Best Roth Conversion Calculator

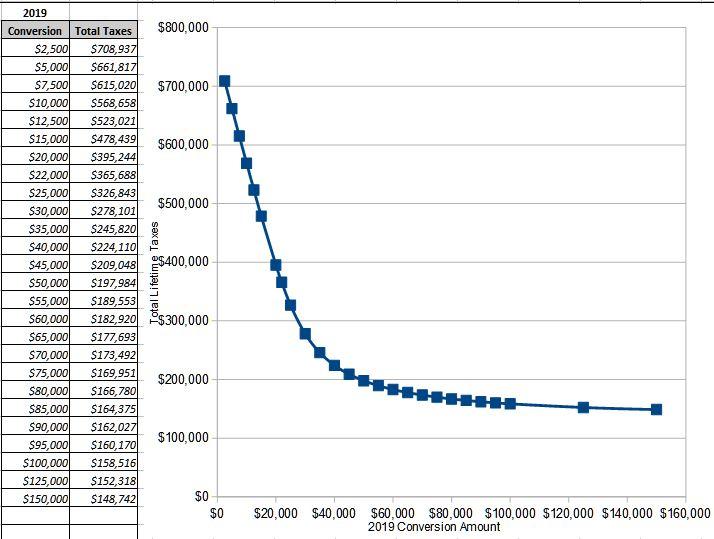

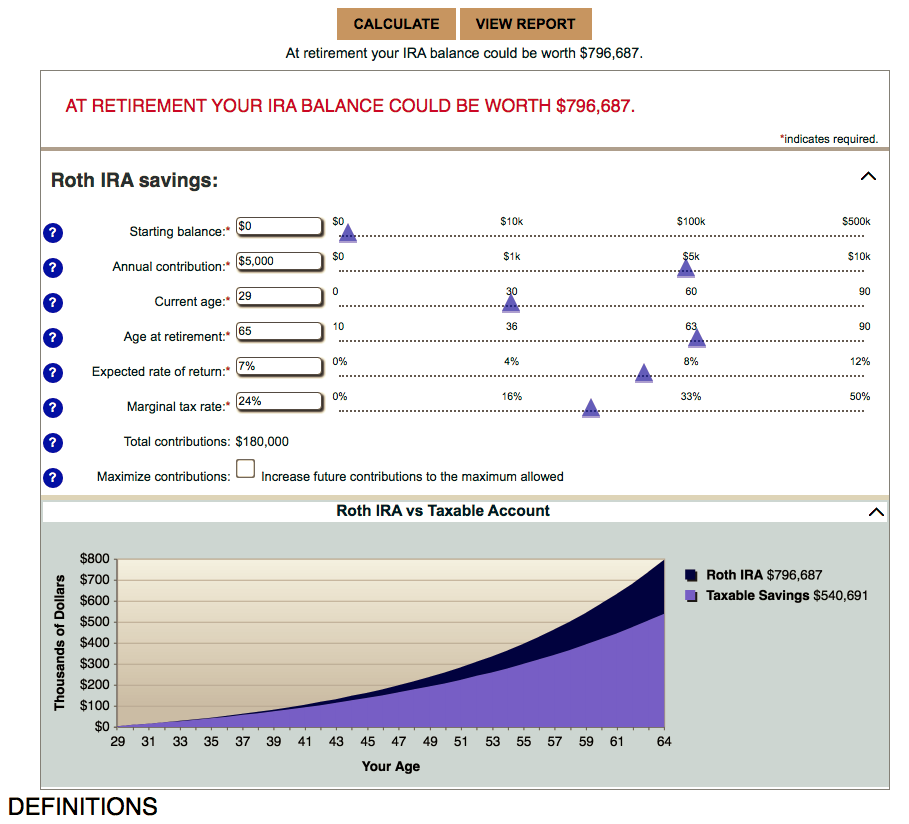

Best Roth Conversion Calculator - Web published november 24, 2020 converting a traditional ira to a roth can shield your retirement savings from future tax increases, but there are pitfalls and trapdoors, too. Converting your traditional ira to a roth ira may be beneficial to you in the long term. See an estimate of the taxes. Web if you’ve got one already or plan to open one soon, use our roth ira calculator to see how much you can save for retirement. What’s the best tax strategy?

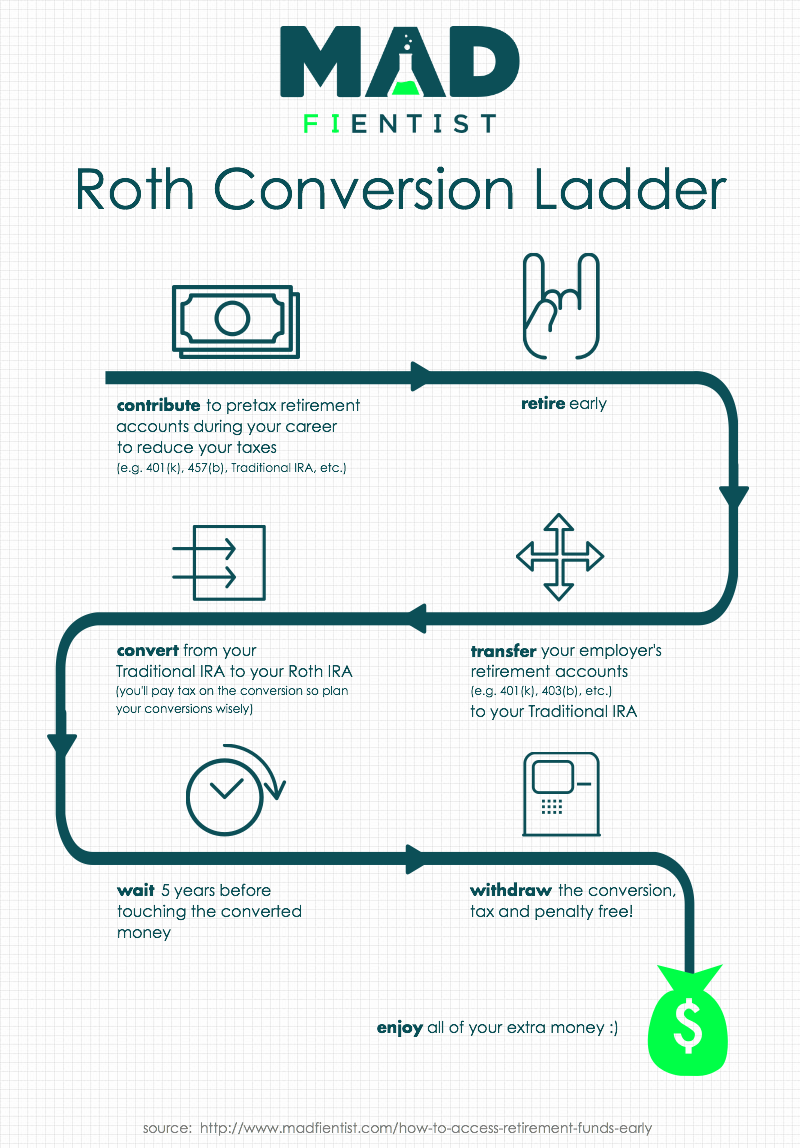

Web i’m 47, left my job and want to convert my $130,000 traditional ira to a roth. Depending on your situation, converting retirement savings that are currently in a traditional account to a roth retirement account may make sense. No commissions401(k) & ira rolloversfree retirement guideadvice on how to invest Web understanding roth ira conversion essentials. Web use this free roth ira calculator to find out how much your roth ira contributions could be worth at retirement, calculate your estimated maximum annual. Web if you’ve got one already or plan to open one soon, use our roth ira calculator to see how much you can save for retirement. Web one big decision is whether or not you should convert your traditional ira into a roth ira.

Roth Conversion Calculator Use Our Roth IRA Conversion Calculator For

Yet, keep in mind that when you convert your. Web to find a comfortable amount to convert, try our roth conversion calculator. Converting your traditional ira to a roth ira may be beneficial to you in the long term. What’s the best tax strategy? Web should i convert to a roth ira? See an estimate.

IRA To ROTH Conversion Calculator Seeking Alpha

What’s the best tax strategy? Web bankrate.com provides a free convert ira to roth calculator and other 401k calculators to help consumers determine the best option for retirement savings. Web when you convert money to a roth ira, you will need to pay income taxes on the entire amount in the tax year that you.

Roth IRA Calculator 2023 Estimate Your Retirement Savings!

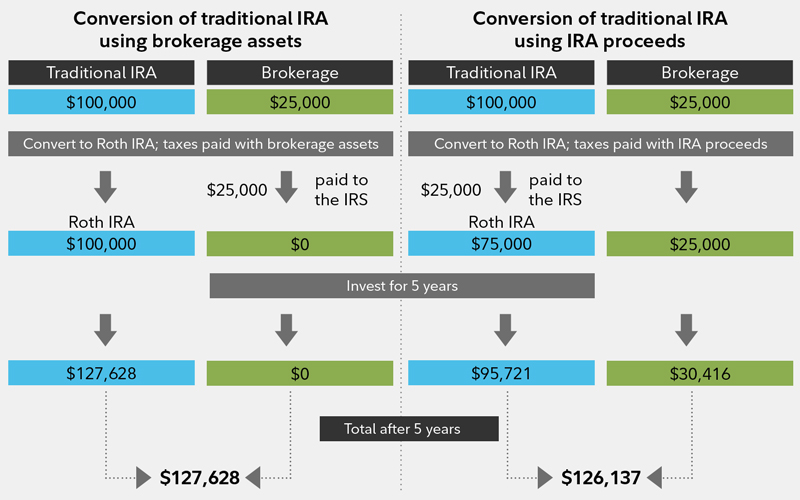

Converting it to a roth. Web ira roth conversion analysis. Web with a roth conversion, the taxable portion of your traditional ira (deductible contributions and earnings) is subject to tax in the year of conversion. Web published november 24, 2020 converting a traditional ira to a roth can shield your retirement savings from future tax.

Roth Conversion Chart 2 Using Aftertax Fund Smart Strategies for

Web published november 24, 2020 converting a traditional ira to a roth can shield your retirement savings from future tax increases, but there are pitfalls and trapdoors, too. Reaching a decision involves many considerations. Web bankrate.com provides a free roth ira calculator and other 401k calculators to help consumers determine the best option for retirement.

Roth Conversion Ladder and SEPP How to Access Your Retirement Accounts

Web with a roth conversion, the taxable portion of your traditional ira (deductible contributions and earnings) is subject to tax in the year of conversion. 3, 2024 at 9:28 a.m. Yet, keep in mind that when you convert your. Web roth ira conversion calculator is converting to a roth ira the right move for you?.

401k to roth ira rollover calculator LyndseyRuana

Web ira roth conversion analysis. Traditional iras can be converted to roth iras if you're over the income limit. Web one big decision is whether or not you should convert your traditional ira into a roth ira. Web you'll owe income tax on any money you convert. Web if you’ve got one already or plan.

Roth Conversions 101

Web if you’ve got one already or plan to open one soon, use our roth ira calculator to see how much you can save for retirement. Web published november 24, 2020 converting a traditional ira to a roth can shield your retirement savings from future tax increases, but there are pitfalls and trapdoors, too. Web.

How to Use a Roth IRA Calculator Ready to Roth

Web when you convert money to a roth ira, you will need to pay income taxes on the entire amount in the tax year that you make the conversion. A roth ira conversion involves transferring funds from a traditional retirement savings account, such as a 401(k) or a. Web you'll owe income tax on any.

401k vs roth ira calculator Choosing Your Gold IRA

Web if you’ve got one already or plan to open one soon, use our roth ira calculator to see how much you can save for retirement. What’s the best tax strategy? Converting it to a roth. Use this calculator to see how converting your traditional ira to a roth ira could affect your net worth.

Guide to Roth Conversions Why, When, and How Much to Convert

No commissions401(k) & ira rolloversfree retirement guideadvice on how to invest 3, 2024 at 9:28 a.m. Yet, keep in mind that when you convert your. Web bankrate.com provides a free roth ira calculator and other 401k calculators to help consumers determine the best option for retirement savings. Web with a roth conversion, the taxable portion.

Best Roth Conversion Calculator Web understanding roth ira conversion essentials. This calculator can show you the consequences of such a decision. Is time on your side? Web with a roth conversion, the taxable portion of your traditional ira (deductible contributions and earnings) is subject to tax in the year of conversion. Reaching a decision involves many considerations.

Web You'll Owe Income Tax On Any Money You Convert.

Web when you convert money to a roth ira, you will need to pay income taxes on the entire amount in the tax year that you make the conversion. Depending on your situation, converting retirement savings that are currently in a traditional account to a roth retirement account may make sense. 3, 2024 at 9:28 a.m. Newyorklife.com has been visited by 100k+ users in the past month

For Example, If You Move $100,000 Into A Roth 401 (K) And You're In The 22% Tax Bracket, You'll Owe $22,000 In.

Yet, keep in mind that when you convert your. Is time on your side? See an estimate of the taxes. Converting it to a roth.

Web A Traditional Ira Or Traditional 401 (K) That Has Been Converted To A Roth Ira Will Be Taxed And Penalized If Withdrawals Are Taken Within Five Years Of The Conversion.

Web $ current and future tax rates filing status estimated taxable income (not including conversion amount) $ current federal income tax rate (based on your estimated taxable. A roth ira conversion involves transferring funds from a traditional retirement savings account, such as a 401(k) or a. Web roth ira conversion calculator is converting to a roth ira the right move for you? Converting your traditional ira to a roth ira may be beneficial to you in the long term.

Web Use This Free Roth Ira Calculator To Find Out How Much Your Roth Ira Contributions Could Be Worth At Retirement, Calculate Your Estimated Maximum Annual.

Web ira roth conversion analysis. Web one big decision is whether or not you should convert your traditional ira into a roth ira. Web use our roth ira conversion calculator to compare the estimated future values of keeping your traditional ira vs. Web i’m 47, left my job and want to convert my $130,000 traditional ira to a roth.