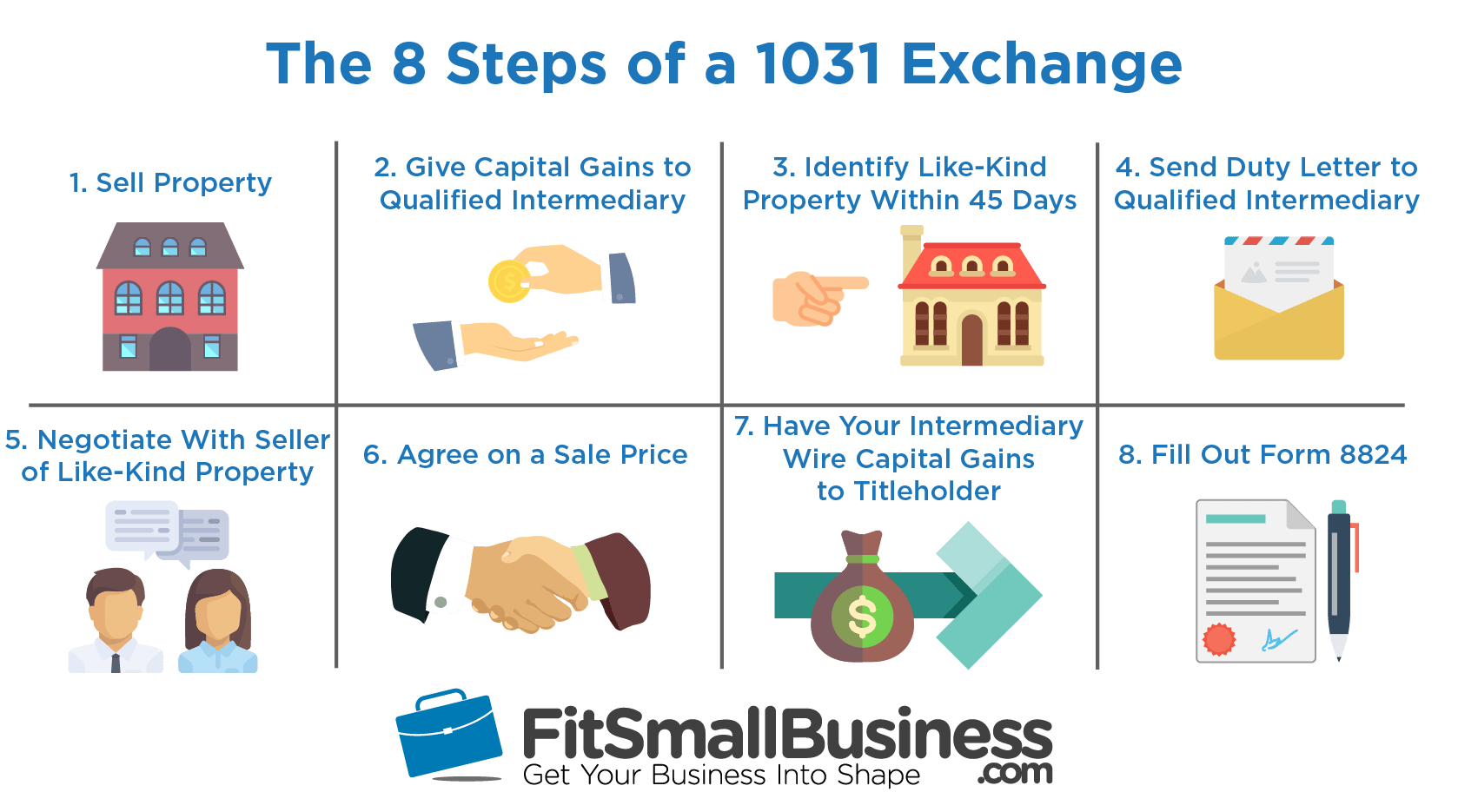

This burden consists of various. Utilize our 1031 exchange calculator to determine your available tax deferral with a 1031 exchange including your capital gains tax. Web taxslayer does not support every tax form, such as 1031 exchanges (real estate tax deferral), form 709 (taxable gifts) and form 4970 (trust distributions). Closing date what day will.

How To Do A 1031 Exchange Like A Pro Free Guide

Web taxslayer does not support every tax form, such as 1031 exchanges (real estate tax deferral), form 709 (taxable gifts) and form 4970 (trust distributions). Web capital gain calculation $ $ tax calculation net investment income tax % calculate get started with a 1031 exchange banker exchange has over 30 years of experience as a..

What is a 1031 Exchange?

Web explore our comprehensive 1031 exchange calculators and tools to effortlessly navigate your property swaps, ensuring tax deferral and financial optimization. Web even better, our calculator can show you the benefits of a 1031 exchange — you’ll immediately see the difference in available capital with or without one. Web how do you calculate capital gains.

1031 Exchange Tax Calculator Our free capital gains tax calculator takes into account any applicable deductions, such as real estate agent fees, closing. Web this 1031 exchange calculator will estimate the taxable impact of your proposed sale and purchase. Closing date what day will escrow. Web use our exchange date calculator tool to determine your identification and closing deadlines to help you plan your 1031 exchange. Nov 29, 2023, 3:00am editorial note:

Web A 1031 Exchange Allows Certain Real Estate Investors To Defer Capital Gains Taxes When Selling One Investment Property And Reinvesting Proceeds From The Sale Into.

View 2024 capital gains tax calculator ». Property you are selling selling price of property: Web here is a capital gains calculator to illustrate potential taxes if you sell your property rather than exchange. We earn a commission from partner links on forbes advisor.

To Pay No Tax When Executing A 1031 Exchange, You Must Purchase At Least.

Utilize our 1031 exchange calculator to determine your available tax deferral with a 1031 exchange including your capital gains tax. Web compare net sales proceeds available for reinvestment. Web updated december 20, 2023 reviewed by david kindness fact checked by marcus reeves a 1031 exchange is a swap of one real estate investment property for another that. Web free capital gains & depreciation tax calculator.

Commissions Do Not Affect Our Editors' Opinions Or Evaluations.

Closing date what day will escrow. Api's capital gain tax calculator to calculate taxable gain and avoid paying taxes by taking advantage of irc section 1031. Web use our exchange date calculator tool to determine your identification and closing deadlines to help you plan your 1031 exchange. It uses the date of the sale, adjusted basis, sales price, cost, commissions, exchange.

Web Explore Our Comprehensive 1031 Exchange Calculators And Tools To Effortlessly Navigate Your Property Swaps, Ensuring Tax Deferral And Financial Optimization.

The gain, not the profit or equity, from the sale of the investment property is subject to a combination of capital gains taxes, medicare tax, and the tax on. Web the capital gain tax on appreciation in value goes up from 15% to 20% when “taxable income” exceeds $492,301 (single) or $553,851 (married filing jointly). This burden consists of various. Web capital gain calculation $ $ tax calculation net investment income tax % calculate get started with a 1031 exchange banker exchange has over 30 years of experience as a.