401K Rollover To Roth Ira Tax Calculator

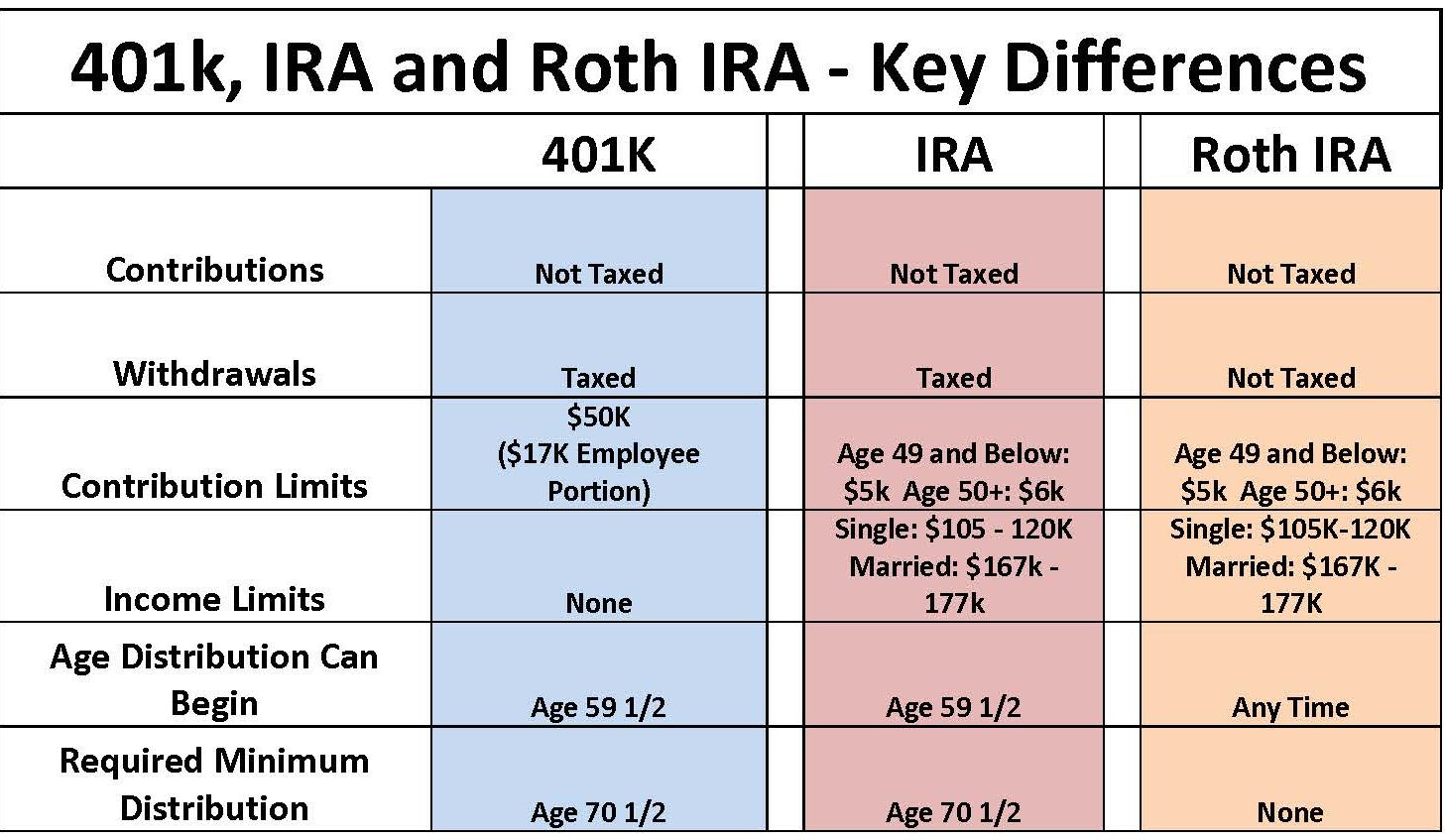

401K Rollover To Roth Ira Tax Calculator - Web say you have $100,000 in your 401 (k), $10,000 of which is nondeductible contributions. Web you can roll over funds from 401(k)s, 403(b)s, 457 plans, traditional iras, sep iras and simple iras. The tool assumes that you are paying any taxes owed with funds that you have available outside. • avoiding roth ira income restrictions. Web traditional 401 (k) or roth 401 (k) calculator calculate your earnings and more a 401 (k) can be an effective retirement tool.

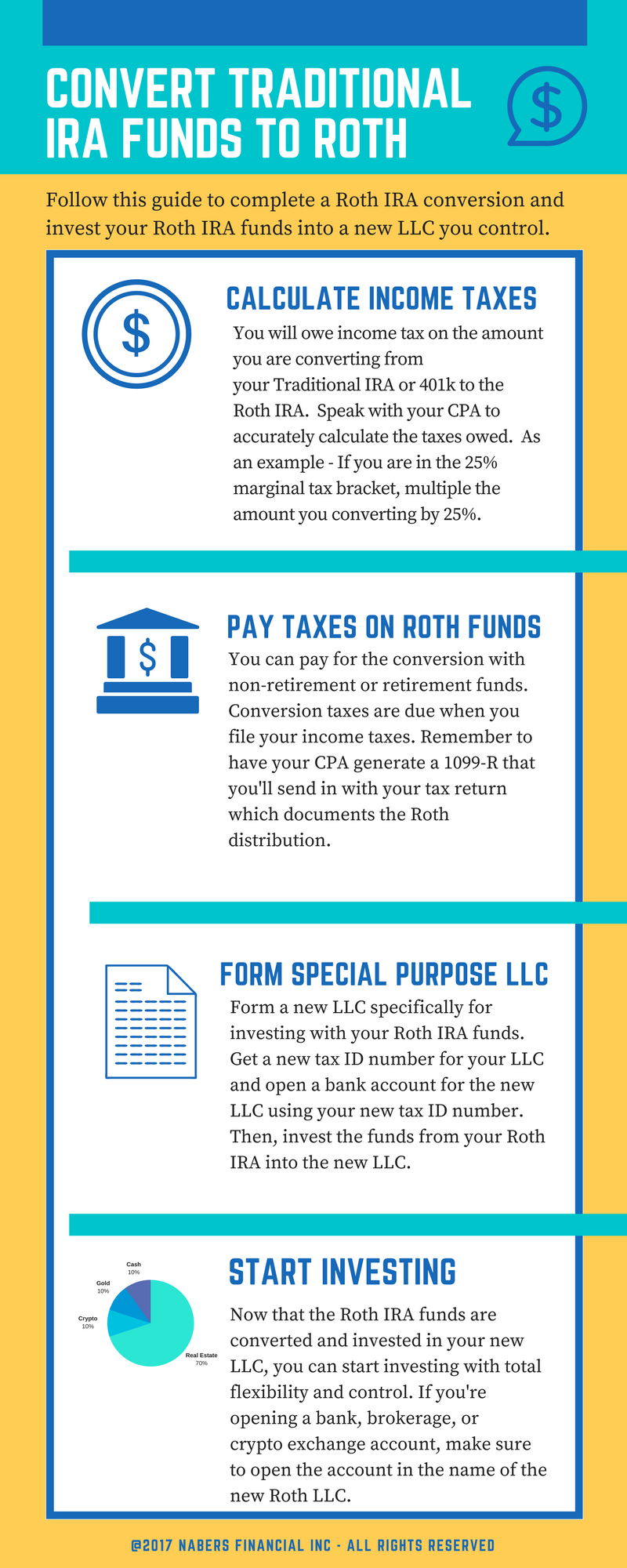

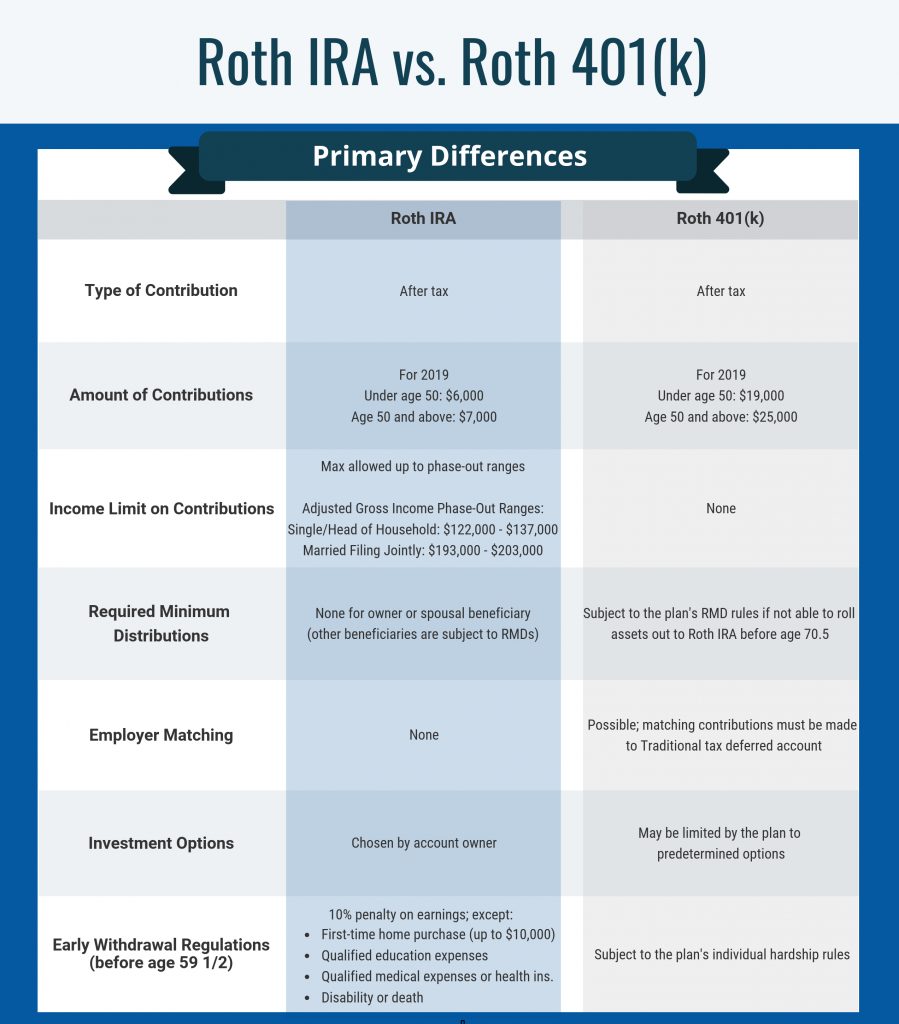

Web for 2024, maximum roth ira contributions are $7,000 per year, or $8,000 per year if you are 50 or older. Web for example, if you move $50,000 from your traditional ira to your roth ira, you would add on $50,000 to your taxable income that year, potentially pushing you into. With the passage of the “ american tax relief act “, any 401k plan that allows for. Most traditional ira investments can convert to a roth ira without being sold. • avoiding roth ira income restrictions. A roth ira may be a great way to instill the value of investing for a grandchild with earned income. Most 401(k)s convert in cash.

Rollover 401(k) to Roth IRA Rules, Pros, Cons, Signs, & How to Rollover

“a system in which you periodically. Web for a single filer it is $138,000 to $153,000. The limit for both traditional and roth iras is $7,000 total from among all accounts, a $500 increase from the $6,500 limit in 2023. If you wanted to convert $10,000 to a roth ira, only 10% of the converted..

After Tax 401K Rollover To Roth Ira Id Project

Free roth ira calculator to. The irs limits rollovers to once per year per ira account. Bankrate.com provides a free convert ira to roth calculator and other 401k calculators to help consumers determine the best option for. • avoiding roth ira income restrictions. Web you can shift money from a traditional ira or 401 (k).

401k vs roth ira calculator Choosing Your Gold IRA

Amount to convert from a traditional ira account to a roth ira. The contribution limit for a roth ira in. For those filing single, the. Even if your annual income is above the thresholds for roth ira. Web for example, if you move $50,000 from your traditional ira to your roth ira, you would add.

Roth 401(k) to Roth IRA Rollover How to Do It & Things to Consider

Converting it to a roth. Free roth ira calculator to. Traditional iras can be converted to roth iras if you're over the income limit. Web keep your 401 (k) most employers allow separated workers to keep their 401 (k) so long as it maintains a minimum balance, typically $5,000 (or $7,000 beginning. Web a rollover.

401k to roth ira tax calculator NataliaAsel

Web a rollover involves transferring the assets from your 401 (k) to a roth or traditional ira. Web say you have $100,000 in your 401 (k), $10,000 of which is nondeductible contributions. With the passage of the “ american tax relief act “, any 401k plan that allows for. Web traditional 401 (k) or roth.

roth ira vs roth 401k Choosing Your Gold IRA

Most traditional ira investments can convert to a roth ira without being sold. Web ira contribution limits for 2024. With the passage of the “ american tax relief act “, any 401k plan that allows for. Even if your annual income is above the thresholds for roth ira. A roth ira may be a great.

Roll over 401k to roth ira tax calculator FordBreandon

See an estimate of the taxes. The limit for both traditional and roth iras is $7,000 total from among all accounts, a $500 increase from the $6,500 limit in 2023. Web for example, if you move $50,000 from your traditional ira to your roth ira, you would add on $50,000 to your taxable income that.

Roth 401(k) to Roth IRA Rollover How to Do It & Things to Consider

Web traditional 401 (k) or roth 401 (k) calculator calculate your earnings and more a 401 (k) can be an effective retirement tool. The limit for both traditional and roth iras is $7,000 total from among all accounts, a $500 increase from the $6,500 limit in 2023. Web you can shift money from a traditional.

Rules for Converting Rollover 401(k) To a Roth IRA A Comprehensive Guide

When you arrange a direct rollover, the money goes straight from the 401 (k) to the ira provider and no taxes will be withheld or charged. Web traditional 401 (k) or roth 401 (k) calculator calculate your earnings and more a 401 (k) can be an effective retirement tool. Web use our roth ira conversion.

How to Convert Traditional IRA Funds to Roth Solo 401k

Web required minimum distributions, or rmds, cannot be converted into roth ira funds. The irs limits rollovers to once per year per ira account. The limit for both traditional and roth iras is $7,000 total from among all accounts, a $500 increase from the $6,500 limit in 2023. Considering converting some of your retirement funds.

401K Rollover To Roth Ira Tax Calculator Web for example, if you move $50,000 from your traditional ira to your roth ira, you would add on $50,000 to your taxable income that year, potentially pushing you into. Web for 2024, maximum roth ira contributions are $7,000 per year, or $8,000 per year if you are 50 or older. Traditional iras can be converted to roth iras if you're over the income limit. The contribution limit for a roth ira in. Web use our roth ira conversion calculator to compare the estimated future values of keeping your traditional ira vs.

Web For Example, If You Move $50,000 From Your Traditional Ira To Your Roth Ira, You Would Add On $50,000 To Your Taxable Income That Year, Potentially Pushing You Into.

Web you can shift money from a traditional ira or 401 (k) into a roth ira by doing a roth ira conversion. The contribution limit for a roth ira in. Amount to convert from a traditional ira account to a roth ira. Web use our roth ira conversion calculator to compare the estimated future values of keeping your traditional ira vs.

Web For A Single Filer It Is $138,000 To $153,000.

Free roth ira calculator to. “a system in which you periodically. Web say you have $100,000 in your 401 (k), $10,000 of which is nondeductible contributions. When you arrange a direct rollover, the money goes straight from the 401 (k) to the ira provider and no taxes will be withheld or charged.

Web Savings And Cd Rates.

• avoiding roth ira income restrictions. If you wanted to convert $10,000 to a roth ira, only 10% of the converted. Considering converting some of your retirement funds to roth? The amount you convert is added to your gross income for.

Web Keep Your 401 (K) Most Employers Allow Separated Workers To Keep Their 401 (K) So Long As It Maintains A Minimum Balance, Typically $5,000 (Or $7,000 Beginning.

Web required minimum distributions, or rmds, cannot be converted into roth ira funds. Web a rollover involves transferring the assets from your 401 (k) to a roth or traditional ira. A roth ira may be a great way to instill the value of investing for a grandchild with earned income. Web traditional 401 (k) or roth 401 (k) calculator calculate your earnings and more a 401 (k) can be an effective retirement tool.

_into_a_Roth_IRA-1.png?width=3360&height=1890&name=Signs_to_Roll_your_401_(k)_into_a_Roth_IRA-1.png)

_to_a_Roth_IRA_Account.png?width=2626&name=Steps_in_Rolling_Over_a_Roth_401(k)_to_a_Roth_IRA_Account.png)

_to_Roth_IRA_Rollover.png#keepProtocol)