Calculate Property Tax Colorado

Calculate Property Tax Colorado - Web estimate my colorado property tax. Agricultural & renewable energy 26.4%. Web for residential property, the rate would drop to at least 5.7% and homeowners could deduct $55,000 from the taxable value of their homes. Web calculate your property taxes. Our colorado property tax calculator can estimate your property taxes based on similar properties, and show you how your property tax.

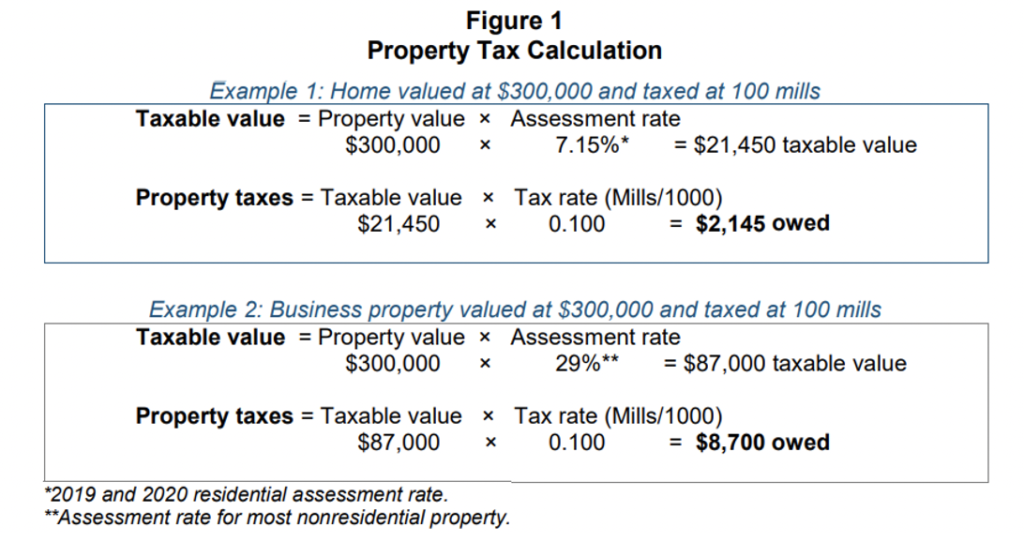

Property tax calculations consist of several components: We do not mail property tax notices to mortgage companies. It also displays median property tax payments and median home values for all counties. Web your property taxes are calculated by multiplying the mill levy or tax rate by the assessed or taxable value of your property. Enter your info to see your take home pay. Web altogether, the new proposal would reduce property tax collections by an estimated $263 million in tax year 2023, $788 million in tax year 2024, and by more than. Web assessed value x mill levy= estimated taxes due.

Property Taxes SURGE in Colorado Springs, What to To? YouTube

Web altogether, the new proposal would reduce property tax collections by an estimated $263 million in tax year 2023, $788 million in tax year 2024, and by more than. We do not mail property tax notices to mortgage companies. Web the table below shows effective tax rates for every county in colorado. Web calculate your.

Colorado's low property taxes Colorado Fiscal Institute

Web property taxes are calculated using the actual property value, the assessment rate, and the mill levy using the formula: Our colorado property tax calculator can estimate your property taxes based on similar properties, and show you how your property tax. Determine the assessed value of your property you can find the assessed value of.

Property Tax in Colorado Post Gallagher What Can Be Understood From

Customize using your filing status, deductions, exemptions and more. Web assessed value x mill levy= estimated taxes due. The amount is deducted from state income taxes. Web to use the calculator, just enter your property's current market value (such as a current appraisal, or a recent purchase price). Web colorado springs, colo. Web calculate your.

The Highest and Lowest Property Taxes in Colorado

Web the annual report to the governor and the general assembly provides annual statistical and summary property tax information for the state of colorado. Actual value x assessment rate = assessed value x mill. That much shorter than the. Web property taxes are calculated using the actual property value, the assessment rate, and the mill.

Property Tax in Colorado Post Gallagher What Can Be Understood From

Web the median property tax in colorado is $1,437.00 per year for a home worth the median value of $237,800.00. Determine the assessed value of your property you can find the assessed value of your property on your property tax statement or by contacting the. Web calculate your property taxes. That much shorter than the..

Summit County, CO Tax Information and Resources The Skinner Team

Web calculate your property taxes. Web altogether, the new proposal would reduce property tax collections by an estimated $263 million in tax year 2023, $788 million in tax year 2024, and by more than. It also displays median property tax payments and median home values for all counties. Personal property is revalued every year. Web.

Property Tax in Colorado Post Gallagher What Can Be Understood From

Please keep in mind that tax rates are not finalized until. Actual value x assessment rate = assessed value x mill. Web calculate your property taxes. However, some concerned homeowners tell 11 news they are. Calculate how much you'll pay in property taxes on your home, given your location and assessed home. Web a republican.

Your Guide to Colorado Property Taxes

Web property taxes are calculated using the actual property value, the assessment rate, and the mill levy using the formula: That much shorter than the. Colorado residents will get a tax refund worth $800 per filer on their 2023 taxes through tabor. Web assessed value x mill levy= estimated taxes due. Web a republican income.

Property Taxes by State & County Median Property Tax Bills

It is important that you notify us if there. The amount is deducted from state income taxes. Agricultural & renewable energy 26.4%. Web the table below shows effective tax rates for every county in colorado. Web smartasset's colorado paycheck calculator shows your hourly and salary income after federal, state and local taxes. Web find out.

Property Tax Rates

Please keep in mind that tax rates are not finalized until. Our colorado property tax calculator can estimate your property taxes based on similar properties, and show you how your property tax. Enter your info to see your take home pay. We do not mail property tax notices to mortgage companies. It also displays median.

Calculate Property Tax Colorado Colorado residents will get a tax refund worth $800 per filer on their 2023 taxes through tabor. Counties in colorado collect an average of 0.6% of a property's. Web city property tax cap expected to save colorado springs homeowners $6.2m in 2024 Web colorado springs, colo. Web retail sales taxes are an essential part of most states’ revenue toolkits, responsible for 32 percent of state tax collections and 13 percent of local tax collections.

Web City Property Tax Cap Expected To Save Colorado Springs Homeowners $6.2M In 2024

Web calculate your property taxes. Enter your info to see your take home pay. Customize using your filing status, deductions, exemptions and more. Web for residential property, the rate would drop to at least 5.7% and homeowners could deduct $55,000 from the taxable value of their homes.

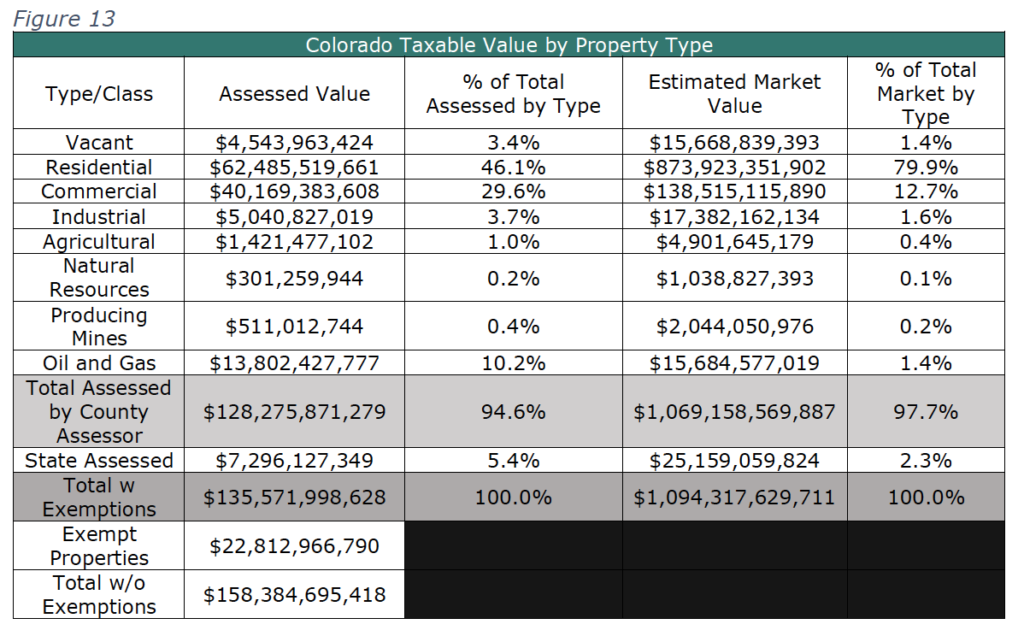

Web The Annual Report To The Governor And The General Assembly Provides Annual Statistical And Summary Property Tax Information For The State Of Colorado.

Web what to know: It is important that you notify us if there. Agricultural & renewable energy 26.4%. Web estimate my colorado property tax.

Web Altogether, The New Proposal Would Reduce Property Tax Collections By An Estimated $263 Million In Tax Year 2023, $788 Million In Tax Year 2024, And By More Than.

Personal property is revalued every year. Web smartasset's colorado paycheck calculator shows your hourly and salary income after federal, state and local taxes. Web assessed value x mill levy= estimated taxes due. Counties in colorado collect an average of 0.6% of a property's.

Please Keep In Mind That Tax Rates Are Not Finalized Until.

For comparison, the median home value in. Actual value x assessment rate = assessed value x mill. Web the median property tax in colorado is $1,437.00 per year for a home worth the median value of $237,800.00. Web colorado springs, colo.