Alabama Paycheck Tax Calculator

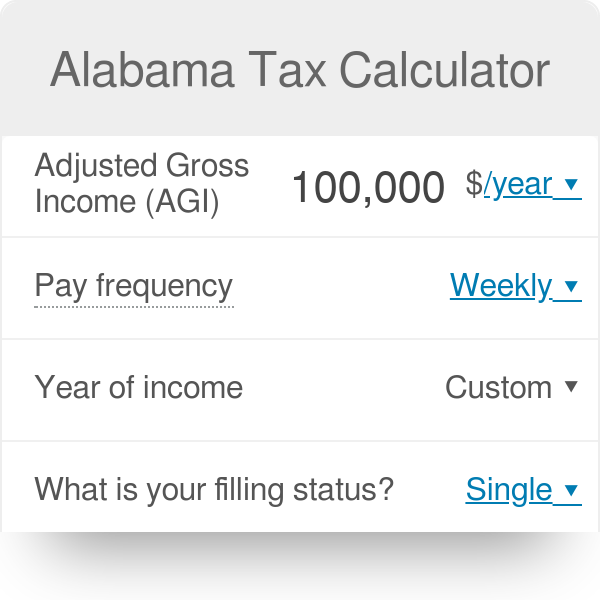

Alabama Paycheck Tax Calculator - Calculate your 2023 alabama state income taxes. Simply input salary details, benefits and deductions, and any. Web the gross pay in the hourly calculator is calculated by multiplying the hours times the rate. Just enter the wages, tax. ©istock.com/ryanjlane federal paycheck quick facts federal income tax rates range from 10% up to a top marginal rate of 37%.

Our calculator has recently been updated to include both the. Calculate your 2023 alabama state income taxes. Use adp’s alabama paycheck calculator to estimate net or “take home” pay for either hourly or salaried employees. Web the current ctc limits their qualifying earnings to $10,500 because their first $2,500 of income isn't counted. Web you are able to use our alabama state tax calculator to calculate your total tax costs in the tax year 2023/24. Updated on dec 8 2023. You can add multiple rates.

19+ Paycheck Calculator Alabama SalemArianwen

Web the irs has created a free calculator, called the tax withholding estimator, which can help you figure out if you are withholding too much—or too little—from your. To get started, open the tax forms(eg, alabama form 40) or your saved tax. Web the calculator accurately accounts for federal, state, and local taxes, alongside standard.

Happy tax day Forbes says Alabama is the 10th best state for taxes

Calculate your 2023 alabama state income taxes. Web estimate your tax liability in alabama with this income tax calculator. The following features are available within this alabama tax calculator for 2024: Alabama is among the states that are most. Updated on dec 8 2023. ©istock.com/ryanjlane federal paycheck quick facts federal income tax rates range from.

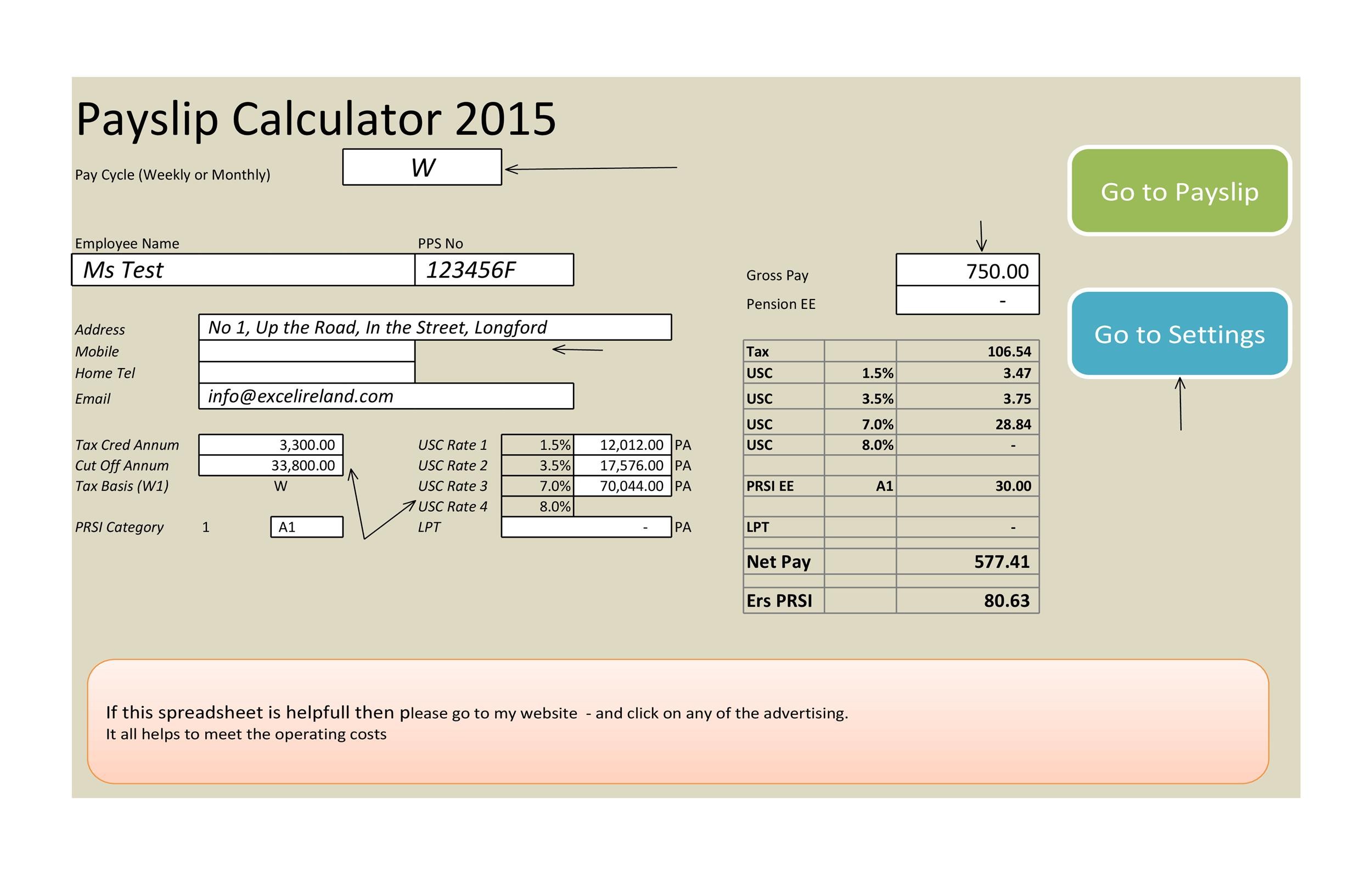

Alabama Paycheck Calculator 2023

Multiply that $10,500 by 15%, and the parent's. Web use the alabama paycheck calculator to estimate net or “take home” pay for salaried employees. Simply input salary details, benefits and deductions, and any. Web you can quickly estimate your alabama state tax and federal tax by selecting the tax year, your filing status, gross income.

Alabama State Tax Tables 2023 US iCalculator™

Wolterskluwer.com has been visited by 10k+ users in the past month Web the gross pay in the hourly calculator is calculated by multiplying the hours times the rate. This calculator will take a gross pay and calculate the net. Updated on dec 8 2023. Use the alabama salary paycheck calculator to see the amount of..

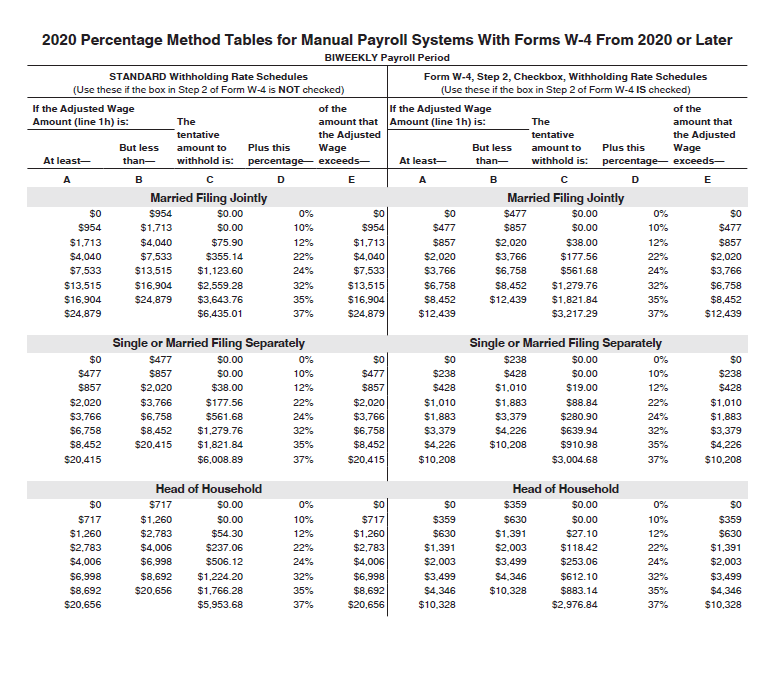

Alabama Withholding Tax Tables 2021 Federal Withholding Tables 2021

Calculate your 2023 alabama state income taxes. Web the total income tax is $9,710 for a single filer. To get started, open the tax forms(eg, alabama form 40) or your saved tax. You can add multiple rates. Besides, up to 2% will. Web the state income tax rate in alabama is progressive and ranges from.

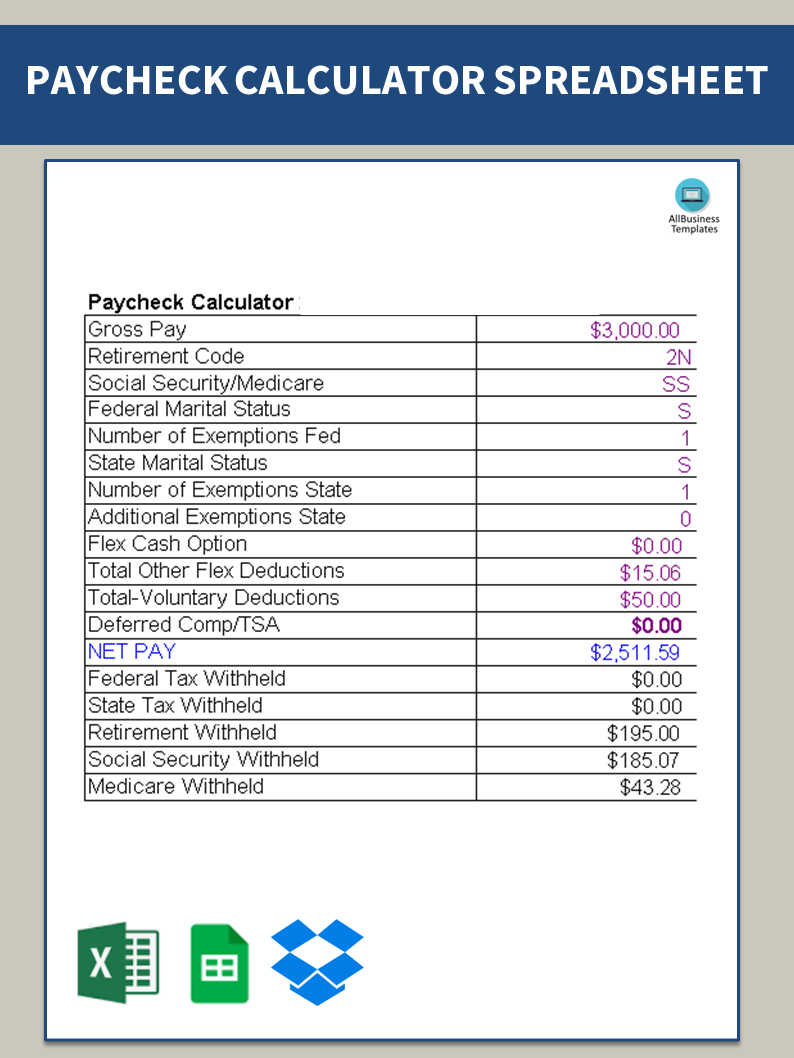

Free Printable Payroll Templates Printable World Holiday

©istock.com/ryanjlane federal paycheck quick facts federal income tax rates range from 10% up to a top marginal rate of 37%. Web alabama salary and tax calculator features. Our calculator has recently been updated to include both the. Multiply that $10,500 by 15%, and the parent's. Web federal paycheck calculator photo credit: Web the total income.

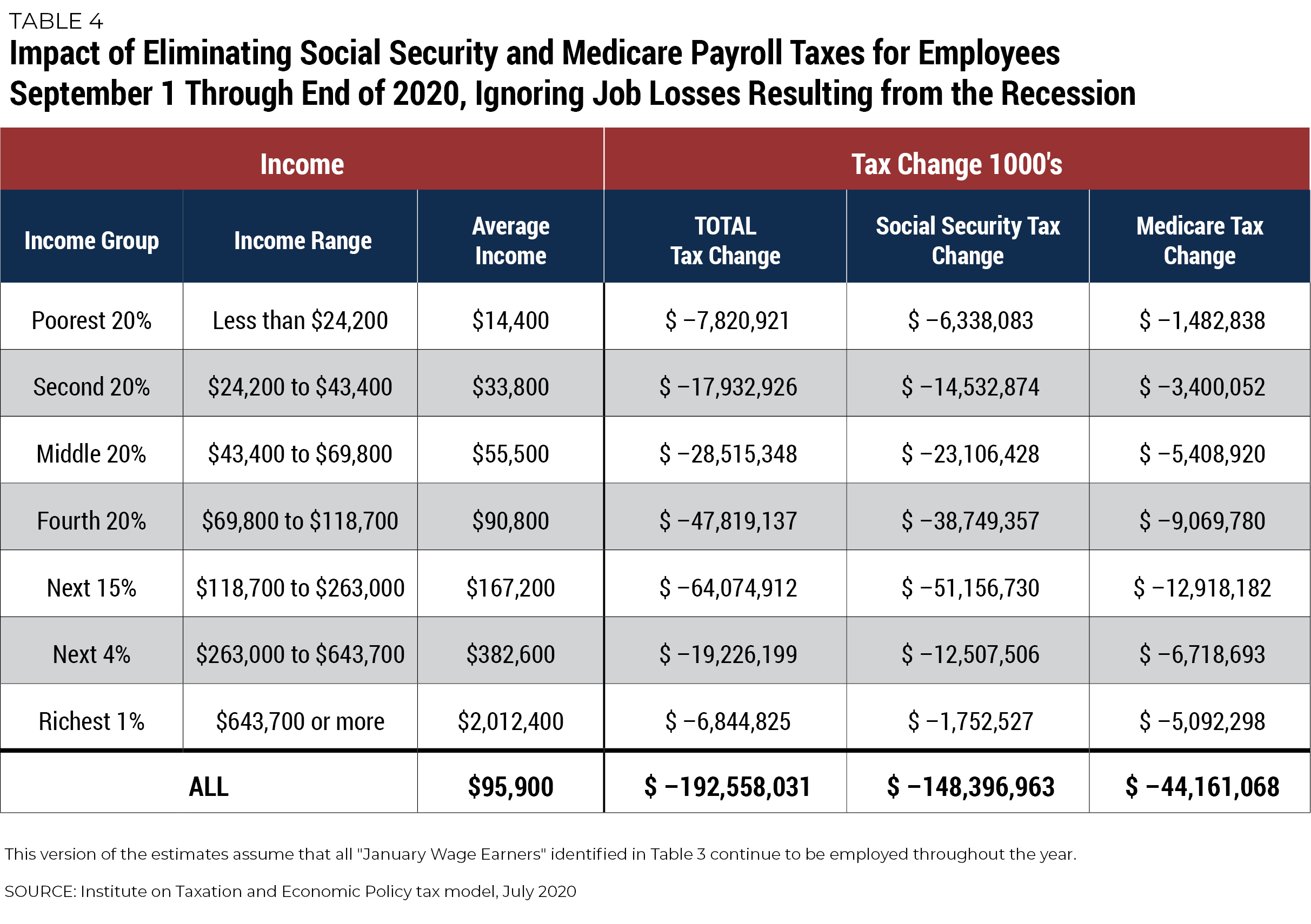

An Updated Analysis of a Potential Payroll Tax Holiday ITEP

Web the state income tax rate in alabama is progressive and ranges from 2% to 5% while federal income tax rates range from 10% to 37% depending on your income. Web use smartasset's paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal, state,.

Paycheck Calculator Gratis

Calculate your 2023 alabama state income taxes. Web the total income tax is $9,710 for a single filer. To get started, open the tax forms(eg, alabama form 40) or your saved tax. Web the individual income tax is lower rates of 2.00 % to 5.00 % and the corporate income tax is at a 6.50.

25+ Alabama Paycheck Calculator AurenAyodele

Web the irs has created a free calculator, called the tax withholding estimator, which can help you figure out if you are withholding too much—or too little—from your. Simply enter their federal and state w. Web use smartasset's paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after.

Alabama Paycheck Calculator 2023 2024 Paycheck Calculator Zrivo

Besides, up to 2% will. Web the calculator accurately accounts for federal, state, and local taxes, alongside standard deductions, tax credits, and exemptions for the year. You can add multiple rates. To get started, open the tax forms(eg, alabama form 40) or your saved tax. Web alabama's income tax are progressive, meaning higher earners will.

Alabama Paycheck Tax Calculator Web calculate your net pay and taxes for salary and hourly payment in alabama in 2023. Last updated on february 11, 2024) alabama state charges 2 to 5% of tax on your income. Web the current ctc limits their qualifying earnings to $10,500 because their first $2,500 of income isn't counted. Web the irs has created a free calculator, called the tax withholding estimator, which can help you figure out if you are withholding too much—or too little—from your. Just enter the wages, tax.

You Can Add Multiple Rates.

Web the total income tax is $9,710 for a single filer. Web calculate your net pay and taxes for salary and hourly payment in alabama in 2023. Find out how much federal, state and local taxes you will pay based on your income, filing status and. Web alabama paycheck calculator generate paystubs with accurate alabama state tax withholding calculations.

Web The Individual Income Tax Is Lower Rates Of 2.00 % To 5.00 % And The Corporate Income Tax Is At A 6.50 % Corporate Tax Rate On Income.

Web the irs has created a free calculator, called the tax withholding estimator, which can help you figure out if you are withholding too much—or too little—from your. Web you can quickly estimate your alabama state tax and federal tax by selecting the tax year, your filing status, gross income and gross expenses, this is a great way to. Just enter the wages, tax. Simply input salary details, benefits and deductions, and any.

Web Use Smartasset's Paycheck Calculator To Calculate Your Take Home Pay Per Paycheck For Both Salary And Hourly Jobs After Taking Into Account Federal, State, And Local Taxes.

Web alabama's income tax are progressive, meaning higher earners will be subject to higher income tax rates. Web the state income tax rate in alabama is progressive and ranges from 2% to 5% while federal income tax rates range from 10% to 37% depending on your income. Web estimate your tax liability in alabama with this income tax calculator. Last updated on february 11, 2024) alabama state charges 2 to 5% of tax on your income.

Use The Alabama Salary Paycheck Calculator To See The Amount Of.

Web federal paycheck calculator photo credit: Besides, up to 2% will. To get started, open the tax forms(eg, alabama form 40) or your saved tax. Web use the alabama paycheck calculator to estimate net or “take home” pay for salaried employees.