401K To Roth 401K Conversion Calculator

401K To Roth 401K Conversion Calculator - Web most roth 401k calculators assume two things: Web roth 401 (k) conversion calculator. Web converting a 401 (k) to a roth ira is essentially the same process as rolling your 401 (k) funds over to a traditional ira, but there's the extra step of paying taxes on. Web keep your 401 (k) most employers allow separated workers to keep their 401 (k) so long as it maintains a minimum balance, typically $5,000 (or $7,000 beginning. Say that your effective tax rate had dropped to just 15% in retirement.

The process of converting your pretax 401(k) into a roth 401(k) varies from company to company, but. Web roth 401 (k) conversion calculator. Web what are the contribution limits in 2024? The roth would then generate the same. That you’ll contribute the same dollar amount into a roth as you would a traditional 401k. Say that your effective tax rate had dropped to just 15% in retirement. Web backdoor roth conversion taxes and cooldowns.

Downlodable Freeware CONVERT 401K TO ROTH IRA CALCULATOR

$ 110,000 total taxes with current account: Web if the balance in your ira at the end of 2023 was $150,000, you’d need to divide $150,000 by 24.6 years. That you’ll contribute the same dollar amount into a roth as you would a traditional 401k. Web what are the contribution limits in 2024? Web $.

401k to roth ira rollover calculator LyndseyRuana

Web roth 401 (k) conversion calculator. 55 years planned retirement agethe age when. Web $ 707,204 total taxes with converted roth: Web converting a 401 (k) to a roth ira is essentially the same process as rolling your 401 (k) funds over to a traditional ira, but there's the extra step of paying taxes on..

Traditional 401k to roth 401k conversion tax calculator SunniaHavin

Web traditional 401 (k) or roth 401 (k) calculator calculate your earnings and more a 401 (k) can be an effective retirement tool. Web $ 707,204 total taxes with converted roth: Contribution limits for roth and traditional 401 (k) plans are the same. $ 110,000 total taxes with current account: That you’ll contribute the same.

roth ira vs 401k Choosing Your Gold IRA

Web roth ira conversion calculator is converting to a roth ira the right move for you? $ 817,204 current ageyour age today. Web $ 707,204 total taxes with converted roth: Web nerdwallet’s free 401(k) retirement calculator calculates your 2024 contribution limit and employer match, then estimates what your 401(k) balance will be at. Web 2023.

Traditional 401k to roth 401k conversion tax calculator SunniaHavin

Traditional iras can be converted to roth iras if you're over the income limit. Web roth ira conversion calculator is converting to a roth ira the right move for you? Traditional ira calculator self employed 401k calculator social security benefit. Web $ 707,204 total taxes with converted roth: Web $ 707,204 total taxes with converted.

How to Convert Traditional IRA Funds to Roth Solo 401k

$ 110,000 total taxes with current account: Web keep your 401 (k) most employers allow separated workers to keep their 401 (k) so long as it maintains a minimum balance, typically $5,000 (or $7,000 beginning. Whether you participate in a 401 (k), 403 (b) or 457 (b). Web if the balance in your ira at.

Roth 401k calculator with match ChienSelasi

Traditional ira calculator self employed 401k calculator social security benefit. Web nerdwallet’s free 401(k) retirement calculator calculates your 2024 contribution limit and employer match, then estimates what your 401(k) balance will be at. Web keep your 401 (k) most employers allow separated workers to keep their 401 (k) so long as it maintains a minimum.

Infographic Converting to a Roth 401k LLC Solo 401k

$ 110,000 total taxes with current account: Whether you participate in a 401 (k), 403 (b) or 457 (b). Web roth 401 (k) conversion calculator. You can contribute as much as $23,000 to a 401 (k) plan in. Web to convert to roth, you would pay approximately $12,000 in taxes today, but in 20 years,.

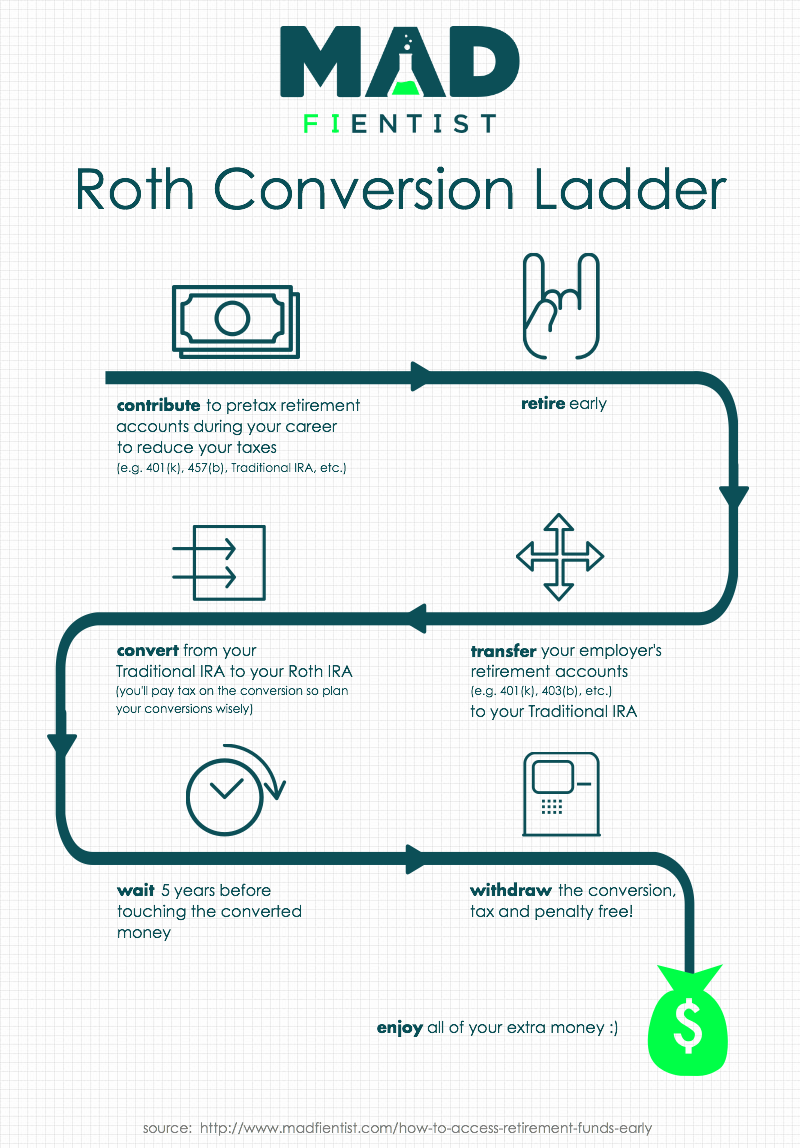

Roth Conversion Ladder and SEPP How to Access Your Retirement Accounts

With the passage of the 'american tax relief act', any 401 (k) plan that allows for roth contributions will now be eligible to convert existing. Web backdoor roth conversion taxes and cooldowns. $ 110,000 total taxes with current account: Whether you participate in a 401 (k), 403 (b) or 457 (b). Web keep your 401.

401k and roth ira calculator SinclairLeri

The roth would then generate the same. Web keep your 401 (k) most employers allow separated workers to keep their 401 (k) so long as it maintains a minimum balance, typically $5,000 (or $7,000 beginning. The process of converting your pretax 401(k) into a roth 401(k) varies from company to company, but. Traditional iras can.

401K To Roth 401K Conversion Calculator Web a roth conversion is simply the process of moving funds from traditional retirement accounts, such as a 401 (k) or a traditional ira, into a roth ira. The roth would then generate the same. Web keep your 401 (k) most employers allow separated workers to keep their 401 (k) so long as it maintains a minimum balance, typically $5,000 (or $7,000 beginning. Web $ 707,204 total taxes with converted roth: Web retirement planner retirement pension planner retirement shortfall calculator roth vs.

Web What Are The Contribution Limits In 2024?

Whether you participate in a 401 (k), 403 (b) or 457 (b). Web most roth 401k calculators assume two things: Web keep your 401 (k) most employers allow separated workers to keep their 401 (k) so long as it maintains a minimum balance, typically $5,000 (or $7,000 beginning. The process of converting your pretax 401(k) into a roth 401(k) varies from company to company, but.

Web Retirement Planner Retirement Pension Planner Retirement Shortfall Calculator Roth Vs.

$ 110,000 total taxes with current account: Web traditional 401 (k) or roth 401 (k) calculator calculate your earnings and more a 401 (k) can be an effective retirement tool. Affordable policiesprotect your familyknowledgeable agents Web if the balance in your ira at the end of 2023 was $150,000, you’d need to divide $150,000 by 24.6 years.

55 Years Planned Retirement Agethe Age When.

Contribution limits for roth and traditional 401 (k) plans are the same. That you’ll contribute the same dollar amount into a roth as you would a traditional 401k. Web how do i convert my traditional 401(k) into a roth 401(k)? Traditional ira calculator self employed 401k calculator social security benefit.

$ 817,204 Current Ageyour Age Today.

Web $ 707,204 total taxes with converted roth: Web backdoor roth conversion taxes and cooldowns. Web nerdwallet’s free 401(k) retirement calculator calculates your 2024 contribution limit and employer match, then estimates what your 401(k) balance will be at. The roth would then generate the same.