Calculate Dscr For Rental Property

Calculate Dscr For Rental Property - The income potential of the rental property is evaluated during the loan application process. To calculate dscr, divide the noi by the annual debt service to calculate the debt service coverage ratio. Web to calculate dscr for rental property, you need to divide the net operating income (noi) by total annual debt service. Use our simple dscr calculator above. What is dscr used for in the rental industry?

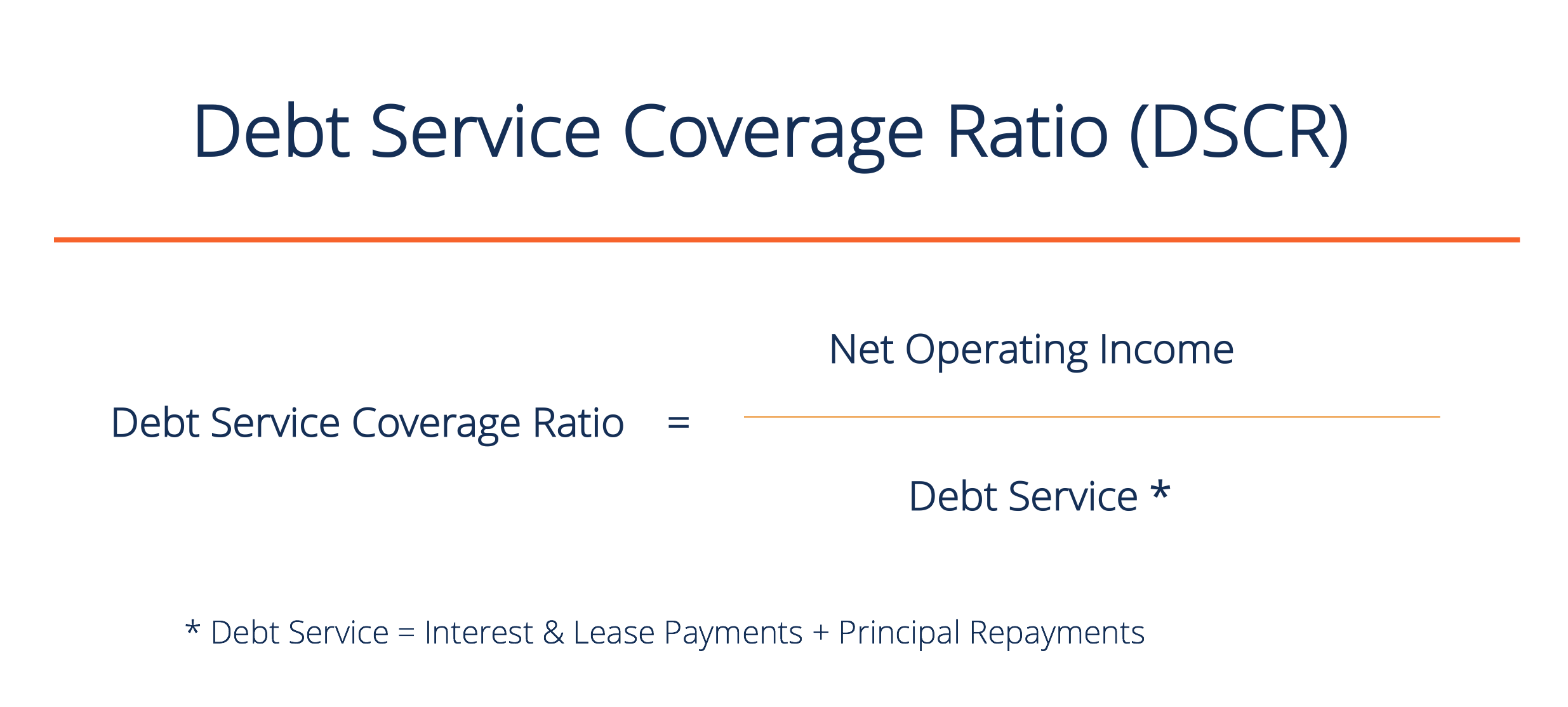

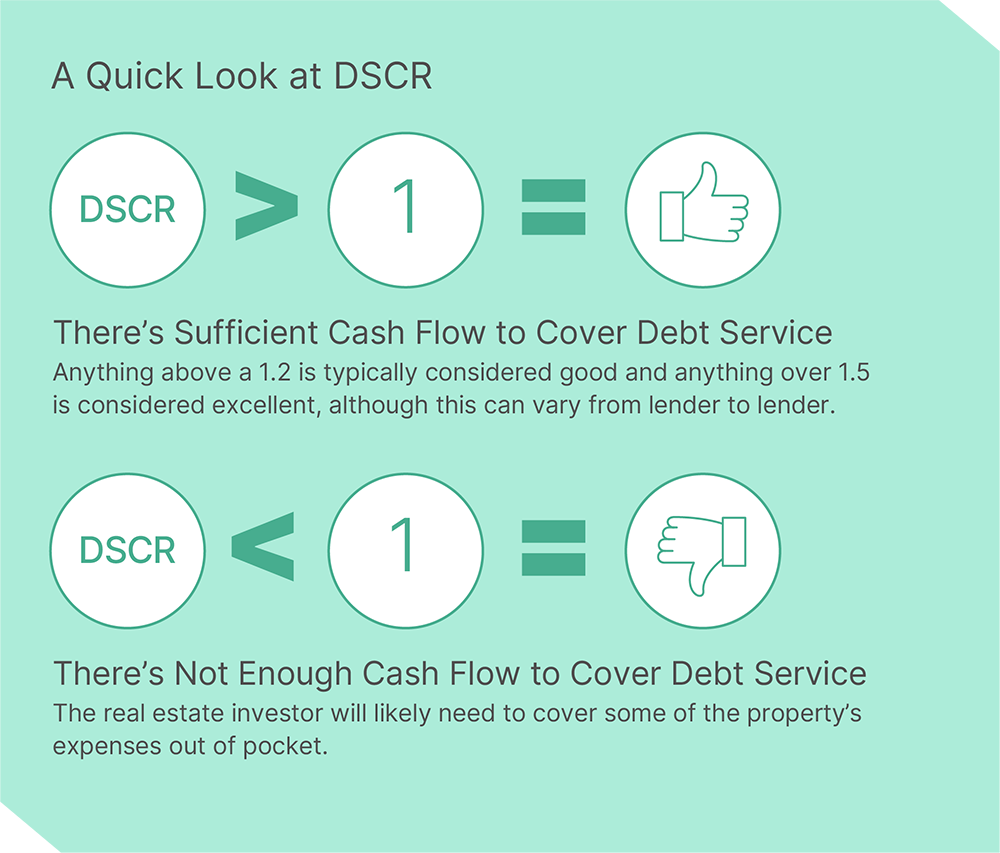

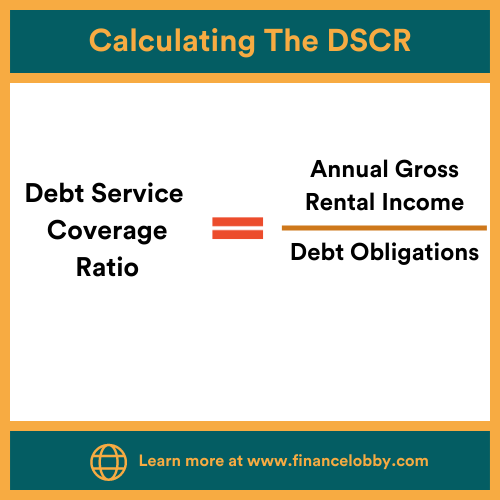

Web debt service coverage ratio (dscr) is a financial metric used in real estate investing. If the ratio is more. Web one can calculate dscr by dividing the company’s net operating income by the total debt service. Web the dscr is calculated as 6.14x, or the borrower can cover their debt service more than six times, given their operating income. (net operating income / debt service) = dscr. To calculate dscr, divide the noi by the annual debt service to calculate the debt service coverage ratio. Web you calculate dscr by dividing the property’s income (rents) by its expenses (monthly mortgage payment, taxes, insurance, and hoa if applicable).

Dscr Loan Interest Rates What You Need To Know Angela Cade

To calculate dscr, divide the noi by the annual debt service to calculate the debt service coverage ratio. What is dscr used for in the rental industry? Get your net operating income (noi) from the property. Web use this calculator to evaluate the viability of an rental property from a financing perspective. Web dscr loan.

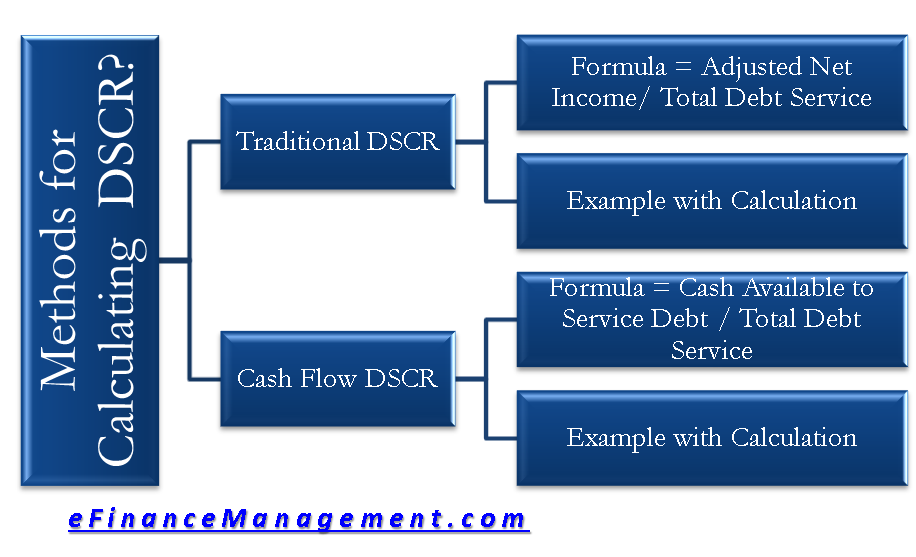

How to Calculate DSCR? 2 Methods Traditional & Cash Flow eFM

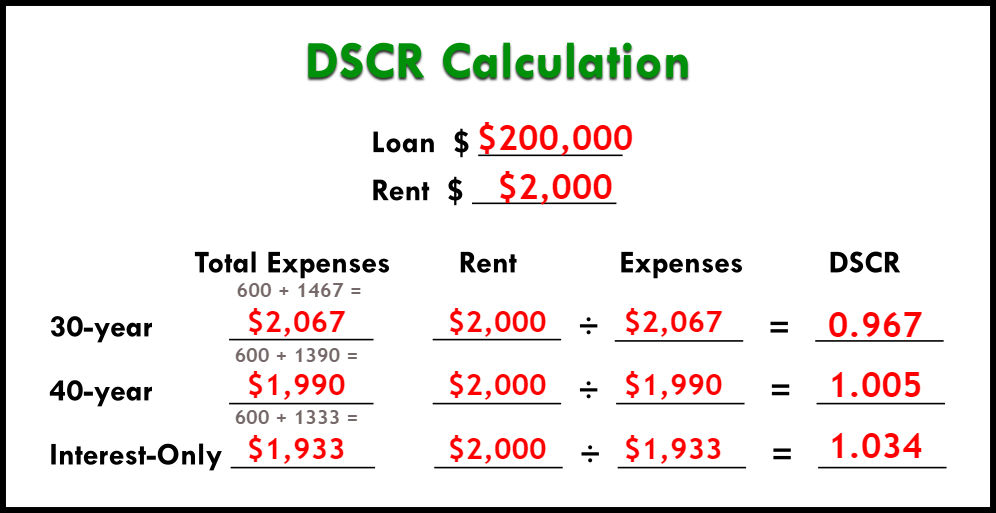

The value that is thus generated is interpreted in two ways; Web debt service = $21,830.09 debt service coverage ratio (dscr) = noi / debt service dscr = $27,500 / $21,830.09 dscr = 1.26 x calculating the dscr to calculate the. The income potential of the rental property is evaluated during the loan application process..

The complete guide to DSCR rental property loans

Web what is debt service coverage ratio? Noi/debt service = $24,000/$19,672 = 1.22. It acts as a test of a property’s ability to generate enough income to cover its debt. What is dscr used for in the rental industry? Web to calculate dscr, take the monthly rental income and divide it by the monthly expenses..

How to calculate DSCR ratio from Balance Sheet? How to calculate debt

No more paperrequest a demoinspections made easysyncs across devices Web what is debt service coverage ratio? The value that is thus generated is interpreted in two ways; Debt service coverage ratio is a calculation that compares your rental income on an investment property to the expenses of the. To calculate dscr, divide the noi by.

How to Calculate a DSCR Loan Step By Step The Cash Flow Company

Web debt service coverage ratio (dscr) is a financial metric used in real estate investing. Noi/debt service = $24,000/$19,672 = 1.22. (net operating income / debt service) = dscr. It acts as a test of a property’s ability to generate enough income to cover its debt. Web how to calculate dscr? Web to calculate dscr.

How to Calculate DSCR LendSure Mortgage Corp

(net operating income / debt service) = dscr. The income potential of the rental property is evaluated during the loan application process. Web the dscr is calculated as 6.14x, or the borrower can cover their debt service more than six times, given their operating income. Web to calculate dscr, take the monthly rental income and.

DSCR Loan Everything You Need to Know Finance Lobby

Web what is debt service coverage ratio? Web how to calculate dscr? The debt service coverage ratio (dscr). The income potential of the rental property is evaluated during the loan application process. Calculate your total debt service (expenses). Web debt service coverage ratio (dscr) is a financial metric used in real estate investing. No more.

How to Calculate DSCR on Your Rental Property The Cash Flow Company

Web follow these steps to calculate for your dscr loan: The value that is thus generated is interpreted in two ways; 1.22 tells the investor and. Use our simple dscr calculator above. The debt service coverage ratio (dscr). Web debt service = $21,830.09 debt service coverage ratio (dscr) = noi / debt service dscr =.

DSCR Formula What Is It, Formula, How to Calculate, Importance

Use our simple dscr calculator above. Mortgage = $2,500 maintainance = $200 insurance = $50. Noi is calculated as gross rental. What is debt service coverage ratio? The value that is thus generated is interpreted in two ways; It acts as a test of a property’s ability to generate enough income to cover its debt..

How to calculate a DSCR loan for Rental Properties

(net operating income / debt service) = dscr. Web to calculate dscr for rental property, you need to divide the net operating income (noi) by total annual debt service. Web debt service coverage ratio (dscr) is a financial metric used in real estate investing. Web you calculate dscr by dividing the property’s income (rents) by.

Calculate Dscr For Rental Property Web you calculate dscr by dividing the property’s income (rents) by its expenses (monthly mortgage payment, taxes, insurance, and hoa if applicable). What is dscr used for in the rental industry? If the ratio is more. Get your net operating income (noi) from the property. Web follow these steps to calculate for your dscr loan:

Calculate Your Total Debt Service (Expenses).

To calculate dscr, divide the noi by the annual debt service to calculate the debt service coverage ratio. What is dscr used for in the rental industry? Web how to calculate dscr? What is debt service coverage ratio?

Web Debt Service Coverage Ratio (Dscr) Is A Financial Metric Used In Real Estate Investing.

Get your net operating income (noi) from the property. 1.22 tells the investor and. If the ratio is more. No more paperrequest a demoinspections made easysyncs across devices

The Debt Service Coverage Ratio (Dscr).

Web one can calculate dscr by dividing the company’s net operating income by the total debt service. Web you calculate dscr by dividing the property’s income (rents) by its expenses (monthly mortgage payment, taxes, insurance, and hoa if applicable). \begin {aligned} &\text {dscr} = \frac. Noi/debt service = $24,000/$19,672 = 1.22.

Web Debt Service = $21,830.09 Debt Service Coverage Ratio (Dscr) = Noi / Debt Service Dscr = $27,500 / $21,830.09 Dscr = 1.26 X Calculating The Dscr To Calculate The.

Web follow these steps to calculate for your dscr loan: It acts as a test of a property’s ability to generate enough income to cover its debt. Debt service coverage ratio is a calculation that compares your rental income on an investment property to the expenses of the. Web the dscr is calculated as 6.14x, or the borrower can cover their debt service more than six times, given their operating income.