Calculate Property Tax Nj

Calculate Property Tax Nj - 8 am to 4 pm. New jersey property tax rates by county and town: In 1670, a levy of one half penny. Our local property tax goes back to the colonial period. Web to calculate your new jersey property tax for 2024, follow these steps:

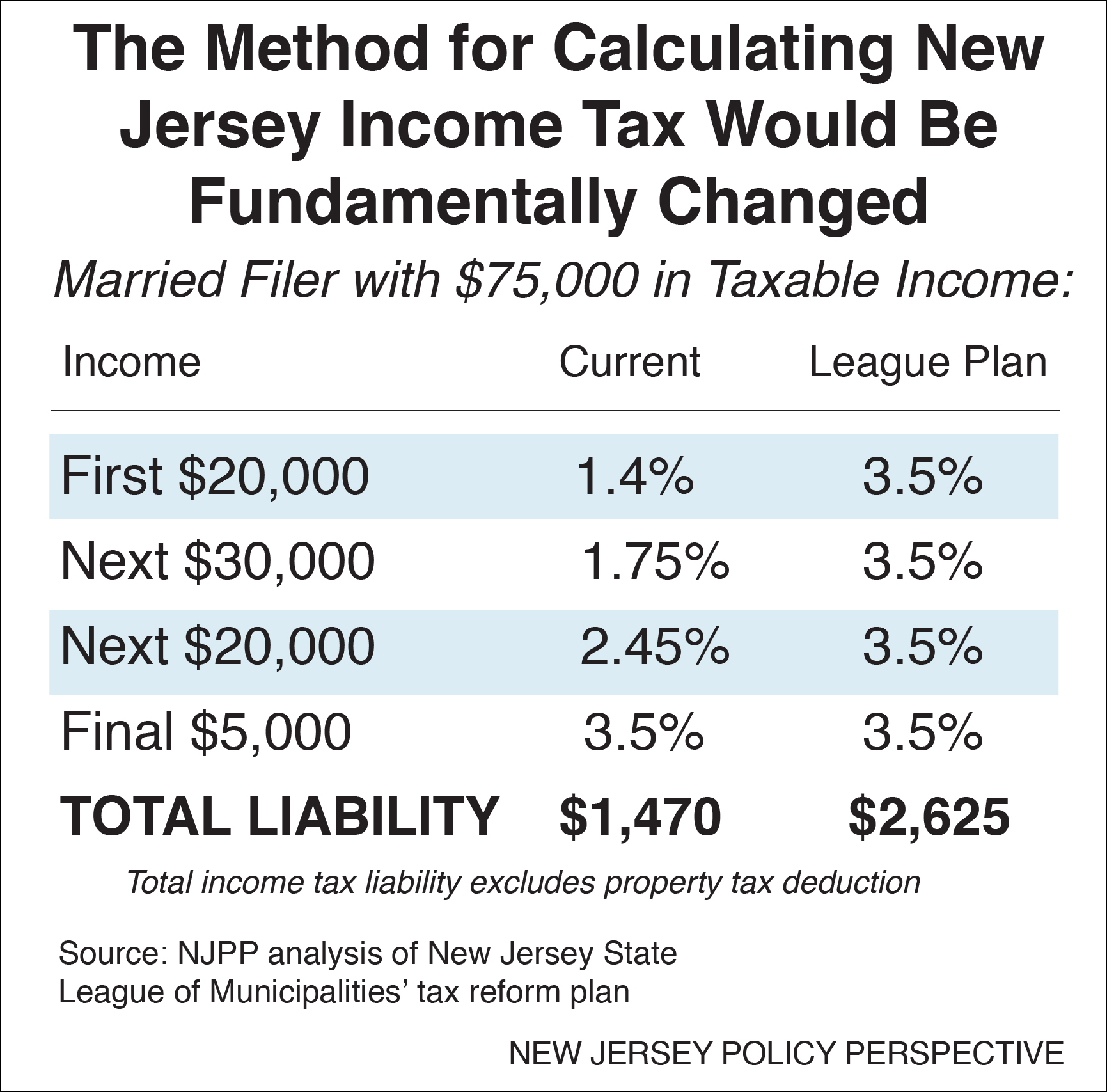

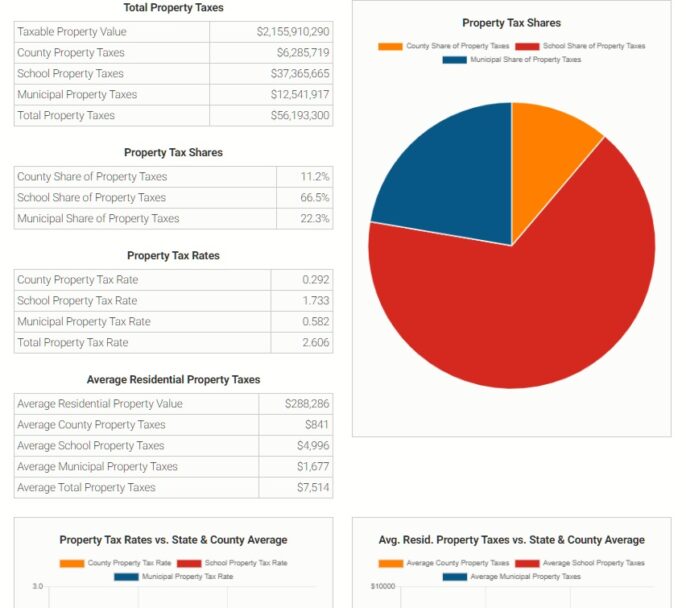

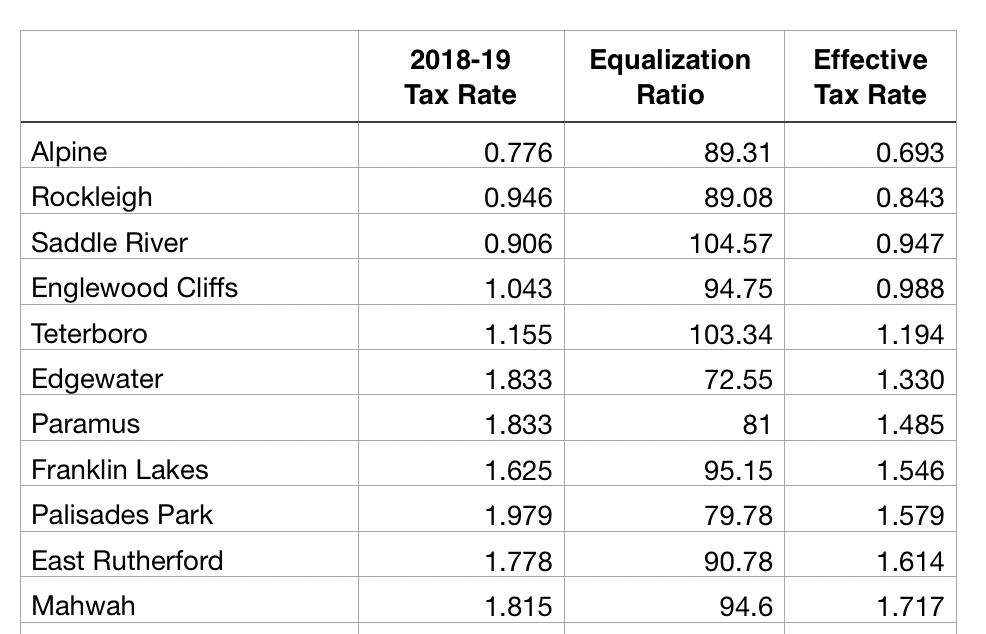

Web a town's general tax rate is calculated by dividing the total dollar amount it needs to raise to meet local budget expenses by the total assessed value of all its. Web when calculating the property tax deduction or credit for tax year 2023, do not use the amount of property taxes (or mobile home site fees) paid for 2023. 8 am to 4 pm. In 1670, a levy of one half penny. Residents clamor for relief every year so they. Web to calculate your new jersey property tax for 2024, follow these steps: Web enter your 2022 and 2023 property assessment values in each box below and then hit calculate to see the year's difference in your individual property tax bill.

Why Significant, Lasting Property Tax Reform is So Difficult New

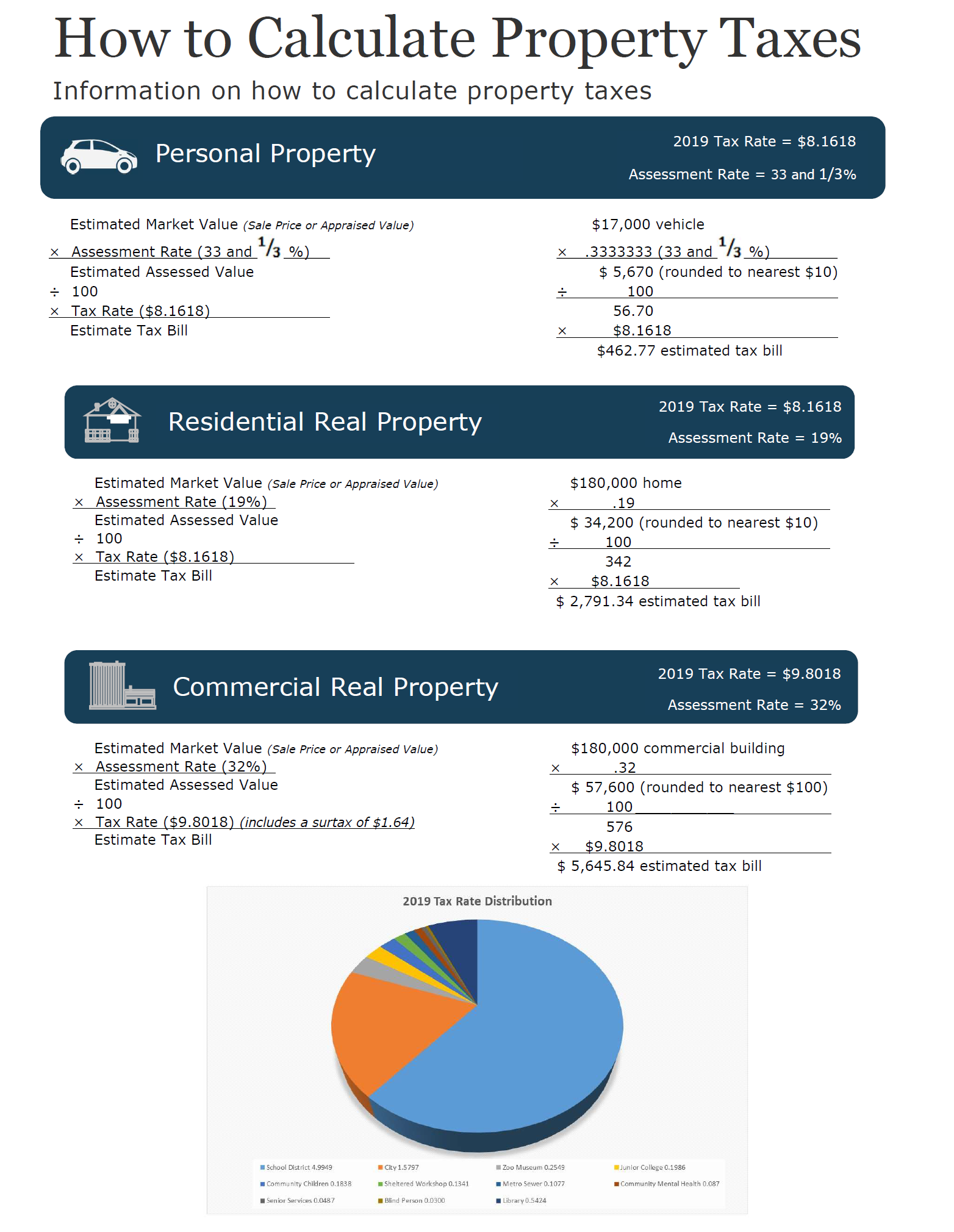

Web property taxes are calculated by multiplying the assessed value of your property by the current year tax rate (base rate). 8 am to 4 pm. Property taxes in nj is calculated using the formula: Web new jersey courts have determined “full and fair value,” “market value,” and “true value” to be synonymous. Web new.

How to Calculate Property Taxes

Web click here to view. Web while the exact property tax rate you will pay for your properties is set by the local tax assessor, you can estimate your yearly property tax burden by choosing the state and. Determine the assessed value of your property, which is the value assigned to your. Enter your info.

Property Taxes By Town In Nj Property Walls

Assessed value x (general tax rate/100)= property tax. Web new jersey assesses a property tax on real estate and provides property tax deductions or exemptions to homeowners, veterans, senior citizens, religious and educational. The general tax rate is used to calculate the tax assessed on a property. Web new jersey courts have determined “full and.

Fair Property Taxes for All NJ Launches New “Property Tax Viewer

Web to calculate your new jersey property tax for 2024, follow these steps: To calculate your property taxes, start by typing the county and state where the property is located and then enter the home value. Determine the assessed value of your property, which is the value assigned to your. New jersey property tax rates.

Property Tax Calculator and Complete Guide

Based on the information provided, you are eligible to claim a property tax deduction or credit for tax year 2023. Web while the exact property tax rate you will pay for your properties is set by the local tax assessor, you can estimate your yearly property tax burden by choosing the state and. Assessed value.

How to Calculate Property Tax 10 Steps (with Pictures) Wiki How To

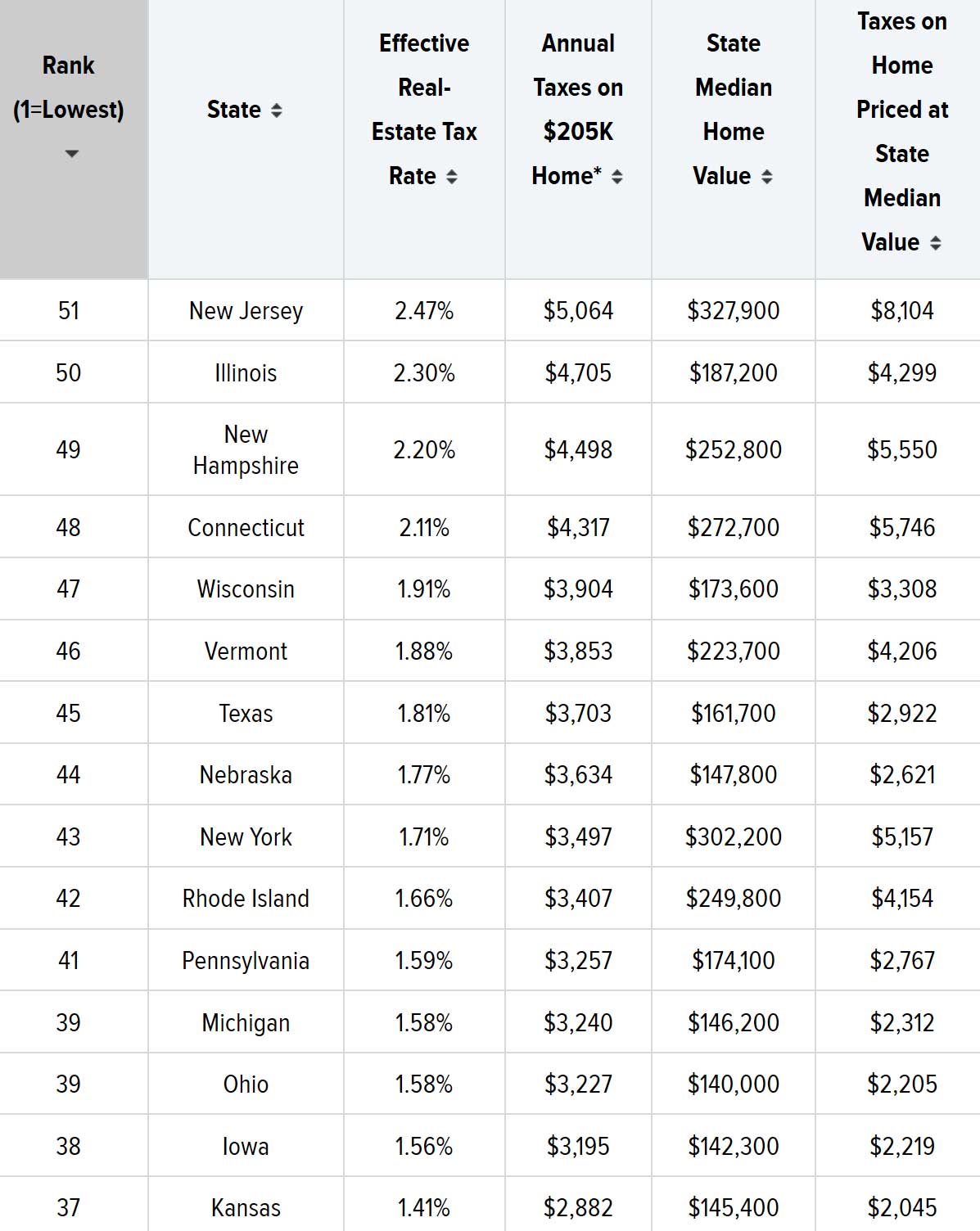

New jersey property tax rates by county and town: Web smartasset's new jersey paycheck calculator shows your hourly and salary income after federal, state and local taxes. The tax assessor determines the. P roperty is to be assessed for taxation purposes by general laws and. Web new jersey assesses a property tax on real estate.

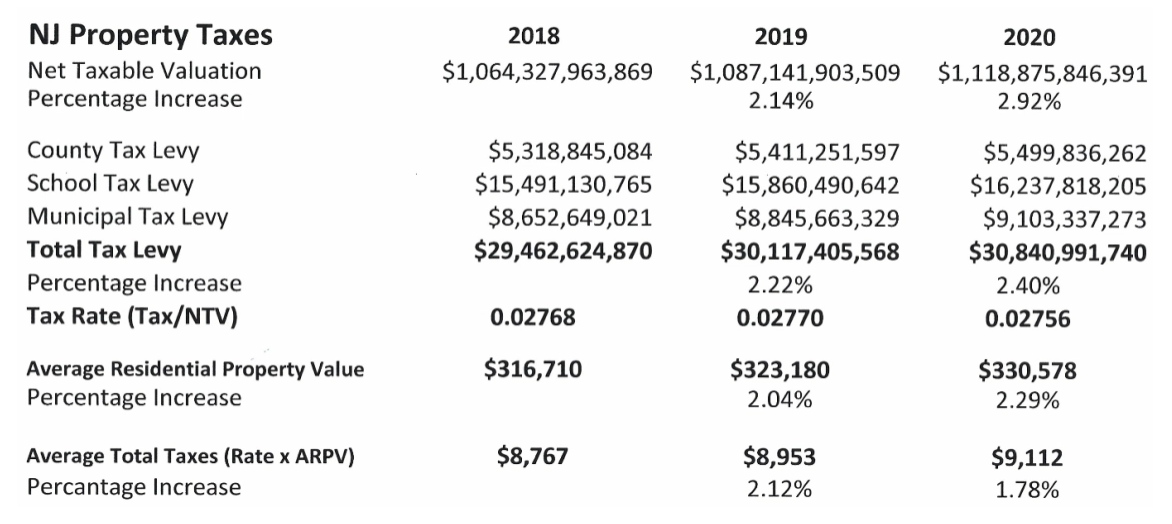

NJ Property Taxes A Primer Actuarial News

Our local property tax goes back to the colonial period. New jersey property tax rates by county and town: The tax assessor determines the. Residents clamor for relief every year so they. Click here for a map of new jersey with more tax information. Web to better understand new jersey property taxes, consider the following..

33+ how to calculate nj property tax LadyArisandi

Residents clamor for relief every year so they. Web new jersey assesses a property tax on real estate and provides property tax deductions or exemptions to homeowners, veterans, senior citizens, religious and educational. Web smartasset's new jersey paycheck calculator shows your hourly and salary income after federal, state and local taxes. To calculate your property.

How to Calculate Property Tax 10 Steps (with Pictures) wikiHow

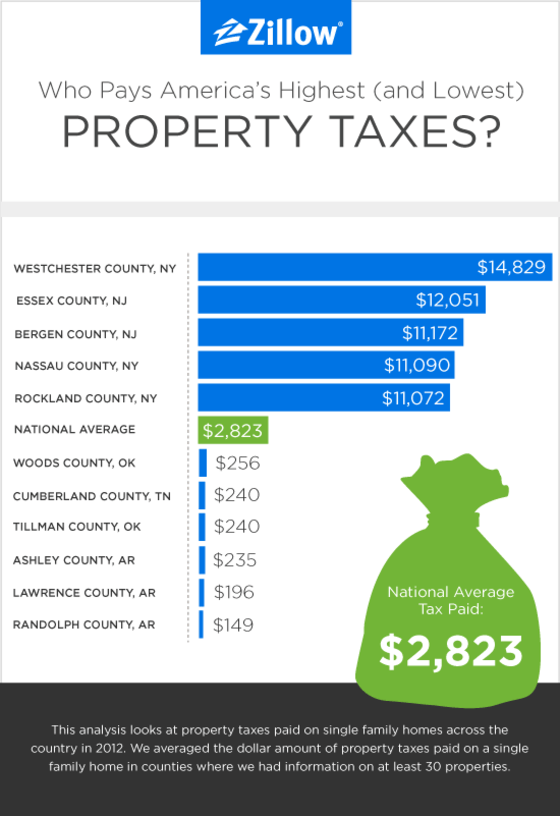

List and map of property tax. Our local property tax goes back to the colonial period. Web new jersey has the highest property taxes in the nation, with an average bill of $9,490 in 2022, according to state data. Web new jersey assesses a property tax on real estate and provides property tax deductions or.

33+ how to calculate nj property tax LadyArisandi

Enter your info to see your take home pay. To calculate your property taxes, start by typing the county and state where the property is located and then enter the home value. Web estimate my new jersey property tax. Determine the assessed value of your property, which is the value assigned to your. 8 am.

Calculate Property Tax Nj In 1670, a levy of one half penny. Our new jersey property tax calculator can estimate your property taxes based on similar properties, and show you how your. P roperty is to be assessed for taxation purposes by general laws and. Assessed value x (general tax rate/100)= property tax. Our local property tax goes back to the colonial period.

Determine The Assessed Value Of Your Property, Which Is The Value Assigned To Your.

Use this calculator to estimate your nj property tax bill. Web when calculating the property tax deduction or credit for tax year 2023, do not use the amount of property taxes (or mobile home site fees) paid for 2023. The general tax rate is used to calculate the tax assessed on a property. Web a town's general tax rate is calculated by dividing the total dollar amount it needs to raise to meet local budget expenses by the total assessed value of all its.

Web Enter Your 2022 And 2023 Property Assessment Values In Each Box Below And Then Hit Calculate To See The Year's Difference In Your Individual Property Tax Bill.

Assessed value x (general tax rate/100)= property tax. Web while the exact property tax rate you will pay for your properties is set by the local tax assessor, you can estimate your yearly property tax burden by choosing the state and. Web new jersey property tax calculator. Web new jersey assesses a property tax on real estate and provides property tax deductions or exemptions to homeowners, veterans, senior citizens, religious and educational.

Web How To Calculate Property Taxes In Nj?

Enter your info to see your take home pay. Web estimate my new jersey property tax. Web to better understand new jersey property taxes, consider the following. Web new jersey has the highest property taxes in the nation, with an average bill of $9,490 in 2022, according to state data.

Ratios Of Assessed To True Value By County And Town:

8 am to 4 pm. To calculate your property taxes, start by typing the county and state where the property is located and then enter the home value. Property taxes in nj is calculated using the formula: Web new jersey courts have determined “full and fair value,” “market value,” and “true value” to be synonymous.