Calculate Cash Back

Calculate Cash Back - The farther away you are from retirement, the more. Web you can calculate 3% cash back multiplying 0.03 by the amount you plan on spending. Points are transferable to other chase ultimate rewards credit cards. Web you can calculate 10% cash back multiplying 0.1 by the amount you plan on spending. C = a x p.

You may be able to apply your cash back to pay off your credit card balance. If you were to spend $1,000, you would calculate 10% back by doing $1,000 x 0.1 which. Web you can calculate 10% cash back multiplying 0.1 by the amount you plan on spending. The cash advance annual percentage rate. This is by far the hardest part in determining how much you'll need in retirement. Web the formula for your cash back calculation will be: Then you can pay any remaining balance with a debit card or other.

1 Credit Card Cash Back Calculators Calculate & Compare Cash

Web the formula for your cash back calculation will be: Here is the basic formula that our shopping percentage calculator uses while functioning, such as: Web you can calculate the cash back amount by multiplying the total purchase by the cashback percentage and then dividing the amount by 100. Web cashback credit cards allow you.

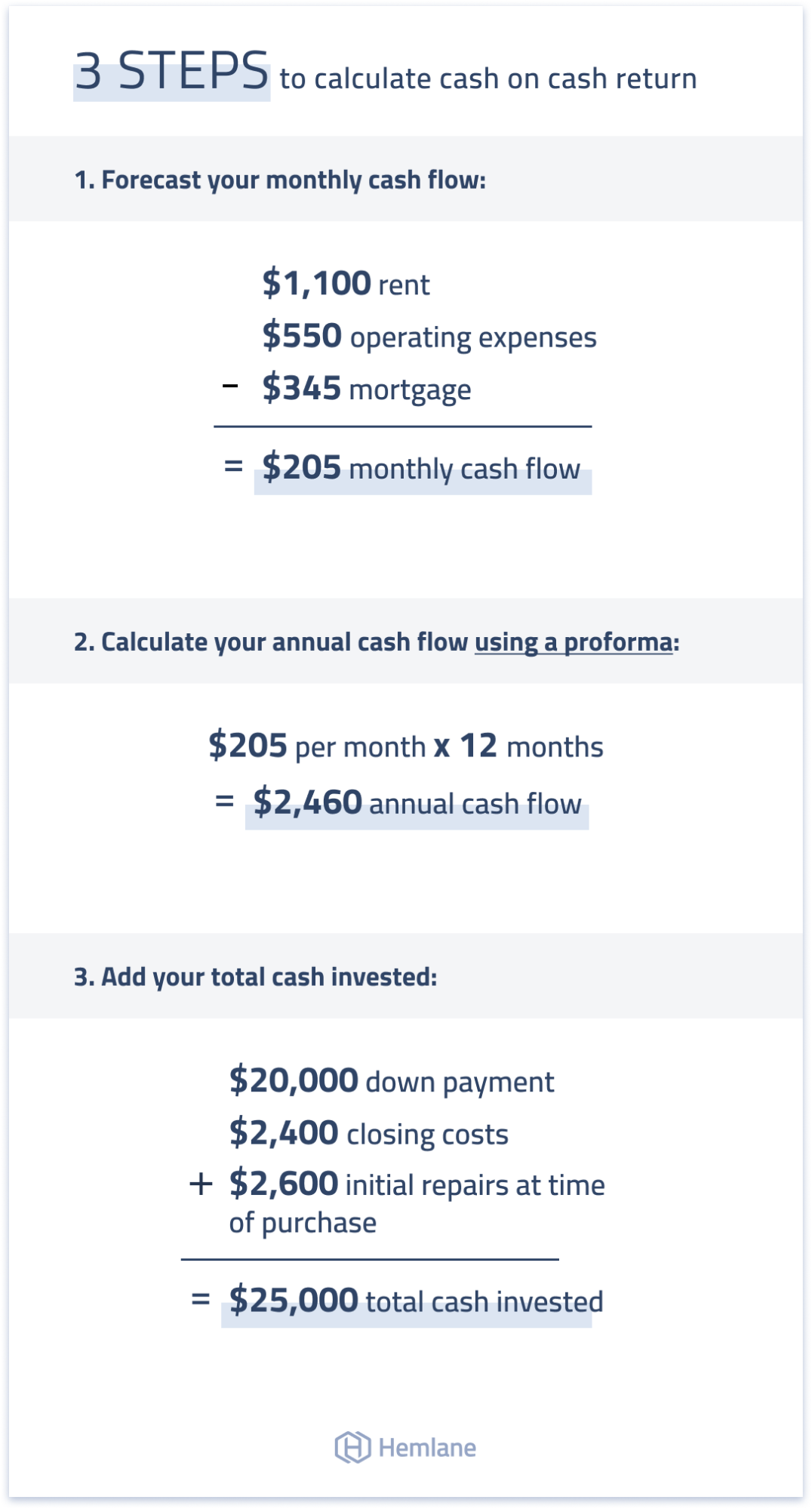

Calculating Cash on Cash Returns (2023 Guide)

So if you spend $1,000, it would be $1,000 x 0.03 which equals $30. So if you spend $1,000, it would be $1,000 x 0.04 which equals $40. If you were to spend $1,000, you would calculate. So if you spend $1,000, it would be $1,000 x 0.02 which equals $20. Purchase price x cash.

How to Calculate Cash On Cash Return YouTube

You may be able to apply your cash back to pay off your credit card balance. You can deduct up to 60% of your. Web you can calculate 1.5% cash back multiplying 0.015 by the amount you plan on spending. An example would be if you bought a. It's typically the simplest way to earn.

Stores that Give Cash Back on Debit Cards in 2023

Web formula to calculate cash back: So if you spend $1,000, it would be $1,000 x 0.02 which equals $20. Enter each year’s cash flow in cells b1, c1, d1, and so on. Web open excel and start a new spreadsheet. Web chase freedom unlimited® earns cash back that is displayed as ultimate rewards points..

What is Cash on Cash Return? Formula + Calculator

So if you spend $1,000, 1.5% back would be $1,000 x 0.015 which is $15. So if you spend $1,000, it would be $1,000 x 0.03 which equals $30. Web cashback credit cards allow you to earn money back on what you spend, which is usually paid as a credit on your account either monthly.

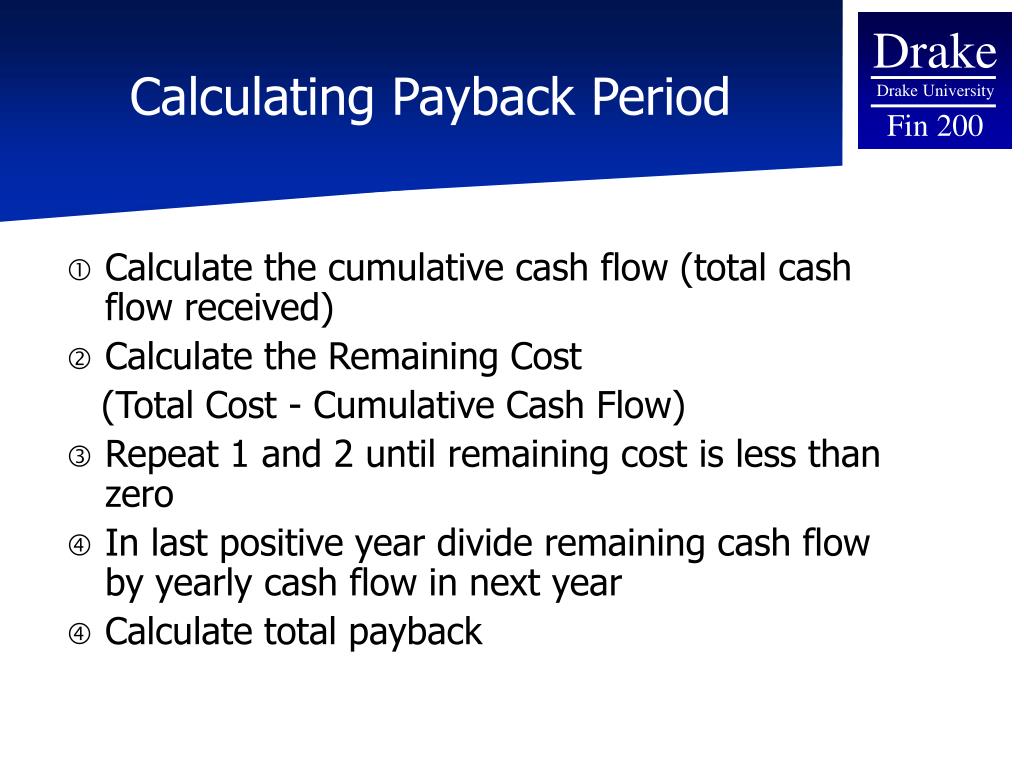

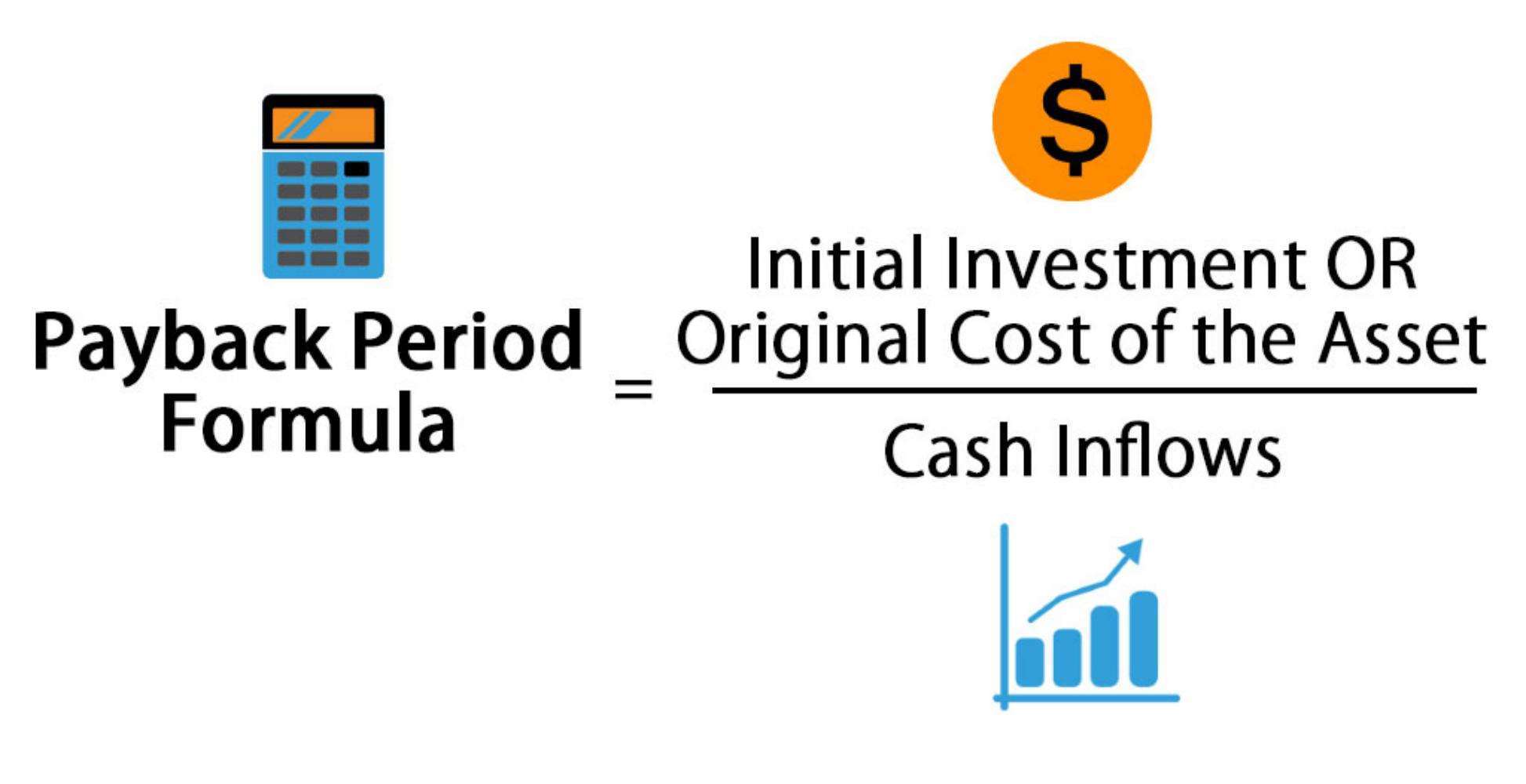

How To Calculate Pay Back Period

A smart consumer can use a free online credit card cash back calculator to calculate the cash back rewards for each credit card. Web formula to calculate cash back: Here is the basic formula that our shopping percentage calculator uses while functioning, such as: You can deduct up to 60% of your. C = a.

Discounted Payback Period Formula and Calculation

% calculate total cash back $ 0.00 maximize savings with our cash back calculator. Web you can calculate 10% cash back multiplying 0.1 by the amount you plan on spending. Web credit card cash back definition. Web cardholders who earn 5% cash back in rotating bonus categories receive this elevated rewards rate for up to.

Payback Period How to Use and Calculate It BooksTime

Then you can pay any remaining balance with a debit card or other. Web you can calculate 2% cash back multiplying 0.02 by the amount you plan on spending. You can deduct up to 60% of your. So if you spend $1,000, 1.5% back would be $1,000 x 0.015 which is $15. Web you can.

How to Calculate a Payback Period with Inconsistent Cash Flows YouTube

Cashback is a common term used in. An example would be if you bought a. Points are transferable to other chase ultimate rewards credit cards. So if you spend $1,000, it would be $1,000 x 0.02 which equals $20. If you were to spend $1,000, you would calculate 10% back by doing $1,000 x 0.1.

What Is Cash on Cash Return and How to Calculate It? Infographic

Cashback is a common term used in. You can calculate 5% cash back multiplying 0.05 by the amount you plan on spending. Web our calculator only allows you to calculate interest for cds that mature yearly. The cash advance annual percentage rate. Web open excel and start a new spreadsheet. Web enter cash back percentages:.

Calculate Cash Back Here is the basic formula that our shopping percentage calculator uses while functioning, such as: If you were to spend $1,000, you would calculate 10% back by doing $1,000 x 0.1 which. This is by far the hardest part in determining how much you'll need in retirement. A smart consumer can use a free online credit card cash back calculator to calculate the cash back rewards for each credit card. The farther away you are from retirement, the more.

Look Up The Cash Back Percentages Offered By Your Credit Card For Each Spending Category And Input Them Into The Calculator.

Web you can calculate 3% cash back multiplying 0.03 by the amount you plan on spending. For example, the capital one quicksilver cash rewards credit card offers. Then you can pay any remaining balance with a debit card or other. Here is the basic formula that our shopping percentage calculator uses while functioning, such as:

An Example Would Be If You Bought A.

Web the formula for your cash back calculation will be: Web for example, if you get a cash advance for $500, your cash advance balance may be $525 after a 5% cash advance fee. So if you spend $1,000, 1.5% back would be $1,000 x 0.015 which is $15. Web you can calculate the cash back amount by multiplying the total purchase by the cashback percentage and then dividing the amount by 100.

You Can Calculate 5% Cash Back Multiplying 0.05 By The Amount You Plan On Spending.

Web open excel and start a new spreadsheet. The cash advance annual percentage rate. The farther away you are from retirement, the more. This is by far the hardest part in determining how much you'll need in retirement.

C = A X P.

Web how do you calculate 5% cash back? Web cashback credit cards allow you to earn money back on what you spend, which is usually paid as a credit on your account either monthly or yearly. So if you spend $1,000, it would be $1,000 x 0.02 which equals $20. Points are transferable to other chase ultimate rewards credit cards.