Accounts Receivable Calculator

Accounts Receivable Calculator - Billtrust.com has been visited by 10k+ users in the past month Calculate vehicle payments, mortgage payments, savings goals and more. Add up all charges you'll want to add up all the amounts that customers owe the company for products and. Web access free accounts receivable calculators from black hills federal credit union. You’ll divide your net credit sales by your.

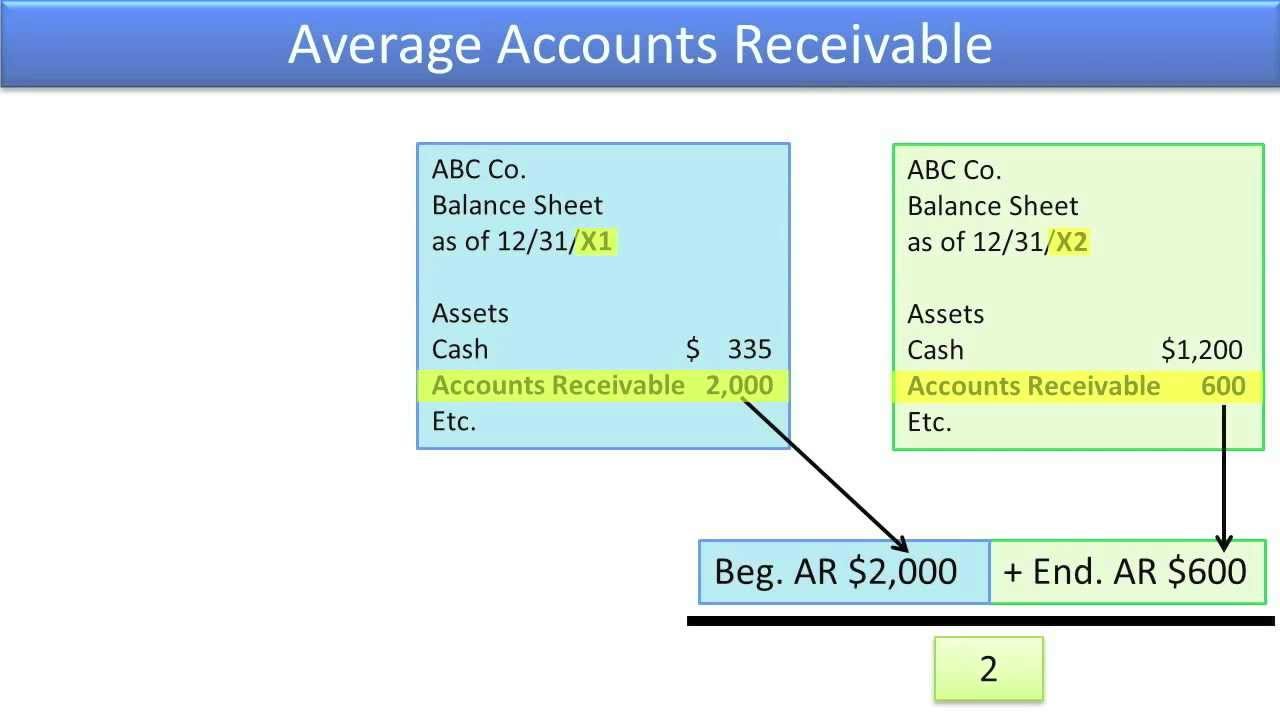

Then divide your net credit sales by your average accounts. Web access free accounts receivable calculators from black hills federal credit union. Calculating average collection period with average accounts receivable and total credit sales. Web this calculator will compute a company's accounts receivable by total assets ratio, given the company's accounts receivable balance and total assets. Web if you start with zero and put away $135 a month (about $33.75 a week) in a savings account that compounds monthly and earns a 4% annual interest rate, you. Web average accounts receivable calculator this calculator will compute a company's average accounts receivable balance over a specific time period, given the accounts. Average accounts receivables = ($2000 + $3000) / 2 = $2500.

What is Accounts Receivable? (A/R) Definition + Examples

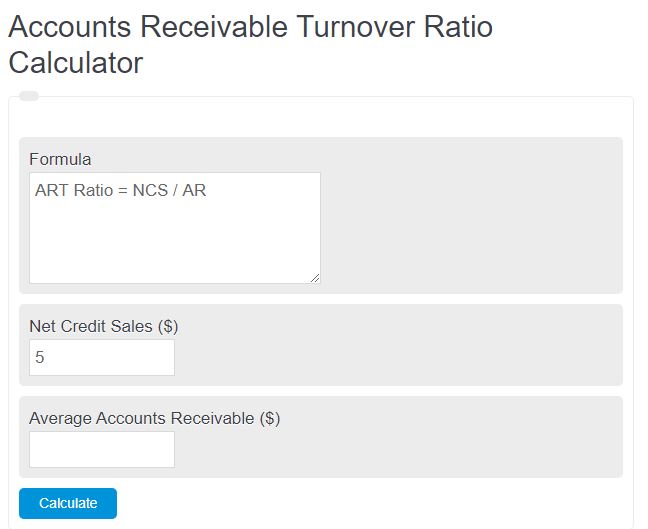

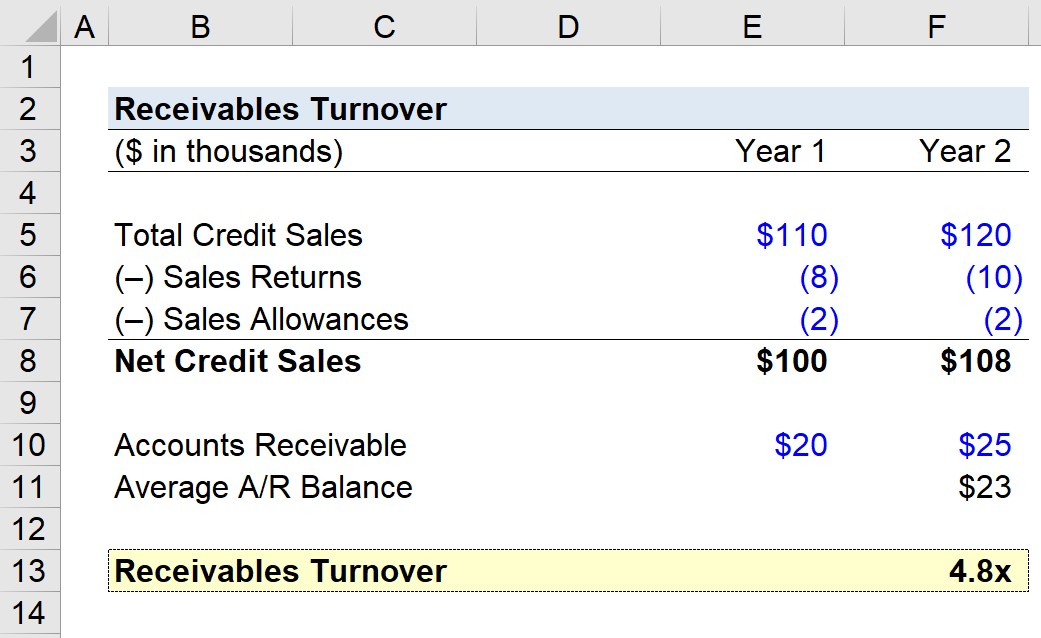

Enter “1,800,000” in the calculator’s “net. It allows businesses to identify areas. Analyzing accounts receivable is vital for cash flow, financial planning, and risk management. This straightforward calculation can hint at trends, especially when evaluated over. In this case, your turnover ratio is equal to 6. Accounts receivable turnover ratio = net credit sales /.

How to Determine Net Accounts Receivable 10 Steps (with Pictures)

Web use our accounts receivable analysis calculator to determine the receivable turnover and the sales to accounts receivable ratios of your business. Calculate vehicle payments, mortgage payments, savings goals and more. Billtrust.com has been visited by 10k+ users in the past month Web (starting accounts receivable + ending accounts receivable) ÷ 2 = average accounts.

Accounts Receivable Turnover Ratio Calculator Formula Calc Academy

Odoo.com has been visited by 100k+ users in the past month Web if you start with zero and put away $135 a month (about $33.75 a week) in a savings account that compounds monthly and earns a 4% annual interest rate, you. Calculating average collection period with average accounts receivable and total credit sales. Billtrust.com.

EXCEL of Corporate Accounts Receivable and Accounts Payable Details

Billtrust.com has been visited by 10k+ users in the past month Though it can be expensive, this method can also. Web average accounts receivable calculator this calculator will compute a company's average accounts receivable balance over a specific time period, given the accounts. Web the accounts receivable turnover ratio is an accounting measure used to.

Accounts Receivable Excel Template

Analyzing accounts receivable is vital for cash flow, financial planning, and risk management. Web the accounts receivable turnover ratio formula is as follows: Web access free accounts receivable calculators from black hills federal credit union. This straightforward calculation can hint at trends, especially when evaluated over. Web the accounts receivable turnover ratio is an accounting.

How To Calculate Accounts Receivable Percentage Info Loans

Super cool accounting coordinator 퐋퐨퐜퐚퐭퐢퐨. Web the accounts receivable turnover ratio formula is as follows: Web accounts receivables turnover calculator we’ll now move to a modeling exercise, which you can access by filling out the form below. Average accounts receivable = (beginning ar + ending ar)/2. Web average accounts receivable calculator this calculator will compute.

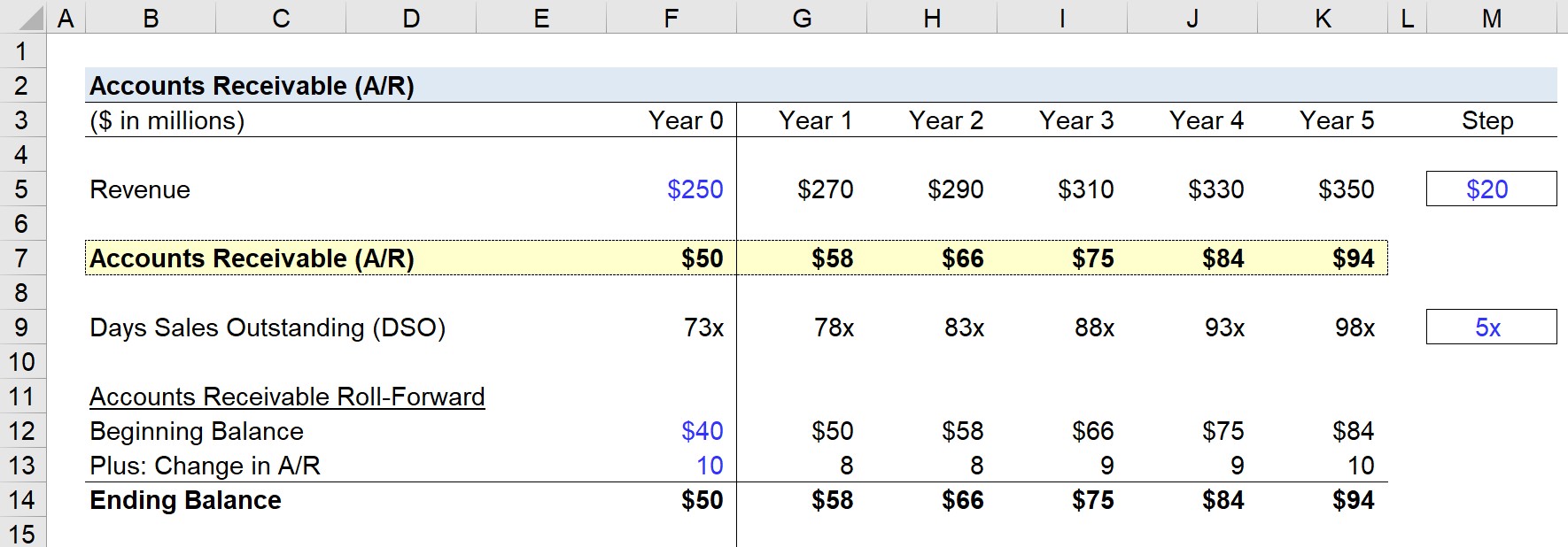

Receivables Turnover Formula and Ratio Calculation

Average accounts receivables = ($2000 + $3000) / 2 = $2500. Super cool accounting coordinator 퐋퐨퐜퐚퐭퐢퐨. This straightforward calculation can hint at trends, especially when evaluated over. A/r days = (average accounts receivable ÷ revenue) × 365 days. Average accounts receivable = (beginning ar + ending ar)/2. Receivables turnover ratio = $15000 / $2500 =.

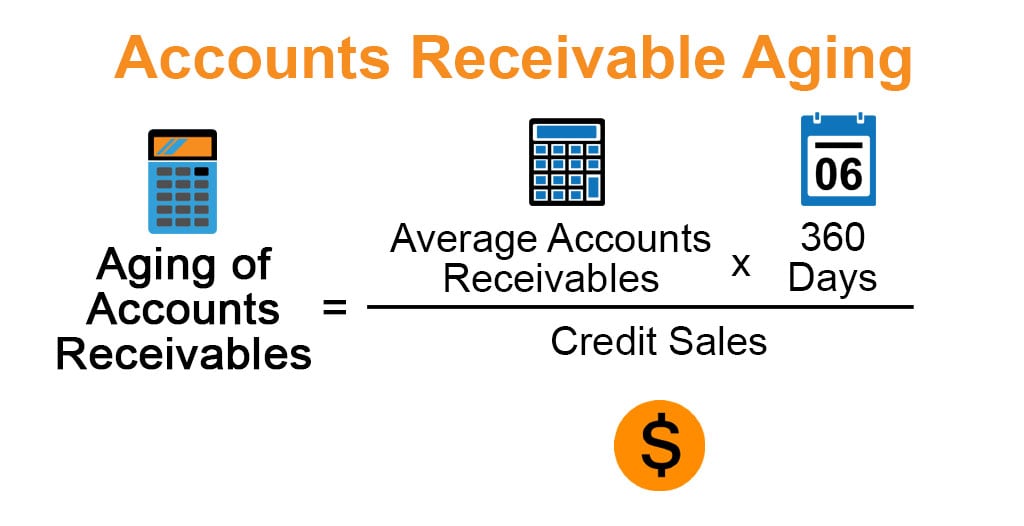

Accounts Receivable Aging How to Calculate Accounts Receivable Aging

Web the accounts receivable turnover ratio is an accounting measure used to quantify how efficiently a company is in collecting receivables from its clients. Analyzing accounts receivable is vital for cash flow, financial planning, and risk management. Determine the accounts receivable balance. Billtrust.com has been visited by 10k+ users in the past month Average accounts.

Accounts Receivable Calculator eFinancialModels

Enter “1,800,000” in the calculator’s “net. Then you need to divide the next credit sale by your result: Then divide your net credit sales by your average accounts. Web if you start with zero and put away $135 a month (about $33.75 a week) in a savings account that compounds monthly and earns a 4%.

Guide To Accounts Receivable Lendio

Web here is a receivables turnover calculator, which computes how quickly a company turns over its receivables, or sales extended on credit to customers. To calculate your average collection period, multiply your average. Web (starting accounts receivable + ending accounts receivable) ÷ 2 = average accounts receivable. Web analyzing accounts receivable. Those calculations are easy.

Accounts Receivable Calculator Web the accounts receivable turnover ratio formula is as follows: Web learn how to calculate the accounts receivable turnover ratio, a key financial ratio that measures how quickly a company collects cash from customers. Web average accounts receivable calculator this calculator will compute a company's average accounts receivable balance over a specific time period, given the accounts. Web accounts receivable factoring is a way of financing your business by selling unpaid invoices for cash advances. Billtrust.com has been visited by 10k+ users in the past month

In This Case, Your Turnover Ratio Is Equal To 6.

A/r days = (average accounts receivable ÷ revenue) × 365 days. Average accounts receivables = ($2000 + $3000) / 2 = $2500. Web here is a receivables turnover calculator, which computes how quickly a company turns over its receivables, or sales extended on credit to customers. Web follow these steps to calculate accounts receivable:

Super Cool Accounting Coordinator 퐋퐨퐜퐚퐭퐢퐨.

Web accounts receivable factoring is a way of financing your business by selling unpaid invoices for cash advances. Then divide your net credit sales by your average accounts. Once you have these two values, you’ll be able to use the accounts receivable turnover ratio formula. Web this calculator will compute a company's accounts receivable by total assets ratio, given the company's accounts receivable balance and total assets.

To Calculate Your Average Collection Period, Multiply Your Average.

Average accounts receivable = (beginning ar + ending ar)/2. Billtrust.com has been visited by 10k+ users in the past month Web the accounts receivable turnover ratio is an accounting measure used to quantify how efficiently a company is in collecting receivables from its clients. Though it can be expensive, this method can also.

Add Up All Charges You'll Want To Add Up All The Amounts That Customers Owe The Company For Products And.

Web if you start with zero and put away $135 a month (about $33.75 a week) in a savings account that compounds monthly and earns a 4% annual interest rate, you. Calculating average collection period with average accounts receivable and total credit sales. Calculate vehicle payments, mortgage payments, savings goals and more. It allows businesses to identify areas.