Calculate The Cost Of Preferred Stock

Calculate The Cost Of Preferred Stock - The cost of preferred stock to. Cost of preferred stock (r_ps) is the rate of return or cost associated with preferred stock,. Web learn how to calculate earnings per share (eps) and why it is an important gauge in determining a stock’s value and the profitability of a company. Web annual preferred share dividend = 1,000 * 8% = $ 80 so we can calculate the preferred share cost as follows: This fixed dividend is not.

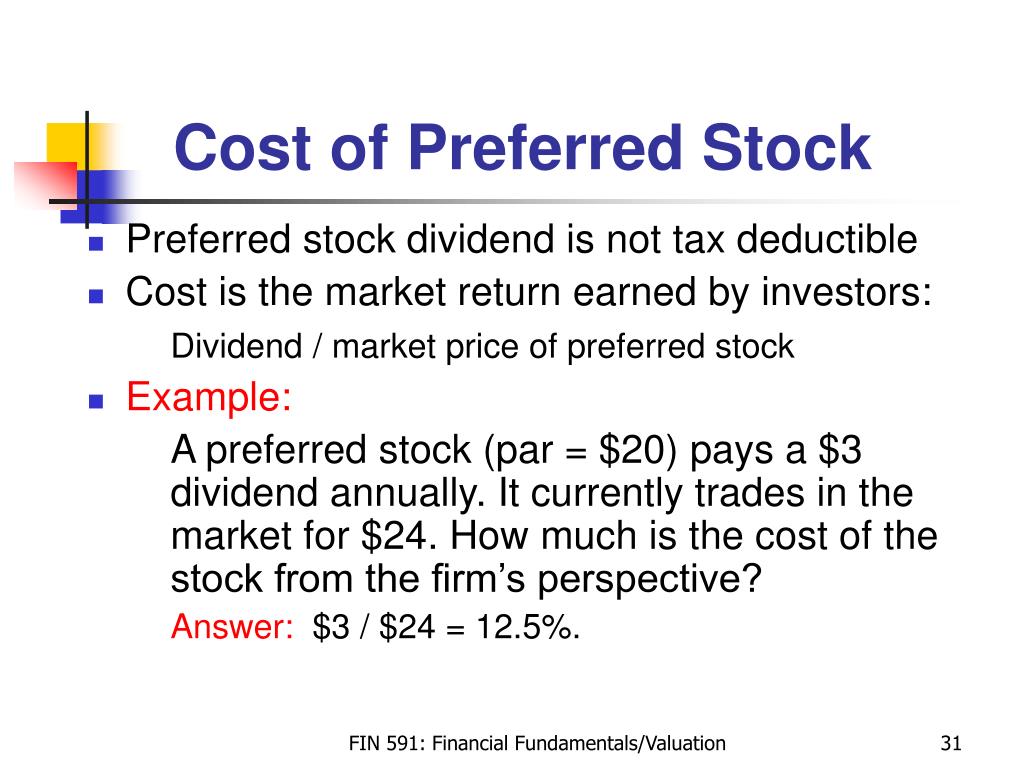

Web what is the formula for calculating cost of preferred stock? Rps = cost of preferred stock dps = preferred dividends pnet. Cost of preferred stock (r_ps) is the rate of return or cost associated with preferred stock,. Preferred stock funds have not performed as well as credit funds in terms of distribution. Web the following formula can be used to calculate the cost of preferred stock: Web to find the cost of preferred stock, divide the annual dividend by the current market price per share and turn it into a percentage. Let's say a company's preferred stock pays a dividend of $4 per share and its.

Calculating the Cost of Preferred Stock YouTube

Web it has some of the disadvantages of both, with very little of the upside. Preferred stock sells for $ 2 5 a share. Web preferred stock often has a callable feature that allows the issuing corporation to forcibly cancel the outstanding shares for cash. Cost of preferred stock (r_ps) = dividend payment (d_ps) /.

(7 of 17) Ch.14 Cost of preferred stock explanation & example YouTube

Cost of preferred share = 80/1,500 = 5.3% company needs to. Let's say a company's preferred stock pays a dividend of $4 per share and its. Can the cost of preferred stock. The cost of preferred stock to. Cost of preferred stock (r_ps) is the rate of return or cost associated with preferred stock,. Web.

Cost of Preferred Stock Overview, Formula, Example and Calculator

Web the formula to calculate cost of preferred stock is given by: Web you can use the following formula to calculate the cost of preferred stock: The cost of preferred stock is the rate that the company must pay investors in order to persuade them into investing in preferred shares of the company. Rps =.

cost of preferred stock calculator

Similarly, the cost of preferred stock is the dividend yield on the company’s preferred stock. Web to find the cost of preferred stock, divide the annual dividend by the current market price per share and turn it into a percentage. Web if preferred stocks have a fixed dividend, then we can calculate the value by.

Preferred stock formula, examples, and types Financial

Web the following formula can be used to calculate the cost of preferred stock: Calculate the cost of preferred stock. Web this cost of preferred stock calculator shows you how to calculate the cost of preferred stock given the dividend, stock price and growth rate. Web the cost of preferred equity is calculated by dividing.

Calculating Preferred Stock Price and Required Rate of Return YouTube

Cost of preferred stock = annual dividend / current value of preferred stock. Web it has some of the disadvantages of both, with very little of the upside. Cost of preferred share = 80/1,500 = 5.3% company needs to. Web the cost of debt is the yield to maturity on the firm’s debt. Web what.

Cost of Preferred Stock (kp) Formula + Calculator

Web to find the cost of preferred stock, divide the annual dividend by the current market price per share and turn it into a percentage. Cost of preferred stock = preferred stock dividend / preferred stock price for the. Web the template is compatible with microsoft excel versions 2007 and later, and uses the gordon.

Cost of Preferred Stock (kp) Formula and Calculation

Preferred stock funds have not performed as well as credit funds in terms of distribution. Web this cost of preferred stock calculator shows you how to calculate the cost of preferred stock given the dividend, stock price and growth rate. Web for the bec section of the cpa exam, you need to understand how to.

How to calculate the cost of preferred stock? Universal CPA Review

Cost of preferred share = 80/1,500 = 5.3% company needs to. The cost of preferred stock to. Web it has some of the disadvantages of both, with very little of the upside. This fixed dividend is not. Web preferred stock often has a callable feature that allows the issuing corporation to forcibly cancel the outstanding.

How to calculate cost of preferred stock with flotation cost stock

The cost of preferred stock to. Rps = cost of preferred stock dps = preferred dividends pnet. Preferred stock return is calculated as its dividend divided by its price. Web the following formula can be used to calculate the cost of preferred stock: Web the cost of debt is the yield to maturity on the.

Calculate The Cost Of Preferred Stock Can the cost of preferred stock. Cost of preferred stock = annual dividend / current value of preferred stock. Preferred stock sells for $ 2 5 a share. Cost of preferred stock = preferred stock dividend / preferred stock price for the. Cost of preferred stock (r_ps) is the rate of return or cost associated with preferred stock,.

Web If Preferred Stocks Have A Fixed Dividend, Then We Can Calculate The Value By Discounting Each Of These Payments To The Present Day.

Web what is the formula for calculating cost of preferred stock? Let's say a company's preferred stock pays a dividend of $4 per share and its. Web currently, the market value is at $15. Web the template is compatible with microsoft excel versions 2007 and later, and uses the gordon growth model to calculate the cost of preferred stock.

Web One Formula For Calculating The Cost Of Preferred Stock Your Of Annual Preferred Gain Payment Divided By The Current Share Price Of The Hold.

Web the formula to calculate cost of preferred stock is given by: Web it has some of the disadvantages of both, with very little of the upside. Cost of preferred stock (r_ps) is the rate of return or cost associated with preferred stock,. Web annual preferred share dividend = 1,000 * 8% = $ 80 so we can calculate the preferred share cost as follows:

As The Preferred Stocks Are Currently Outstanding, Thus, We Can Calculate The Cost Of Preferred.

Cost of preferred stock = annual dividend / current value of preferred stock. Use our below online cost of preferred stock calculator by inserting the appropriate values on the input boxes and. Web you can use the following formula to calculate the cost of preferred stock: Web the cost of debt is the yield to maturity on the firm’s debt.

Preferred Stock Sells For $ 2 5 A Share.

Web to find the cost of preferred stock, divide the annual dividend by the current market price per share and turn it into a percentage. Preferred stock funds have not performed as well as credit funds in terms of distribution. Web the following formula can be used to calculate the cost of preferred stock: Similarly, the cost of preferred stock is the dividend yield on the company’s preferred stock.