403B Early Withdrawal Calculator

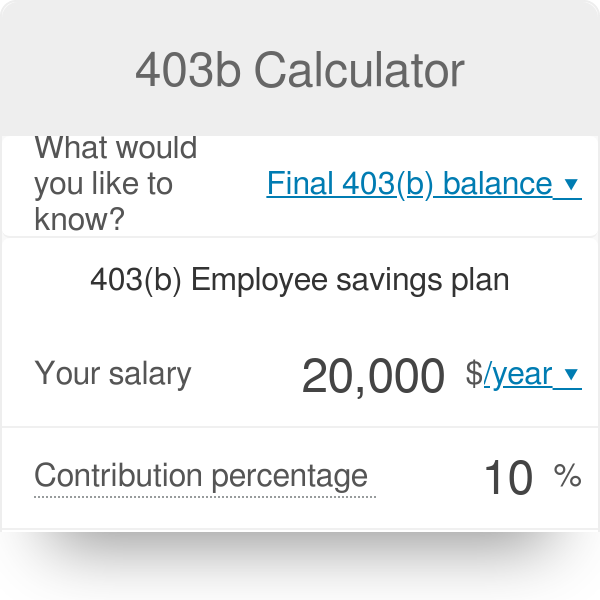

403B Early Withdrawal Calculator - In addition to setting back your retirement savings, early 403. Use this calculator to help you create your retirement plan. Your required minimum distribution, therefore, is. It is the simplest, most straightforward of all possible models by. Web if you are specifically interested in a 403b retirement plan, check our 403b calculator.

Web the 403(b) plan rules mirror ira rules in that the total distribution from multiple 403(b) plans can be taken from one or more of the 403(b) accounts. A plan distribution before you turn 65 (or the plan’s normal retirement age, if earlier) may result. Your required minimum distribution, therefore, is. Web the 403 (b) early withdrawal penalty is a fee imposed by the internal revenue service (irs) on individuals who withdraw money from their 403 (b) retirement. Web if the balance in your ira at the end of 2023 was $150,000, you’d need to divide $150,000 by 24.6 years. Web when it comes to 403 (b) plans, an early withdrawal means any distribution taken before you turn 59 1/2 years old. Web early withdrawal calculator opens in a new window.

401(k)/403(b) Retirement Calculator Chase

Web the 403 (b) early withdrawal penalty is a fee imposed by the internal revenue service (irs) on individuals who withdraw money from their 403 (b) retirement. For a 403(b) retirement plan, the rmd is calculated separately but may be withdrawn from any of your. Web if the balance in your ira at the end.

Retirement Withdrawal Calculator Retirement advice, Daily calendar

You can determine the best contribution. In addition to setting back your retirement savings, early 403. Web early withdrawal calculator opens in a new window. It is the simplest, most straightforward of all possible models by. Use this calculator to help you create your retirement plan. Web there is typically a 10% early withdrawal penalty.

Roth 403(b) Plan How It Works, Rules, Contributions, & Taxes

Web there is typically a 10% early withdrawal penalty if you take a 401(k) distribution before age 59 1/2. You’re over 59 1/2, so you don’t have to pay federal or state penalties on retirement plan withdrawals. Web this is called aggregation, and the irs also permits it for 403(b) plans. Web under the 72(t).

Roth 403b calculator EllisLujane

For a 403(b) retirement plan, the rmd is calculated separately but may be withdrawn from any of your. Web under the 72(t) rule, you can take early withdrawals from your 403(b) plan as long as they're part of a sepp plan, which lasts for five years or until you reach age. Web what are 403(b).

Roth 403b calculator EllisLujane

Use this calculator to help you create your retirement plan. Your required minimum distribution, therefore, is. Web the 403(b) plan rules mirror ira rules in that the total distribution from multiple 403(b) plans can be taken from one or more of the 403(b) accounts. It is the simplest, most straightforward of all possible models by..

403 B Withdrawal Request Fill Online, Printable, Fillable, Blank

Your required minimum distribution, therefore, is. Web early withdrawal calculator opens in a new window. Generally, the amounts an individual withdraws from. Web if you take an early withdrawal from a 401(k) or 403(b) before age 59 1/2 you will generally have to pay a 10% early withdrawal penalty. Web estimate how much in taxes.

FREE 403b Calculator How Much Should I Save And Have In My 403b?

Generally, the amounts an individual withdraws from. Web using this 401k early withdrawal calculator is easy. Your required minimum distribution, therefore, is. Web there is typically a 10% early withdrawal penalty if you take a 401(k) distribution before age 59 1/2. You’re over 59 1/2, so you don’t have to pay federal or state penalties.

Roth ira early withdrawal calculator ToniiTimotei

Generally, the amounts an individual withdraws from. Web according to the irs, taxes can generally be avoided on an early retirement withdrawal by rolling over the funds into another qualified retirement account, if done within 60 days. You can determine the best contribution. It helps you determine the minimum amount you need to withdraw from.

403b Calculator

Web most retirement plan distributions are subject to income tax and may be subject to an additional 10% tax. You’re over 59 1/2, so you don’t have to pay federal or state penalties on retirement plan withdrawals. Use this calculator to help you create your retirement plan. For a 403(b) retirement plan, the rmd is.

403b Withdrawal 403 b Withdrawal YouTube

Web the early withdrawal calculator (the “tool”) allows you to estimate the impact of taking a hypothetical early withdrawal from your retirement account, including potential lost. Web withdrawing money from a qualified retirement plan, such as a traditional ira, 401 (k) or 403 (b) plans, among others, can create a sizable tax obligation. It is.

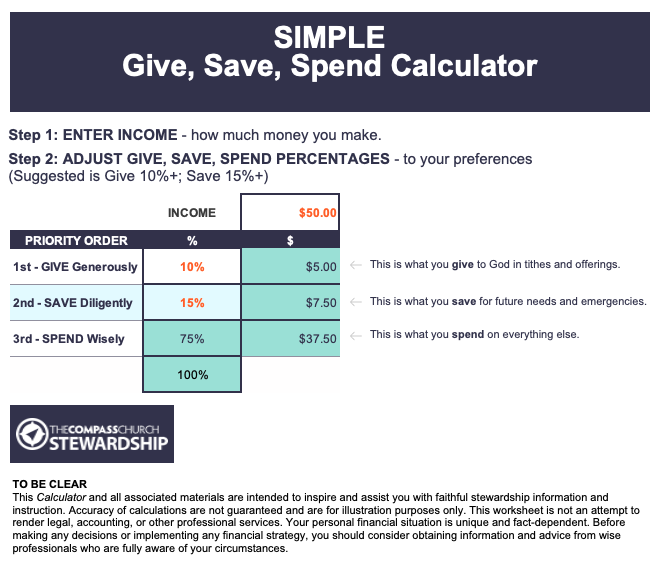

403B Early Withdrawal Calculator Web for these reasons, this retirement withdrawal calculator models a simple amortization of retirement assets. Web there is typically a 10% early withdrawal penalty if you take a 401(k) distribution before age 59 1/2. Web 403b calculator is a tool for you to evaluate the growth of your monthly contribution to a 403b retirement plan. Web under the 72(t) rule, you can take early withdrawals from your 403(b) plan as long as they're part of a sepp plan, which lasts for five years or until you reach age. Enter the current balance of your plan, your current age, the age you expect to retire, your federal income tax bracket, state.

Web Most Retirement Plan Distributions Are Subject To Income Tax And May Be Subject To An Additional 10% Tax.

Your required minimum distribution, therefore, is. In addition to setting back your retirement savings, early 403. Generally, the amounts an individual withdraws from. Web the early withdrawal calculator (the “tool”) allows you to estimate the impact of taking a hypothetical early withdrawal from your retirement account, including potential lost.

Use This Calculator To Help You Create Your Retirement Plan.

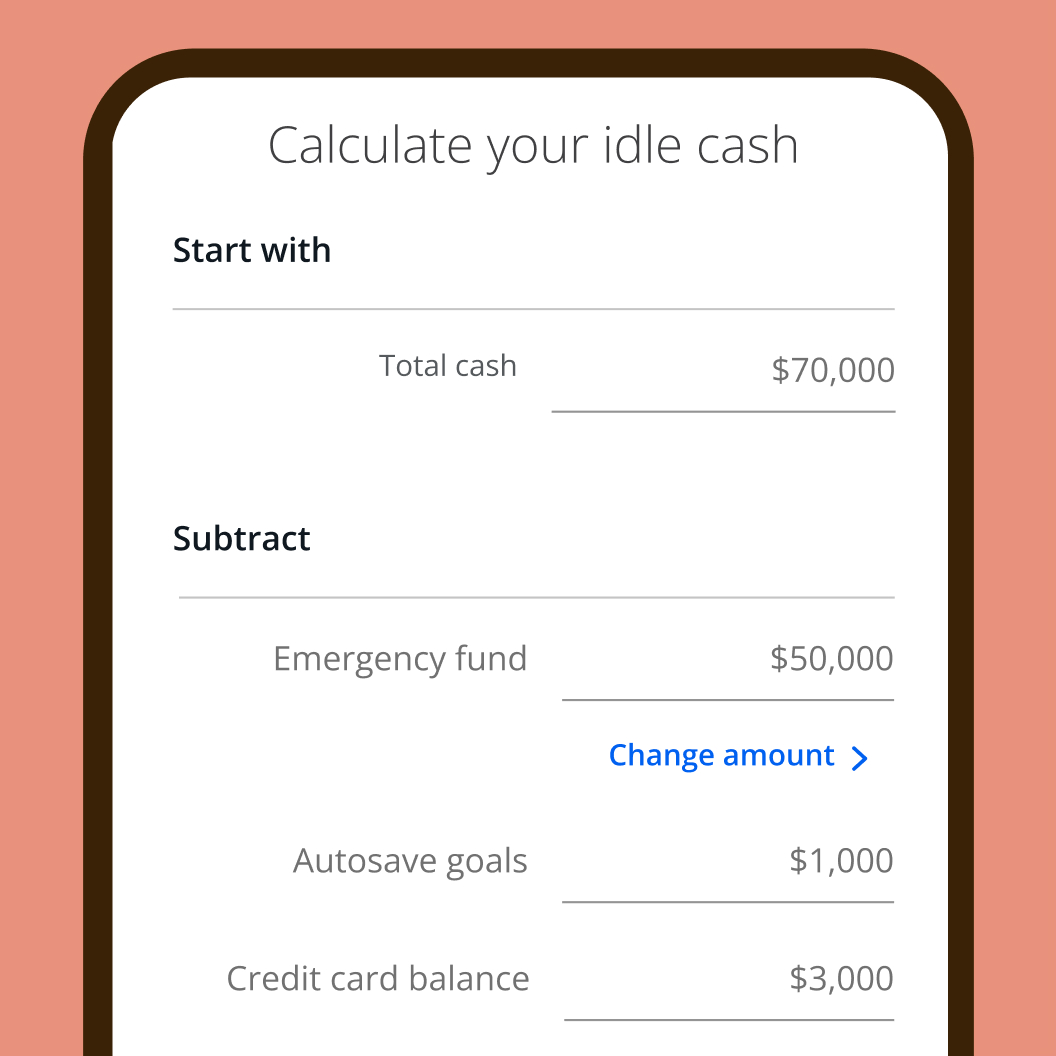

Web withdrawing money from a qualified retirement plan, such as a traditional ira, 401 (k) or 403 (b) plans, among others, can create a sizable tax obligation. Web for these reasons, this retirement withdrawal calculator models a simple amortization of retirement assets. If you are under 59 1/2. Web what are 403(b) withdrawal rules?

Web Retirement Plan Withdrawal Calculator Do You Know What It Takes To Work Towards A Secure Retirement?

Web dear ana, not always, but usually. Web if you take an early withdrawal from a 401(k) or 403(b) before age 59 1/2 you will generally have to pay a 10% early withdrawal penalty. Web the 403 (b) early withdrawal penalty is a fee imposed by the internal revenue service (irs) on individuals who withdraw money from their 403 (b) retirement. For a 403(b) retirement plan, the rmd is calculated separately but may be withdrawn from any of your.

Web Using This 401K Early Withdrawal Calculator Is Easy.

It is the simplest, most straightforward of all possible models by. Enter the current balance of your plan, your current age, the age you expect to retire, your federal income tax bracket, state. Web according to the irs, taxes can generally be avoided on an early retirement withdrawal by rolling over the funds into another qualified retirement account, if done within 60 days. Web estimate how much in taxes you could owe if you take a distribution from your 401 (k) or other qrp before retirement.

_Withdrawal_Rules.png?width=5760&name=403(b)_Withdrawal_Rules.png)