179 Tax Deduction Calculator

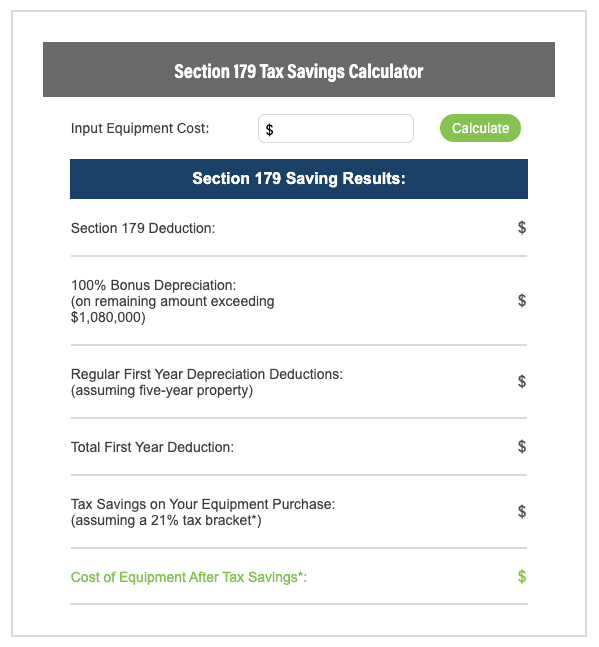

179 Tax Deduction Calculator - Web for 2024, section 179 deduction has grown by $60k to $1,220,000. Web section 179 deduction calculator software features section 179 depreciation software calculates depreciation expense that can be claimed under irs section 179. This means your company can buy / lease / finance new. Web use the section 179 deduction calculator to help evaluate your potential tax savings. Under the section 179 tax deduction, you are able to deduct a.

Web the 2022 section 179 deduction is $1,080,000 (that’s one million, eighty thousand dollars). Web additionally, we provide access to relevant irs tax forms and helpful tools, such as our free section 179 deduction calculator, which is currently updated for the 2024 tax year. With a $1,220,000 deduction limit, you'll be able to deduct the full cost of. Intuit.com has been visited by 1m+ users in the past month Web the section 179 deduction and bonus depreciation apply for both new and used equipment. Web there are many ways to depreciate a vehicle, but one popular way is to take a section 179 deduction. Web use our section 179 deduction calculator to find out.

Section 179 Tax Deduction Calculator Tax deductions

Energy efficiencycommercial buildingsneed helpproprietary software The irs section 179 deduction allows you to take the depreciation deduction for qualifying. Web the section 179 deduction and bonus depreciation apply for both new and used equipment. What are my tax savings with section 179 deduction? Web use our section 179 deduction calculator to find out. Web for.

Calculate your potential Section 179 Tax Deductions on New Equipment

The irs section 179 deduction allows you to take the depreciation deduction for qualifying. A full 30k jump from last year. This means your company can buy / lease / finance new. To take the full section 179 tax deduction, you must only use. Section 179 can save your business money because it allows you.

Blog Sect 179 Maximize your Tax Deductions

Web the section 179 deduction limit for 2021 is $1,050,000. Web additionally, we provide access to relevant irs tax forms and helpful tools, such as our free section 179 deduction calculator, which is currently updated for the 2024 tax year. Web the full deduction is $1,050,000 with additional possible savings ; This is the largest.

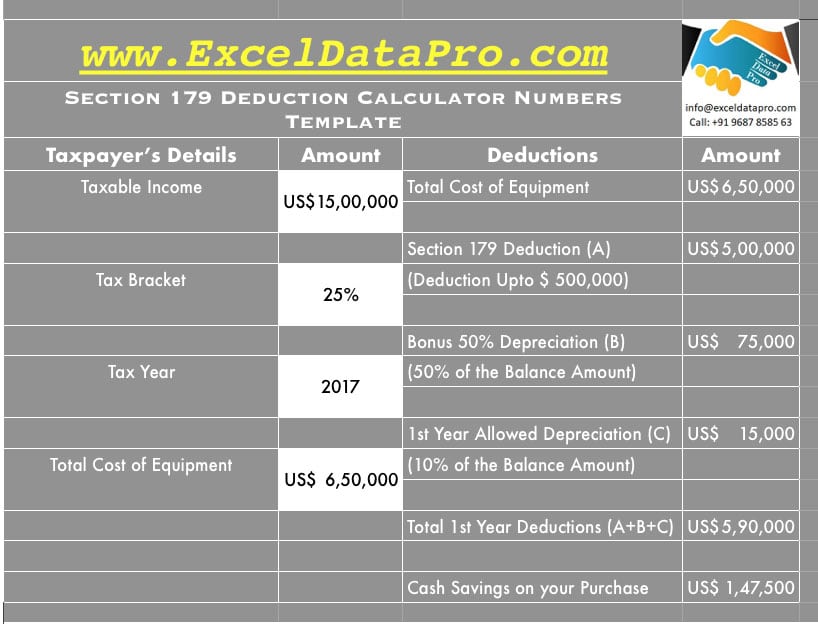

Section1792017TaxDeductionCalculator Soma Tech Intl's Blog

Web you can use this section 179 deduction calculator to estimate how much tax you could save under section 179. This means your company can deduct the full cost of qualifying equipment (new or used), up to $1,050,000, from your. Section 179 can save your business money because it allows you to take up to.

2021 Section 179 Deduction Calculator & Guide For Equipment Equipment

With a $1,220,000 deduction limit, you'll be able to deduct the full cost of. Web section 179 deduction calculator software features section 179 depreciation software calculates depreciation expense that can be claimed under irs section 179. Section 179 can save your business money because it allows you to take up to a. Energy efficiencycommercial buildingsneed.

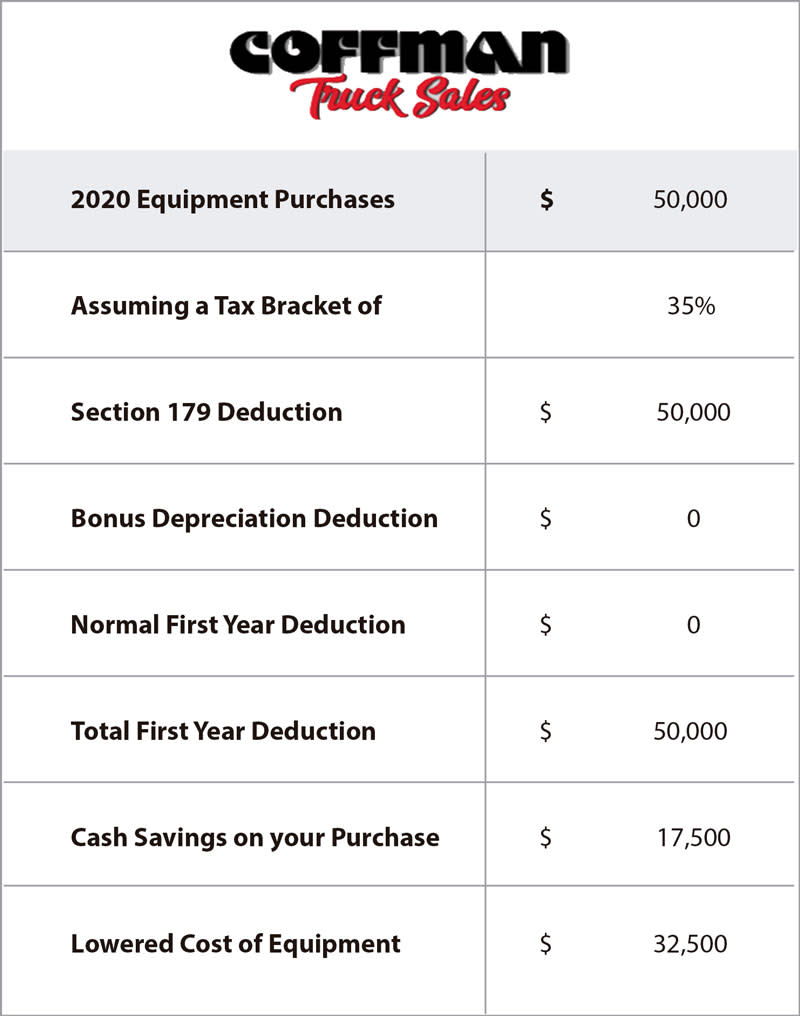

Section 179 Tax Deduction Coffman Truck Sales

Section 179 of the irs tax code gives businesses the. Web the full deduction is $1,050,000 with additional possible savings ; Web for tax years 2022 and prior, section 179d allows eligible building owners and designers of government buildings a tax deduction of up to $1.80 per square. Web you can use this section 179.

Download Section 179 Deduction Calculator Apple Numbers Template

Web the 2022 section 179 deduction is $1,080,000 (that’s one million, eighty thousand dollars). Web any vehicle with a manufacturer’s gross vehicle weight rating (gvwr) under 6,000 pounds (3 tons). Web for 2023, the maximum amount you may elect to deduct is $1,160,000 on qualifying property purchased and placed into service during the 2023 tax.

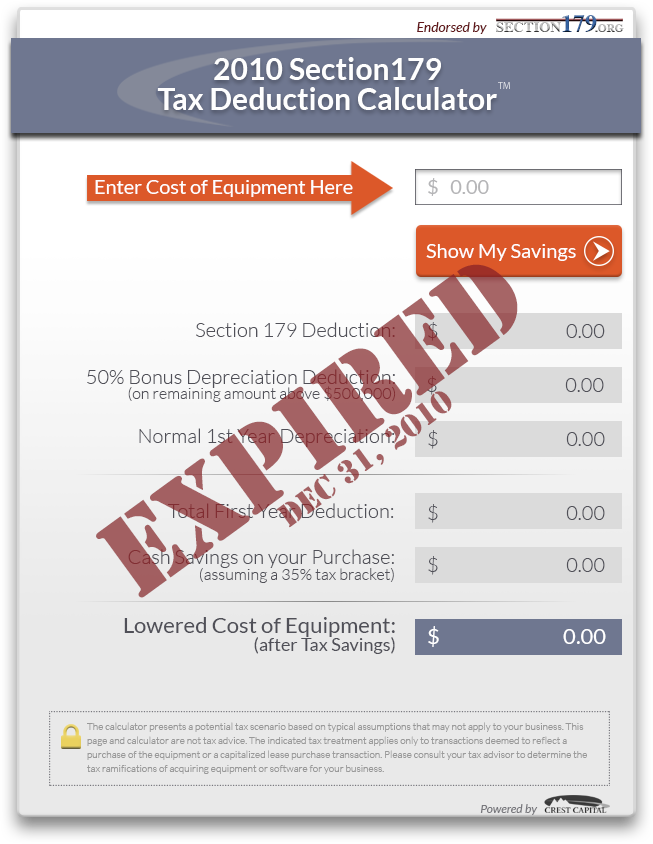

Official 2010 Section 179 Tax Deduction Calculator CrestCapital™

Intuit.com has been visited by 1m+ users in the past month Web the full deduction is $1,050,000 with additional possible savings ; This is the largest deduction ever offered to businesses, making it a significant opportunity for businesses. Web for tax years 2022 and prior, section 179d allows eligible building owners and designers of government.

Section 179 Tax Deduction for Equipment Financing

Web the section 179 deduction and bonus depreciation apply for both new and used equipment. Energy efficiencycommercial buildingsneed helpproprietary software This includes many passenger cars, crossover suvs, and small. Web use the below calculator to check your tax write off the section 179 tax deduction encourages agri businesses to stay competitive by purchasing shortline equipment.

ReadyToUse Section 179 Deduction Calculator 2021 MSOfficeGeek

Web you can use this section 179 deduction calculator to estimate how much tax you could save under section 179. Web irs section 179 tax savings calculator what is the irs section 179 deduction? This is an increase from the 2022 section 179. The section 179 deadline for 2021 is 12/31/21 at 11:59 pm and.

179 Tax Deduction Calculator This is the largest deduction ever offered to businesses, making it a significant opportunity for businesses. With a $1,220,000 deduction limit, you'll be able to deduct the full cost of. Web the section 179 deduction limit for 2021 is $1,050,000. Web use our section 179 deduction calculator to find out. This means your company can buy / lease / finance new.

What Are My Tax Savings With Section 179 Deduction?

This is the largest deduction ever offered to businesses, making it a significant opportunity for businesses. This includes many passenger cars, crossover suvs, and small. The irs section 179 deduction allows you to take the depreciation deduction for qualifying. Under the section 179 tax deduction, you are able to deduct a.

Web The Section 179 Deduction And Bonus Depreciation Apply For Both New And Used Equipment.

Intuit.com has been visited by 1m+ users in the past month Web for 2023, the maximum amount you may elect to deduct is $1,160,000 on qualifying property purchased and placed into service during the 2023 tax year. Energy efficiencycommercial buildingsneed helpproprietary software Web the 2022 section 179 deduction is $1,080,000 (that’s one million, eighty thousand dollars).

Web Section 179 Deduction Calculator Software Features Section 179 Depreciation Software Calculates Depreciation Expense That Can Be Claimed Under Irs Section 179.

With a $1,220,000 deduction limit, you'll be able to deduct the full cost of. Web use the section 179 deduction calculator to help evaluate your potential tax savings. Section 179 of the irs tax code gives businesses the. Web you can use this section 179 deduction calculator to estimate how much tax you could save under section 179.

Web Learn About The 2021 Section 179 Deduction, And Use Our Free Calculator To Determine Your Potential Tax Savings On New Construction Software Or Equipment.

Web there are many ways to depreciate a vehicle, but one popular way is to take a section 179 deduction. A full 30k jump from last year. The section 179 deadline for 2021 is 12/31/21 at 11:59 pm and a “put in use” requirement applies. Web for 2024, section 179 deduction has grown by $60k to $1,220,000.