Accounts Payable Calculator

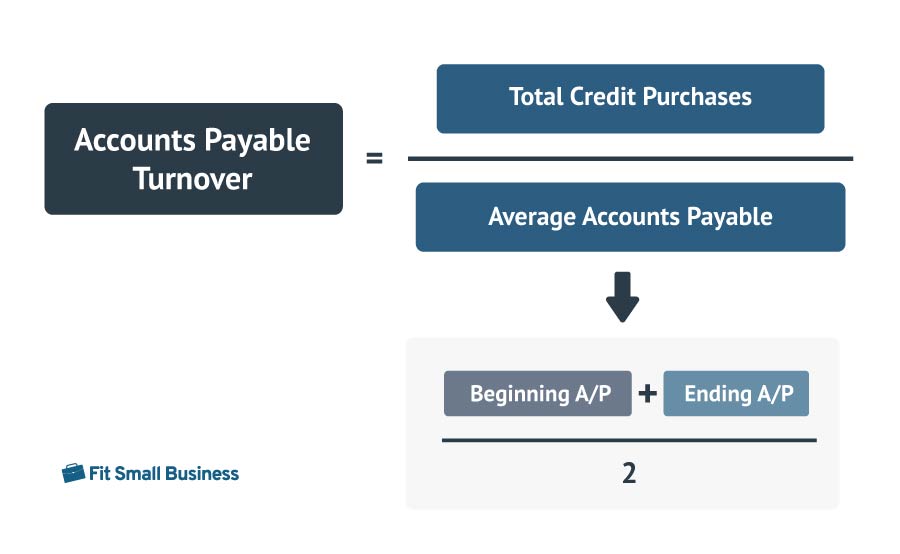

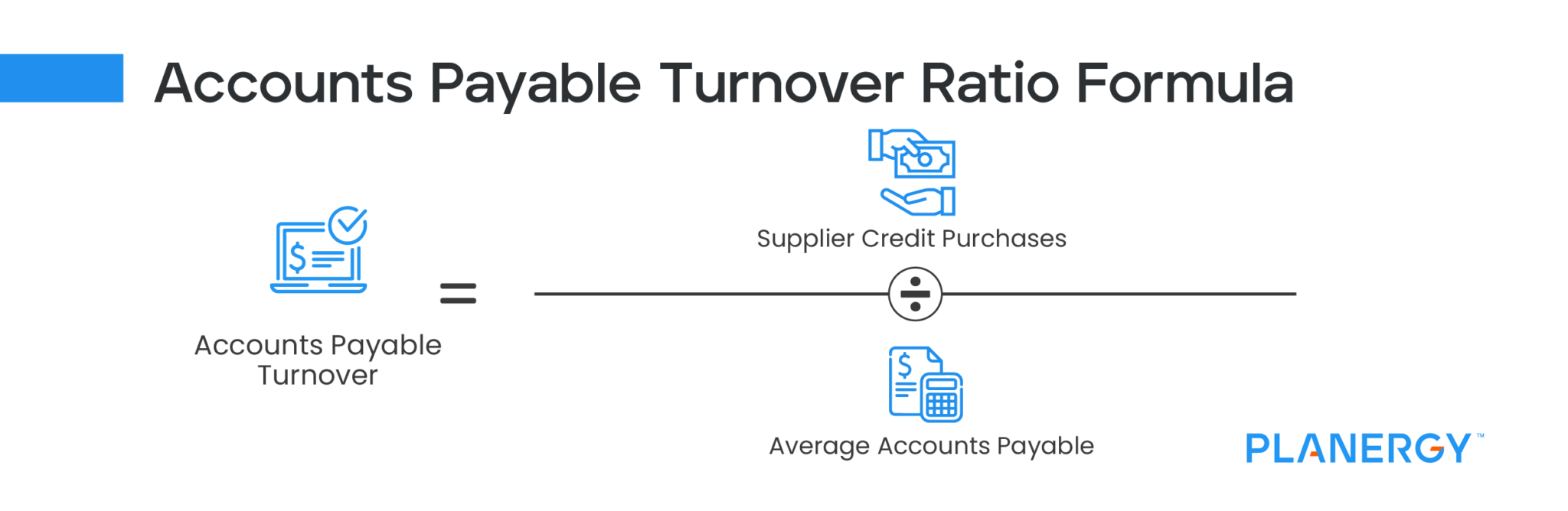

Accounts Payable Calculator - Days payables outstanding (dpo) → increase by $5m/year now, we’ll extend the assumptions across our forecast period until we reach a cogs. Accounts payable days = total purchases by supplier ÷ ( (initial accounts payable + ending accounts payable) / 2) to determine accounts. Web one of the greatest pains for accounts payable is the processing, approving, and paying of supplier invoices. Web it is calculated as: You can calculate the accounts payable by generating accounts payable aging summary report.

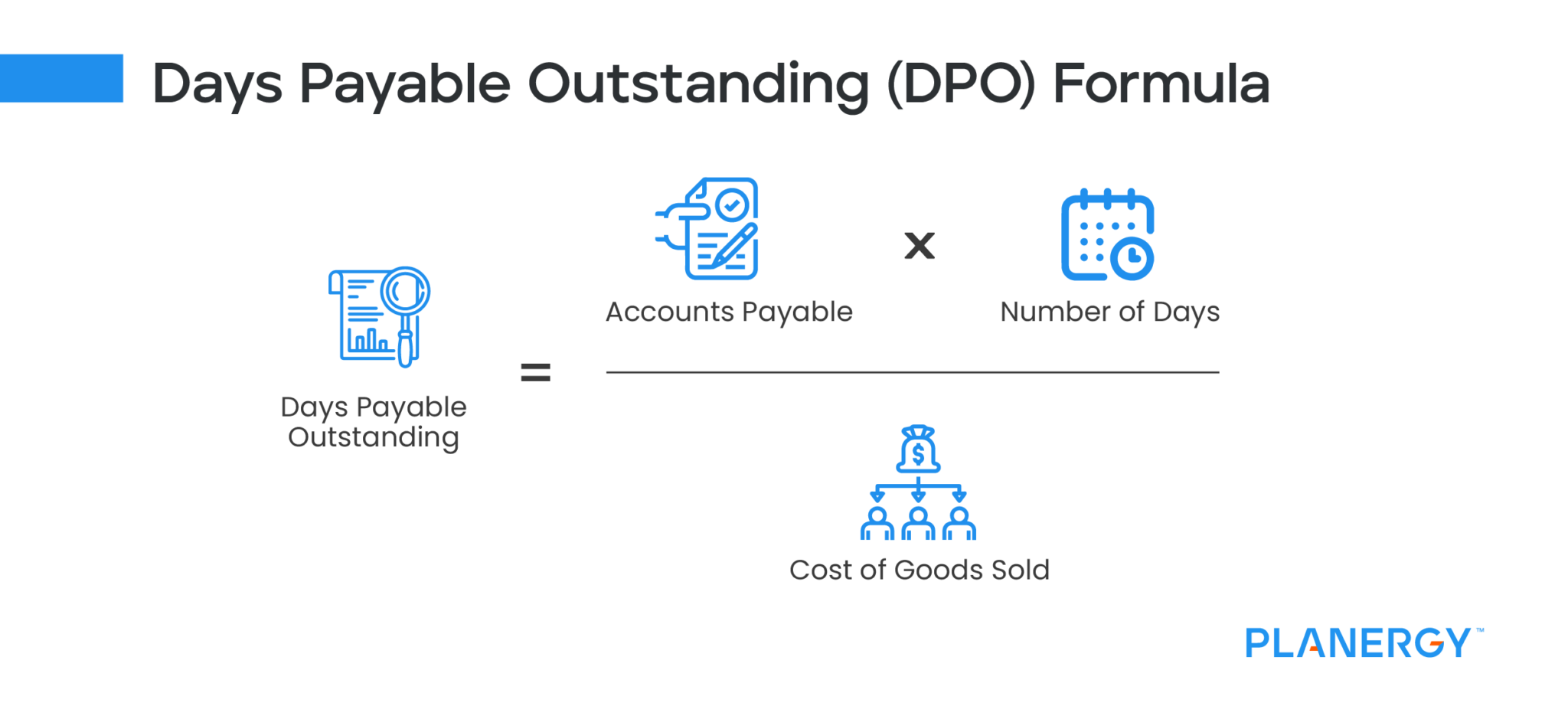

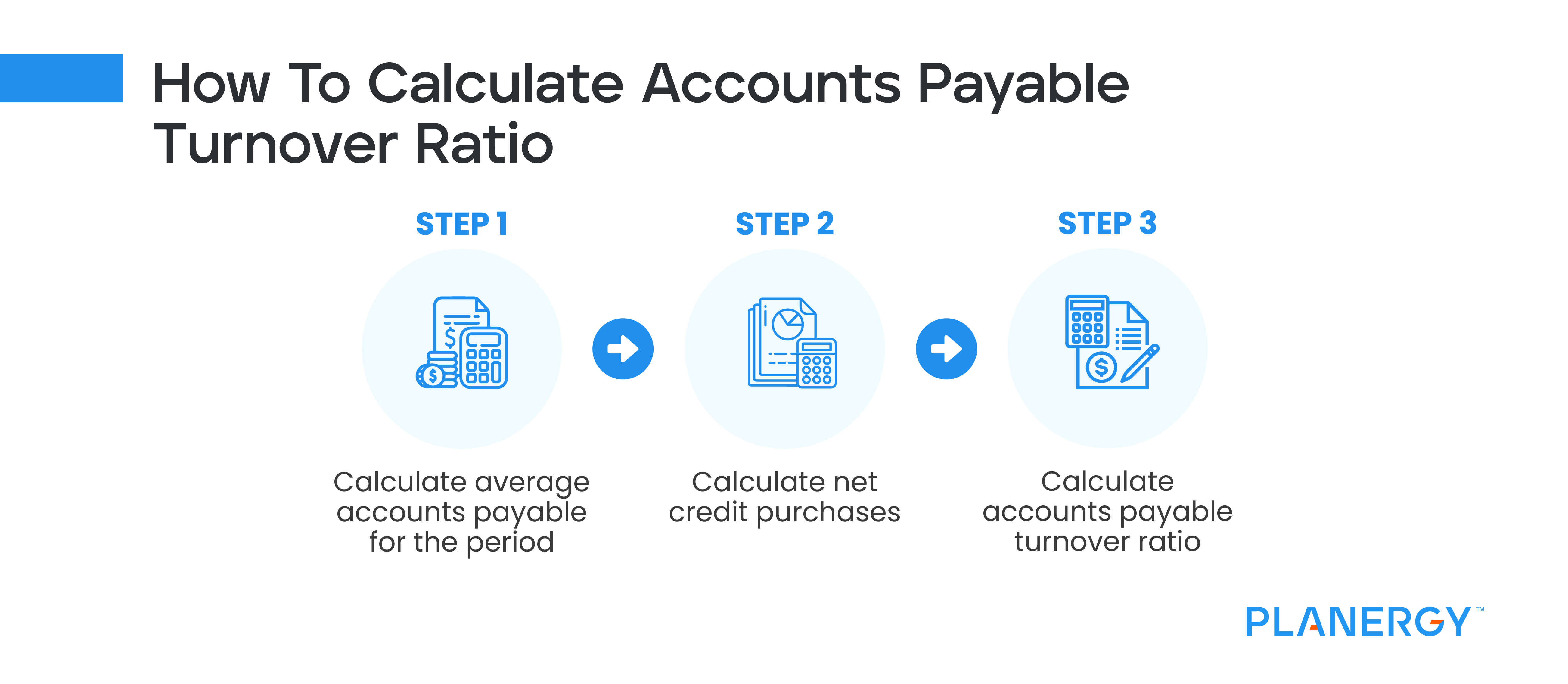

Days of payable outstanding is a measurement of how long a company takes to pay its. Web labor costs labor costs include the cost of employee time to process invoices. Web using the formula: Web to calculate the accounts payable turnover in days, simply divide 365 days by the payable turnover ratio. Locate the cost of goods sold for 2022. Web steps to calculate accounts payable: Web for the purposes of the accounts payable turnover ratio calculation, your total purchases for the year were:

Accounts Payable (A/P) Current Liability Definition

Web if you start with zero and put away $135 a month (about $33.75 a week) in a savings account that compounds monthly and earns a 4% annual interest rate, you. Days of payable outstanding is a measurement of how long a company takes to pay its. Dpo = (average accounts payable / purchases) ×.

Accounts Payable Turnover Ratio What It Is, How To Calculate and

Accounts payable → the accounts payable line. Common stock ($1 par) retained earnings. Web a good head for numbers is vital as an accounts payable clerk. Web this calculator will compute the accounts payable to average daily purchases ratio, given the accounts payable balance and the amount of purchases. Basic math skills are crucial to.

7 Key Accounts Payable KPIs You Should Track

The average accounts payable balance is. Common stock ($1 par) retained earnings. Accounts payable → the accounts payable line. As values of this ratio. Cost of goods sold (cogs) → increase by $25m/year 2. Gather invoices and expert support: Web a good head for numbers is vital as an accounts payable clerk. Web june 10,.

How to calculate accounts payable? Guide]

Web calculate the average accounts payable for the period by adding the accounts payable balance at the beginning of the period from the accounts payable. The company’s a/p turned four times in year 1, meaning that its suppliers were repaid each quarter on. Web using the formula: Web to calculate the accounts payable turnover in.

Accounts Payable Turnover Definition, Formula & Calculator

Web average payment period = average accounts payable ÷ (credit purchases ÷ number of days in period) where: Read our use cases & start improving your processes while reducing operating costs. Common stock ($1 par) retained earnings. As values of this ratio. Web accumulate all the purchases that you have made during a year (or.

Accounts Payable Days Formula, How To Calculate It, and What It Means

Web a/p days = (average accounts payable ÷ cost of goods sold) × 365 days where: Web calculate the average accounts payable for the period by adding the accounts payable balance at the beginning of the period from the accounts payable. Web this calculator will compute the accounts payable to average daily purchases ratio, given.

Accounts Payable Days Formula, How To Calculate It, and What It Means

Web discover why over 440 accounts payable departments run on celonis. Days of payable outstanding is a measurement of how long a company takes to pay its. One metric many companies are measuring their effectiveness and. The average accounts payable balance is. Web using the formula: Web june 10, 2022 accounts payable are calculated by.

Payables Turnover Formula and Ratio Calculation

As values of this ratio. The company’s a/p turned four times in year 1, meaning that its suppliers were repaid each quarter on. This is in case you are. Web steps to calculate accounts payable: Web it is calculated as: Web to calculate the accounts payable turnover in days, simply divide 365 days by the.

Accounts Payable Calculator Get Free Excel Template

Cost of goods sold (cogs) → increase by $25m/year 2. The average accounts payable balance is. Web one of the greatest pains for accounts payable is the processing, approving, and paying of supplier invoices. To begin calculating your company’s accounts payable, collect all your outstanding invoices for. Web calculate the average accounts payable for the.

Accounts Payable Excel Calculator Template Free Download

Accounts payable → the accounts payable line. Web how to calculate accounts payable? Web average payment period = average accounts payable ÷ (credit purchases ÷ number of days in period) where: Web for the purposes of the accounts payable turnover ratio calculation, your total purchases for the year were: One metric many companies are measuring.

Accounts Payable Calculator Web accumulate all the purchases that you have made during a year (or a period of your choice) and divide it by the average accounts payable during the same time period. The average accounts payable balance is. Web it is calculated as: Web how to calculate accounts payable? Days payables outstanding (dpo) → increase by $5m/year now, we’ll extend the assumptions across our forecast period until we reach a cogs.

To Begin Calculating Your Company’s Accounts Payable, Collect All Your Outstanding Invoices For.

Web accumulate all the purchases that you have made during a year (or a period of your choice) and divide it by the average accounts payable during the same time period. Web discover why over 440 accounts payable departments run on celonis. This is in case you are. Web to calculate the accounts payable turnover in days, simply divide 365 days by the payable turnover ratio.

The Average Accounts Payable Balance Is.

Payable turnover in days = 365 / payable turnover ratio. Web you can calculate dpo using the following days payable outstanding formula: ($470,000 + $510,000) / 2 = $490,000. Web accounts payable departments' cost per invoice is a major factor in driving ap automation success.

As Values Of This Ratio.

Cost of goods sold (cogs) → increase by $25m/year 2. Days payables outstanding (dpo) → increase by $5m/year now, we’ll extend the assumptions across our forecast period until we reach a cogs. Accounts payable days = total purchases by supplier ÷ ( (initial accounts payable + ending accounts payable) / 2) to determine accounts. Read our use cases & start improving your processes while reducing operating costs.

Web A/P Days = (Average Accounts Payable ÷ Cost Of Goods Sold) × 365 Days Where:

Locate the cost of goods sold for 2022. Web if you start with zero and put away $135 a month (about $33.75 a week) in a savings account that compounds monthly and earns a 4% annual interest rate, you. Web average payment period = average accounts payable ÷ (credit purchases ÷ number of days in period) where: Accounts payable → the accounts payable line.

![How to calculate accounts payable? Guide]](https://assets-global.website-files.com/5f689f82910c6b4f1ffb855b/62a81f547e50864e76ecacf1_A Guide to Calculating Accounts Payable-p-2600.png)