403 B Contribution Calculator

403 B Contribution Calculator - The maximum contributions allowed are $22,500 for 2023 and $23,000. Web 403 (b) savings calculator * indicates required. 403 (b) employee savings plan: Web the 2024 403(b) contribution limit is $23,000 for pretax and roth employee contributions, and $69,0000 for employer and employee contributions. All ratings and reviews are voluntarily submitted by existing customers.

All ratings and reviews are voluntarily submitted by existing customers. Q4 2017 results based on 403(b) participants and contributions. Workers who contribute to a 401 (k), 403 (b), most 457 plans and the federal government’s thrift savings plan can contribute up. $3,000, up to a total of $15,000, if you have at least 15 years of service with your employer and have contributed on average less than. Web the 2024 403(b) contribution limit is $23,000 for pretax and roth employee contributions, and $69,0000 for employer and employee contributions. Web 403 (b) savings calculator * indicates required. Web 401 (k) contribution limits for 2024.

Online 403(b) Contributions (EFT)

Web 403 (b) savings calculator * indicates required. Web 403b calculator is a tool for you to evaluate the growth of your monthly contribution to a 403b retirement plan. 403 (b) employee savings plan: Web 401 (k) contribution limits for 2024. If you are over the age of 50, your contribution limit increases to. 501c.

403(b) vs 457(b) Eligibility, Process & Contribution Comparison

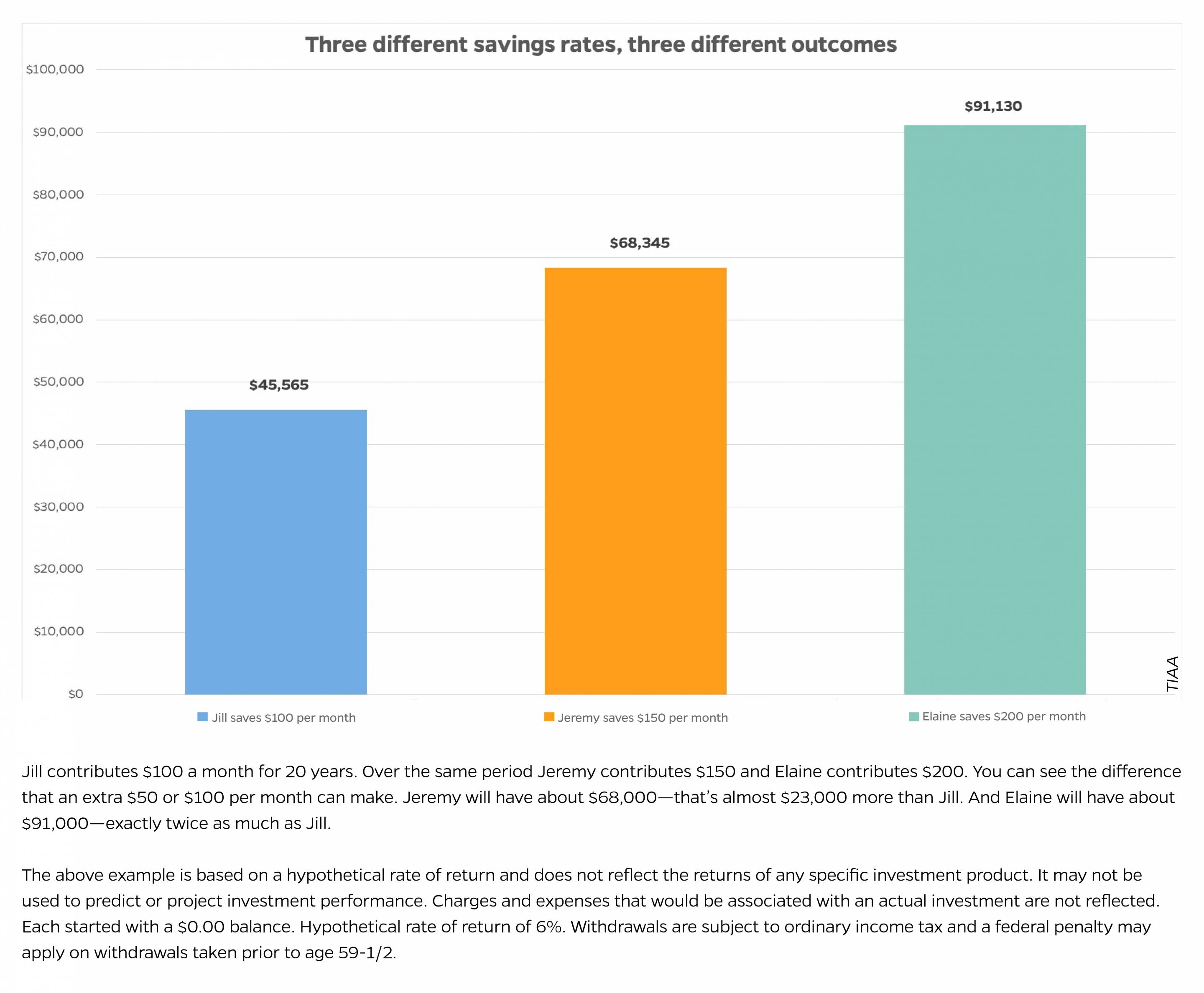

They each save $150 per month and get an 8% average annual return on their. Web the 403(b) plan has the same caps on yearly contributions that come with 401(k) plans. Q4 2017 results based on 403(b) participants and contributions. 501c (3) corps, including colleges,. Web 403 (b) savings calculator your contributions annual salary $.

403(b) Retirement Plan

Whether you participate in a 401 (k), 403 (b) or 457 (b). $3,000, up to a total of $15,000, if you have at least 15 years of service with your employer and have contributed on average less than. Web however, your annual contribution is also subject to certain maximum total contributions per year. This calculator.

The Beginners Guide To Understand 403 B Plan Overview CC

Web 403b calculator is a tool for you to evaluate the growth of your monthly contribution to a 403b retirement plan. Web use a 403 (b) calculator to help if you need help figuring out how much you will have and how much you need to contribute now to meet your retirement needs, use the.

403(b) TaxSheltered Annuity Calculator, Contribution, Withdrawal Rules

This calculator assumes that you make your contribution at the beginning of. All ratings and reviews are voluntarily submitted by existing customers. 403 (b) employee savings plan: $0 $10k $100k $1m percent to contribute:* ? Web jayla and hannah started contributing to their 403 (b) plans. Web the policy, which stands for setting every community.

403(b) TaxSheltered Annuity Calculator, Contribution, Withdrawal Rules

Whether you participate in a 401 (k), 403 (b) or 457 (b). The irs elective contribution limit to a 403 (b) for 2024 starts at $23000. This calculator assumes that you make your contribution at the beginning of. Q4 2017 results based on 403(b) participants and contributions. They each save $150 per month and get.

What is a 403(b) plan and how does it work Money Journey Today

Web 403b calculator is a tool for you to evaluate the growth of your monthly contribution to a 403b retirement plan. $0 $10k $100k $1m percent to contribute:* ? The irs elective contribution limit to a 403 (b) for 2024 starts at $23000. 403 (b) employee savings plan: Web the 403(b) plan has the same.

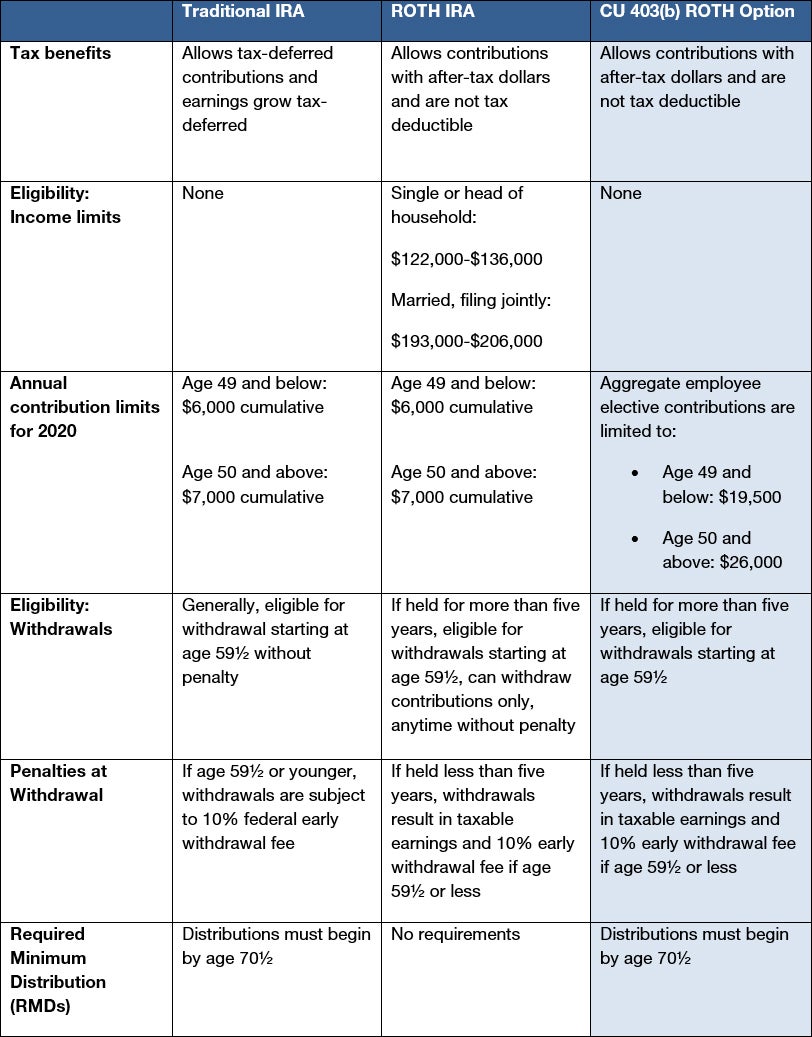

CU’s new 403(b) ROTH option enables aftertax savings for retirement

The irs elective contribution limit to a 403 (b) for 2024 starts at $23000. 501c (3) corps, including colleges,. 403 (b) employee savings plan: The annual maximum for 2023 is $22,500. They each save $150 per month and get an 8% average annual return on their. Web 403 (b) savings calculator your contributions annual salary.

Making voluntary contributions to your 403(b) retirement plan Hub

Workers who contribute to a 401 (k), 403 (b), most 457 plans and the federal government’s thrift savings plan can contribute up. Web 403 (b) savings calculator * indicates required. You can determine the best contribution. They each save $150 per month and get an 8% average annual return on their. Whether you participate in.

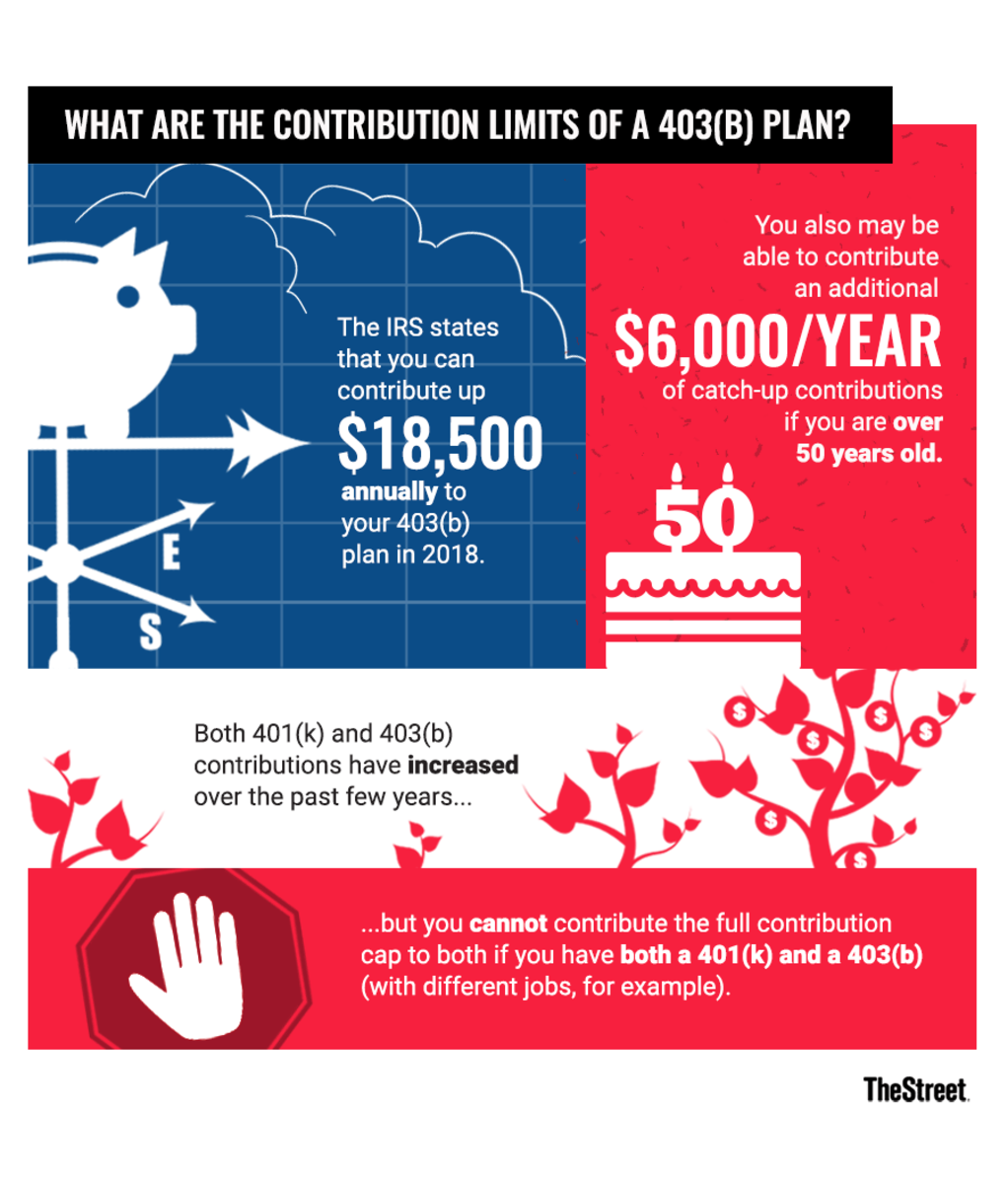

What Is a 403(b) Plan and How Do You Contribute? TheStreet

Web 403b calculator is a tool for you to evaluate the growth of your monthly contribution to a 403b retirement plan. Workers who contribute to a 401 (k), 403 (b), most 457 plans and the federal government’s thrift savings plan can contribute up. This calculator assumes that you make your contribution at the beginning of..

403 B Contribution Calculator Q4 2017 results based on 403(b) participants and contributions. Web jayla and hannah started contributing to their 403 (b) plans. The amount you will contribute to your retirement savings each year. The irs elective contribution limit to a 403 (b) for 2024 starts at $23000. Web the policy, which stands for setting every community up for retirement enhancement, “permits an employer to make matching contributions under a 401(k).

The Amount You Will Contribute To Your Retirement Savings Each Year.

403 (b) employee savings plan: They each save $150 per month and get an 8% average annual return on their. Web use a 403 (b) calculator to help if you need help figuring out how much you will have and how much you need to contribute now to meet your retirement needs, use the free and. You can determine the best contribution.

All Ratings And Reviews Are Voluntarily Submitted By Existing Customers.

The maximum contributions allowed are $22,500 for 2023 and $23,000. Jayla is 23 and hannah is 33. Web 401 (k) contribution limits for 2024. The irs elective contribution limit to a 403 (b) for 2024 starts at $23000.

The Maximum Amount An Employee Can Elect To Contribute Out Of Salary To A 403 (B) Retirement Plan For 2020 Is.

Workers who contribute to a 401 (k), 403 (b), most 457 plans and the federal government’s thrift savings plan can contribute up. 501c (3) corps, including colleges,. This calculator assumes that you make your contribution at the beginning of. Web the 2024 403(b) contribution limit is $23,000 for pretax and roth employee contributions, and $69,0000 for employer and employee contributions.

Web The 403(B) Plan Has The Same Caps On Yearly Contributions That Come With 401(K) Plans.

The annual maximum for 2023 is $22,500. If you are age 50 or over, a 'catch. 0% 33% 67% 100% current. This calculator is meant to help you determine the maximum elective salary deferral contribution you may make to your 403.

_vs._457(b).png?width=960&height=540&name=403(b)_vs._457(b).png)