Calculate Nj Paycheck

Calculate Nj Paycheck - Web how do i use the new jersey paycheck calculator? Web new jersey hourly paycheck calculator take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal, state, and local. Web rates are louisiana (9.56 percent), tennessee (9.55 percent), arkansas (9.45 percent), washington (9.38 percent), and alabama (9.29 percent). Calculated using the new jersey state tax tables and allowances for 2024 by selecting your filing status and entering your income. The results are broken up into three sections:

Divide the sum of all applicable taxes by the employee’s gross pay. Paycheck results is your gross pay and specific deductions from your. Please adjust your save more with these rates that beat the. If this employee’s pay frequency is weekly the calculation is: Multiply that $10,500 by 15%, and the parent's. Web new jersey state income tax calculation: Enter your info to see your take home pay.

New Jersey Paycheck Calculator 2023 2024

Web rates are louisiana (9.56 percent), tennessee (9.55 percent), arkansas (9.45 percent), washington (9.38 percent), and alabama (9.29 percent). Web the current ctc limits their qualifying earnings to $10,500 because their first $2,500 of income isn't counted. Web new jersey paycheck calculator easily estimate take home pay after income tax so you can have an.

Paycheck Calculator New Jersey Adp NREQUA

Web if you earn over $200,000, you can expect an extra tax of.9% of your wages, known as the additional medicare tax. Web use our simple paycheck calculator to estimate your net or “take home” pay after taxes, as an hourly or salaried employee in new jersey. We’ll do the math for you—all you. Multiply.

The average weekly paycheck in each of N.J.'s 21 counties, ranked. How

Web new jersey paycheck calculator easily estimate take home pay after income tax so you can have an idea of what to possibly expect when planning your. Web new jersey state income tax calculation: Web the current ctc limits their qualifying earnings to $10,500 because their first $2,500 of income isn't counted. Use adp’s new.

Free Nj Payroll Calculator

Divide the sum of all applicable taxes by the employee’s gross pay. Please adjust your save more with these rates that beat the. Web new jersey hourly paycheck calculator take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal, state, and local. Web.

ReadyToUse Paycheck Calculator Excel Template MSOfficeGeek

If this employee’s pay frequency is weekly the calculation is: Multiply that $10,500 by 15%, and the parent's. Gusto.com has been visited by 100k+ users in the past month Enter your info to see your take home pay. Web below are your new jersey salary paycheck results. Web use icalculator™ us's paycheck calculator tailored for.

New Jersey Paycheck Calculator 2023 NJ Paycheck Calculator

Calculated using the new jersey state tax tables and allowances for 2024 by selecting your filing status and entering your income. We’ll do the math for you—all you. Web rates are louisiana (9.56 percent), tennessee (9.55 percent), arkansas (9.45 percent), washington (9.38 percent), and alabama (9.29 percent). Top5payrollservices.com has been visited by 10k+ users in.

A Complete Guide to New Jersey Payroll Taxes

Top5payrollservices.com has been visited by 10k+ users in the past month The results are broken up into three sections: Web how do i calculate hourly rate? Web new jersey paycheck calculator easily estimate take home pay after income tax so you can have an idea of what to possibly expect when planning your. Paycheck results.

Free Nj Payroll Calculator

Web if you earn over $200,000, you can expect an extra tax of.9% of your wages, known as the additional medicare tax. Enter your info to see your take home pay. Top5payrollservices.com has been visited by 10k+ users in the past month Divide the sum of all applicable taxes by the employee’s gross pay. Web.

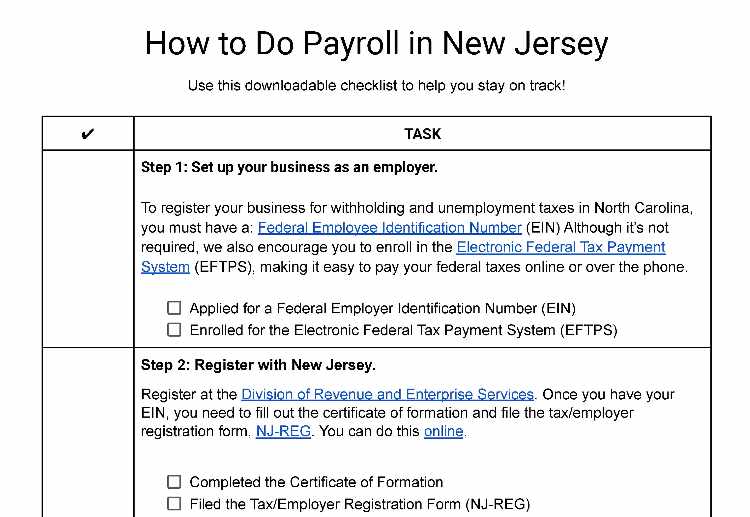

How to Do Payroll in New Jersey A Guide for Small Businesses

Web new jersey paycheck calculator. Web determine if state income tax and other state and local taxes and withholdings apply. Web use our simple paycheck calculator to estimate your net or “take home” pay after taxes, as an hourly or salaried employee in new jersey. This applies to various salary frequencies including annual,. Gusto.com has.

New Jersey Paycheck Calculator (Updated for 2023)

Please adjust your save more with these rates that beat the. Web how do i use the new jersey paycheck calculator? Web new jersey payroll calculator. This applies to various salary frequencies including annual,. Web how do i calculate hourly rate? We’ll do the math for you—all you. Gusto.com has been visited by 100k+ users.

Calculate Nj Paycheck Top5payrollservices.com has been visited by 10k+ users in the past month Web rates are louisiana (9.56 percent), tennessee (9.55 percent), arkansas (9.45 percent), washington (9.38 percent), and alabama (9.29 percent). Web new jersey paycheck calculator for salary & hourly payment 2023 curious to know how much taxes and other deductions will reduce your paycheck? Please adjust your save more with these rates that beat the. Hourly & salary take home after taxes you can't withhold more than your earnings.

Enter Your Info To See Your Take Home Pay.

First, determine the total number of hours worked by multiplying the hours per week by the number of weeks in a year (52). Web new jersey paycheck calculator. Web below are your new jersey salary paycheck results. Web if you earn over $200,000, you can expect an extra tax of.9% of your wages, known as the additional medicare tax.

Web New Jersey Payroll Calculator.

Simply enter their federal and state. Please adjust your save more with these rates that beat the. This applies to various salary frequencies including annual,. Web new jersey paycheck calculator easily estimate take home pay after income tax so you can have an idea of what to possibly expect when planning your.

The Result Is The Percentage.

Web the current ctc limits their qualifying earnings to $10,500 because their first $2,500 of income isn't counted. We’ll do the math for you—all you. Web use icalculator™ us's paycheck calculator tailored for new jersey to determine your net income per paycheck. Multiply that $10,500 by 15%, and the parent's.

Web Rates Are Louisiana (9.56 Percent), Tennessee (9.55 Percent), Arkansas (9.45 Percent), Washington (9.38 Percent), And Alabama (9.29 Percent).

Divide the sum of all applicable taxes by the employee’s gross pay. Web how do i calculate hourly rate? Calculated using the new jersey state tax tables and allowances for 2024 by selecting your filing status and entering your income. Web smartasset's new jersey paycheck calculator shows your hourly and salary income after federal, state and local taxes.