Calculate Landed Cost

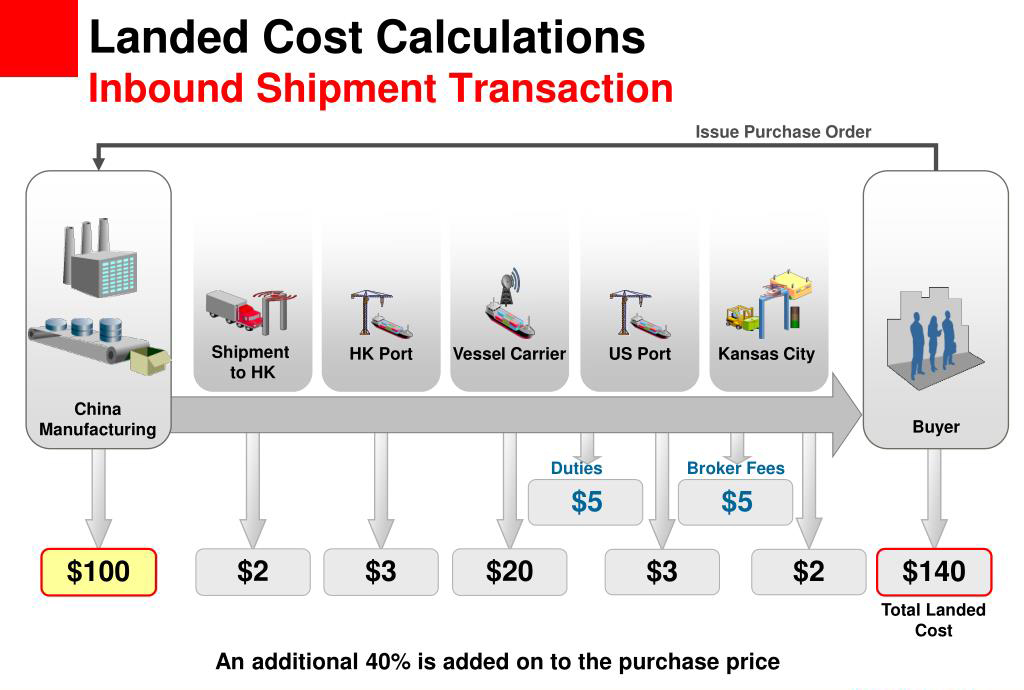

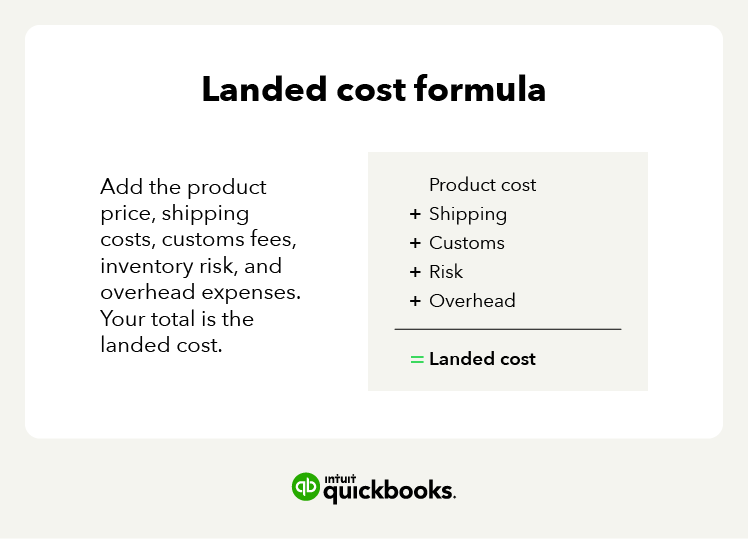

Calculate Landed Cost - Landed cost = product + shipping + customs + risk + overhead Web what is landed cost? 2%, which is us$50, or us$0.20/unit. Web to calculate landed cost, add the cost of a product, shipping, customs, risk, and overhead expenses. Then, risk is the cost of.

Web the method for calculating landed costs can vary. 2%, which is us$50, or us$0.20/unit. Risk insurance premiums as well as overhead expenses. $0.20 per unit (2% x $10) insurance: The shipping fee for 250 units is us$500, or us$2/unit. Cost of shipping (see how to maximize your ground shipping $$ or. Product + shipping + customs + risk + overhead = landed cost.

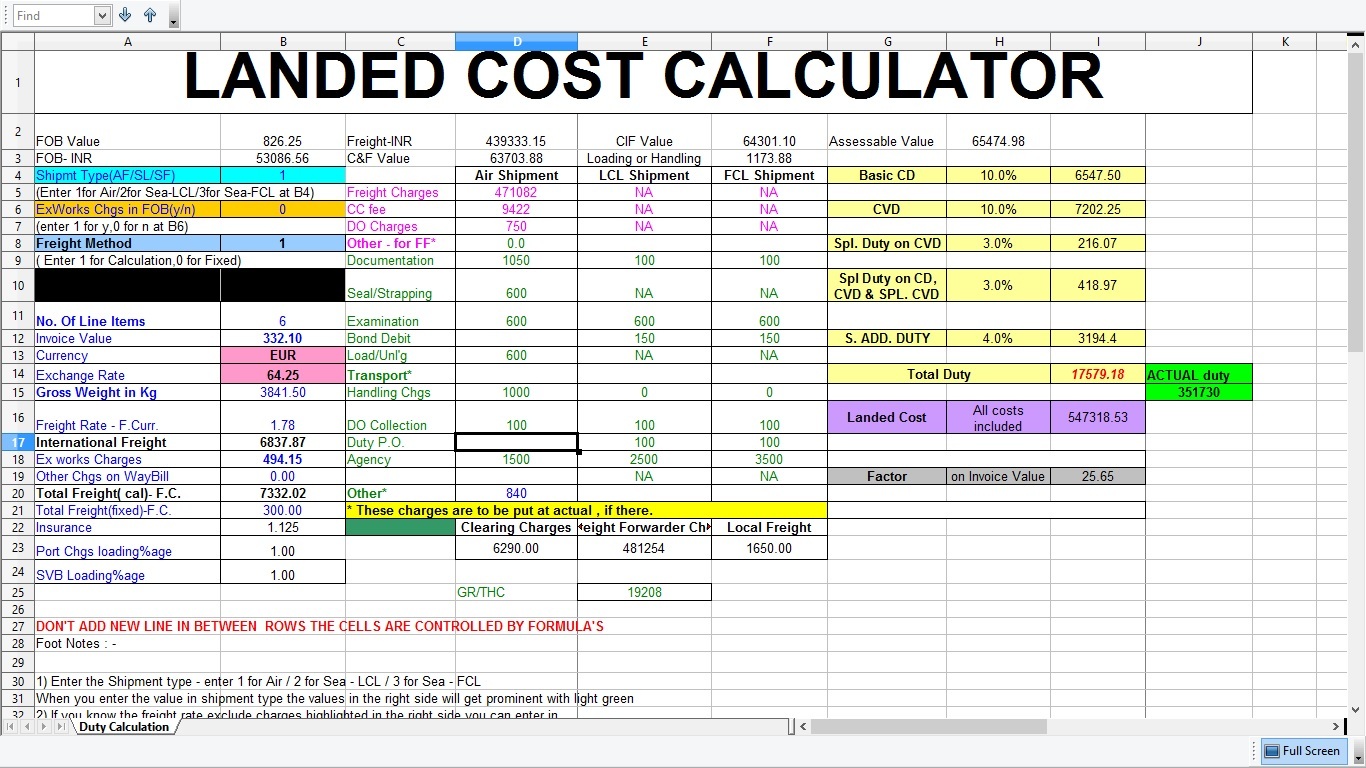

Excel 5 1 3 How to Compute Landed Cost another example of complex

Get a full landed cost including import duty, sales tax, additional taxes, hs codes, calculation breakdown and compliance information for your shipment in three simple steps. $0.20 per unit (2% x $10) insurance: Start free trial what is the true cost of getting a package to your customer’s doorstep? The quotation will include the following.

Landed Cost Definition, Why You Need It, and How to Calculate It

Web when you have obtained and organized all the necessary records, classify your expenses as per the five components stated above to calculate the landed cost. Risk insurance premiums as well as overhead expenses. After accounting for product and shipping costs, add customs, which includes all tariffs, taxes, and duties required by the country’s regulations..

What Is Landed Cost? How to Calculate it For Importing Business?

Start free trial what is the true cost of getting a package to your customer’s doorstep? $5.40 per unit [$200 insurance fee + ($5 per package shipped x 500) / 500] payment processing fee: After accounting for product and shipping costs, add customs, which includes all tariffs, taxes, and duties required by the country’s regulations..

Landed cost Reduce shipping expenses and increase profitability

Importers determine the cost items which will be included in the landed cost. Web the landed cost calculator enables a user to calculate duties and other import taxes as well as transportation and insurance charges associated with an international shipment and to incorporate them into a ddp price. Web to figure out the total landed.

International Trade Landed Cost Calculation + Template Supplyia

A “landed cost estimate” is a calculation of the total amount you can expect to pay for transit costs and insurance charges, as well as applied duties, taxes and fees for the commodities being shipped. Web to calculate landed cost, add the cost of a product, shipping, customs, risk, and overhead expenses. $0.20 per unit.

International Trade Landed Cost Calculation + Template Supplyia

Then, risk is the cost of. The landed cost of a product includes all the expenses related to shipping it to the final destination, i.e., you as the distributor/wholesaler. The shipping fee for 250 units is us$500, or us$2/unit. Determine the cost of goods purchased from the supplier. 2%, which is us$50, or us$0.20/unit. Product.

What is Landed Cost? Calculation and Tips to Improve

Then, risk is the cost of. The quotation will include the following details: Web the total amount spent by you to get that vase in your store shelf i.e., landed cost = $50+$15= $65 this example shows how landed cost can affect your selling price decision and how different products can have different costs involved.

Easy Guide to Calculating Landed Costs

Web the landed cost calculator enables a user to calculate duties and other import taxes as well as transportation and insurance charges associated with an international shipment and to incorporate them into a ddp price. Determine the customs duties, taxes, handling fees, and any. Web landed cost includes to grand total of any costs involved.

Calculate Landed Cost Excel Template For Import Export, Inc. Freight

Web when you have obtained and organized all the necessary records, classify your expenses as per the five components stated above to calculate the landed cost. Landed cost = product + shipping + customs + risk + overhead Web the landed cost calculator enables a user to calculate duties and other import taxes as well.

What Is Landed Cost? How to Calculate it For Importing Business?

Cost of the actual product (s) associated taxes/duty fees etc. Calculate the freight costs, including shipping and transportation expenses. Shipper & consignee’s details incoterm® & place port of loading (pol) & port of discharge (pod) currency (most commonly usd) product. Web the landed cost calculator enables a user to calculate duties and other import taxes.

Calculate Landed Cost It goes beyond the money you invest into materials or inventory storage. Web landed cost analysis, here is how you can use the net landing cost formula to calculate the landed cost of imported goods: Product + shipping + customs + risk + overhead = landed cost. Web how to calculate landed cost. Web to figure out the total landed cost per unit, simply add together product costs, shipping rates, any applicable customs fees and duties imposed on imports or exports.

Risk Insurance Premiums As Well As Overhead Expenses.

Web to use the landed cost calculator formula, follow these steps: Determine the customs duties, taxes, handling fees, and any. Landed cost = product + shipping + customs + risk + overhead Tlc is the sum of all the costs associated with moving goods from.

Product + Shipping + Customs + Risk + Overhead = Landed Cost.

Determine the cost of goods purchased from the supplier. Web when you have obtained and organized all the necessary records, classify your expenses as per the five components stated above to calculate the landed cost. The shipping fee for 250 units is us$500, or us$2/unit. Importers determine the cost items which will be included in the landed cost.

Web The Landed Cost Calculator Enables A User To Calculate Duties And Other Import Taxes As Well As Transportation And Insurance Charges Associated With An International Shipment And To Incorporate Them Into A Ddp Price.

Web landed cost analysis, here is how you can use the net landing cost formula to calculate the landed cost of imported goods: Then, risk is the cost of. Some manufacturing accountants include production costs in the calculation, while others do not. $5.40 per unit [$200 insurance fee + ($5 per package shipped x 500) / 500] payment processing fee:

Cost Of Shipping (See How To Maximize Your Ground Shipping $$ Or.

Web share what is a landed cost? A “landed cost estimate” is a calculation of the total amount you can expect to pay for transit costs and insurance charges, as well as applied duties, taxes and fees for the commodities being shipped. Web landed cost includes to grand total of any costs involved in getting the product to your door. It goes beyond the money you invest into materials or inventory storage.