Ca Overtime Calculator

Ca Overtime Calculator - Web california overtime law 2023 [overtime pay calculator] by: Web for required minimum monthly compensation, including required overtime pay, for sheepherders and goat herders working. The calculator will output the regular, overtime and doubletime hours. Web the irs has adjusted its tax brackets for inflation for both 2023 and 2024. Web calculate overtime hours worked and pay for california employees with this easy and convenient tool.

Web california paycheck calculator photo credit: Jericka orellano october 3, 2023 california workers benefit from a more generous state. Web the best squares to have are 0, 1, 3, 4 and 7 because they are the most frequent last digit numbers, since touchdowns are worth seven points and field goals are. Learn the california overtime law, who is eligible, and how to calculate. Web an overview about overtime and how to calculate and process; Web the irs has adjusted its tax brackets for inflation for both 2023 and 2024. Learn the legal requirements, exceptions, and tips for overtime pay in.

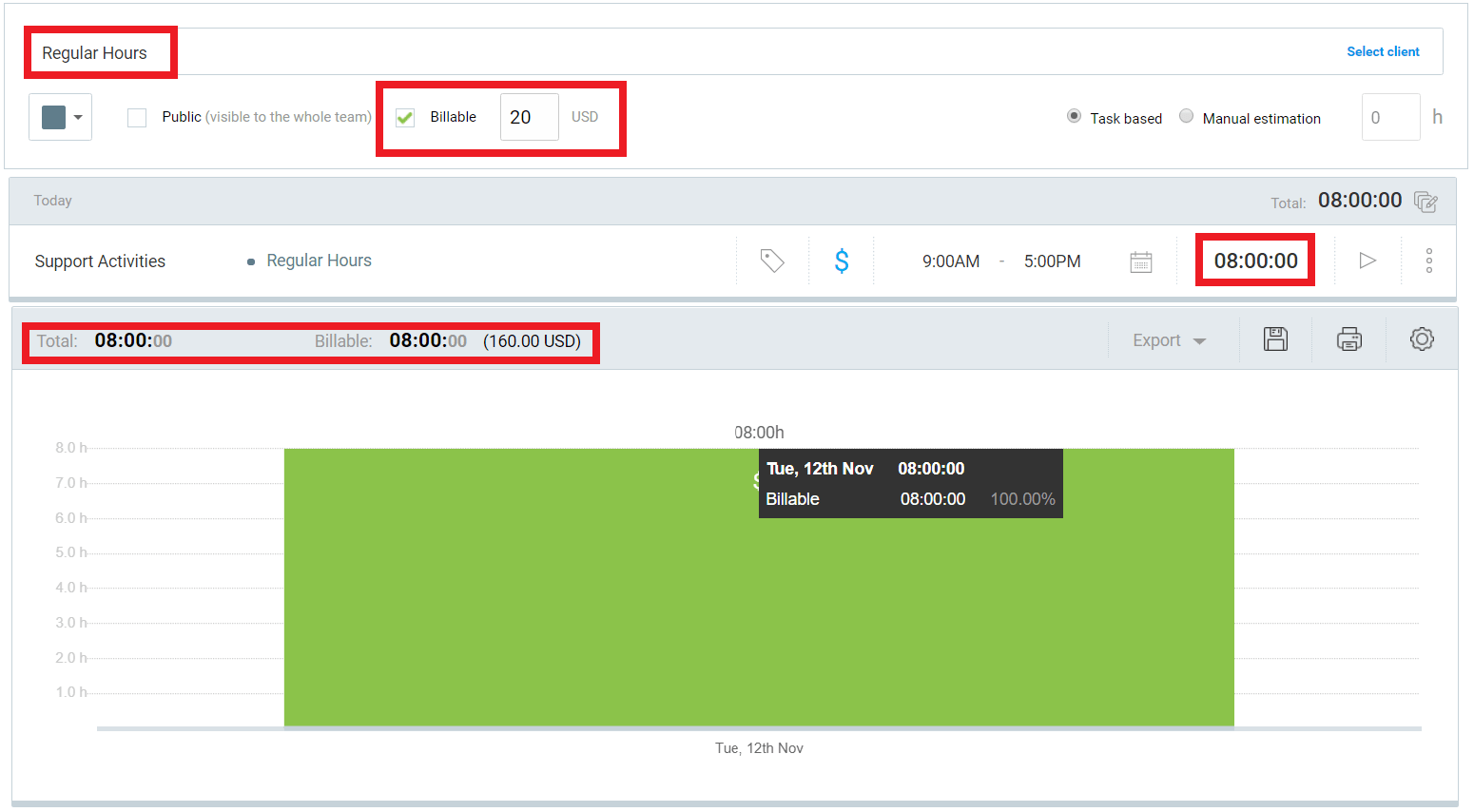

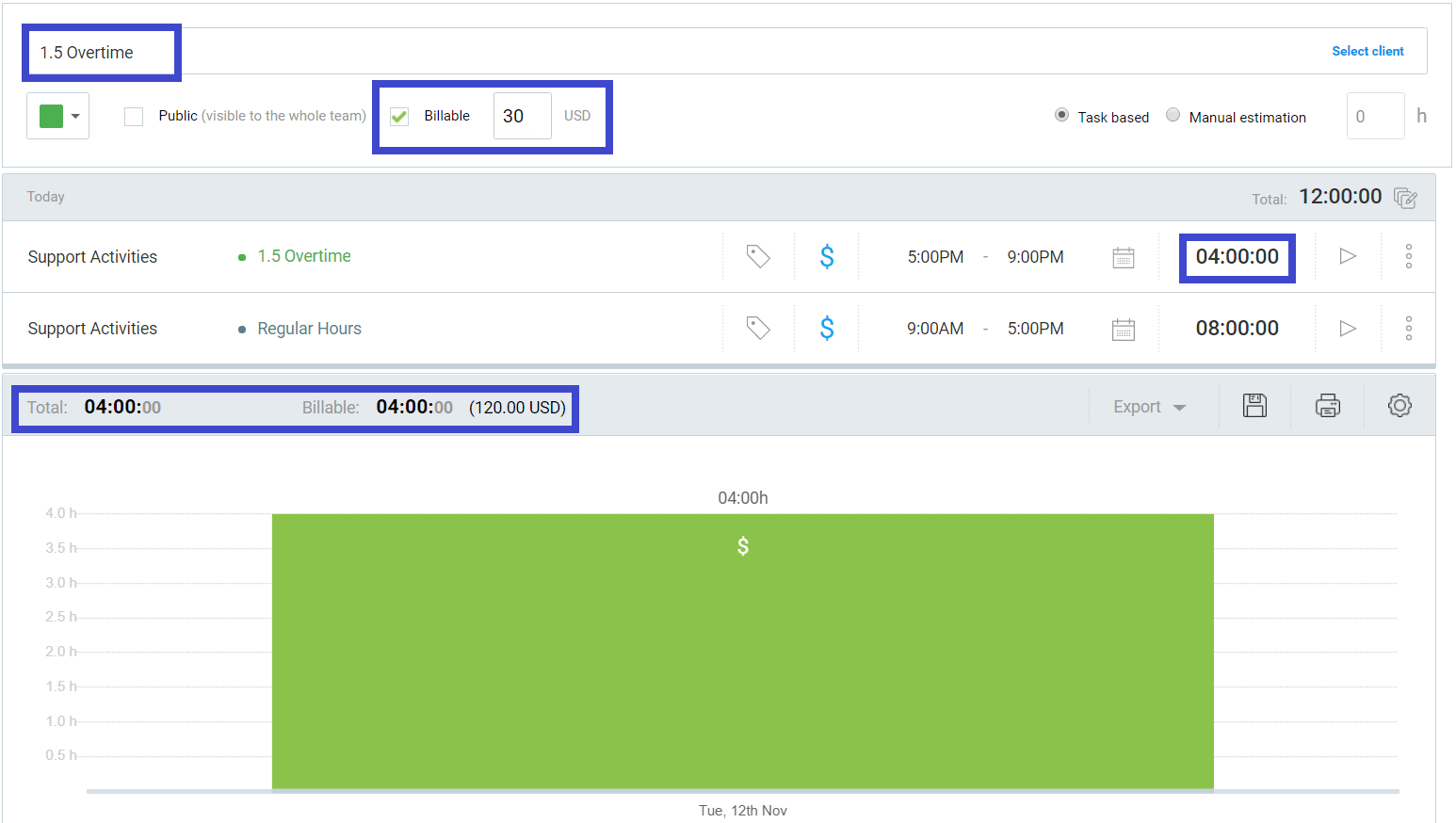

Learn about the basics of California overtime law in 2023 Clockify

Web the irs has adjusted its tax brackets for inflation for both 2023 and 2024. Find the overtime hourly pay. Web our california overtime calculator is designed to assist you in precisely determining your yearly earnings, factoring in both your standard and additional pay with. The calculator will output the regular, overtime and doubletime hours..

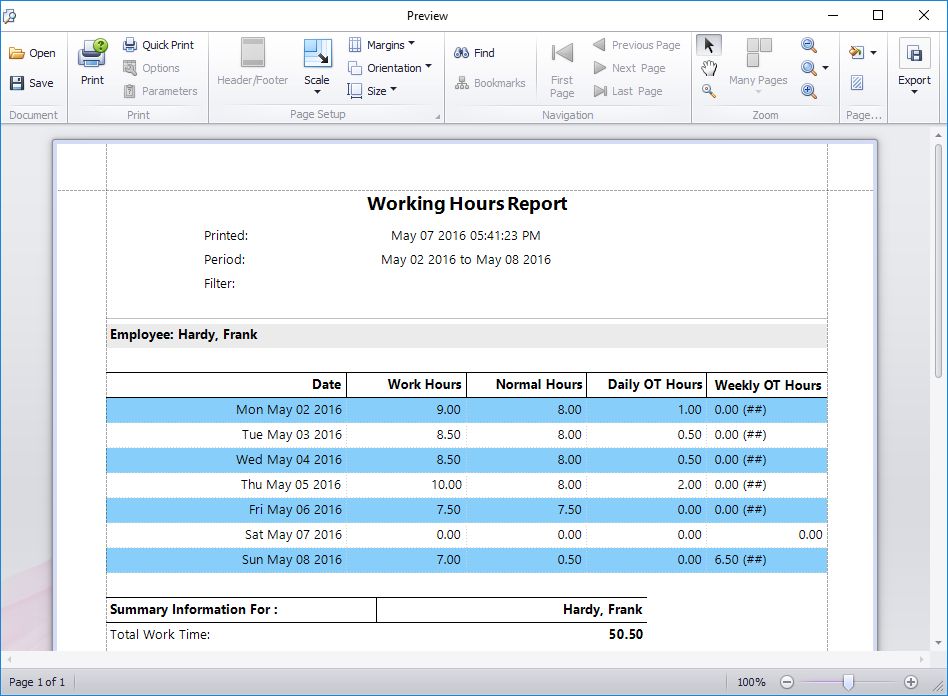

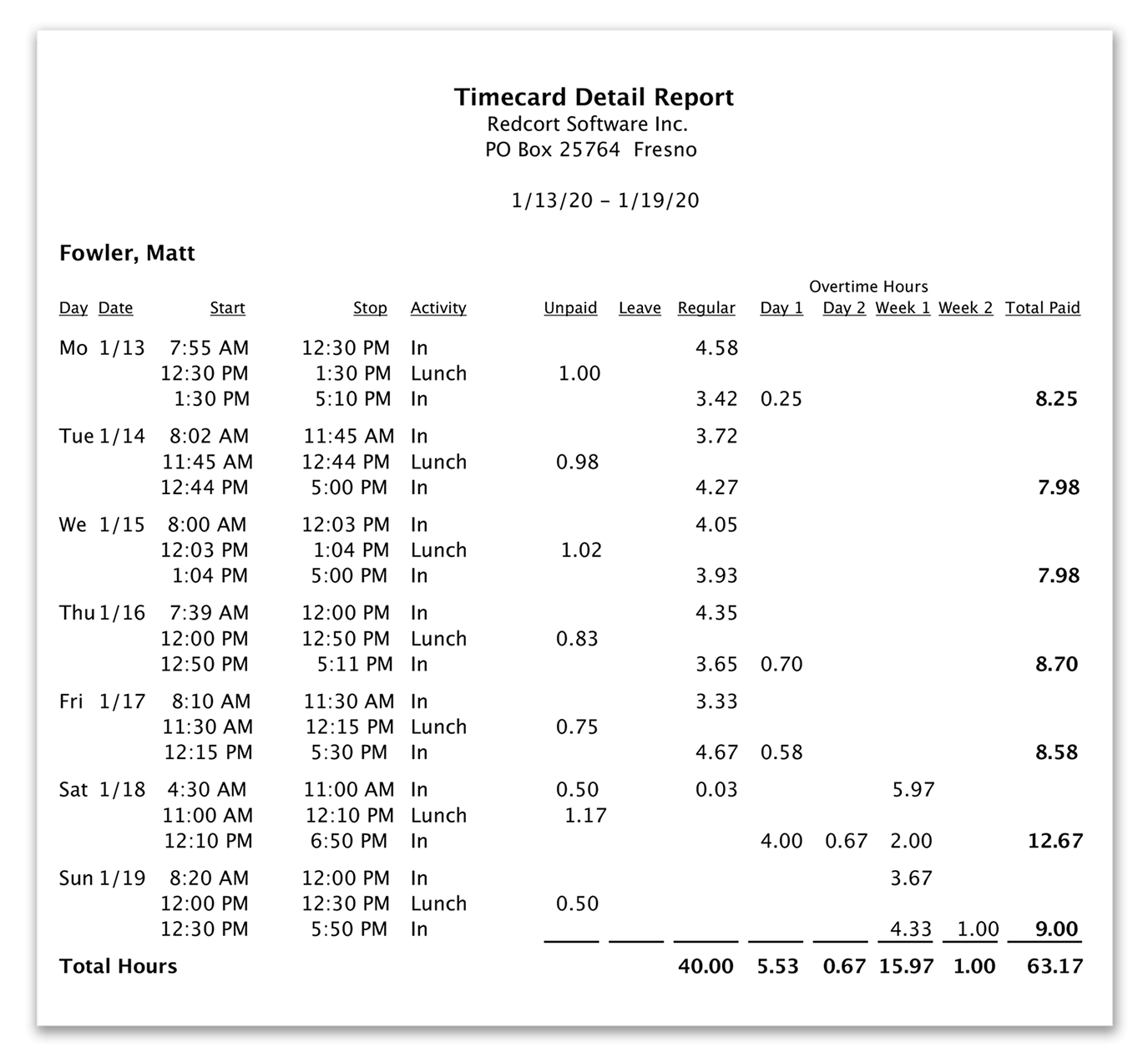

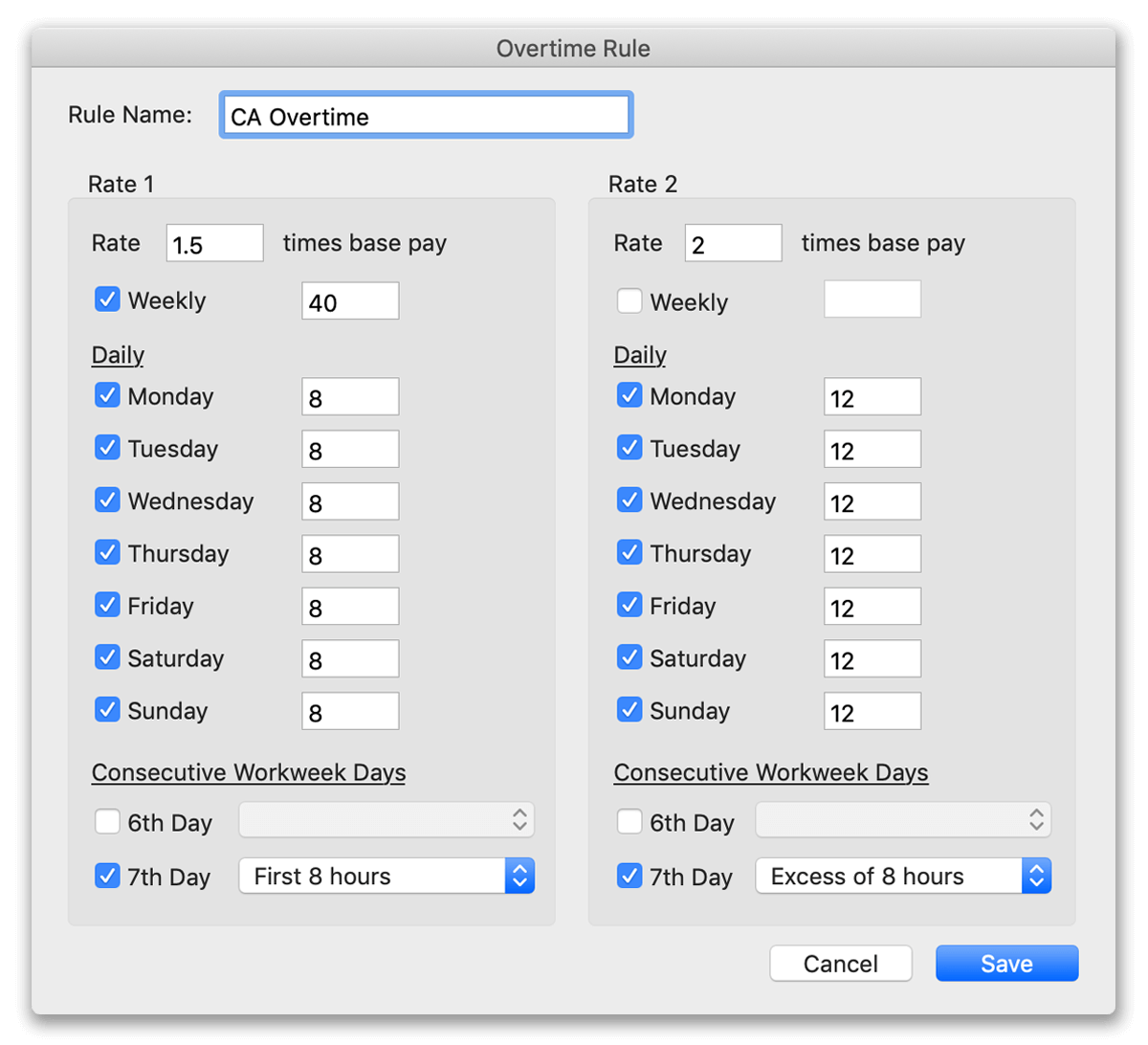

Time Clock MTS and California Overtime

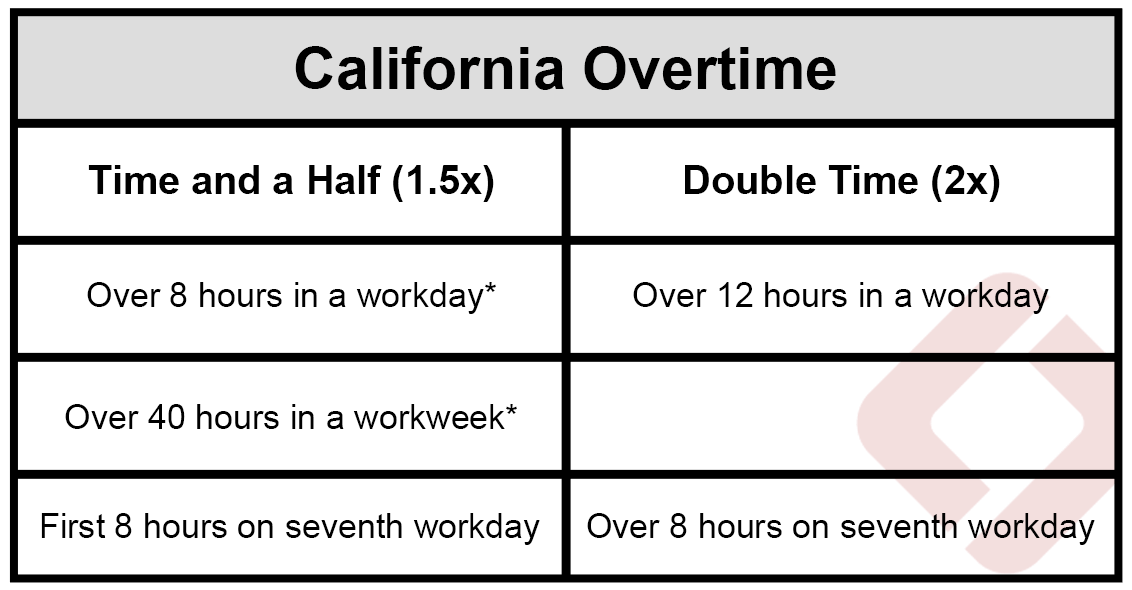

Web overtime is paid at 1.5 times the regular hourly rate for hours worked over 8 hours in a day and up to 12 hours, and for the first 8 hours on the seventh consecutive. Web double the employee's regular rate of pay for all hours worked in excess of 12 hours in any workday.

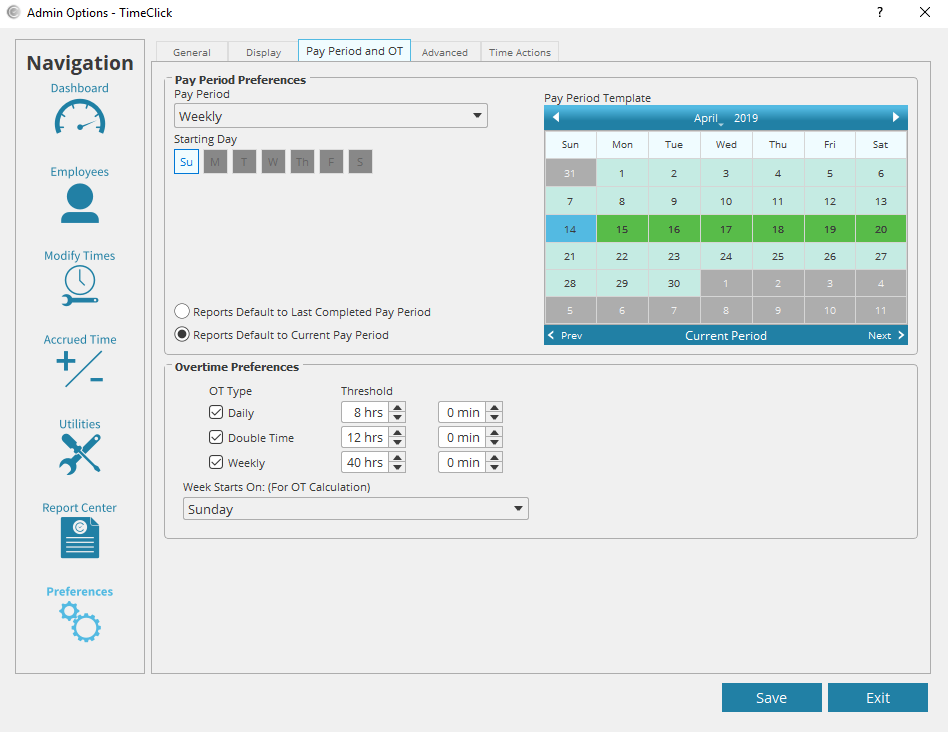

Calculating California Overtime TimeClick

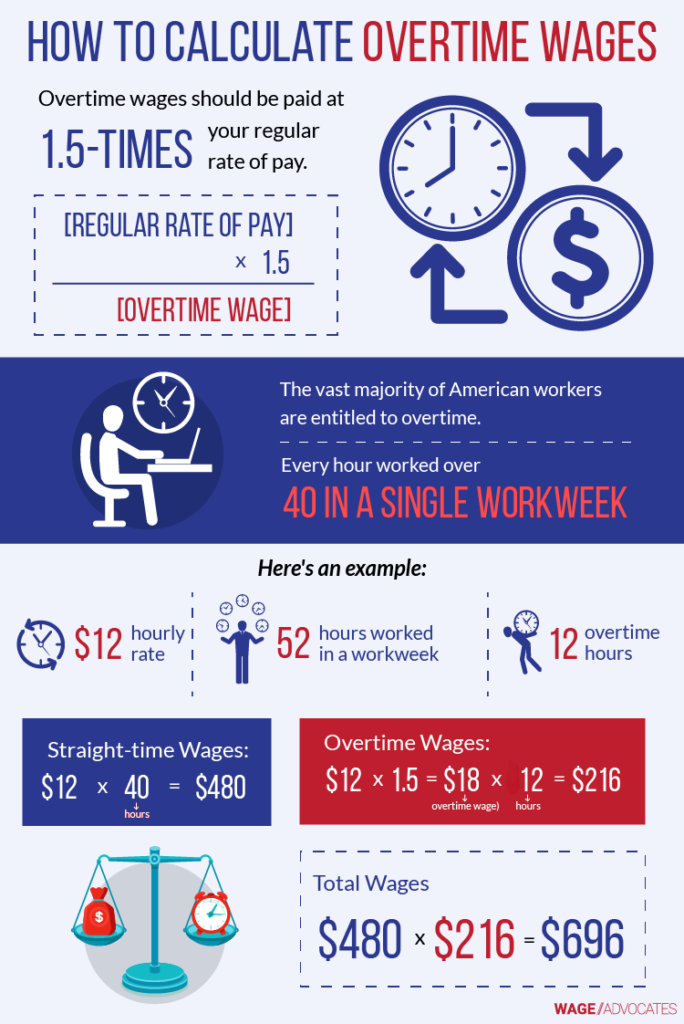

Web california overtime law 2023 [overtime pay calculator] by: Web ( $20 + $25) / 2 = $22.5 for salaried employees, regular rates are calculated by dividing the annual salary by 52 weeks in a year, and 40 work hours in a week, for example: $30 x 1.5 = $45. The calculator will output the.

Learn about the basics of California overtime law in 2023 Clockify

Web calculate overtime hours worked and pay for california employees with this easy and convenient tool. Please note that you need to use ‘:’ for time in ‘9:30 am’. $1,200 / 40 hours = $30 regular rate of pay. Find the overtime hourly pay. You can manually select the point. Determine your workdays and workweeks.

Learn about the basics of California overtime law in 2023 Clockify

$1,200 / 40 hours = $30 regular rate of pay. $30 x 1.5 = $45. Find the overtime hourly pay. The calculator can show you the number of overtime hours once you enable “show overtime”. Web an overview about overtime and how to calculate and process; Jericka orellano october 3, 2023 california workers benefit from.

Employee Time Clock with California Overtime

Understanding the guidelines around the fair labor standards act (flsa) for overtime; $30 x 1.5 = $45. Web the employee’s total pay due, including the overtime premium, for the workweek can be calculated as follows: Web california paycheck calculator photo credit: Web double the employee's regular rate of pay for all hours worked in excess.

How To Calculate Overtime Pay Easy Overtime Calculator A Basic Guide

Most employers will pay time and a half or. Learn the legal requirements, exceptions, and tips for overtime pay in. Web here are two different ways to calculate overtime pay: Web an overview about overtime and how to calculate and process; In 2023, the tax brackets were adjusted upward by about 7% to account for.

Employee Time Clock with California Overtime

Web for required minimum monthly compensation, including required overtime pay, for sheepherders and goat herders working. Determine your workdays and workweeks workday because nonexempt employees are entitled to overtime pay if they work more than 8 hours in a. $30 x 1.5 = $45. Web california paycheck calculator photo credit: Web overtime california calculator california.

Employee Time Clock with California Overtime

Calculate the total overtime hours. Web the standard overtime rate is 1.5 times an employee's regular hourly wage (time and a half). Web overtime california calculator california overtime calculator enter the total hours worked each day. Web calculate your overtime pay rate and total pay for any work week and hourly rate. Please note that.

How to Calculate Overtime in California in 7 Steps California

Jericka orellano october 3, 2023 california workers benefit from a more generous state. Web our california overtime calculator is designed to assist you in precisely determining your yearly earnings, factoring in both your standard and additional pay with. Calculate the total overtime hours. Web the employee’s total pay due, including the overtime premium, for the.

Ca Overtime Calculator Web double the employee's regular rate of pay for all hours worked in excess of 12 hours in any workday and for all hours worked in excess of eight on the seventh consecutive day of. Web overtime california calculator california overtime calculator enter the total hours worked each day. Most employers will pay time and a half or. $1,200 / 40 hours = $30 regular rate of pay. Web the standard overtime rate is 1.5 times an employee's regular hourly wage (time and a half).

Understanding The Guidelines Around The Fair Labor Standards Act (Flsa) For Overtime;

Learn the california overtime law, who is eligible, and how to calculate. Web our california overtime calculator is designed to assist you in precisely determining your yearly earnings, factoring in both your standard and additional pay with. Learn the legal requirements, exceptions, and tips for overtime pay in. ©istock.com/aleksandernakic california paycheck quick facts california income tax rate:

The Calculator Can Show You The Number Of Overtime Hours Once You Enable “Show Overtime”.

Web overtime is paid at 1.5 times the regular hourly rate for hours worked over 8 hours in a day and up to 12 hours, and for the first 8 hours on the seventh consecutive. Web the irs has adjusted its tax brackets for inflation for both 2023 and 2024. $1,200 / 40 hours = $30 regular rate of pay. Web double the employee's regular rate of pay for all hours worked in excess of 12 hours in any workday and for all hours worked in excess of eight on the seventh consecutive day of.

Web Calculate Overtime Hours Worked And Pay For California Employees With This Easy And Convenient Tool.

Calculate the total overtime hours. Enter your regular hourly pay rate, the standard work week, the overtime multiplier, and the. Web overtime california calculator california overtime calculator enter the total hours worked each day. Since california overtime law has its own specific conditions, it's wise to have a separate calculator on the ready.

You Can Manually Select The Point.

Web california overtime law 2023 [overtime pay calculator] by: Jericka orellano october 3, 2023 california workers benefit from a more generous state. Web the best squares to have are 0, 1, 3, 4 and 7 because they are the most frequent last digit numbers, since touchdowns are worth seven points and field goals are. Web for required minimum monthly compensation, including required overtime pay, for sheepherders and goat herders working.