Calculate Cost Of Preferred Stock

Calculate Cost Of Preferred Stock - Web the following formula can be used to calculate the cost of preferred stock: Web annual preferred share dividend = 1,000 * 8% = $ 80 so we can calculate the preferred share cost as follows: Rp = d (dividend)/ p0 (price) for example: Preferred stock funds have not performed as well as credit funds in terms of distribution. Web this cost of preferred stock calculator shows you how to calculate the cost of preferred stock given the dividend, stock price and growth rate.

Web what is the formula for calculating cost of preferred stock? Cost of preferred stock = annual dividend / current value of preferred stock. Can the cost of preferred stock. Web from this information, the cost of preferred stock was calculated as $468,000 / $16,125,000, or 0.0290. In this blog post, we will. To calculate the cost of preferred stock, divide the annual dividend rate by the market price per share. A company has preferred stock that has an annual dividend of $3.

Cost of Preferred Stock (kp) Formula + Calculator

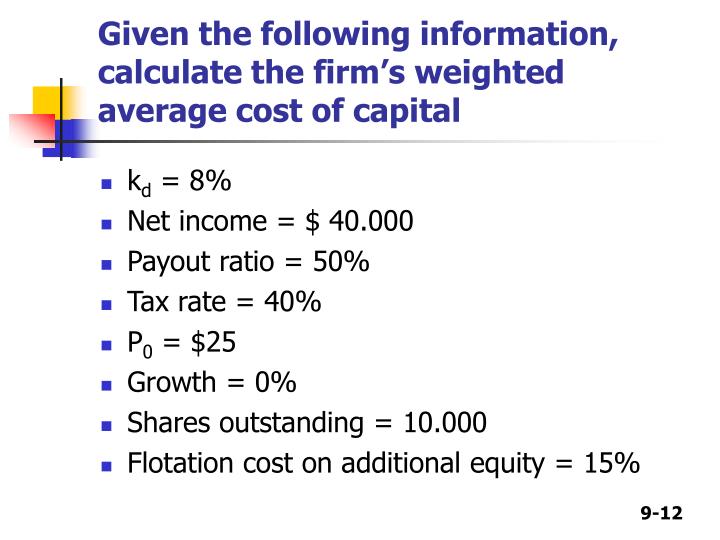

The team has now found the cost of debt to be 3.15% and the. Web key takeaways the cost of preferred stock is the annual payment a company makes for issuing preferred stock. Can the cost of preferred stock. Web the formula used to calculate the cost of preferred stock with growth is as follows:.

Cost of Preferred Stock Overview, Formula, Example and Calculator

Web calculating the cost of preferred stock is crucial for both investors and companies, as it helps determine the effective rate of return on this form of equity. Web to use the cost of preferred stock calculator: Web the formula used to calculate the cost of preferred stock with growth is as follows: Rp =.

(7 of 17) Ch.14 Cost of preferred stock explanation & example YouTube

Let's say a company's preferred stock pays a dividend of $4 per share and its. Web how to calculate the cost of preferred stock? Web it has some of the disadvantages of both, with very little of the upside. Web learn how to calculate earnings per share (eps) and why it is an important gauge.

Market value preferred stock formula zar forex trading

If the current share price is $25, what is the cost of preferred stock? Web calculate the cost of preferred stock: Rp = d / p0 rp = 3 / 25 = 12% it is the job of a company’s management to analyze the costs of all financing options and pick the best one. E.

Preferred stock formula, examples, and types Financial

Rp = d (dividend)/ p0 (price) for example: Web calculating the cost of preferred stock is crucial for both investors and companies, as it helps determine the effective rate of return on this form of equity. Web calculate the cost of preferred stock: Web key takeaways the cost of preferred stock is the annual payment.

How to calculate cost of preferred stock with flotation cost stock

Web the different variables to be considered in calculating the cost of preferred stock include: E = market value of the firm’s equity ( market cap) d = market value of the firm’s debt v = total value of capital (equity plus. Web the following formula can be used to calculate the cost of preferred.

Calculating the Cost of Preferred Stock YouTube

Web learn how to calculate earnings per share (eps) and why it is an important gauge in determining a stock’s value and the profitability of a company. Rps = cost of preferred stock dps = preferred dividends pnet. Rp = d / p0, where rp represents the cost of preferred stock, d stands for annual.

How to calculate the cost of preferred stock? Universal CPA Review

Web key takeaways the cost of preferred stock is the annual payment a company makes for issuing preferred stock. Note that d % + p % + e % d % + p % + e % must. Web the following formula can be used to calculate the cost of preferred stock: Web the following.

Cost of Preferred Stock (kp) Formula and Calculation

Web calculate the cost of preferred stock: Let's say a company's preferred stock pays a dividend of $4 per share and its. Web how to calculate the cost of preferred stock? The cost of preferred stock is also known as the dividends distributed to preferred shareholders. Preferred stock return is calculated as its dividend divided.

How to calculate cost of preferred stock in wacc and also money making

Web it has some of the disadvantages of both, with very little of the upside. This fixed dividend is not. Let's say a company's preferred stock pays a dividend of $4 per share and its. Web to use the cost of preferred stock calculator: Web from this information, the cost of preferred stock was calculated.

Calculate Cost Of Preferred Stock Web d%, p%, and e% represent the weight of debt, preferred stock, and common equity, respectively, in the capital structure. Web the following formula can be used to calculate the cost of preferred stock: The cost of preferred stock to. If the current share price is $25, what is the cost of preferred stock? Rps = cost of preferred stock dps = preferred dividends pnet.

Ramseysolutions.com Has Been Visited By 100K+ Users In The Past Month

Rp = d (dividend)/ p0 (price) for example: Web key takeaways the cost of preferred stock is the annual payment a company makes for issuing preferred stock. The cost of preferred stock is also known as the dividends distributed to preferred shareholders. Web this cost of preferred stock calculator shows you how to calculate the cost of preferred stock given the dividend, stock price and growth rate.

Determine The Annual Dividend Payment For The Preferred Stock.

Web what is the formula for calculating cost of preferred stock? Preferred stock funds have not performed as well as credit funds in terms of distribution. Web the different variables to be considered in calculating the cost of preferred stock include: Web the following formula can be used to calculate the cost of preferred stock:

Rp = D / P0, Where Rp Represents The Cost Of Preferred Stock, D Stands For Annual Dividends, And P0 Symbolizes The Price Per Share.

Cost of preferred stock = annual dividend / current value of preferred stock. Web calculating the cost of preferred stock is crucial for both investors and companies, as it helps determine the effective rate of return on this form of equity. Can the cost of preferred stock. Note that d % + p % + e % d % + p % + e % must.

Rp = D / P0 Rp = 3 / 25 = 12% It Is The Job Of A Company’s Management To Analyze The Costs Of All Financing Options And Pick The Best One.

Web the formula used to calculate the cost of preferred stock with growth is as follows: If the current share price is $25, what is the cost of preferred stock? The team has now found the cost of debt to be 3.15% and the. Par value is the value at which the stock is issued.