457B Withdrawal Calculator

457B Withdrawal Calculator - Customized adviceadvisor offices near youfinancial evaluations Web there is typically a 10% early withdrawal penalty if you take a 401 (k) distribution before age 59 1/2. Gainbridge.io has been visited by 10k+ users in the past month Web 457 savings calculator a 457 can be one of your best tools for creating a secure retirement. In this case, your savings in this plan can be rolled over, like assets in a.

Web 457 savings calculator a 457 can be one of your best tools for creating a secure retirement. Web there is typically a 10% early withdrawal penalty if you take a 401 (k) distribution before age 59 1/2. Web use this calculator to determine how long those funds will last given regular withdrawals. Web use this calculator to estimate how much your plan may accumulate for retirement. Web the amount you wish to withdraw from your qualified retirement plan. Web use this calculator to see what your net withdrawal would be after taxes are taken into account. It provides you with two important advantages.

457b distribution rule Inflation Protection

457 plan withdrawal * indicates required. Web get started [1] keep in mind any amounts rolled into a governmental 457 (b) plan from a qualified plan, 403 (b) plan or traditional ira may be subject to an additional 10% early. Customized adviceadvisor offices near youfinancial evaluations Current savings balance ($) proposed monthly withdrawal amounts ($).

What is a 457(b) Plan & How Does it Work? WealthKeel

The irs uses a formula that includes your total account balances, your age, and your life expectancy and your. It provides you with two important advantages. Customized adviceadvisor offices near youfinancial evaluations Web irc 457 (b) deferred compensation plans. It provides you with two important advantages. 457 plan withdrawal * indicates required. Web use this.

LKJ Financial Traditional vs. Roth 457(b) calculator

It provides you with two important advantages. Web the goal of a retirement withdrawal calculator is to figure out how much you withdraw from savings without running out of money before you run out of life. Web evaluate your retirement income potential using our retirement calculator. Web the amount you wish to withdraw from your.

What is a 457(b) Plan & How Does it Work? WealthKeel

It assumes that you participate in a single 457 (b) plan in 2024 with one employer. Plans of deferred compensation described in irc section 457 are available for certain state and local governments and non. If you were employed by a government agency, you will fall under these rules. In this case, your savings in.

Competitive Benefits Administrators 457(b) calculator

Customized adviceadvisor offices near youfinancial evaluations Make adjustments and add in other savings to see how changes affect your goals. Gainbridge.io has been visited by 10k+ users in the past month Withdrawals are subject to income tax. If you were employed by a government agency, you will fall under these rules. Web use this calculator.

MCERA 457b Plan Withdrawal Options (CalPERS Voya) YouTube

Web use this calculator to determine how long those funds will last given regular withdrawals. Web irc 457 (b) deferred compensation plans. Web the amount you wish to withdraw from your qualified retirement plan. Web how do i calculate my required minimum distribution? Gainbridge.io has been visited by 10k+ users in the past month Your.

Retirement plan 457b Early Retirement

Web irc 457 (b) deferred compensation plans. It helps you determine the minimum amount you need to withdraw from your retirement. 457 plan withdrawal * indicates required. For this calculation we assume that all contributions to the. Web a 457 (b) plan can be an effective tool for creating a secure retirement because provides two.

(PDF) Annuities Governmental 457(b) withdrawal request...MetLife will

Web 457 (b) governmental plan. 457 plan withdrawal * indicates required. For this calculation we assume that all contributions to the. Customized adviceadvisor offices near youfinancial evaluations Web use this calculator to determine your required minimum distribution (rmd). Web this calculator will help you determine the maximum contribution to your 457 (b) plan. Web how.

457 Calculator (2024)

Web this calculator will help you determine the maximum contribution to your 457 (b) plan. Web 457 (b) governmental plan. Your required minimum distribution, therefore, is. Customized adviceadvisor offices near youfinancial evaluations Gainbridge.io has been visited by 10k+ users in the past month 457 plan withdrawal * indicates required. Web irc 457 (b) deferred compensation.

457 b Withdrawal Rules YouTube

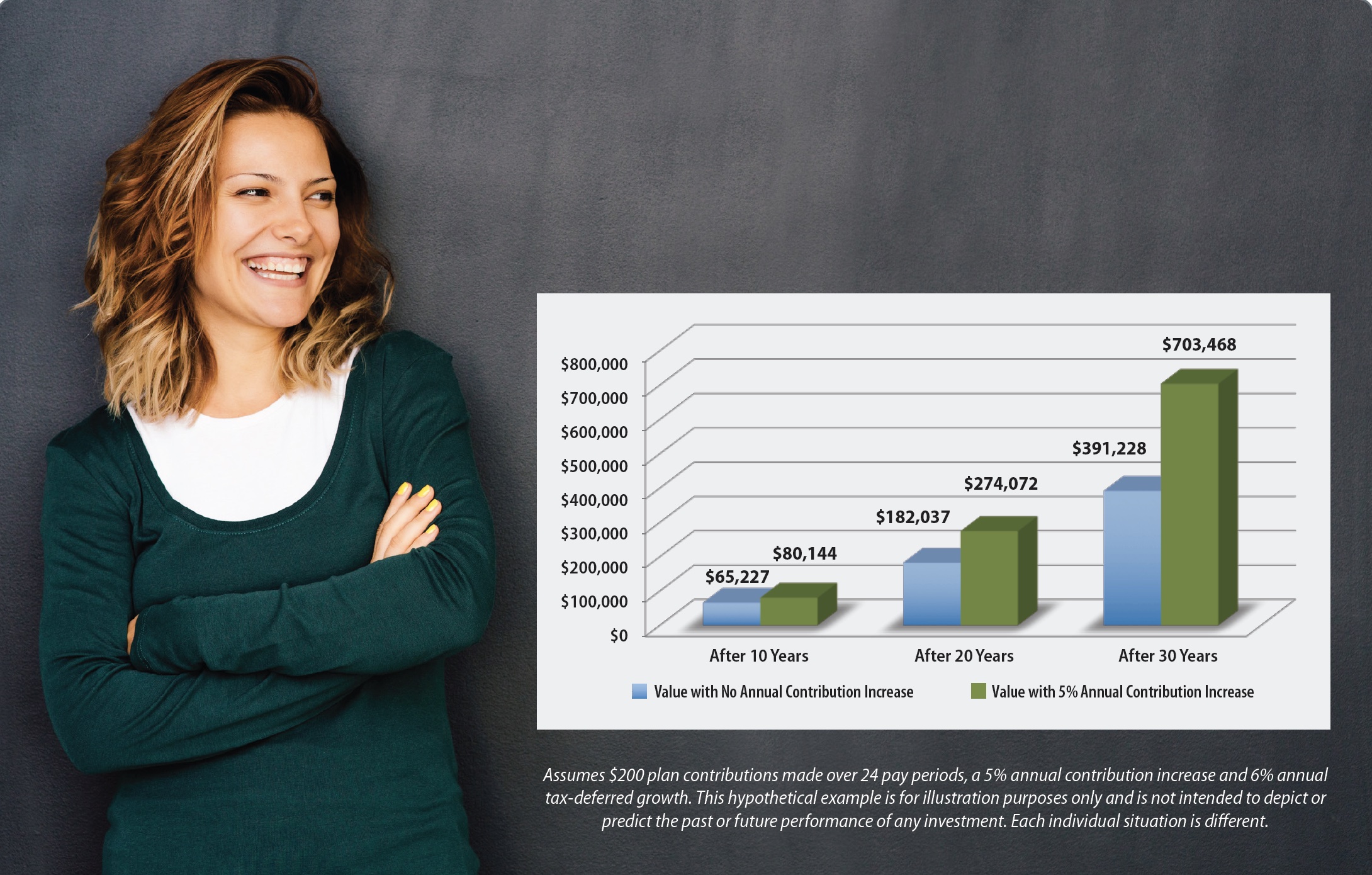

Years until retirement (1 to 50) current annual income ($) annual salary increases (0% to 10%). It assumes that you participate in a single 457 (b) plan in 2024 with one employer. For this calculation we assume that all contributions to the. Plans of deferred compensation described in irc section 457 are available for certain.

457B Withdrawal Calculator For this calculation we assume that all contributions to the. Your required minimum distribution, therefore, is. Web get started [1] keep in mind any amounts rolled into a governmental 457 (b) plan from a qualified plan, 403 (b) plan or traditional ira may be subject to an additional 10% early. Make adjustments and add in other savings to see how changes affect your goals. Web a 457 (b) plan can be an effective tool for creating a secure retirement because provides two important advantages.

Web 457 Savings Calculator A 457 Can Be One Of Your Best Tools For Creating A Secure Retirement.

Web evaluate your retirement income potential using our retirement calculator. It assumes that you participate in a single 457 (b) plan in 2024 with one employer. Make adjustments and add in other savings to see how changes affect your goals. Web how do i calculate my required minimum distribution?

Web You Can Withdraw $600.25 At The Beginning Of Each Month To Deplete Your Expected Balance By The End Of Your Retirement.

Web 457 (b) governmental plan. Web if the balance in your ira at the end of 2023 was $150,000, you’d need to divide $150,000 by 24.6 years. Your required minimum distribution, therefore, is. Web irc 457 (b) deferred compensation plans.

Withdrawals Are Subject To Income Tax.

Web use this calculator to determine how long those funds will last given regular withdrawals. Current savings balance ($) proposed monthly withdrawal amounts ($) annual. Web 457 savings calculator a 457 can be one of your best tools for creating a secure retirement. Web use this calculator to estimate how much your plan may accumulate for retirement.

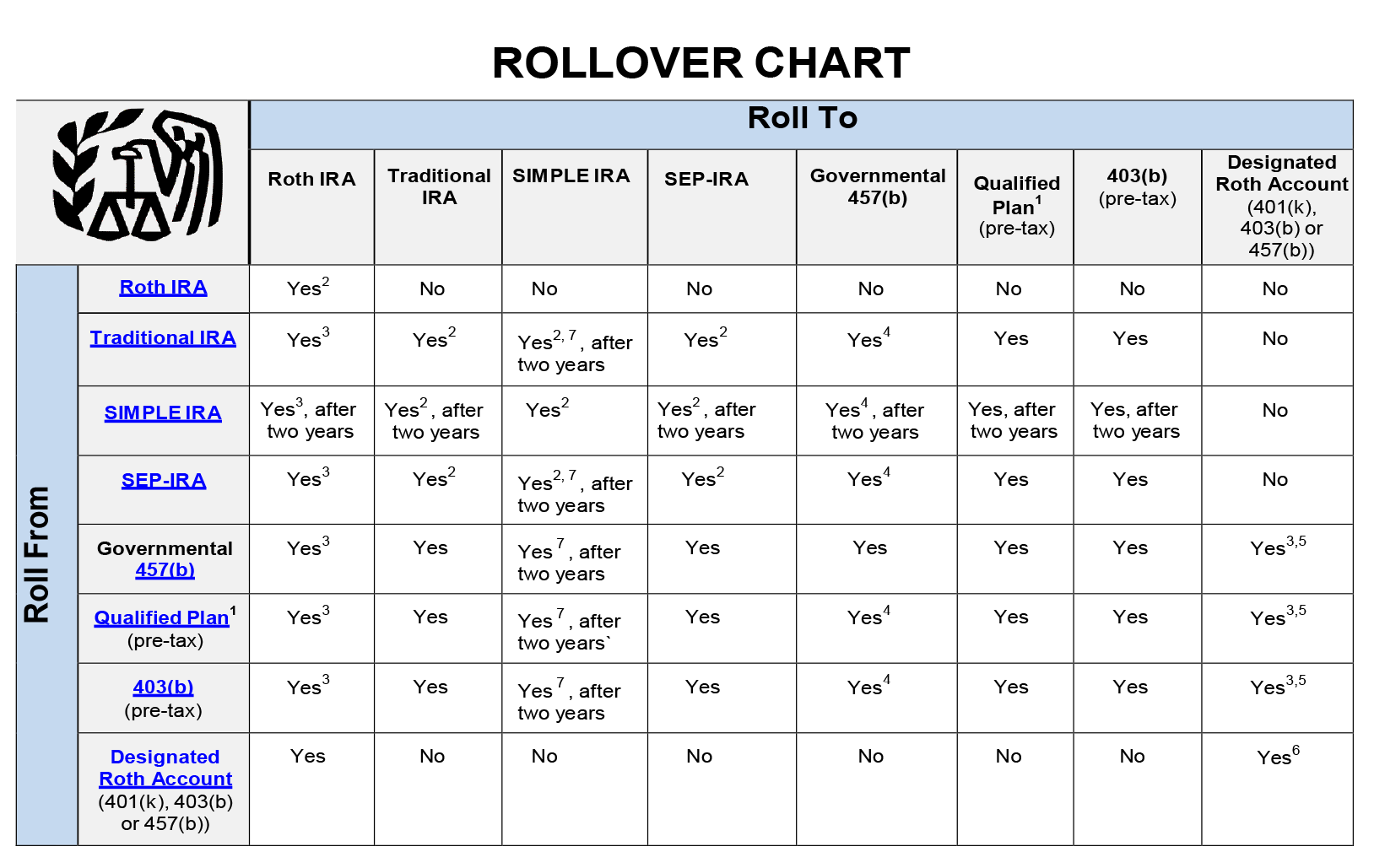

In This Case, Your Savings In This Plan Can Be Rolled Over, Like Assets In A.

457 plan withdrawal * indicates required. If you were employed by a government agency, you will fall under these rules. It provides you with two important advantages. Web the goal of a retirement withdrawal calculator is to figure out how much you withdraw from savings without running out of money before you run out of life.