Calculate Present Value Of Lease Payments

Calculate Present Value Of Lease Payments - Insert the pv function step 4: In an excel spreadsheet, title three. Create your table with headers step 2: Web how to calculate the present value of lease payments in excel. This can be demonstrated in excel using either pv.

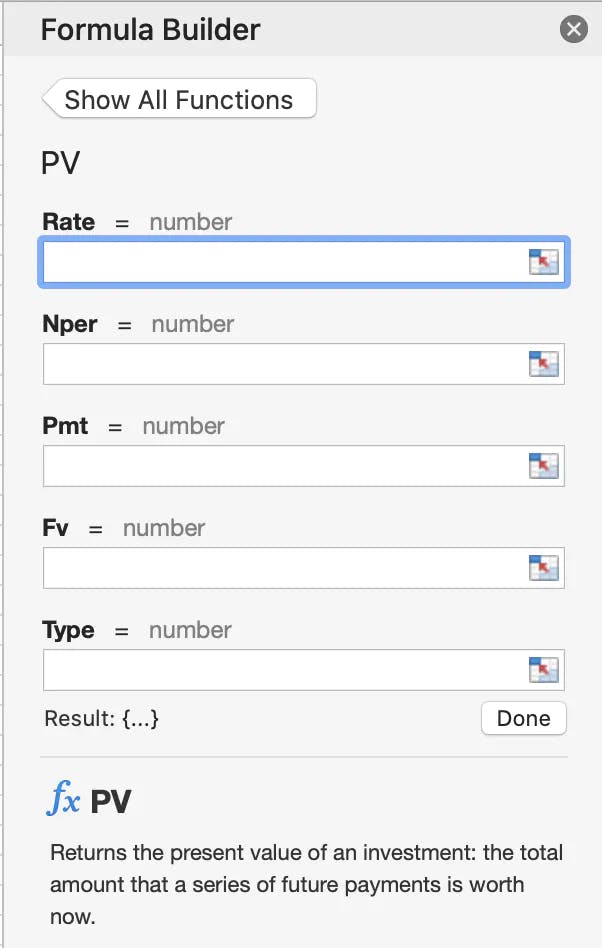

Create your table with headers. Pv of minimum lease payment: This can be demonstrated in excel using either pv. Enter the rate, nper pmt, and. Web how to calculate the present value of lease payments in excel. Web the present value formula is pv=fv/ (1+i) n, where you divide the future value fv by a factor of 1 + i for each period between present and future dates. Thecarconnection.com has been visited by 10k+ users in the past month

How to Calculate Present Value of Minimum Lease Payments in Excel

$50 / [ (1 + 5%) ^ 3] = $43.19. Web applying 4.58% as the discount rate, the present value of the future lease payments should equate to $55,000. Insert the pv function step 4: In an excel spreadsheet, title three. $43.19 + $272.32 = $315.51. Web if you enter the number “0”, this will.

How to Calculate a Lease Payment 12 Steps (with Pictures)

Web applying 4.58% as the discount rate, the present value of the future lease payments should equate to $55,000. Enter the rate, nper pmt, and. Pv = present value p = periodic lease payment amount r =. Leased equipment often has a residual value at the end. This example shows one route to. Web if.

How to Calculate a Lease Payment 12 Steps (with Pictures)

In an excel spreadsheet, title three. This can be demonstrated in excel using either pv. Before diving into calculations, ensure that you have all the. Create your table with headers. Create your table with headers step 2: Pv = sum [50000 / (1 + 5) 3] + [45000 / (1 + 5) 3] = 175035.09.

How to Calculate the Present Value of Lease Payments in Excel

Leased equipment often has a residual value at the end. Web how to calculate the present value of a payment stream using excel in 5 steps. Web use this calculator to find the present value of a certain amount of money in the future or periodical annuity payments. Pv = present value p = periodic.

How to Calculate the Present Value of Future Lease Payments

Web use this calculator to find the present value of a certain amount of money in the future or periodical annuity payments. Insert the pv function step 4: In an excel spreadsheet, title three. Enter the rate, nper pmt, and. January 1, 2021 lease end date: Before diving into calculations, ensure that you have all.

How to Calculate the Present Value of Lease Payments Excel Occupier

January 1, 2021 lease end date: Web if you enter the number “0”, this will adjust the present value calculation to assume lease payments are made at the end of each period, or in arrears; Web how to calculate the present value of lease payments in excel. Create your table with headers step 2: Leased.

How to Calculate the Present Value of Future Lease Payments

Web if you enter the number “0”, this will adjust the present value calculation to assume lease payments are made at the end of each period, or in arrears; Before diving into calculations, ensure that you have all the. $43.19 + $272.32 = $315.51. Web applying 4.58% as the discount rate, the present value of.

How to Calculate the Present Value of Lease Payments Excel Occupier

Enter the future value, number of periods, interest rate,. Before diving into calculations, ensure that you have all the. Web if you enter the number “0”, this will adjust the present value calculation to assume lease payments are made at the end of each period, or in arrears; Create your table with headers. Thecarconnection.com has.

How to Calculate the Present Value of Future Lease Payments

Pv of minimum lease payment: Pv = sum [50000 / (1 + 5) 3] + [45000 / (1 + 5) 3] = 175035.09 ↳ calculators ↳ mortgage ↳ use our online present value of future minimum lease payments. Web use this calculator to find the present value of a certain amount of money in the.

How to Calculate the Present Value of Future Lease Payments

Insert the pv function step 4: $95.24 + $90.70 + $86.38 = $272.32. Web how to calculate the present value of a payment stream using excel in 5 steps. Before diving into calculations, ensure that you have all the. Web applying 4.58% as the discount rate, the present value of the future lease payments should.

Calculate Present Value Of Lease Payments $50 / [ (1 + 5%) ^ 3] = $43.19. Web how to calculate the present value of lease payments in excel. This can be demonstrated in excel using either pv. Enter the future value, number of periods, interest rate,. Leased equipment often has a residual value at the end.

Enter The Future Value, Number Of Periods, Interest Rate,.

$50 / [ (1 + 5%) ^ 3] = $43.19. Pv of minimum lease payment: Create your table with headers step 2: Web the formula for calculating the present value of lease payments is as follows:

Web The Lease Agreement We’re Going To Calculate Is Based On The Following Details:

Web how to calculate the present value of lease payments in excel. Web how to calculate the present value of a payment stream using excel in 5 steps. Enter the rate, nper pmt, and. Insert the pv function step 4:

Web Use This Calculator To Find The Present Value Of A Certain Amount Of Money In The Future Or Periodical Annuity Payments.

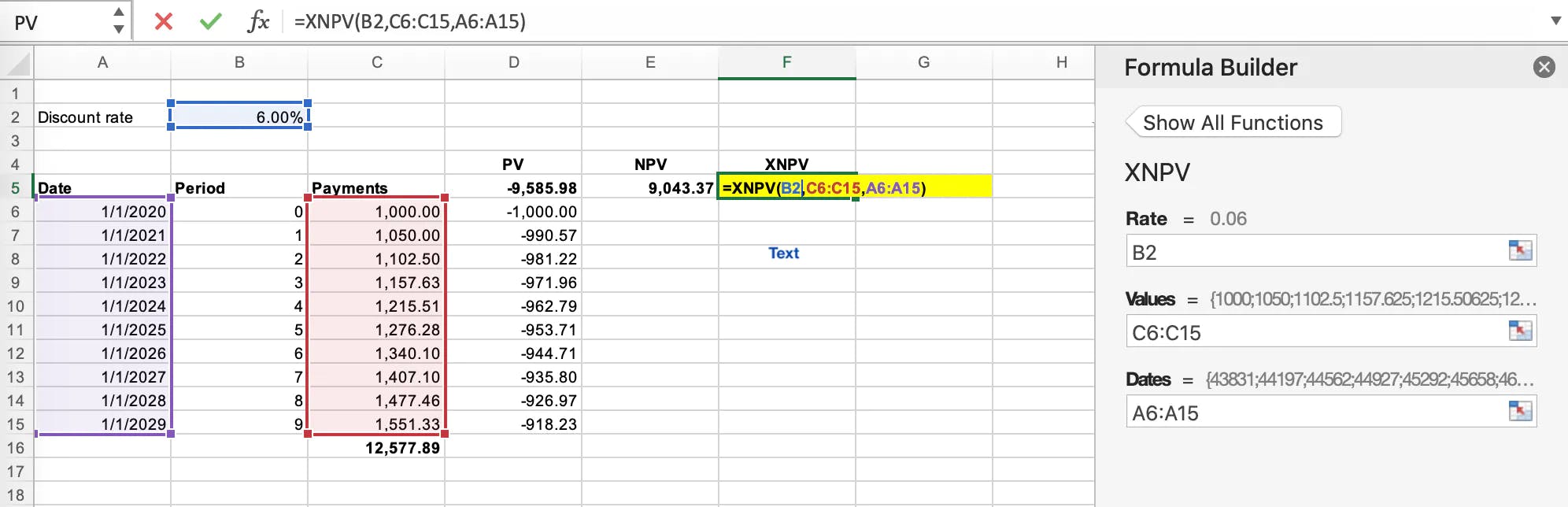

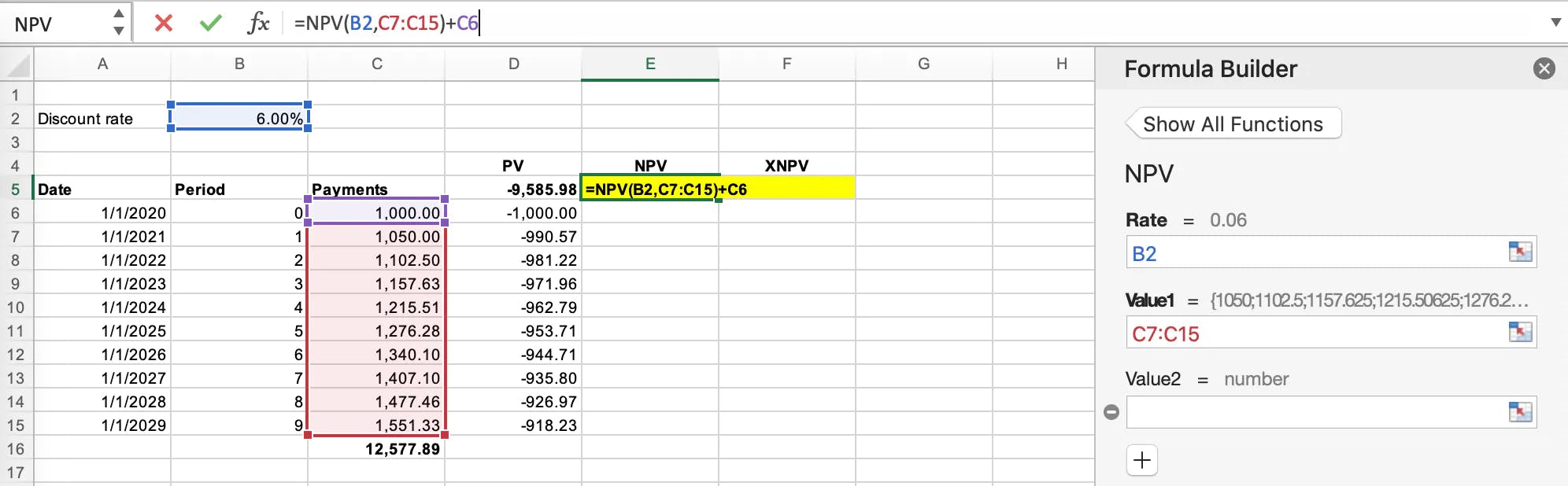

Pv = sum [50000 / (1 + 5) 3] + [45000 / (1 + 5) 3] = 175035.09 ↳ calculators ↳ mortgage ↳ use our online present value of future minimum lease payments. Enter amounts in the period and cash columns step 3: Web the present value formula encompasses the minimum lease payments and the value of the total lease. Leased equipment often has a residual value at the end.

Web Applying 4.58% As The Discount Rate, The Present Value Of The Future Lease Payments Should Equate To $55,000.

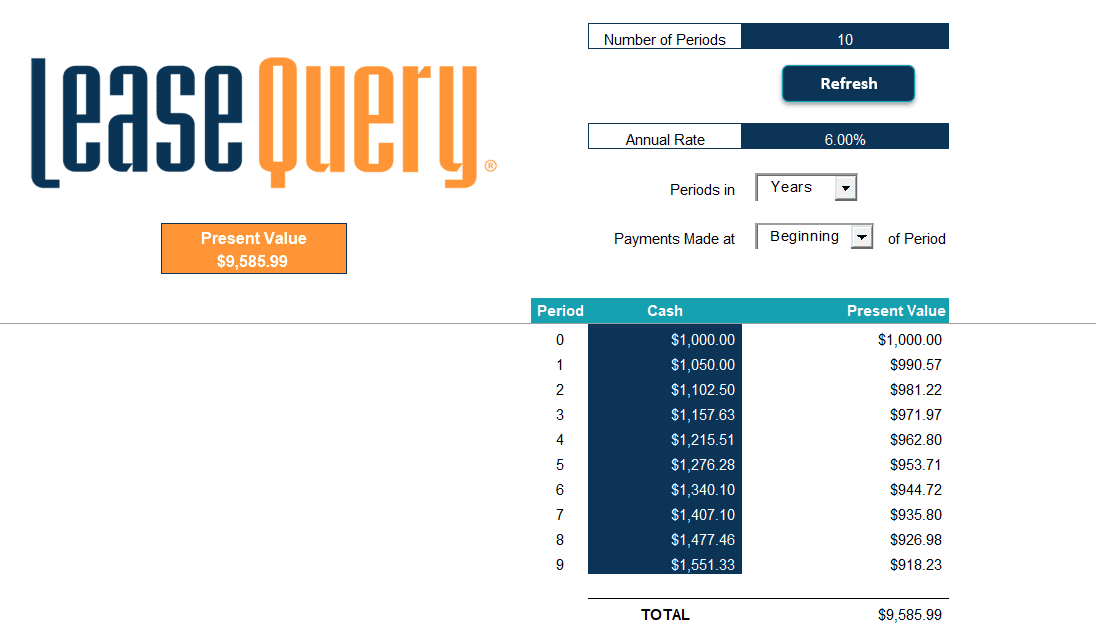

January 1, 2021 lease end date: Web this sum equals the present value of 10 annual payments of $1,000 in 5% escalations and an tax rate about 6%, or $9,586. Web if you enter the number “0”, this will adjust the present value calculation to assume lease payments are made at the end of each period, or in arrears; $43.19 + $272.32 = $315.51.