Amazon Sales Tax Calculator

Amazon Sales Tax Calculator - Web blog home the ultimate guide to amazon sales tax [full resource] by denym bird 19 minutes read feb 5, 2021 in 2022, the us is estimated to have spent. Web how to use the amazon fba revenue calculator: Web the standard deduction for 2023 is: Set up an amazon seller account for. Web the sales tax calculator can compute any one of the following, given inputs for the remaining two:

Web steps to calculate us sales tax on amazon 1. Web this is a very simple to use sales tax calculator that only requires the price and the rate of sales tax usually once. Web the sales tax calculator can compute any one of the following, given inputs for the remaining two: Add the sales tax rates for each. Web blog home the ultimate guide to amazon sales tax [full resource] by denym bird 19 minutes read feb 5, 2021 in 2022, the us is estimated to have spent. $ 1,500.00 + sales tax (7.25%): Register for a sales tax permit.

Sales Tax Calculator Amazon.co.uk

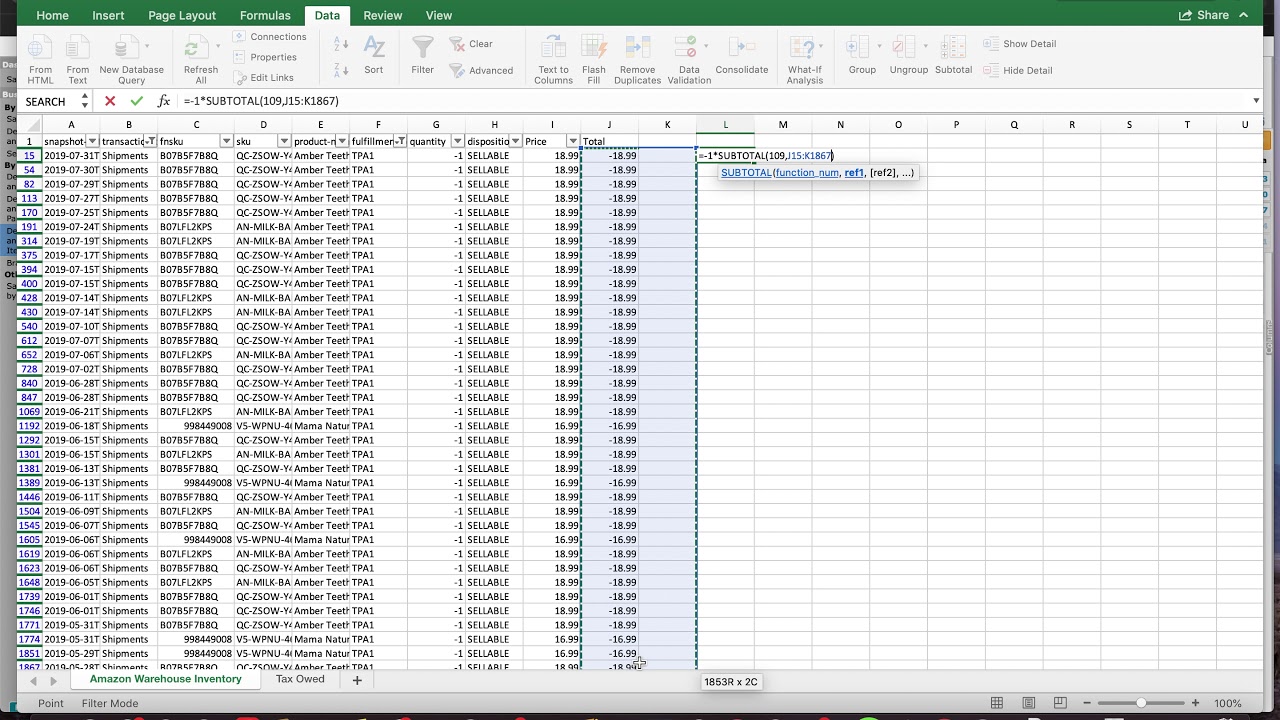

Web calculate how much you spent on amazon.com and paid in sales tax. Browse resources4.7/5 stars on trustpilotview productssellers use jungle scout Amazon’s fba sales tax rate is determined at the district, city, county, and state levels. Web this is a very simple to use sales tax calculator that only requires the price and the.

Calculate Amazon Sales Taxes pt 1 YouTube

It provides the irs with annual and monthly gross. Web this is a very simple to use sales tax calculator that only requires the price and the rate of sales tax usually once. Web the sales tax calculator can compute any one of the following, given inputs for the remaining two: Web steps to calculate.

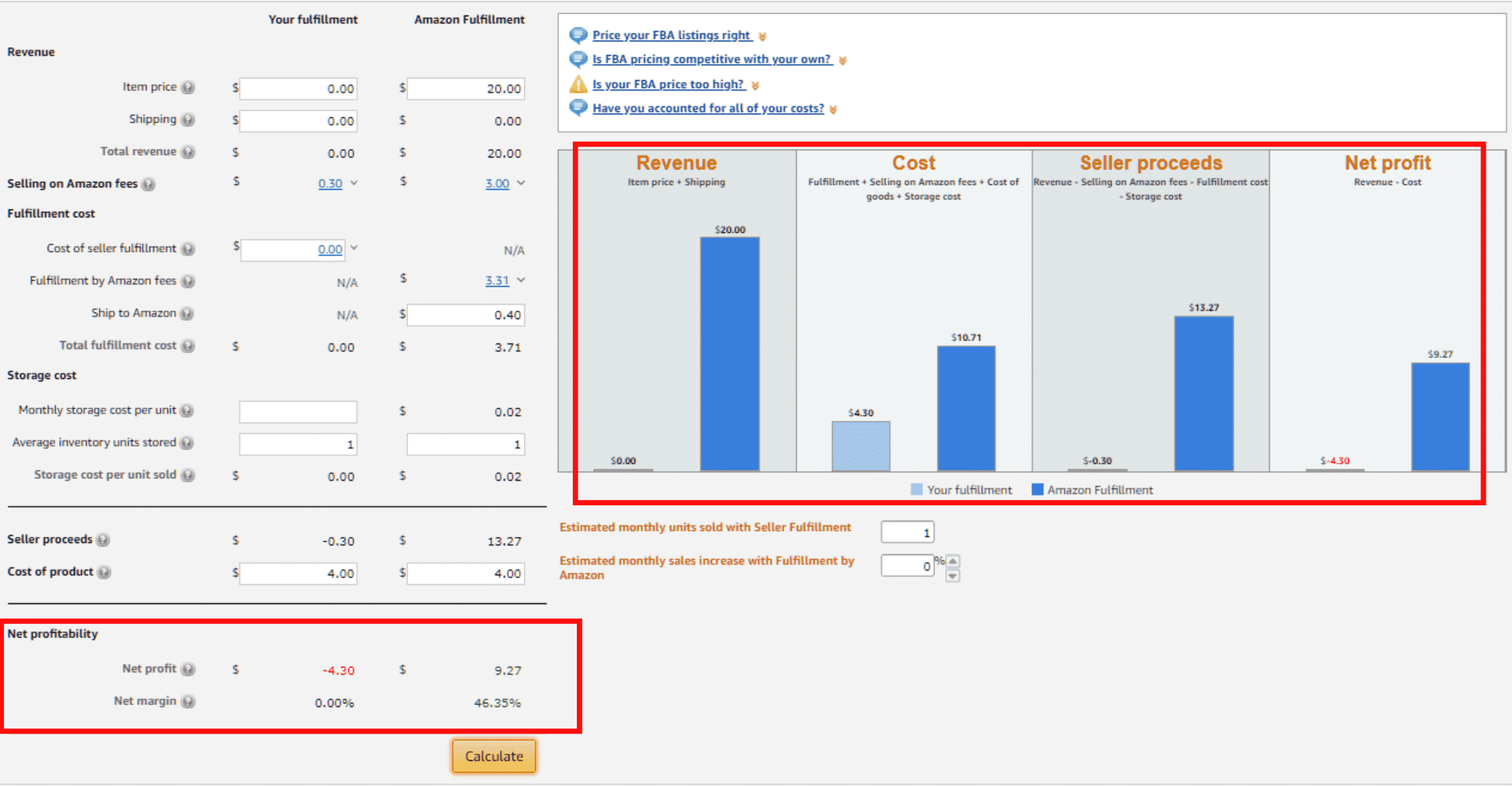

How to Use Amazon FBA Calculator in 2020 Amazon Sellers Guide

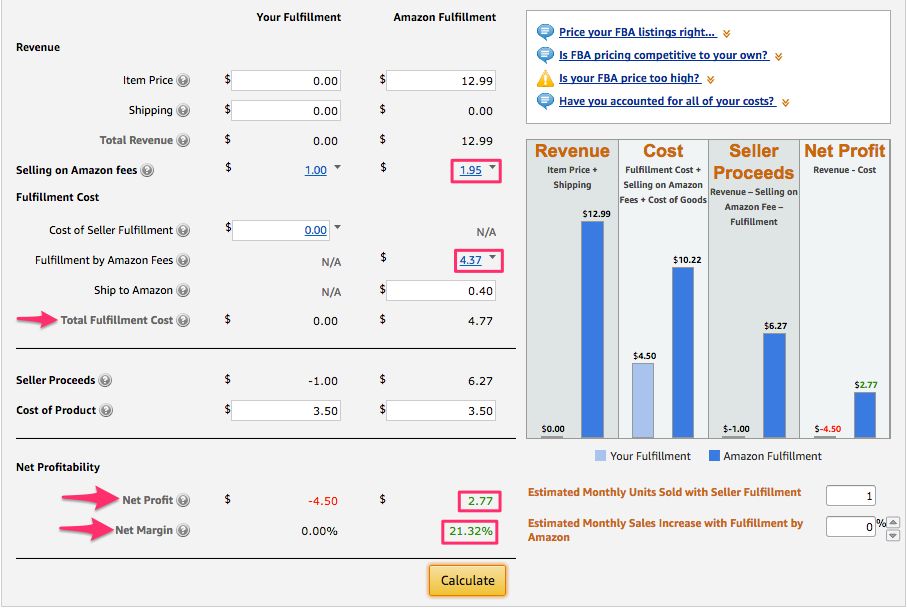

Amazon’s fba sales tax rate is determined at the district, city, county, and state levels. Web the standard deduction for 2023 is: Set up an amazon seller account for. Register for a sales tax permit. Add the sales tax rates for each. Web here are the steps to download a detailed report from amazon to.

The Top 5 Amazon Sales Tax Tools for Sellers 2023 SellerApp

$13,850 for single or married filing separately. Web learn how to use the amazon tax calculator to estimate your sales tax liability and stay compliant with state tax regulations. Add the sales tax rates for each. $ 1,500.00 + sales tax (7.25%): Web collect sales tax on eligible orders: Register for a sales tax permit..

How To Calculate Sales Tax If You Are Selling On Amazon

Web as a result, it is possible that some items in your order may be taxed, while others may not be. Web how to use the amazon fba revenue calculator: Add the sales tax rates for each. It provides the irs with annual and monthly gross. Web here are the steps to download a detailed.

Amazon Sales Tax What it is & How to Calculate Tax For FBA Sellers

Set up an amazon seller account for. Log in to your amazon seller central account. $27,700 for married couples filing jointly or qualifying surviving spouse. Web as the marketplace facilitator, amazon will now be responsible to calculate, collect, remit, and refund state sales tax on sales sold by third party sellers for. Web this is.

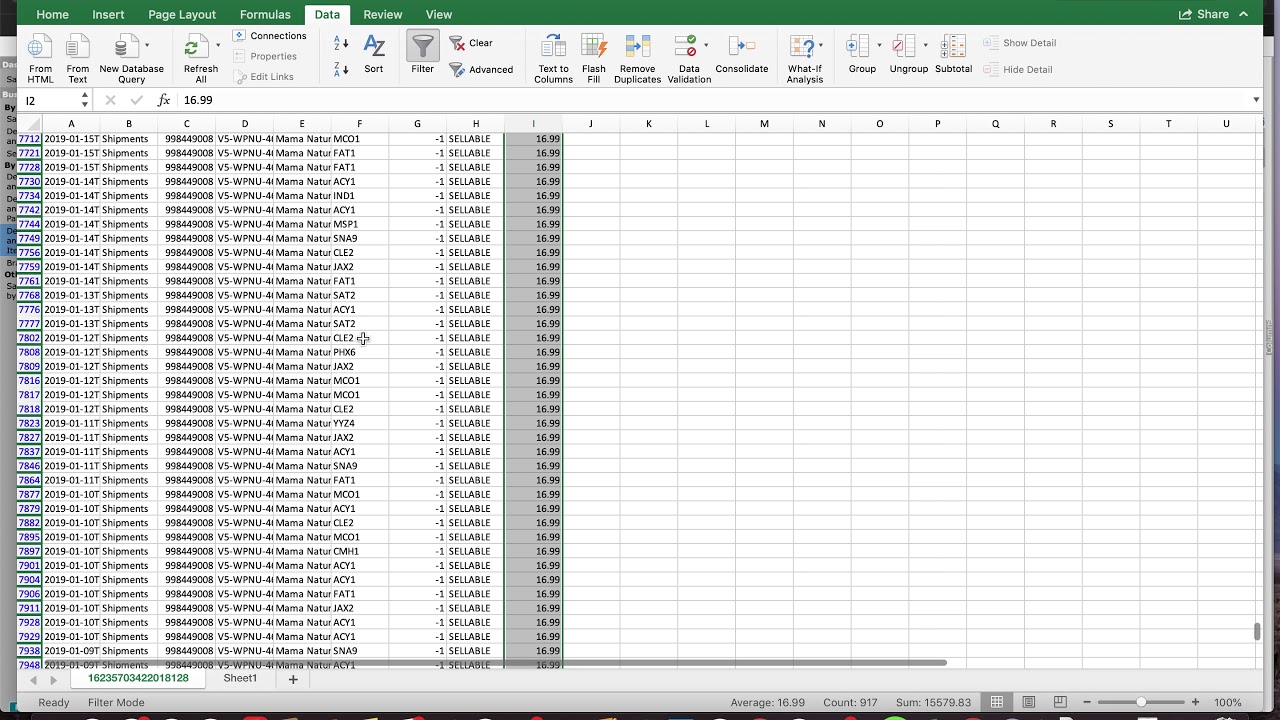

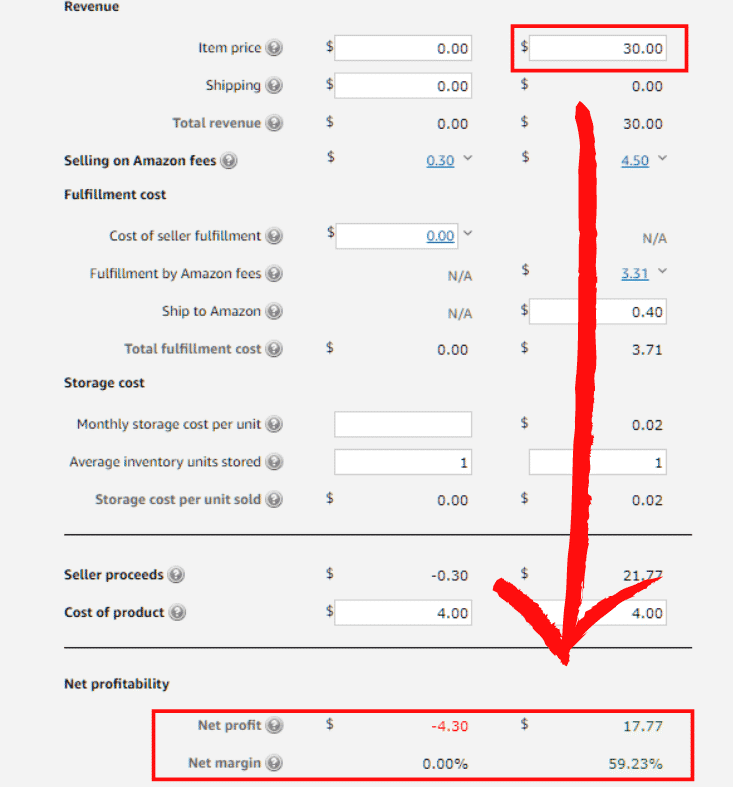

How to Use the Amazon FBA Calculator

Register for a sales tax permit. Web collect sales tax on eligible orders: Web learn how to use the amazon tax calculator to estimate your sales tax liability and stay compliant with state tax regulations. $27,700 for married couples filing jointly or qualifying surviving spouse. If you are doing your taxes or you are just.

The Top 5 Amazon Sales Tax Tools for Sellers 2023 SellerApp

Amazon’s fba sales tax rate is determined at the district, city, county, and state levels. Web the standard deduction for 2023 is: $13,850 for single or married filing separately. Log in to your amazon seller central account. Add the sales tax rates for each. Web this is a very simple to use sales tax calculator.

Calculate Amazon Sales Taxes pt 2 YouTube

Web how to use the amazon fba revenue calculator: Web blog home the ultimate guide to amazon sales tax [full resource] by denym bird 19 minutes read feb 5, 2021 in 2022, the us is estimated to have spent. $ 1,500.00 + sales tax (7.25%): Web as the marketplace facilitator, amazon will now be responsible.

How to Use Amazon FBA Calculator in 2020 Amazon Sellers Guide

Web how to use the amazon fba revenue calculator: Set up an amazon seller account for. Web blog taxes how to calculate sales tax if you are selling on amazon posted by carlos may 8, 2023 • updated on aug 14, 2023 stuck on taxes, rather than. If you are doing your taxes or you.

Amazon Sales Tax Calculator Web the standard deduction for 2023 is: Web as a result, it is possible that some items in your order may be taxed, while others may not be. Find out the basics of sales tax,. Web the sales tax calculator can compute any one of the following, given inputs for the remaining two: Web items sold on amazon marketplaces and shipped to locations both inside and outside the us, including territories, may be subject to tax.

It Provides The Irs With Annual And Monthly Gross.

Access the public version of the calculator or sign into amazon seller central and navigate to the. Web this is a very simple to use sales tax calculator that only requires the price and the rate of sales tax usually once. Amazon will automatically calculate and collect sales tax on eligible orders based on the customer's location and the. Find out the basics of sales tax,.

Web How Is Amazon Fba Sales Tax Calculated?

Web how to use the amazon fba revenue calculator: Web calculate how much you spent on amazon.com and paid in sales tax. The app would save the sales tax rate for you so you would not. Log in to your amazon seller central account.

Web The Sales Tax Calculator Can Compute Any One Of The Following, Given Inputs For The Remaining Two:

Web learn how to use the amazon tax calculator to estimate your sales tax liability and stay compliant with state tax regulations. Web the standard deduction for 2023 is: Browse resources4.7/5 stars on trustpilotview productssellers use jungle scout If you are doing your taxes or you are just curious to see how much you spend on.

Web Items Sold On Amazon Marketplaces And Shipped To Locations Both Inside And Outside The Us, Including Territories, May Be Subject To Tax.

$27,700 for married couples filing jointly or qualifying surviving spouse. Amazon calculates, collects, and remits tax on sales made by merchants shipped to. Amazon’s fba sales tax rate is determined at the district, city, county, and state levels. Web steps to calculate us sales tax on amazon 1.