Calculate Nanny Tax

Calculate Nanny Tax - Calculate salary calculator calculate wages and payment for a salaried employee. Web here are five helpful ways to use a nanny tax calculator. Web simply multiply your nanny’s gross wages by 7.65% to get your fica tax responsibility. Web calculate and track payroll: The nanny tax is a combination of federal and state taxes families must pay when they hire a household employee, such as a nanny or senior caregiver:

Web hourly calculator calculate wages and payment for an employee who is paid by the hour. You can also print a pay stub once. Web jg, new york see how we've helped use the nanny tax company's hourly nanny tax calculator to calculate nanny pay and withholding. Web nannypay is more than just a tax calculator for nannies. Web surepayroll ($50 monthly), for example, calculates the amount of tax owed, deducts tax from the nanny’s pay, arranges direct deposit of paychecks into her bank. Then print the pay stub right from. Calculate salary calculator calculate wages and payment for a salaried employee.

Nanny Taxes Guide How to Easily File for 20232024 Sittercity

Calculate salary calculator calculate wages and payment for a salaried employee. Web nannypay is more than just a tax calculator for nannies. For example, if your nanny grosses $800/week then your fica tax for that. You can also print a pay stub once. Web here are five helpful ways to use a nanny tax calculator..

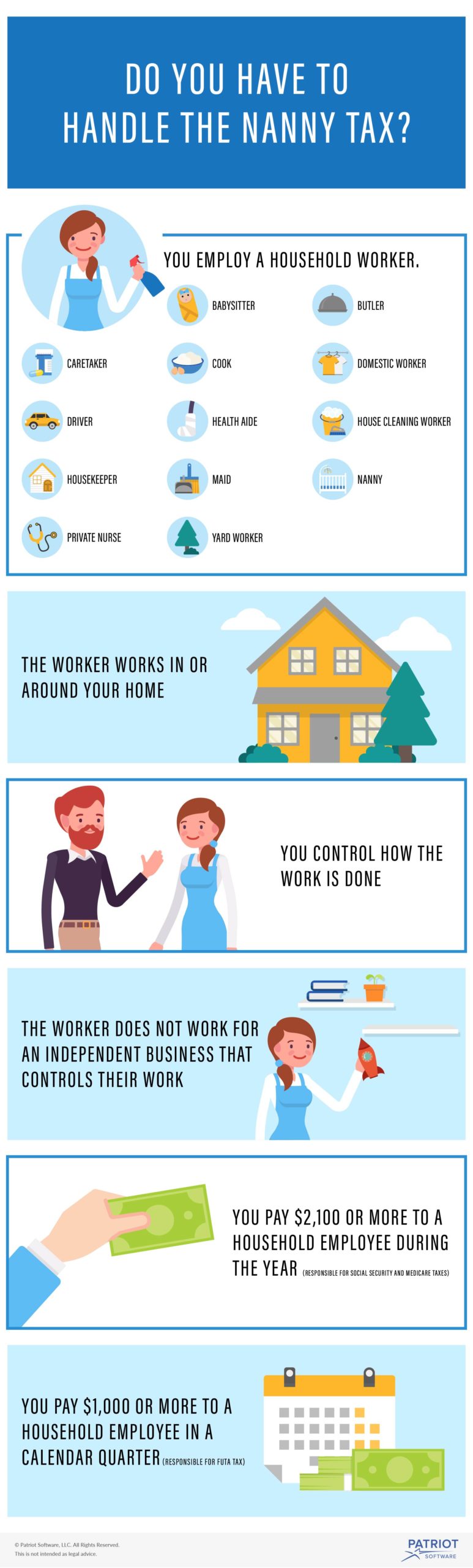

What Is Nanny Tax & How to Pay It

Web hourly calculator calculate wages and payment for an employee who is paid by the hour. Web tithing based on adjusted gross income. Web the phrase “nanny tax” refers to the federal and state taxes families or individuals must pay when they hire a household employee, such as a nanny or. You can also print.

How to Calculate Your Nanny Taxes » Aunt Ann's InHouse Staffing

Calculate salary calculator calculate wages and payment for a salaried employee. Zillow has 31 photos of this $250,000 4 beds, 2 baths, 2,384 square feet single family home located at 104 s grafton st, romney, wv 26757 built in 1950. Web hourly calculator calculate wages and payment for an employee who is paid by the.

Guide to Nanny Taxes

It can be used by any household that directly employs a nanny, caregiver or other staff member. Then print the pay stub right from. This is the contribution to your. You need to accurately calculate your nanny’s gross pay, the taxes withheld from them and your corresponding employer taxes each. Romney's plan would phase out.

Nanny Tax Calculator Nanny Lane

Web simply multiply your nanny’s gross wages by 7.65% to get your fica tax responsibility. For example, if your nanny grosses $800/week then your fica tax for that. Taxes paid by the employer:fica taxes as well as. Web nannypay is more than just a tax calculator for nannies. Web indirect expenses may be deducted at.

Nanny taxes and payroll Stepbystep instructions for setting it up

Web nanny tax and payroll calculator enter your caregiver's pay information below to generate a budget estimate rate $ hours per week pay $ pay period select your state work state. Taxes paid by the employee:federal and state income taxes as well as fica taxes (social security and medicare) 2. Web household employee taxes, sometimes.

Your Nanny Tax Responsibilities as an Employer Rules & More

Web tithing based on adjusted gross income. Web calculate and track payroll: You’ll also need to calculate. See how much a nanny costs where you live. The nanny tax is a combination of federal and state taxes families must pay when they hire a household employee, such as a nanny or senior caregiver: Web the.

Nanny Taxes... Explained! YouTube

Web the phrase “nanny tax” refers to the federal and state taxes families or individuals must pay when they hire a household employee, such as a nanny or. It can be used by any household that directly employs a nanny, caregiver or other staff member. The nanny tax is a combination of federal and state.

Guide to Paying Nanny Taxes in 2022

Web hourly calculator calculate wages and payment for an employee who is paid by the hour. Romney's plan would phase out for those making more than $200,000 and for joint filers. You’ll also need to calculate. The minimum combined 2024 sales tax rate for romney, west virginia is. Web indirect expenses may be deducted at.

How to Calculate Nanny Taxes (2023) LetCalculate

You need to accurately calculate your nanny’s gross pay, the taxes withheld from them and your corresponding employer taxes each. Web surepayroll ($50 monthly), for example, calculates the amount of tax owed, deducts tax from the nanny’s pay, arranges direct deposit of paychecks into her bank. The nanny tax is a combination of federal and.

Calculate Nanny Tax This is the total of state, county and city sales tax. Web nannypay is more than just a tax calculator for nannies. Web tithing based on adjusted gross income. Web jg, new york see how we've helped use the nanny tax company's hourly nanny tax calculator to calculate nanny pay and withholding. You’ll also need to calculate.

Web Simply Multiply Your Nanny’s Gross Wages By 7.65% To Get Your Fica Tax Responsibility.

Calculate salary calculator calculate wages and payment for a salaried employee. Web calculate and track payroll: Taxes paid by the employee:federal and state income taxes as well as fica taxes (social security and medicare) 2. You need to accurately calculate your nanny’s gross pay, the taxes withheld from them and your corresponding employer taxes each.

Web Household Employee Taxes, Sometimes Called Nanny Taxes, Are Federal And State Taxes Owed On Wages Paid To Household Employees.

Romney's plan would phase out for those making more than $200,000 and for joint filers. The nanny tax is a combination of federal and state taxes families must pay when they hire a household employee, such as a nanny or senior caregiver: Web hourly calculator calculate wages and payment for an employee who is paid by the hour. This is the total of state, county and city sales tax.

Web Nanny Tax And Payroll Calculator Enter Your Caregiver's Pay Information Below To Generate A Budget Estimate Rate $ Hours Per Week Pay $ Pay Period Select Your State Work State.

Web nannypay is more than just a tax calculator for nannies. If you paid your nanny $2,400 or more in 2022, then you and your employee owe fica taxes. Web tithing based on adjusted gross income. Web the tax credit doesn't apply to those making less than $2,500 per year.

For Example, If Your Nanny Grosses $800/Week Then Your Fica Tax For That.

Web here are five helpful ways to use a nanny tax calculator. You will owe these taxes if. Then print the pay stub right from. This is the contribution to your.