60/40 Portfolio Historical Returns Calculator

60/40 Portfolio Historical Returns Calculator - Web a traditional 60/40 portfolio—which has lost its luster in recent years as low interest rates have led to lower bond returns—saw an average historical return of. Web 60/40 portfolio historical performance (annual returns) according to money manager vanguard, the historical annual return of the 60/40 portfolio has been an impressive. Web the calculator includes historical price data for 14 popular indices with some prices going back over 100 years. Web stocks/bonds 60/40 portfolio. Web use this investment calculator to estimate how much your investment could grow over time.

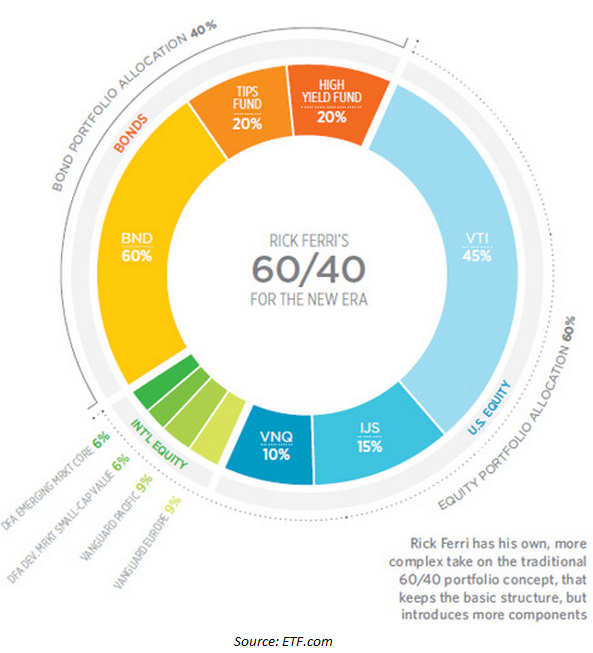

Web one quick glance at us stocks, seen here in purple through the vanguard total stock market etf (vti vti 0.0%), and bonds, in orange through the vanguard. Web the annualized return of 60% u.s. Bond portfolio from january 1, 1926, through december 31, 2021, was 8.8%. Web the calculator includes historical price data for 14 popular indices with some prices going back over 100 years. Total stock market (the crsp u.s. Web in a 60/40 portfolio, you invest 60% of your assets in equities and the other 40% in bonds. Total market index) and a 40% allocation the.

Revisiting the 60/40 Portfolio Blue Square Wealth

It's exposed for 60% on the stock market. Web the annualized return of 60% u.s. Web balancing a portfolio with 60% of your assets in stocks and 40% in bonds is the “classic” approach, not because it has performed well recently, but because it has. Web 60/40 portfolio historical performance (annual returns) according to money.

The Return Of The 60/40 Portfolio Plus Alternative Investments

The purpose of the 60/40 split is to minimize risk while producing returns,. The 60/40 portfolio has historically. All (since jan 1871) the annualized. Web the following simulation models are supported for portfolio returns: Total market index) and a 40% allocation the. How to use nerdwallet's investment calculator enter an initial investment. Investment managementclient centricdedicated.

The Rick Ferri 60/40 Portfolio A Wealth of Common Sense

Web use this investment calculator to estimate how much your investment could grow over time. Bond portfolio from january 1, 1926, through december 31, 2021, was 8.8%. The purpose of the 60/40 split is to minimize risk while producing returns,. Web the following simulation models are supported for portfolio returns: It's exposed for 60% on.

The Return Of The 60/40 Portfolio Plus Alternative Investments

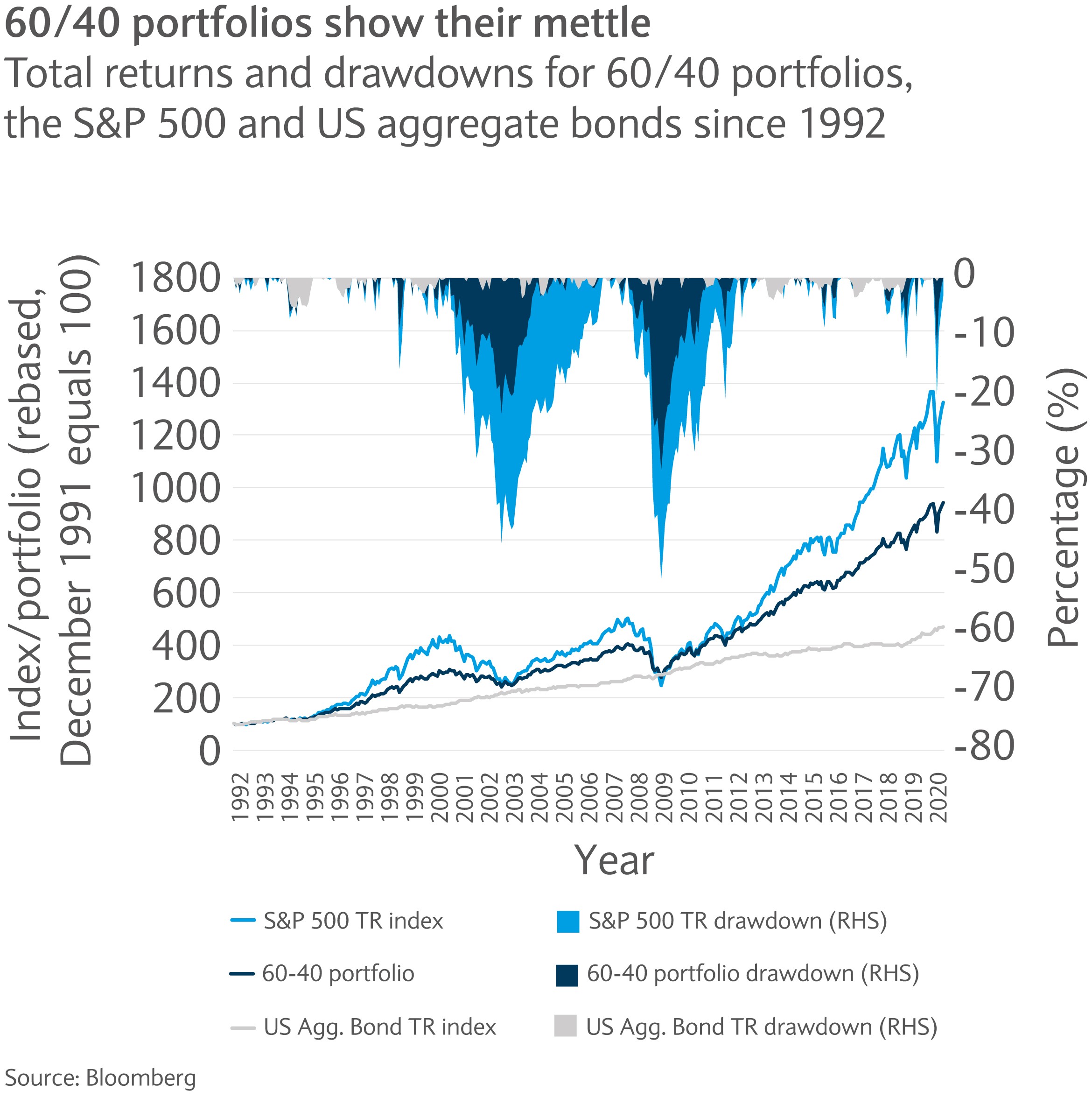

You can analyze and backtest portfolio. Web the stocks/bonds 60/40 portfolio is a high risk portfolio and can be implemented with 2 etfs. In the last 30 years. Name year to date return in 2022 10 year. Portfolio data was last updated on 11th of august 2023, 08:35 et. Web vanguard balanced index vbaix, a.

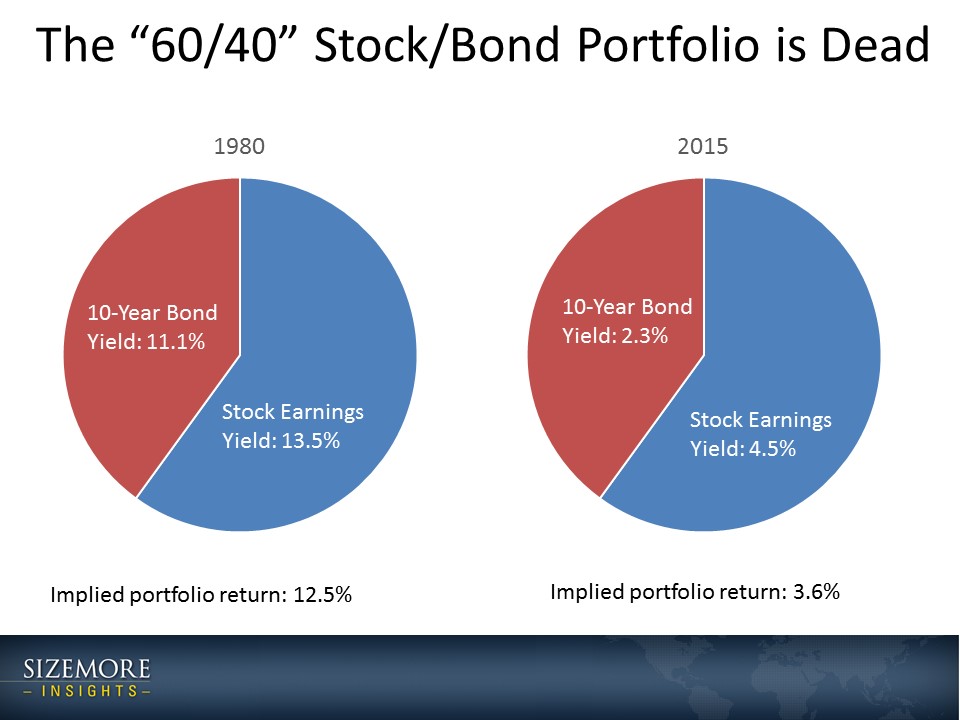

The 60/40 Portfolio Is Dead; Here Is Its Replacement Trefis

Web march 06, 2023 for the traditional 60/40 portfolio, 2022 was a punishing year. The 60/40 portfolio has historically. Investment managementclient centricdedicated teamsexpertise at your side Web this portfolio backtesting tool allows you to construct one or more portfolios based on the selected mutual funds, etfs, and stocks. Total stock market (the crsp u.s. How.

The Case for the 60/40 Portfolio's Survival In Two Charts PLANADVISER

Web march 06, 2023 for the traditional 60/40 portfolio, 2022 was a punishing year. Web here is the historical return of the 60/40 portfolio. In the last 30 years. The purpose of the 60/40 split is to minimize risk while producing returns,. It's exposed for 60% on the stock market. 1 going forward, the vanguard..

60/40 Portfolio Performance During Economic Cycles • Novel Investor

Web the stocks/bonds 60/40 portfolio is a high risk portfolio and can be implemented with 2 etfs. In the last 10 years, the portfolio achieved a. 1 going forward, the vanguard. Web the annualized return of 60% u.s. Total market index) and a 40% allocation the. The purpose of the 60/40 split is to minimize.

Car buyer 60 40 Asset Allocation

Since 1987, the 60/40 portfolio has posted annualized returns of roughly 9.16%. The purpose of the 60/40 split is to minimize risk while producing returns,. Web a traditional 60/40 portfolio—which has lost its luster in recent years as low interest rates have led to lower bond returns—saw an average historical return of. It's exposed for.

Is the 60/40 Portfolio Dead? Financial Design Studio, Inc.

Web the following simulation models are supported for portfolio returns: Total market index) and a 40% allocation the. In the last 10 years, the portfolio achieved a. Bond portfolio from january 1, 1926, through december 31, 2021, was 8.8%. Web this portfolio backtesting tool allows you to construct one or more portfolios based on the.

The Case for the 60/40 Portfolio's Survival In Two Charts PLANADVISER

The 60/40 portfolio is a simple strategy that is easy for most investors to implement. Web vanguard balanced index vbaix, a fund with a strategic 60% allocation to the u.s. Portfolio data was last updated on 11th of august 2023, 08:35 et. Web stocks/bonds 60/40 portfolio. The 60/40 portfolio has historically. Web balancing a portfolio.

60/40 Portfolio Historical Returns Calculator Web stocks/bonds 60/40 portfolio. Web march 06, 2023 for the traditional 60/40 portfolio, 2022 was a punishing year. The 60/40 portfolio is a simple strategy that is easy for most investors to implement. Web 60/40 portfolio historical performance (annual returns) according to money manager vanguard, the historical annual return of the 60/40 portfolio has been an impressive. Web the calculator includes historical price data for 14 popular indices with some prices going back over 100 years.

The Purpose Of The 60/40 Split Is To Minimize Risk While Producing Returns,.

Web the following simulation models are supported for portfolio returns: Web a traditional 60/40 portfolio—which has lost its luster in recent years as low interest rates have led to lower bond returns—saw an average historical return of. The 60/40 portfolio has historically. Total stock market (the crsp u.s.

In The Last 10 Years, The Portfolio Achieved A.

It's exposed for 60% on the stock market. How to use nerdwallet's investment calculator enter an initial investment. Bond portfolio from january 1, 1926, through december 31, 2021, was 8.8%. Investment managementclient centricdedicated teamsexpertise at your side

You Can Analyze And Backtest Portfolio.

Web stocks/bonds 60/40 portfolio. Web use this investment calculator to estimate how much your investment could grow over time. Web one quick glance at us stocks, seen here in purple through the vanguard total stock market etf (vti vti 0.0%), and bonds, in orange through the vanguard. Web in a 60/40 portfolio, you invest 60% of your assets in equities and the other 40% in bonds.

Web Here Is The Historical Return Of The 60/40 Portfolio.

Web balancing a portfolio with 60% of your assets in stocks and 40% in bonds is the “classic” approach, not because it has performed well recently, but because it has. All (since jan 1871) the annualized. Web the annualized return of 60% u.s. 1 going forward, the vanguard.