401K Versus Roth 401K Calculator

401K Versus Roth 401K Calculator - Traditional 401 (k) calculator if available in your employer's plan, the 401 (k) roth allows you to contribute. As of january 2006, there is a new type of 401 (k) contribution. Web when you convert money to a roth ira, you will need to pay income taxes on the entire amount in the tax year that you make the conversion. Impact on retirement fund balances beneficiary required. Web bankrate.com provides a free 401k or roth ira calculator and other 401(k) calculators to help consumers determine the best option for retirement possible.'

Web if you’re in a position to save more than 401(k) rules allow, you can invest up to $7,000 a year—plus $1,000 extra if you’re at least 50 years old—in traditional and. Web 401(k) and roth contribution calculator. Web nerdwallet’s free 401 (k) retirement calculator calculates your 2024 contribution limit and employer match, then estimates what your 401 (k) balance will be at retirement. Access to advisorsadvice & guidance Web roth 401 (k) vs traditional 401 (k) calculator. Simple math tells us then that 91% of people shouldn’t put their money into a roth. You can potentially save much more per year using a roth 401 (k) than a roth ira.

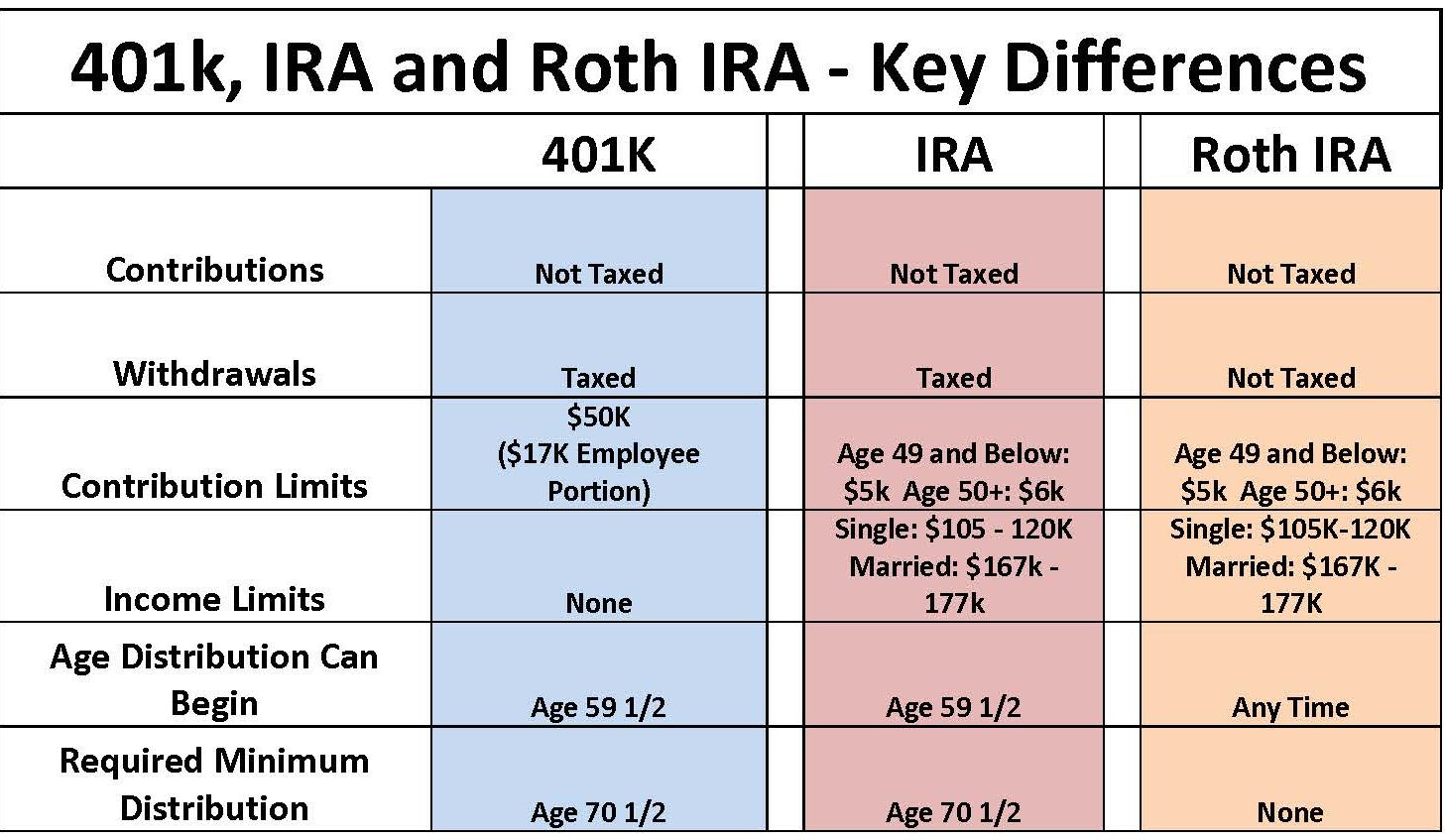

roth ira vs 401k Choosing Your Gold IRA

Web with a roth employer contribution, the company (your business) takes a deduction as an employee benefit expense for making the contribution to your 401k. Web nerdwallet’s free 401 (k) retirement calculator calculates your 2024 contribution limit and employer match, then estimates what your 401 (k) balance will be at retirement. As of january 2006,.

Roth 401k Might Make You Richer Millennial Money

Web updated december 29, 2023 reviewed by eric estevez fact checked by jared ecker roth 401 (k) vs. Access to advisorsadvice & guidance Traditional 401 (k) and your paycheck. Web fact checked by jared ecker roth ira vs. Web contribution limits for roth iras and roth 401 (k)s are very different. Web with a sep.

Roth IRA vs 401(k) Roth IRA Calculator Stashing Dollars

Web if you’re in a position to save more than 401(k) rules allow, you can invest up to $7,000 a year—plus $1,000 extra if you’re at least 50 years old—in traditional and. Web bankrate.com provides a free 401k or roth ira calculator and other 401(k) calculators to help consumers determine the best option for retirement.

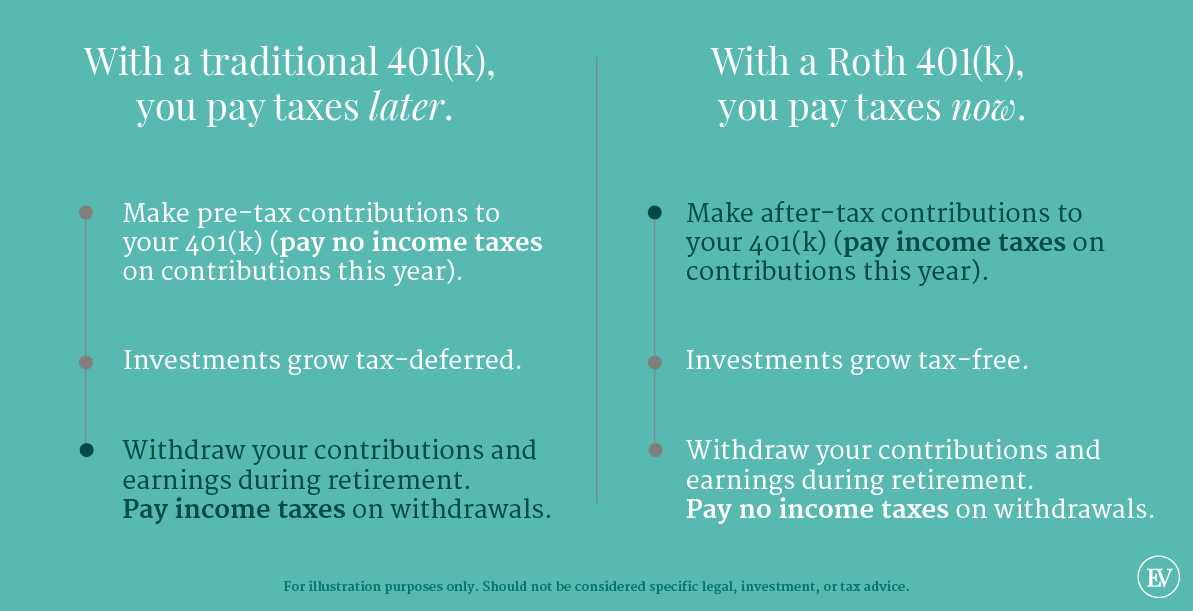

401(k) vs Roth 401(k) How Do You Decide? Ellevest

Access to advisorsadvice & guidance Traditional 401 (k) roth 401 (k) contributions. Web with a sep ira, you can contribute up to $69,000 or 25% of your income (whichever is less) for 2024. A 401 (k) can be an effective retirement tool. Web if you have an annual salary of $25,000 and contribute 6%, your.

401k to roth ira tax calculator NataliaAsel

You can potentially save much more per year using a roth 401 (k) than a roth ira. Web if you’re in a position to save more than 401(k) rules allow, you can invest up to $7,000 a year—plus $1,000 extra if you’re at least 50 years old—in traditional and. Annuity & life insurancegrowth & protection.annuity.

Traditional 401k to roth 401k conversion tax calculator SunniaHavin

Web roth 401 (k) vs traditional 401 (k) calculator. Access to advisorsadvice & guidance Web once you've maxed out an ira, you should refocus on maxing out your 401 (k). Access to advisorsadvice & guidance A traditional 401 (k) may be worth $43,027 more than a roth 401. With a 50% match, your employer will.

401k vs roth ira calculator Choosing Your Gold IRA

You can potentially save much more per year using a roth 401 (k) than a roth ira. Traditional 401 (k) and your paycheck. Web 401(k) and roth contribution calculator. Web roth 401 (k) vs traditional 401 (k) calculator. Web bankrate.com provides a free 401k or roth ira calculator and other 401(k) calculators to help consumers.

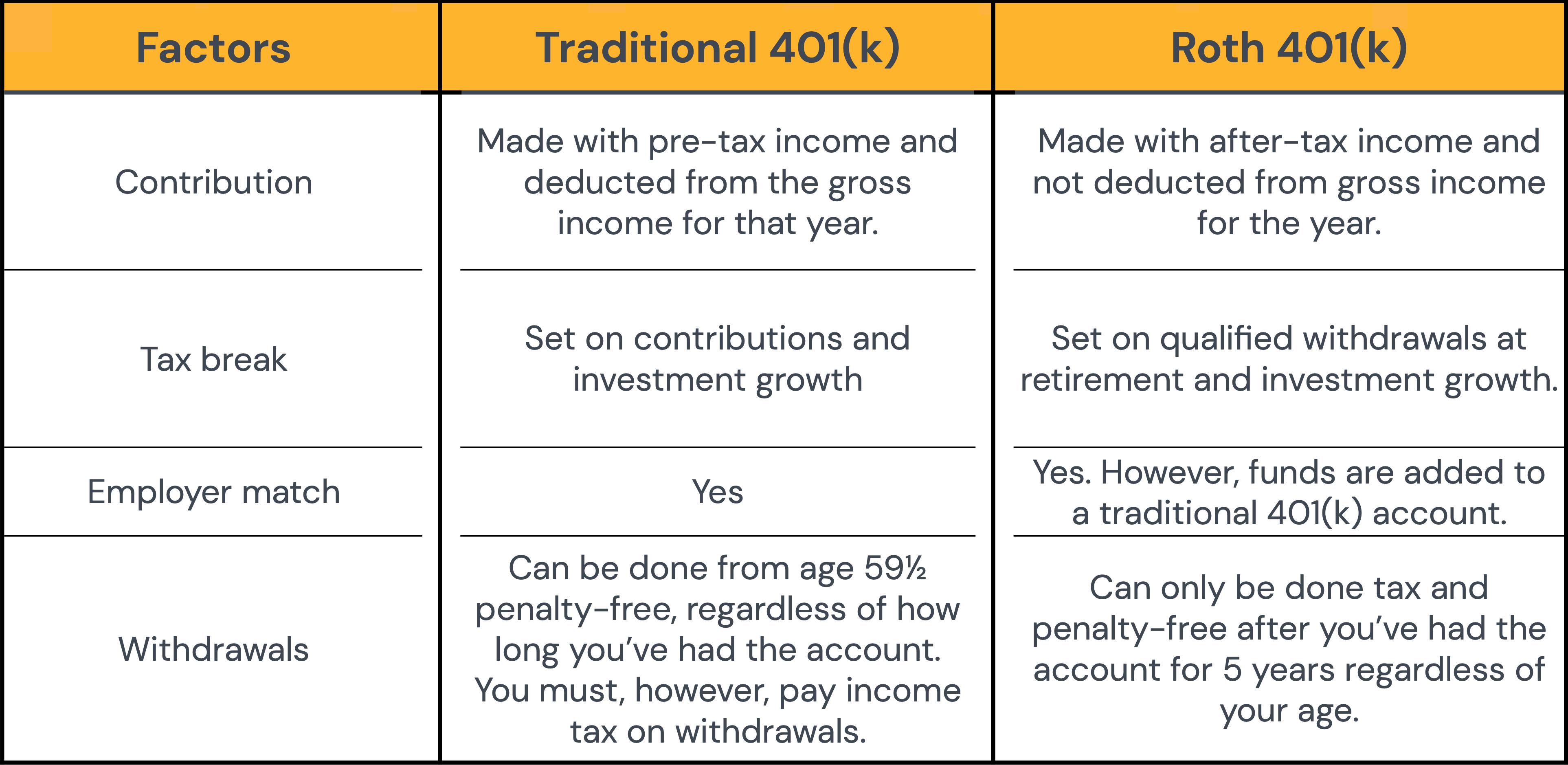

The Differences Between a Roth 401(k) and a Traditional 401(k)

Traditional 401 (k) and your paycheck. You can potentially save much more per year using a roth 401 (k) than a roth ira. Web nerdwallet’s free 401 (k) retirement calculator calculates your 2024 contribution limit and employer match, then estimates what your 401 (k) balance will be at retirement. Annuity & life insurancegrowth & protection.annuity.

Roth 401k calculator with match ChienSelasi

Web roth vs traditional 401 (k) calculator roth 401 (k) contributions are a relatively new type of 401 (k) that allows you to invest money after taxes, and pay no taxes when funds are. Web when you convert money to a roth ira, you will need to pay income taxes on the entire amount in.

The Ultimate Roth 401(k) Guide District Capital Management

The maximum amount you can contribute to an ira (traditional and roth combined) in. Web if you’re in a position to save more than 401(k) rules allow, you can invest up to $7,000 a year—plus $1,000 extra if you’re at least 50 years old—in traditional and. Web bankrate.com provides a free 401k or roth ira.

401K Versus Roth 401K Calculator Traditional 401 (k) calculator if available in your employer's plan, the 401 (k) roth allows you to contribute. A 401 (k) can be an effective retirement tool. Web our survey found that 9% of people should invest in a roth 401k. Traditional 401 (k) and your paycheck. Web 401(k) and roth contribution calculator.

The Maximum Amount You Can Contribute To An Ira (Traditional And Roth Combined) In.

Midasgoldgroup.com has been visited by 10k+ users in the past month Access to advisorsadvice & guidance A 401 (k) can be an effective retirement tool. Web roth 401 (k) vs traditional 401 (k) calculator.

Web The Contribution Limits On A Roth 401(K) Are The Same As Those For A Traditional 401(K):

The roth 401(k) allows you to contribute to your 401(k) account on an. A traditional 401 (k) may be worth $43,027 more than a roth 401. Web with a roth employer contribution, the company (your business) takes a deduction as an employee benefit expense for making the contribution to your 401k. Traditional 401 (k) roth 401 (k) contributions.

Web Our Survey Found That 9% Of People Should Invest In A Roth 401K.

Access to advisorsadvice & guidance Starting in 2026, you won't be able to deposit catch. Web once you've maxed out an ira, you should refocus on maxing out your 401 (k). With a 50% match, your employer will add another $750 to your 401 (k) account.

As Of January 2006, There Is A New Type Of 401 (K) Contribution.

Annuity & life insurancegrowth & protection.annuity & life insurance.retirement planning. Web use this calculator 1 to help determine the option that could work for you and how it might affect your paycheck. Traditional 401 (k) and your paycheck. Simple math tells us then that 91% of people shouldn’t put their money into a roth.