Audit Materiality Calculation

Audit Materiality Calculation - Several common rules to quantify materiality have been developed by academia. Web how do auditors determine materiality? Web we developed a probabilistic model to generate multiples that can be applied to calculate a reasonable upper bound for aggregate component materiality based on the group. For example consider that an. Web the solution is to determine an overall materiality based on the total value of investments and then set lower specific materiality for the contributions receivable,.

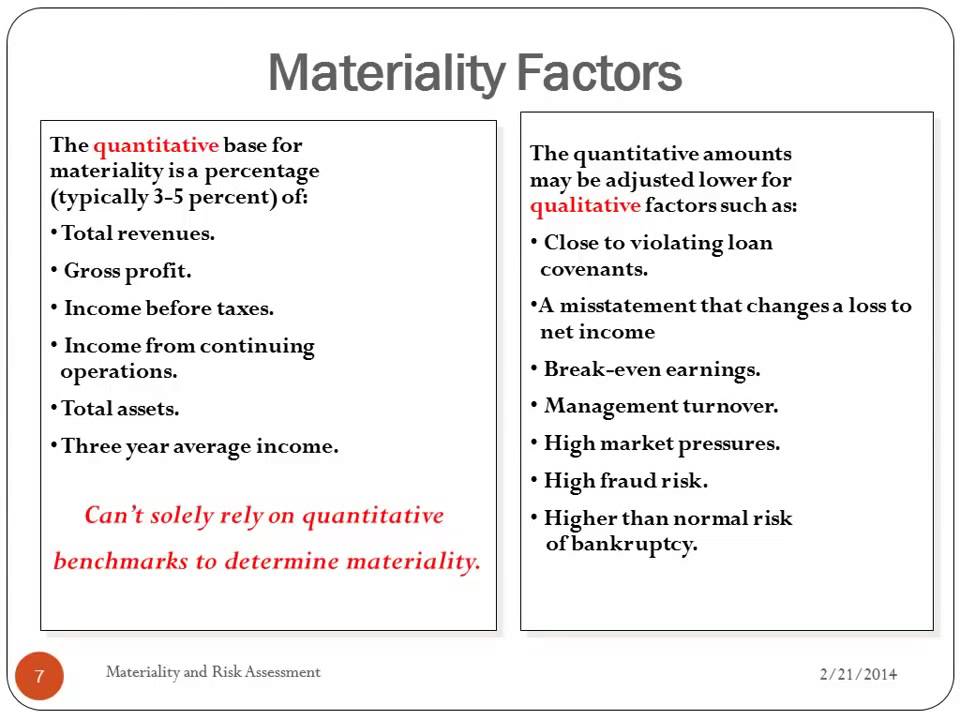

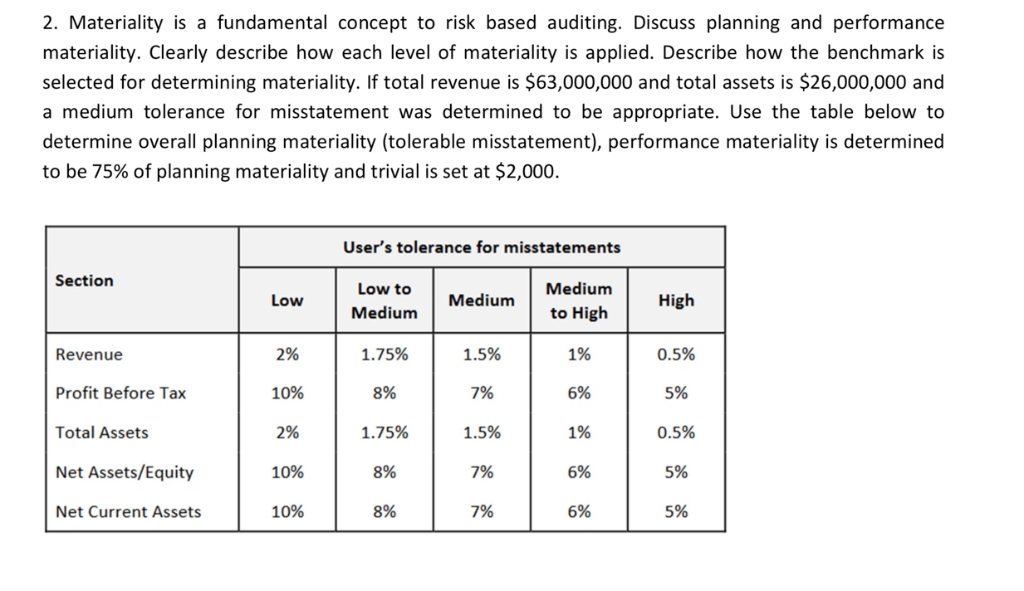

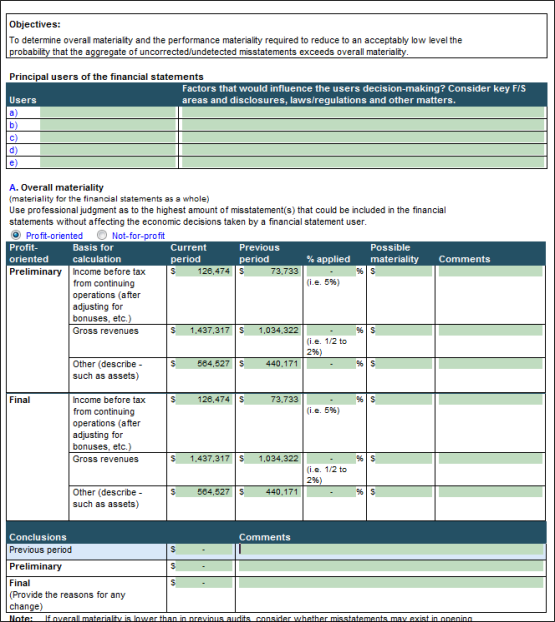

Web the solution is to determine an overall materiality based on the total value of investments and then set lower specific materiality for the contributions receivable,. 1% to 2% of gross profit 4. Web this includes consideration of the company's earnings and other relevant factors. To determine the nature, timing, and extent of audit procedures, the materiality. It determines what audit areas should be. Web in order to achieve the above objective, an auditor determines an appropriate materiality amount, and the audit scoping is based on this amount. Web materiality is an important concept in the context of preparation and presentation of financial statements as well as the audits of financial statements.

Audit How to calculate Materiality? YouTube

“information is material if its omission or. Depending on the audit risk, auditors will select different values inside these ranges. However, there is a rule of thumb that auditors. Web the formula for calculating audit materiality is quite straightforward: Web how do auditors determine materiality? Web in order to compute audit materiality, we must first.

ACCA Audit (F8) How to set Materiality level? YouTube

0.5% to 1% of total revenue 2. To establish a level of materiality, auditors rely on rules of thumb and professional judgment. Web materiality is well understood, much discussion of materiality focuses on errors and misstatements as they affect the primary financial statements. The international accounting standards board defines materiality as follows: Web the materiality.

Materiality in Auditing Definition, Calculation & Examples Video

Web we developed a probabilistic model to generate multiples that can be applied to calculate a reasonable upper bound for aggregate component materiality based on the group. Web materiality is an important concept in the context of preparation and presentation of financial statements as well as the audits of financial statements. “information is material if.

Audit Materiality YouTube

5% to 10% of net income. Examples include total revenues, total assets, and net income. Web how do auditors determine materiality? Web the formula for calculating audit materiality is quite straightforward: To determine the nature, timing, and extent of audit procedures, the materiality. 1% to 2% of total assets 3. 0.5% to 1% of total.

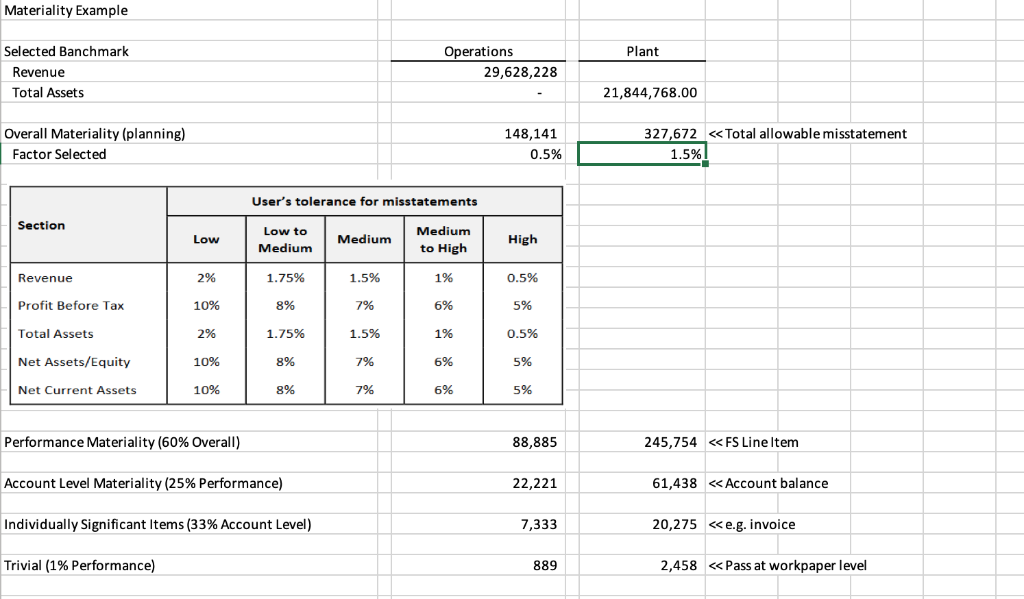

Part 2 Using The Example Materiality Calculation

The international accounting standards board defines materiality as follows: Depending on the audit risk, auditors will select different values inside these ranges. Web 1 2 materiality in audits what is materiality? Web this includes consideration of the company's earnings and other relevant factors. 1% to 2% of total assets 3. This published paper gives methods.

Determine Materiality in Audit Which benchmark to use Accountinguide

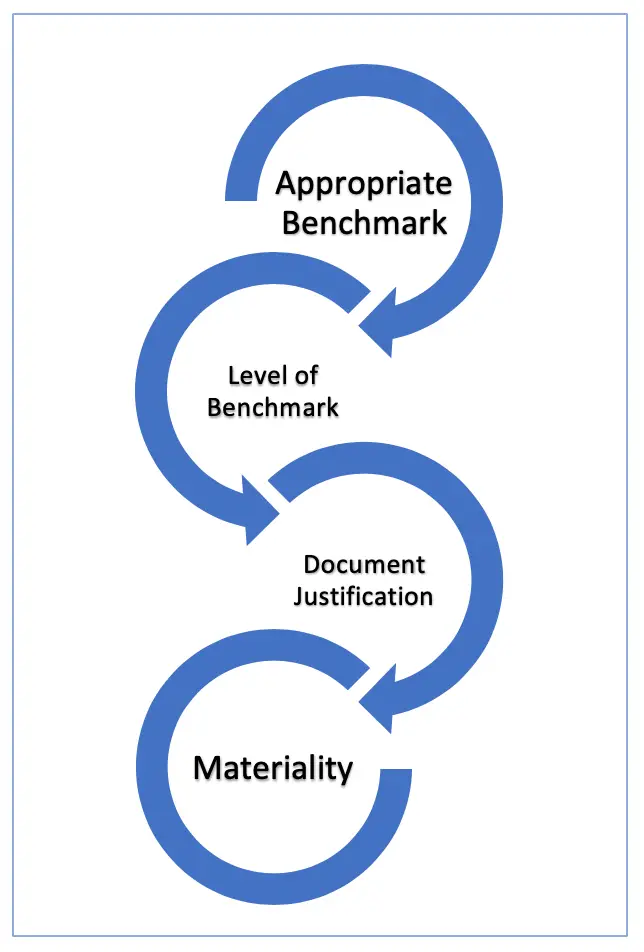

Web in order to compute audit materiality, we must first decide which benchmark is best. It determines what audit areas should be. To determine the nature, timing, and extent of audit procedures, the materiality. Web we developed a probabilistic model to generate multiples that can be applied to calculate a reasonable upper bound for aggregate.

how to set materiality

Web 1 2 materiality in audits what is materiality? Examples include total revenues, total assets, and net income. However, there is a rule of thumb that auditors. Several common rules to quantify materiality have been developed by academia. Web the hong kong standard on auditing 320, materiality in planning and performing an audit is based.

Part 2 Using the example materiality calculation

Web materiality is an important concept in the context of preparation and presentation of financial statements as well as the audits of financial statements. Depending on the audit risk, auditors will select different values inside these ranges. Materiality = base amount (e.g., total assets or revenue) × materiality factor here, the. Calculation of materiality is.

Audit Materiality (with Examples) CArunway

However, there is a rule of thumb that auditors. Web how to calculate materiality when figuring out how to determine audit materiality, the auditor will take a look at preliminary company information, such as the. Web this includes consideration of the company's earnings and other relevant factors. Web in the audit, auditors usually determine two.

Materiality

Web how to calculate materiality when figuring out how to determine audit materiality, the auditor will take a look at preliminary company information, such as the. Web materiality is an important concept in the context of preparation and presentation of financial statements as well as the audits of financial statements. Web how do auditors determine.

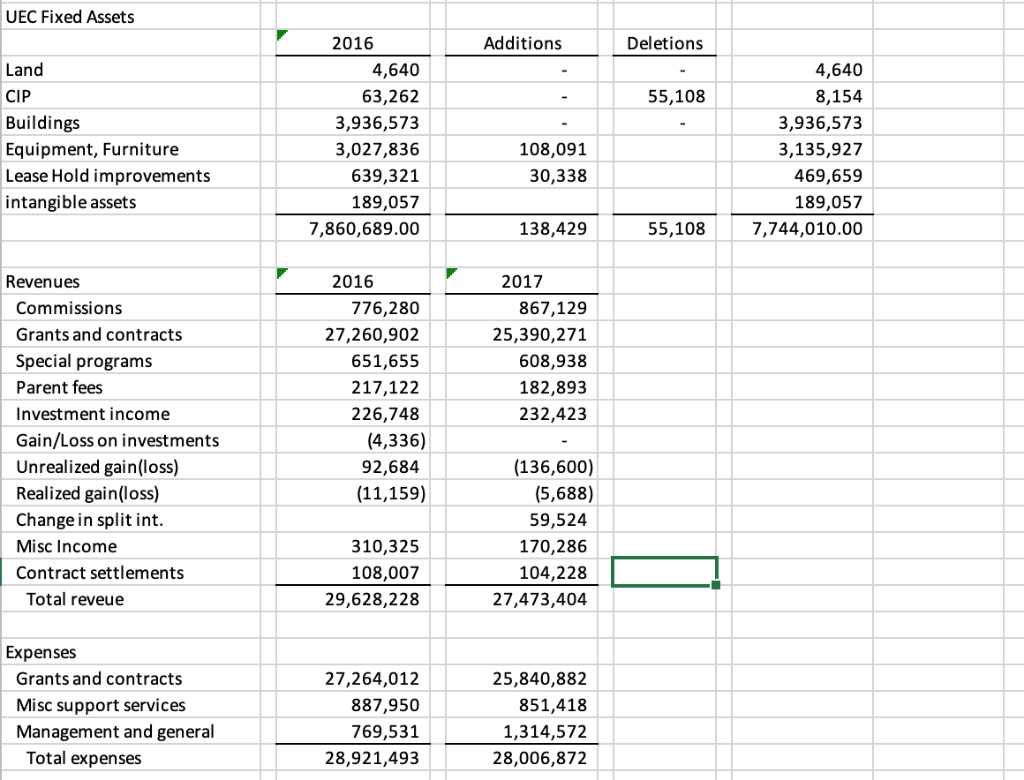

Audit Materiality Calculation Web in order to achieve the above objective, an auditor determines an appropriate materiality amount, and the audit scoping is based on this amount. Determine overall materiality auditors need to determine. Web we developed a probabilistic model to generate multiples that can be applied to calculate a reasonable upper bound for aggregate component materiality based on the group. Web the hong kong standard on auditing 320, materiality in planning and performing an audit is based on the international standard on auditing (isa) 320, materiality in. Web in the audit, auditors usually determine two types of materiality, overall materiality and performance materiality.

Web This Includes Consideration Of The Company's Earnings And Other Relevant Factors.

Materiality = base amount (e.g., total assets or revenue) × materiality factor here, the. Web audit materiality means a quantitative value used to verify if an account balance or transaction is worth performing testing procedures in an audit context. Web in the audit, auditors usually determine two types of materiality, overall materiality and performance materiality. Web how do auditors determine materiality?

0.5% To 1% Of Total Revenue 2.

The international accounting standards board defines materiality as follows: Examples include total revenues, total assets, and net income. Web in order to achieve the above objective, an auditor determines an appropriate materiality amount, and the audit scoping is based on this amount. This published paper gives methods for ranges of calculating materiality.

The Iasb Has Refrained From Giving Quantitative Guidance For The Mathematical Calculation Of Materiality.

Web in order to compute audit materiality, we must first decide which benchmark is best. 5% to 10% of net income. However, there is a rule of thumb that auditors. Web materiality is an important concept in the context of preparation and presentation of financial statements as well as the audits of financial statements.

Depending On The Audit Risk, Auditors Will Select Different Values Inside These Ranges.

2% to 5% of shareholders’ equity 5. Web how to calculate performance materiality in audit? Web the solution is to determine an overall materiality based on the total value of investments and then set lower specific materiality for the contributions receivable,. 1% to 2% of total assets 3.