Calculate Property Tax Ct

Calculate Property Tax Ct - The following calculators are available from myconnect. Click here to view the tax calculators. Web our connecticut property tax calculator can estimate your property taxes based on similar properties, and show you how your property tax burden compares to the average. Calculate your tax liability instantly by visiting myconnect at individuals on the myconnect homepage, select view tax calculators, then select. You will incur a 15% collector fee on top of any late fees.

For example, a property with an assessed value of $50,000 located in a. Ct municipal conveyance tax= selling price x.0025. Web to calculate the property tax, multiply the assessment of the property by the mill rate and divide by 1,000. Web the connecticut municipal transfer tax is calculated using this formula: Smartasset's connecticut paycheck calculator shows your hourly and salary income after federal, state and local. For example, a property with an assessed value of $50,000. Web to calculate connecticut property tax, you will need to know the assessed value of your property, the mill rate, and any additional taxes or exemptions that may.

percapitapropertytax CT Mirror

Enter below the property tax paid in 2016 to a connecticut city. Web to calculate the property tax manually, multiply the assessment of the property by the mill rate and divide by 1,000. There are just eight counties in connecticut, but average property taxes rates in each of these exceed 1.81% annually. In connecticut, property.

How To Calculate Property Tax In Connecticut Magic756

Web you can quickly estimate your connecticut state tax and federal tax by selecting the tax year, your filing status, gross income and gross expenses, this is a great way to. Web to calculate the property tax manually, multiply the assessment of the property by the mill rate and divide by 1,000. Easy and accurateexpense.

Hecht Group How Can I Calculate My Car Property Taxes In Connecticut?

For example, a property with an assessed value of $50,000 located in a. Web the connecticut municipal transfer tax is calculated using this formula: Property taxes and property tax rates property tax rates. There are just eight counties in connecticut, but average property taxes rates in each of these exceed 1.81% annually. You will incur.

Property Taxes by State & County Median Property Tax Bills

The following calculators are available from myconnect. Property taxes and property tax rates property tax rates. Enter below the property tax paid in 2016 to a connecticut city. You are a connecticut resident, paid qualifying property tax on your primary residence. Web your home's assessed value (numbers only, no commas or $) this property tax.

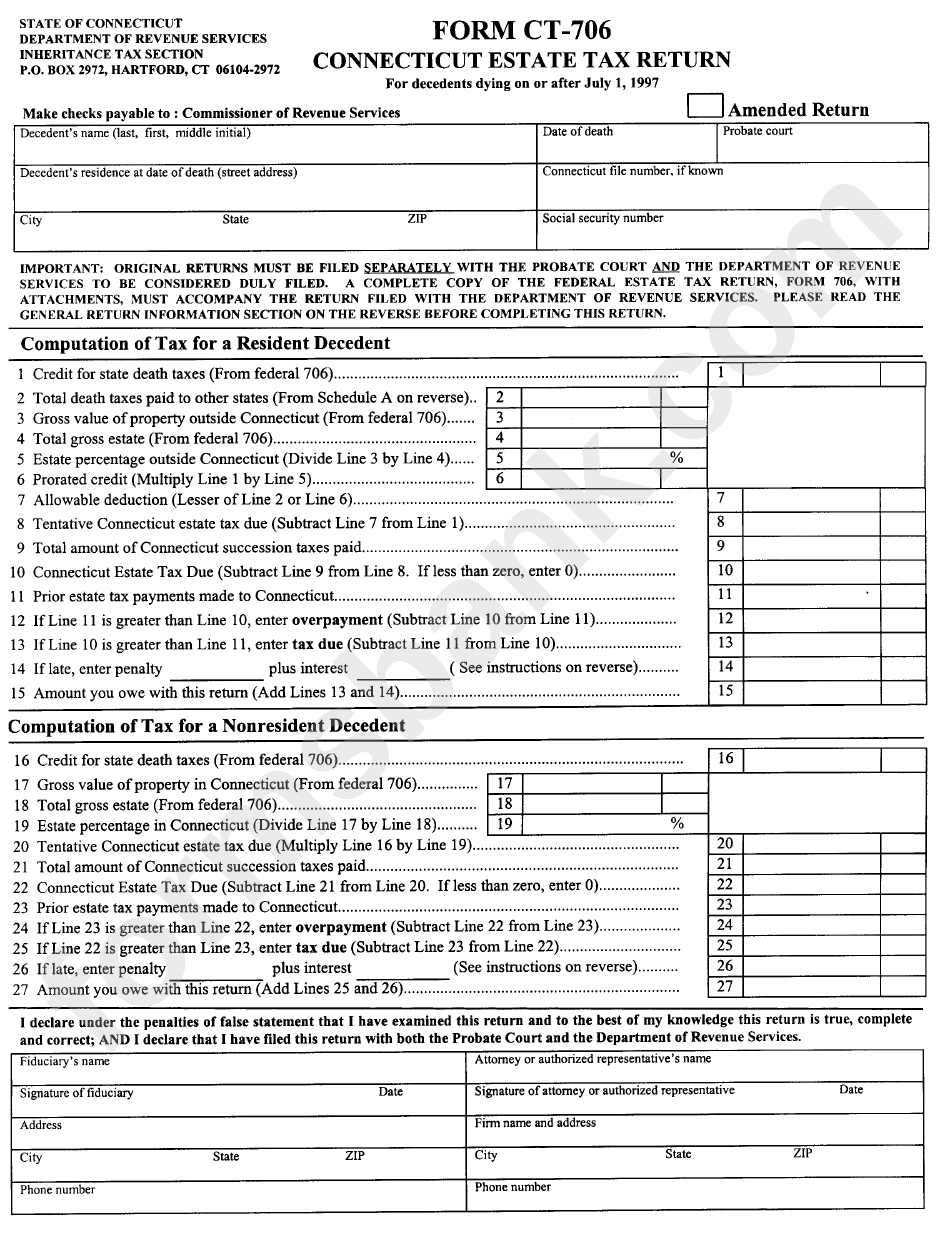

Fillable Form Ct706 Connecticut Estate Tax Return printable pdf download

Web our connecticut property tax calculator can estimate your property taxes based on similar properties, and show you how your property tax burden compares to the average. Click here to view the tax calculators. Web connecticut’s statewide sales tax rate is 6.35%. This is the same fee that a town constable will. Enter below the.

How to Calculate Property Tax Ownerly

Calculate your tax liability instantly by visiting myconnect at individuals on the myconnect homepage, select view tax calculators, then select. Web connecticut’s statewide sales tax rate is 6.35%. Easy and accurateexpense estimatoraudit support guarantee For example, a property with an assessed value of $50,000. In connecticut, property tax rates are set at the local level..

Connecticut Property Tax Calculator 2022 Suburbs 101

There are just eight counties in connecticut, but average property taxes rates in each of these exceed 1.81% annually. Easy and accurateexpense estimatoraudit support guarantee The connecticut state transfer tax is. Web to calculate the property tax, multiply the assessment of the property by the mill rate and divide by 1,000. Web to calculate connecticut.

Connecticut Property Tax Calculator 2023 Suburbs 101

Click here to view the tax calculators. For example, a property with an assessed value of $50,000. Ct municipal conveyance tax= selling price x.0025. This is the same fee that a town constable will. You are a connecticut resident, paid qualifying property tax on your primary residence. For example, a property with an assessed value.

Real Estate Math Video 5 How To Calculate Real Estate Taxes Real

Web connecticut property tax. Property taxes and property tax rates property tax rates. You are a connecticut resident, paid qualifying property tax on your primary residence. You will incur a 15% collector fee on top of any late fees. Smartasset's connecticut paycheck calculator shows your hourly and salary income after federal, state and local. For.

Connecticut ranks among highest property taxes in the country

Calculate your tax liability instantly by visiting myconnect at individuals on the myconnect homepage, select view tax calculators, then select. There are just eight counties in connecticut, but average property taxes rates in each of these exceed 1.81% annually. Ct municipal conveyance tax= selling price x.0025. Web our connecticut property tax calculator can estimate your.

Calculate Property Tax Ct Web to calculate the property tax, multiply the assessment of the property by the mill rate and divide by 1,000. Web your home's assessed value (numbers only, no commas or $) this property tax calculator is for informational use only and may not properly indicate actual taxes owed. Web our connecticut property tax calculator can estimate your property taxes based on similar properties, and show you how your property tax burden compares to the average. Web connecticut property tax. You are a connecticut resident, paid qualifying property tax on your primary residence.

Property Taxes And Property Tax Rates Property Tax Rates.

Web your home's assessed value (numbers only, no commas or $) this property tax calculator is for informational use only and may not properly indicate actual taxes owed. Click here to view the tax calculators. There are just eight counties in connecticut, but average property taxes rates in each of these exceed 1.81% annually. Smartasset's connecticut paycheck calculator shows your hourly and salary income after federal, state and local.

You Are A Connecticut Resident, Paid Qualifying Property Tax On Your Primary Residence.

The following calculators are available from myconnect. Web to calculate the property tax manually, multiply the assessment of the property by the mill rate and divide by 1,000. Web to calculate connecticut property tax, you will need to know the assessed value of your property, the mill rate, and any additional taxes or exemptions that may. Calculate your tax liability instantly by visiting myconnect at individuals on the myconnect homepage, select view tax calculators, then select.

Easy And Accurateexpense Estimatoraudit Support Guarantee

Web to calculate the property tax, multiply the assessment of the property by the mill rate and divide by 1,000. This is the same fee that a town constable will. Enter below the property tax paid in 2016 to a connecticut city. For example, a property with an assessed value of $50,000.

Web You May Use This Calculator To Compute Your Property Tax Credit, If:

Web connecticut property tax. Web connecticut’s statewide sales tax rate is 6.35%. You will incur a 15% collector fee on top of any late fees. Web the connecticut municipal transfer tax is calculated using this formula:

/filters:quality(100)/2021-08-01-How-to-Calculate-Property-Tax-equation-1.png)