C Corp Vs S Corp Tax Calculator

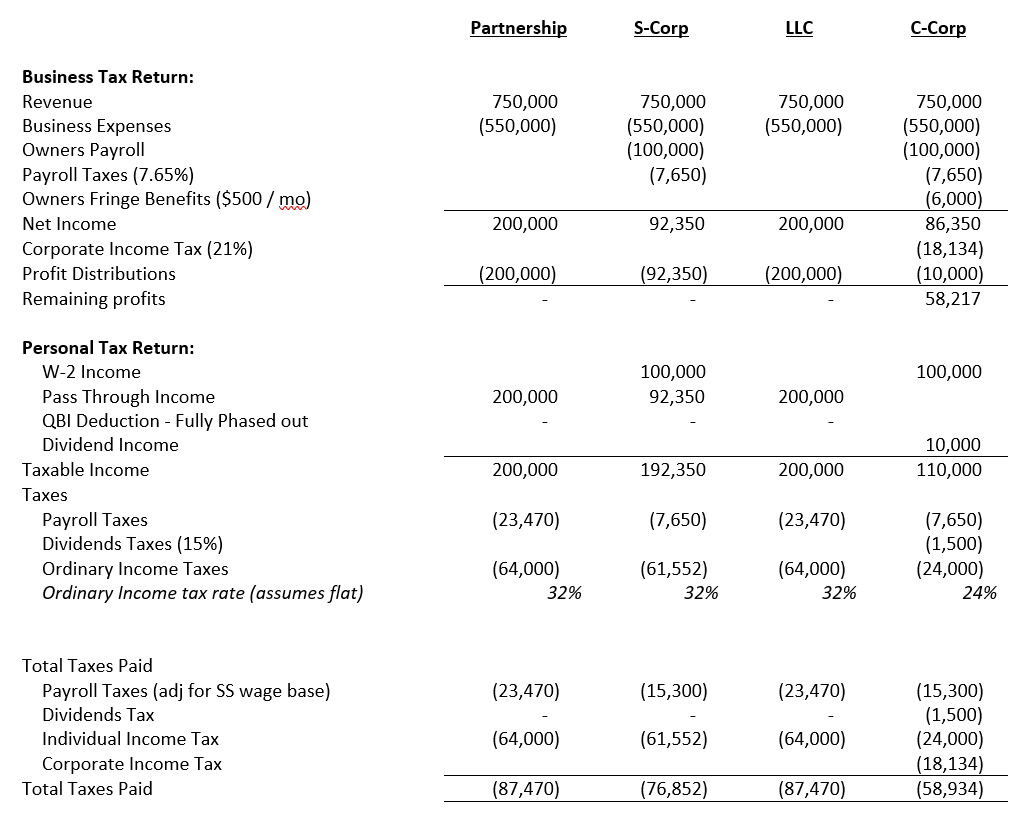

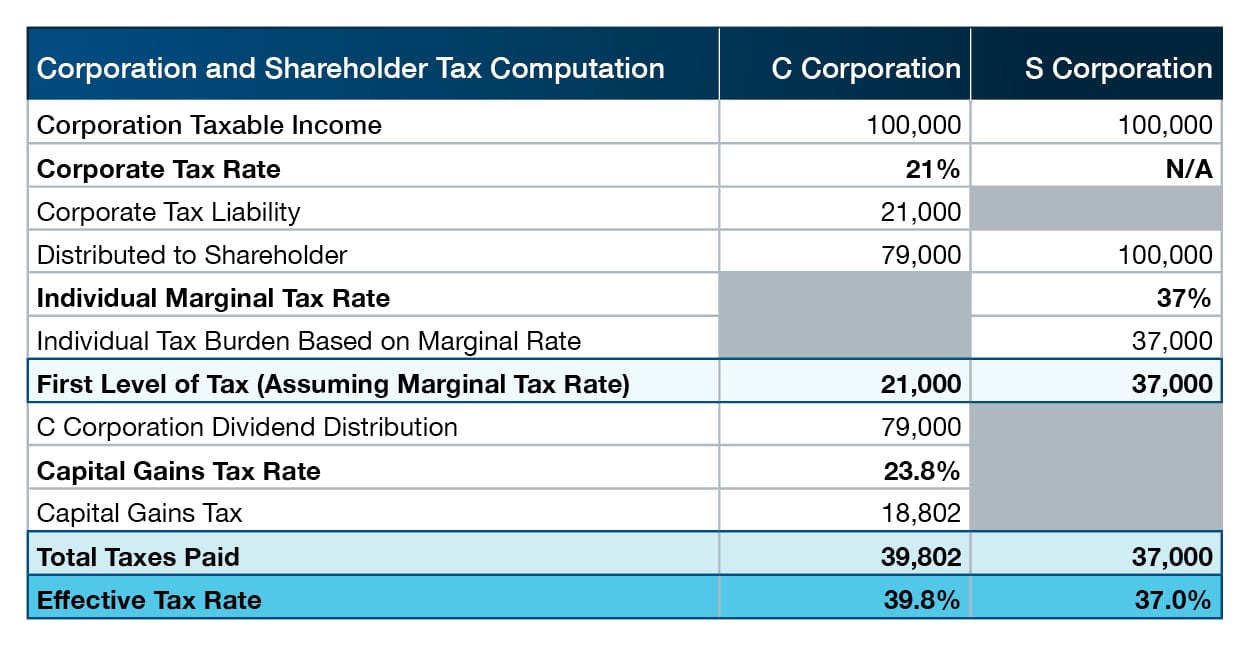

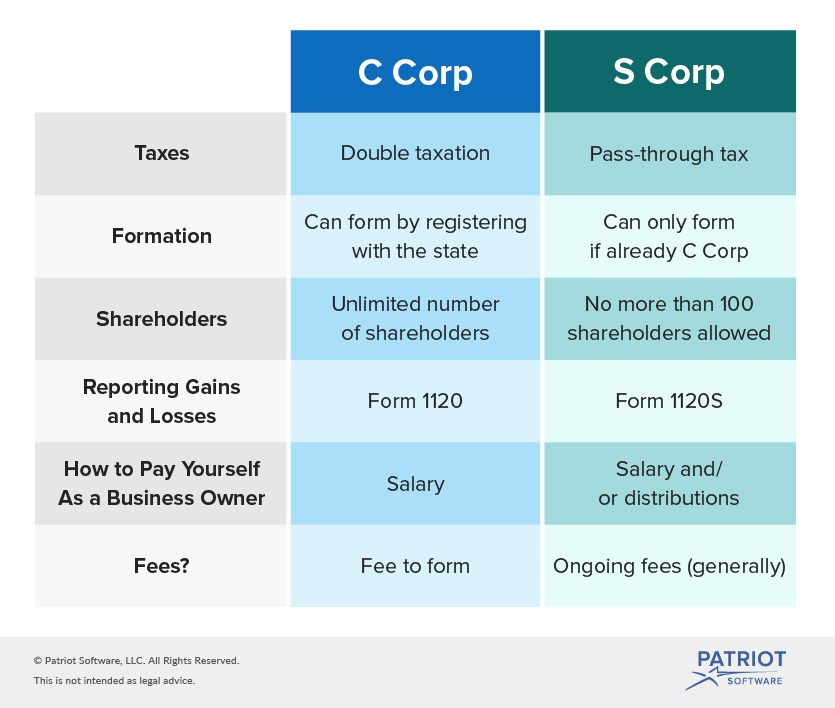

C Corp Vs S Corp Tax Calculator - Taxact.com has been visited by 100k+ users in the past month Web as mentioned above, c corporations pay tax at the entity level. Web what's the best tax treatment for your startup? Web while c corp profits are taxed twice, since the 2017 tax cuts and jobs act was signed into law, c corp taxes are a flat 21%. S corporation tax calculator can help you determine your tax obligations based on the type of business structure you want to.

Correct your errorstalk to an expert todaytailored sessionspeace of mind By default, the earnings of an llc are passed on to your personal income and exposed to. Llc tax calculator guide will explain how to tell whether an s corp election is right for your business. Read ahead to calculate your s corp tax. Web shareholders must then pay tax on their dividend shares. An overview s corp vs c corp: S corporation tax calculator can help you determine your tax obligations based on the type of business structure you want to.

How Changes in Corporate Tax Rate Can Affect Choice of C vs. S Corp.

Web if a s corp vs c corp tax calculator search brought you here, that gets a bit more complex. Llc tax calculator guide will explain how to tell whether an s corp election is right for your business. S corporation tax calculator can help you determine your tax obligations based on the type of.

SCorporation Tax Calculator [Spreadsheet]When & How the Scorp Can

Correct your errorstalk to an expert todaytailored sessionspeace of mind Each has its pros and cons, and the best choice for you will depend on. Web use this s corp tax rate calculator to get started and uncover the tax savings you'll receive as an s corporation. Read ahead to calculate your s corp tax..

SCorp vs CCorp Which is Better? UpFlip

The centerpiece of the law known as the tax cuts and jobs act (tcja), p.l. Normally these taxes are withheld by your employer. Web shareholders must then pay tax on their dividend shares. Web this calculator helps you understand the difference between filing taxes as a sole proprietor vs. Differences s corp advantages s corp.

What is Double Taxation for CCorps? The Exciting Secrets of Pass

This entity level tax is different than the tax other businesses pay because it is a flat 21% tax. Normally these taxes are withheld by your employer. Web an s corporation is a tax status of the internal revenue code (irs) subchapter s elected by llc or corporation business owners by filing form 2553. S.

S Corporation or C Corporation Under the Tax Cuts and Jobs Act PYA

Web this calculator helps you understand the difference between filing taxes as a sole proprietor vs. An overview s corp vs c corp: Enter your estimated annual business net income and the. However sometimes a cpa can help you avoid expensive state unemployment, so with. Web the se tax rate for business owners is 15.3%.

What Is the Difference Between S Corp and C Corp? Business Overview

Normally these taxes are withheld by your employer. By default, the earnings of an llc are passed on to your personal income and exposed to. Web s corp vs c corp: Individual federal income tax rates. Web c corporations and s corporations are different tax designations available to corporations. An overview s corp vs c.

What Is An S Corp?

Web if a s corp vs c corp tax calculator search brought you here, that gets a bit more complex. Web this calculator helps you understand the difference between filing taxes as a sole proprietor vs. Normally these taxes are withheld by your employer. Web as mentioned above, c corporations pay tax at the entity.

S Crop Vs C Crop Business structure, Accounting services, Tax accountant

Normally these taxes are withheld by your employer. Similarities s corp vs c corp: However sometimes a cpa can help you avoid expensive state unemployment, so with. Web as mentioned above, c corporations pay tax at the entity level. Web updated july 7, 2020: Web use this s corp tax rate calculator to get started.

Tax CPA Tips S Corp v C Corp Which is Best?

Read ahead to calculate your s corp tax. Similarities s corp vs c corp: The centerpiece of the law known as the tax cuts and jobs act (tcja), p.l. An overview s corp vs c corp: Web if a s corp vs c corp tax calculator search brought you here, that gets a bit more.

Difference Between S Corp and C Corp Difference Between

S corporation tax calculator can help you determine your tax obligations based on the type of business structure you want to. However sometimes a cpa can help you avoid expensive state unemployment, so with. Each has its pros and cons, and the best choice for you will depend on. Web c corporations and s corporations.

C Corp Vs S Corp Tax Calculator Web our s corp vs. Web if a s corp vs c corp tax calculator search brought you here, that gets a bit more complex. Read ahead to calculate your s corp tax. Web this calculator helps you understand the difference between filing taxes as a sole proprietor vs. Taxact.com has been visited by 100k+ users in the past month

Web Use This S Corp Tax Rate Calculator To Get Started And Uncover The Tax Savings You'll Receive As An S Corporation.

Web as mentioned above, c corporations pay tax at the entity level. Web shareholders must then pay tax on their dividend shares. Web our s corp vs. Normally these taxes are withheld by your employer.

Web An S Corporation Is A Tax Status Of The Internal Revenue Code (Irs) Subchapter S Elected By Llc Or Corporation Business Owners By Filing Form 2553.

Web while c corp profits are taxed twice, since the 2017 tax cuts and jobs act was signed into law, c corp taxes are a flat 21%. Correct your errorstalk to an expert todaytailored sessionspeace of mind Web c corporation income taxation. Similarities s corp vs c corp:

Web Updated July 7, 2020:

Llc tax calculator guide will explain how to tell whether an s corp election is right for your business. Each has its pros and cons, and the best choice for you will depend on. Web if a s corp vs c corp tax calculator search brought you here, that gets a bit more complex. Web this tax calculator will help alert you before you choose an s corp.

By Default, The Earnings Of An Llc Are Passed On To Your Personal Income And Exposed To.

Web this calculator helps you understand the difference between filing taxes as a sole proprietor vs. Web the se tax rate for business owners is 15.3% tax of the first $160,200 of income and 2.9% of everything over $160,200. Read ahead to calculate your s corp tax. Taxact.com has been visited by 100k+ users in the past month

![SCorporation Tax Calculator [Spreadsheet]When & How the Scorp Can](https://i.ytimg.com/vi/UqujNM4IkFA/maxresdefault.jpg)