Beta Of Portfolio Calculator

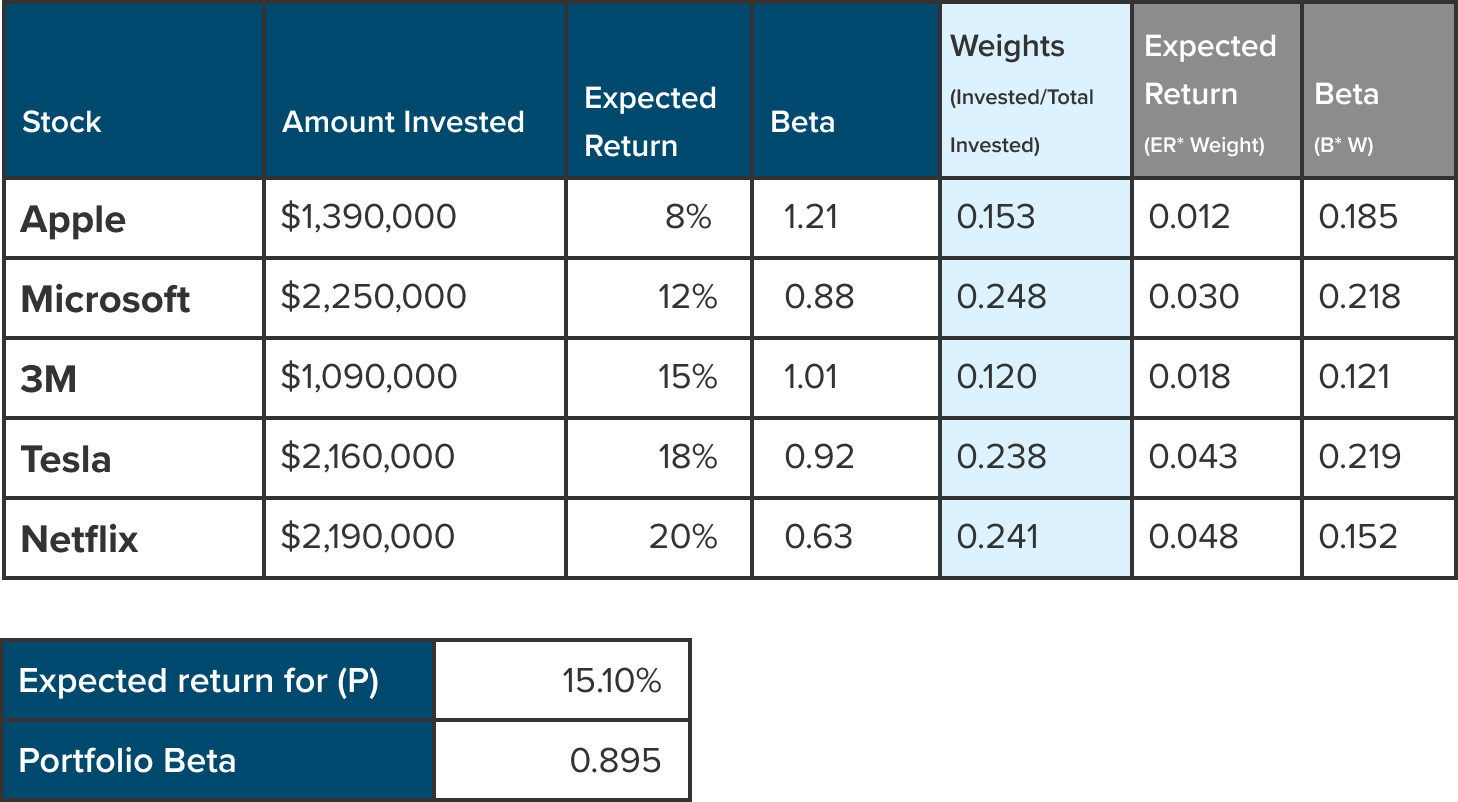

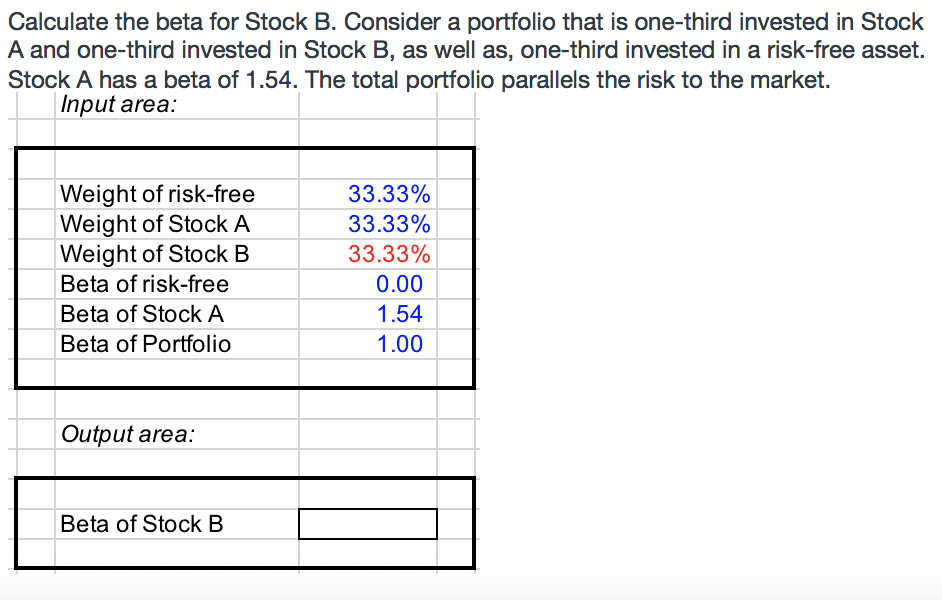

Beta Of Portfolio Calculator - Web the beta portfolio calculator is a powerful tool used in finance to evaluate the risk and performance of an investment portfolio. Web formulaically, the portfolio beta is the weighted sum of the beta coefficients of the securities in an investment portfolio. Web beta is a standard measure to compare volatility with the broader market. Add up the value (number of shares multiplied by the share price) of each. Beta = (w1 * beta1) + (w2 * beta2) +.

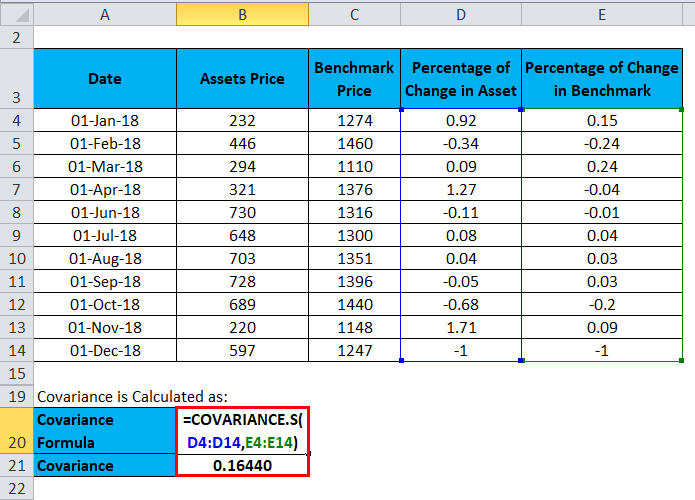

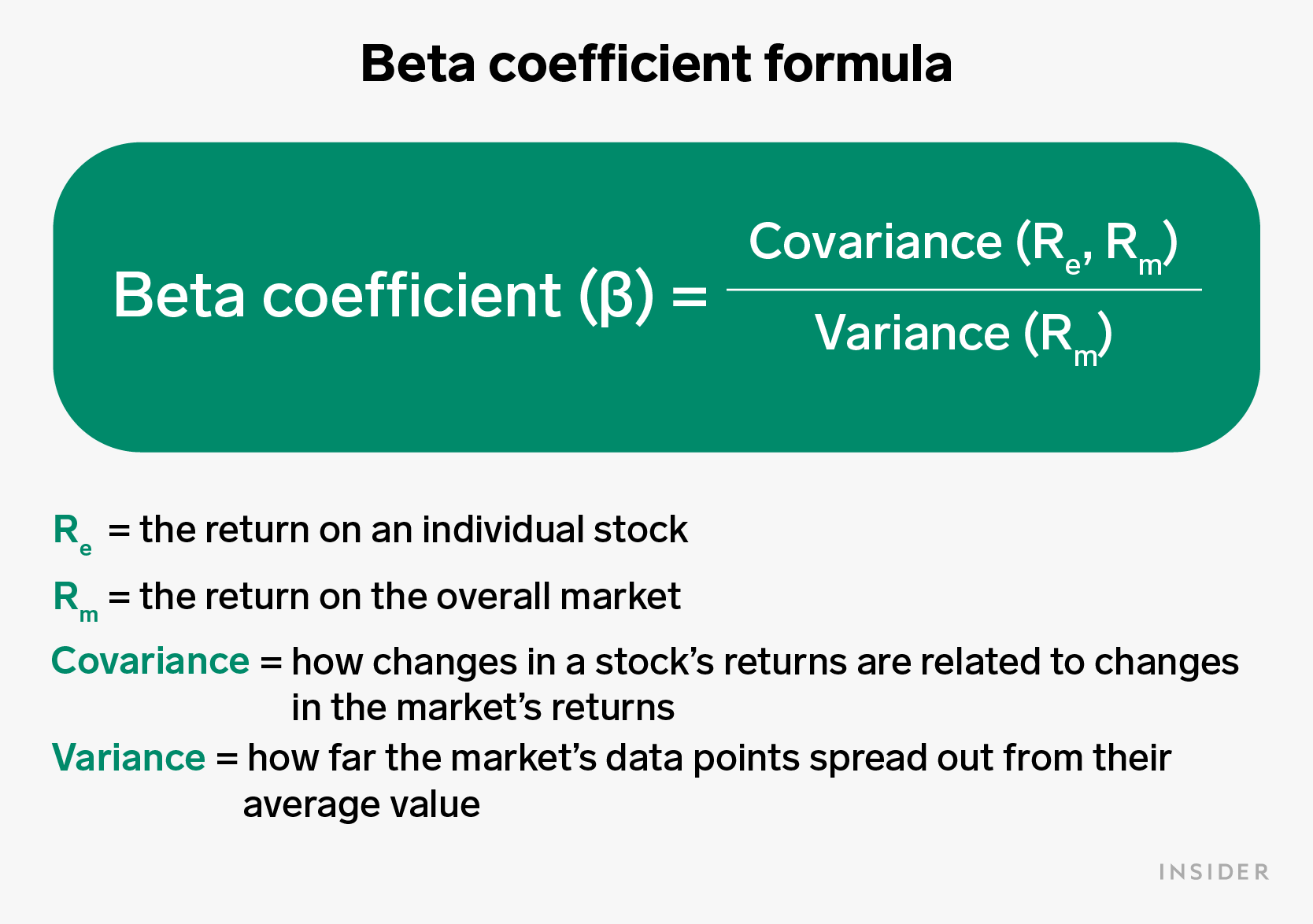

Add up the value (number of shares multiplied by the share price) of each. Web portfolio beta calculator measures the expected move in stock relative to movements in the overall market. Web the beta stock calculator determines the beta of a stock, which is a measure of how volatile a stockis relative to the benchmark market. Web the calculation involves understanding the covariance of the portfolio’s returns with the market returns and dividing it by the variance of the market returns. Web this video shows how to calculate the beta of an entire portfolio. Web the formula for calculating the beta of a portfolio is: Peering through yahoo (yhoo) finance, google ( goog).

What is portfolio beta and How to calculate beta of a portfolio? Wealthface

It calculates the beta of a portfolio,. Portfolio beta calculator overview a portfolio beta calculator. Web asset weight = (value of individual asset) / (total value of portfolio) 3. If the benchmark goes up 10%, the portfolio will go exactly 10%. Web you can calculate portfolio beta using this formula: Peering through yahoo (yhoo) finance,.

How To Calculate Beta Of A Portfolio Using Excel

Calculate the weighted beta for each asset in your portfolio: Web the beta stock calculator determines the beta of a stock, which is a measure of how volatile a stockis relative to the benchmark market. Web the formula for calculating the beta of a portfolio is: Web the calculation involves understanding the covariance of the.

Beta Formula Calculator for Beta Formula (With Excel template)

Calculate the value of each stock you own in your portfolio by listing the number of. Add up the value (number of shares multiplied by the share price) of each. Web portfolio beta calculator measures the expected move in stock relative to movements in the overall market. Provided betas are calculated with time frames unknown.

How to calculate the Portfolio Beta ( fast and easy ) ) YouTube

Portfolio beta calculator overview a portfolio beta calculator. Web the beta stock calculator determines the beta of a stock, which is a measure of how volatile a stockis relative to the benchmark market. + (wn * beta n) where: Web working of equity beta calculator: If the benchmark goes up 10%, the portfolio will go.

Calculate The Beta Of A Portfolio In Excel The Excel Hub YouTube

Web the beta stock calculator determines the beta of a stock, which is a measure of how volatile a stockis relative to the benchmark market. Multiply asset beta by weight: Web calculated betas begin by looking at the time frame chosen for calculating beta. The beta of a portfolio is a measure of the risk.

How to Calculate the Beta of a Portfolio? Wealthface

Represents the beta of the portfolio reflects the beta of a given stock / asset , and denotes the weight. Peering through yahoo (yhoo) finance, google ( goog). Add up the value (number of shares multiplied by the share price) of each. Web the beta stock calculator determines the beta of a stock, which is.

How to Calculate the Beta of a Portfolio Hedge Fund Alpha

Web you can calculate portfolio beta using this formula: Web to calculate the beta of a portfolio, follow the steps outlined below: Web portfolio beta calculator measures the expected move in stock relative to movements in the overall market. Peering through yahoo (yhoo) finance, google ( goog). Web to determine the beta of an entire.

How To Calculate Beta Value Of Portfolio Haiper

Web portfolio beta calculator measures the expected move in stock relative to movements in the overall market. Web beta is a standard measure to compare volatility with the broader market. Web working of equity beta calculator: Multiply asset beta by weight: Web the beta stock calculator determines the beta of a stock, which is a.

Beta can help you determine how much your portfolio will swing when the

Web portfolio beta calculator measures the expected move in stock relative to movements in the overall market. Web asset weight = (value of individual asset) / (total value of portfolio) 3. Web to calculate the beta of a portfolio, follow the steps outlined below: A portfolio beta is nothing but the weighted sum of the.

Portfolio Beta Calculator MarketXLS

The beta of a portfolio is a measure of the risk of the portfolio,. Calculate the value of each stock you own in your portfolio by listing the number of. Web this video shows how to calculate the beta of an entire portfolio. + (wn * beta n) where: Web beta is a standard measure.

Beta Of Portfolio Calculator Portfolio beta calculator overview a portfolio beta calculator. It calculates the beta of a portfolio,. Calculate the value of each stock you own in your portfolio by listing the number of. Web working of equity beta calculator: Web β = 1 — it means the portfolio mirrors the returns of the market to which it is compared.

Add Up The Value (Number Of Shares Multiplied By The Share Price) Of Each.

Web a portfolio beta calculator is a tool that allows investors to calculate the beta of their portfolios. Web calculated betas begin by looking at the time frame chosen for calculating beta. Web beta portfolio calculator december 24, 2023 by calculator experts initial investment (usd): Portfolio beta = ∑ (portfolio weight × beta.

Portfolio Beta Calculator Overview A Portfolio Beta Calculator.

It calculates the beta of a portfolio,. Web β = 1 — it means the portfolio mirrors the returns of the market to which it is compared. Web the formula for calculating the beta of a portfolio is: Web asset weight = (value of individual asset) / (total value of portfolio) 3.

The Beta Of A Portfolio Is A Measure Of The Risk Of The Portfolio,.

Web you can calculate portfolio beta using this formula: If the benchmark goes up 10%, the portfolio will go exactly 10%. Web formulaically, the portfolio beta is the weighted sum of the beta coefficients of the securities in an investment portfolio. + (wn * beta n) where:

Web Beta Is A Standard Measure To Compare Volatility With The Broader Market.

Aiolux automatically calculates beta for your portfolio over different time horizons so that you. Web the calculation involves understanding the covariance of the portfolio’s returns with the market returns and dividing it by the variance of the market returns. Web to calculate the beta of a portfolio, follow the steps outlined below: Calculate the value of each stock you own in your portfolio by listing the number of.