401K To Roth Ira Conversion Calculator

401K To Roth Ira Conversion Calculator - Web this calculator can show you the consequences of such a decision. Total taxes with converted roth: Web use our roth ira conversion calculator to compare the estimated future values of keeping your traditional ira vs. Use these free retirement calculators to determine how. Potential future tax savings and see the results based on your income, tax rates, and.

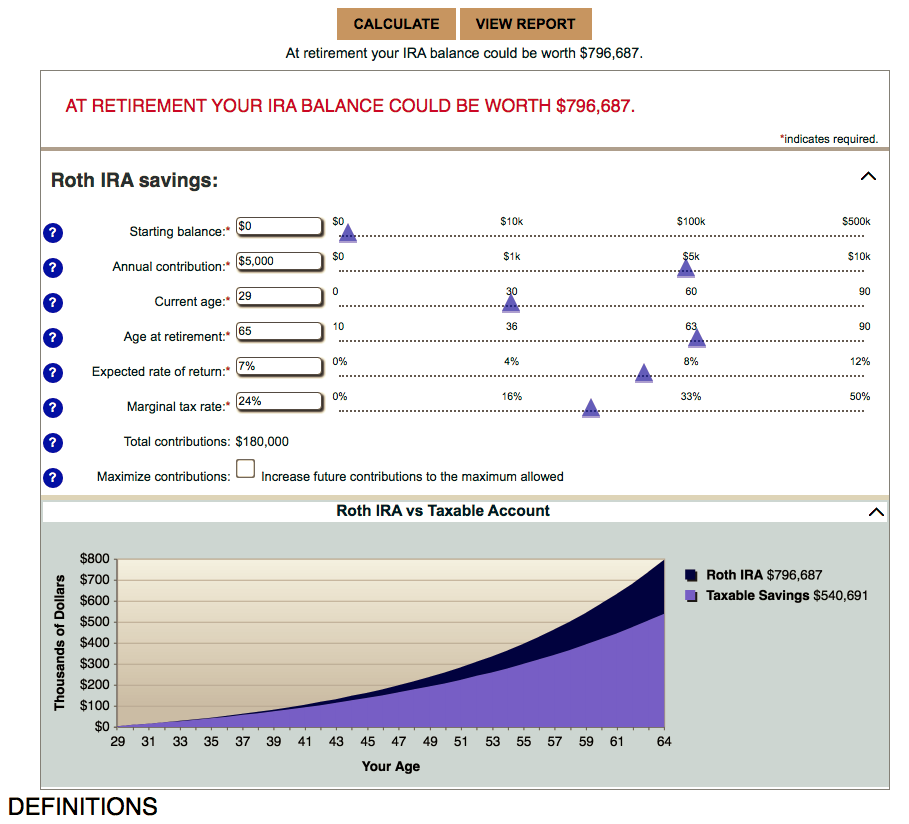

Web use this free roth ira calculator to find out how much your roth ira contributions could be worth at retirement, calculate your estimated maximum annual contribution in 2024,. Ramseysolutions.com has been visited by 100k+ users in the past month Web rolling a roth 401 (k) into a roth ira isn’t that different from completing a normal rollover from a 401 (k) to an ira, says dave lowell, a certified financial planner. If you have a traditional ira. Web if the balance in your ira at the end of 2023 was $150,000, you’d need to divide $150,000 by 24.6 years. Web when you convert from a traditional ira to a roth ira, the amount that you convert is added to your gross income for that tax year. Web to convert to roth, you would pay approximately $12,000 in taxes today, but in 20 years, you could have $22,260 more in total assets, which may make a roth conversion.

Roth 401(k) to Roth IRA Rollover How to Do It & Things to Consider

See an estimate of the taxes. Compare the impact of taxes on the converted amount today vs. Web this calculator assumes that you make your contribution at the beginning of each year. Web roth ira conversion calculator want to know how converting a traditional ira to a roth ira would affect your account? And a.

Infographic Converting to a Roth 401k LLC Solo 401k

It can help lower your lifetime taxes significantly. Web to convert to roth, you would pay approximately $12,000 in taxes today, but in 20 years, you could have $22,260 more in total assets, which may make a roth conversion. If you wanted to convert $10,000 to a roth ira, only 10% of the. See an.

roth ira vs 401k Choosing Your Gold IRA

Web say you have $100,000 in your 401 (k), $10,000 of which is nondeductible contributions. Converting it to a roth. Your required minimum distribution, therefore, is $6,098. And a conversion is not a. Potential future tax savings and see the results based on your income, tax rates, and. Total taxes with converted roth: Web this.

401k vs roth ira calculator Choosing Your Gold IRA

Your required minimum distribution, therefore, is $6,098. It is provided for general educational purposes only. Web published may 02, 2023 getty images if you’re recently retired, or if you’re new to a job, rolling over a traditional 401 (k) plan into a roth ira could be a smart financial move. Total taxes with current account:.

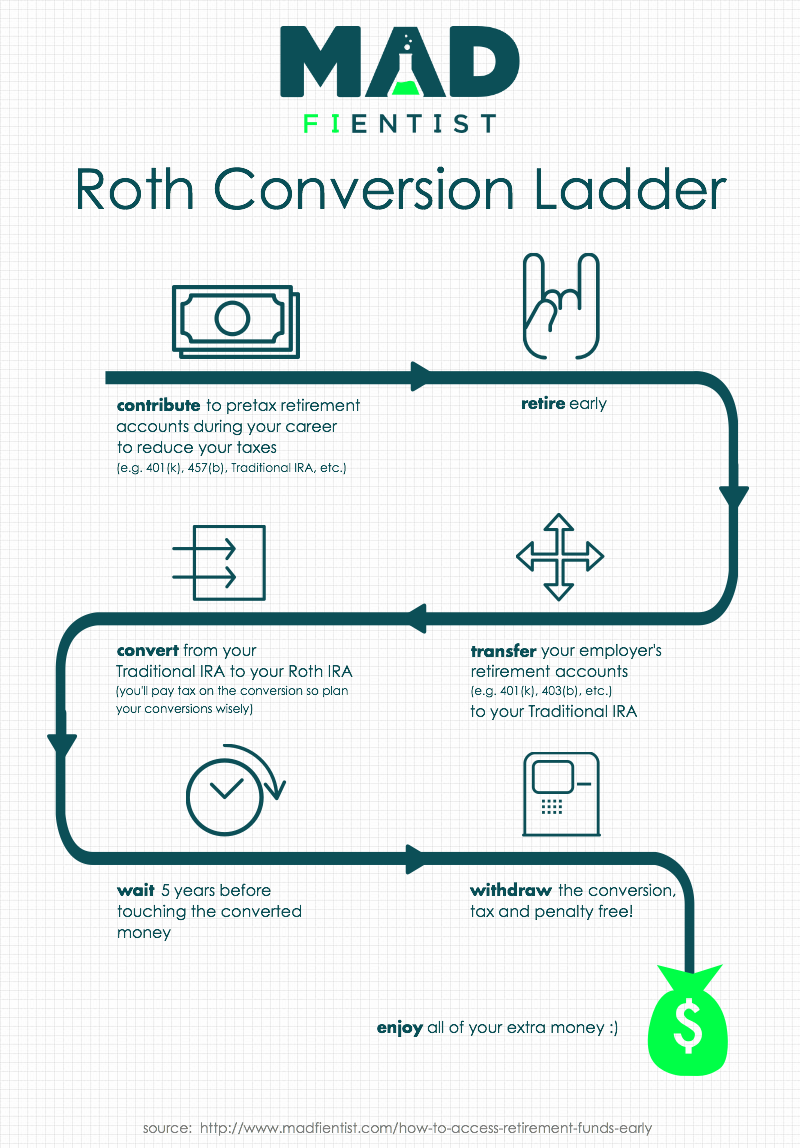

Roth Conversion Ladder and SEPP How to Access Your Retirement Accounts

Web high yield $10,000 mma. It can help lower your lifetime taxes significantly. Web use this free roth ira calculator to find out how much your roth ira contributions could be worth at retirement, calculate your estimated maximum annual contribution in 2024,. Web this calculator assumes that you make your contribution at the beginning of.

Downlodable Freeware CONVERT 401K TO ROTH IRA CALCULATOR

Web roth ira conversion calculator want to know how converting a traditional ira to a roth ira would affect your account? Web projected tax savings with a roth conversion. Web rolling a roth 401 (k) into a roth ira isn’t that different from completing a normal rollover from a 401 (k) to an ira, says.

How to Use a Roth IRA Calculator Ready to Roth

Web projected tax savings with a roth conversion. Converting it to a roth. Web rolling a roth 401 (k) into a roth ira isn’t that different from completing a normal rollover from a 401 (k) to an ira, says dave lowell, a certified financial planner. Ramseysolutions.com has been visited by 100k+ users in the past.

How to Convert Traditional IRA Funds to Roth Solo 401k

Web high yield $10,000 mma. Potential future tax savings and see the results based on your income, tax rates, and. Total taxes with current account: Ramseysolutions.com has been visited by 100k+ users in the past month Total taxes with converted roth: Web this calculator can show you the consequences of such a decision. Web use.

401k to roth ira rollover calculator LyndseyRuana

Web when you convert from a traditional ira to a roth ira, the amount that you convert is added to your gross income for that tax year. See an estimate of the taxes. Potential future tax savings and see the results based on your income, tax rates, and. It increases your income, and. Compare the.

401k and roth ira calculator SinclairLeri

Web this calculator assumes that you make your contribution at the beginning of each year. And a conversion is not a. Your required minimum distribution, therefore, is $6,098. Annuity & life insurancegrowth & protection.retirement planning.annuity & life insurance. Web say you have $100,000 in your 401 (k), $10,000 of which is nondeductible contributions. It increases.

401K To Roth Ira Conversion Calculator And a conversion is not a. Total taxes with current account: Total taxes with converted roth: It can help lower your lifetime taxes significantly. Web this calculator assumes that you make your contribution at the beginning of each year.

If You Have A Traditional Ira.

First enter your current age, the age at which you wish to retire, and the number of years you will need to draw. It can help lower your lifetime taxes significantly. Total taxes with converted roth: Web for example, if you move $50,000 from your traditional ira to your roth ira, you would add on $50,000 to your taxable income that year, potentially pushing you into.

Web High Yield $10,000 Mma.

Web bankrate.com provides a free convert ira to roth calculator and other 401k calculators to help consumers determine the best option for retirement savings. Web to convert to roth, you would pay approximately $12,000 in taxes today, but in 20 years, you could have $22,260 more in total assets, which may make a roth conversion. Converting your traditional ira to a roth ira may be. And a conversion is not a.

This Is When People Generally Retire In The U.s., According To Transamerica And Aegon Research.

Web projected tax savings with a roth conversion. Compare the impact of taxes on the converted amount today vs. Potential future tax savings and see the results based on your income, tax rates, and. Total taxes with current account:

Compare The Advantages And Disadvantages Of.

See an estimate of the taxes. Use these free retirement calculators to determine how. Ramseysolutions.com has been visited by 100k+ users in the past month Traditional iras can be converted to roth iras if you're over the income limit.

_to_a_Roth_IRA_Account.png?width=2626&name=Steps_in_Rolling_Over_a_Roth_401(k)_to_a_Roth_IRA_Account.png)