Calculating Erc With Ppp

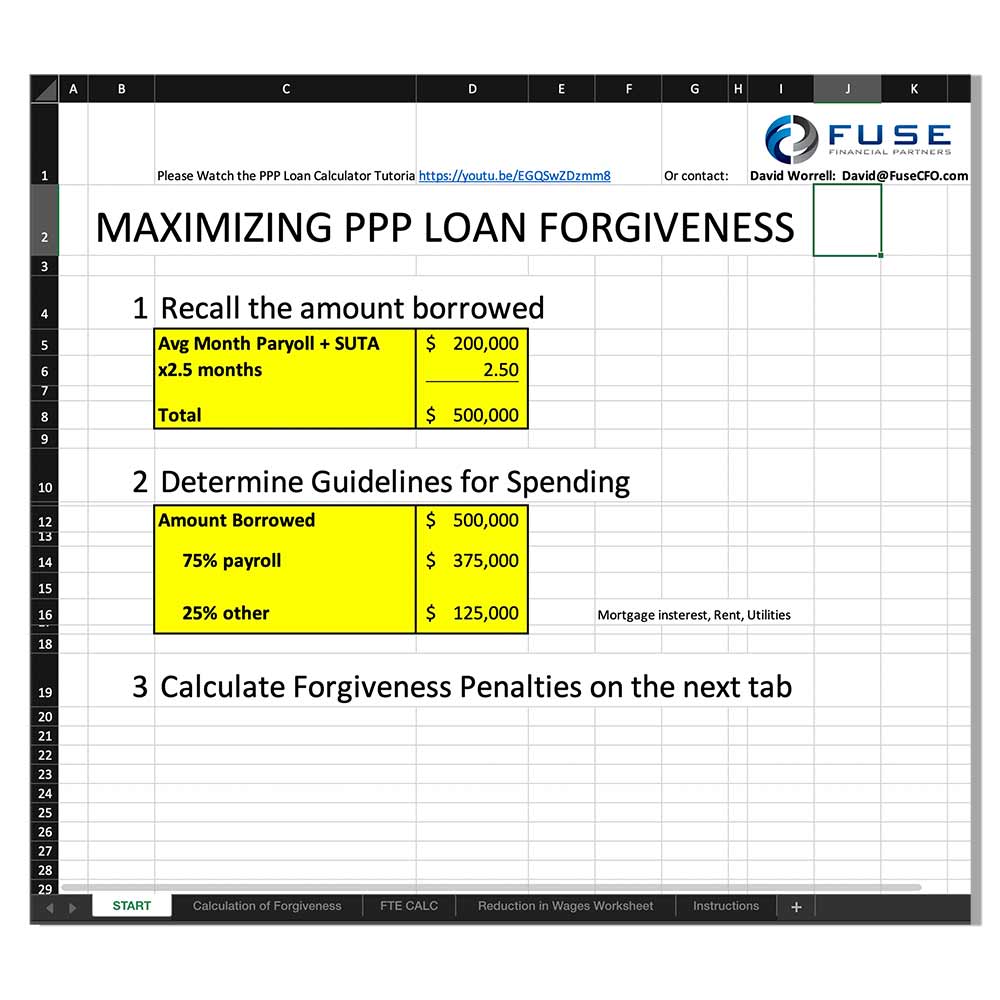

Calculating Erc With Ppp - Web april 27, 2021 updated april 27, 2021 cherry bekaert’s tax team hosted a panel discussion on february 9 th about ppp loans and the employee retention credit. Web next, the borrower calculates average monthly net profit or gross income by dividing the annual amount by 12 (e.g., $100,000 / 12 = $8,333.33). Web interaction between the erc and ppp loan forgiveness how to claim the credit legislation and rules for 2020 and 2021 credit the basics refundable payroll tax credit help. Doing the math for 2020. Can’t use the same wages though;

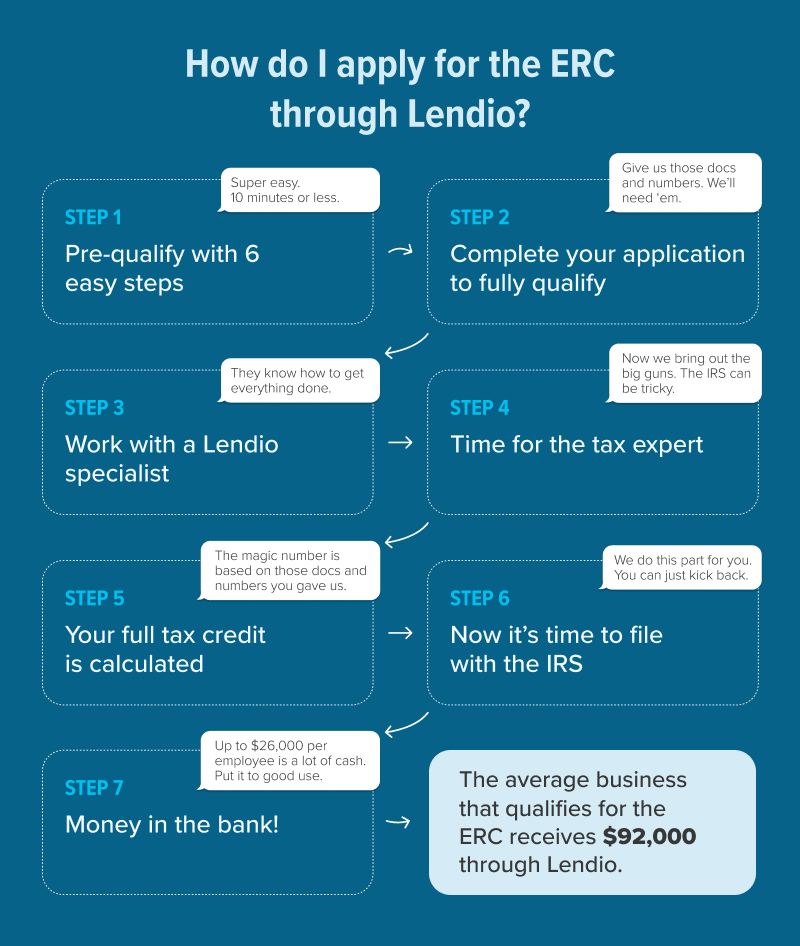

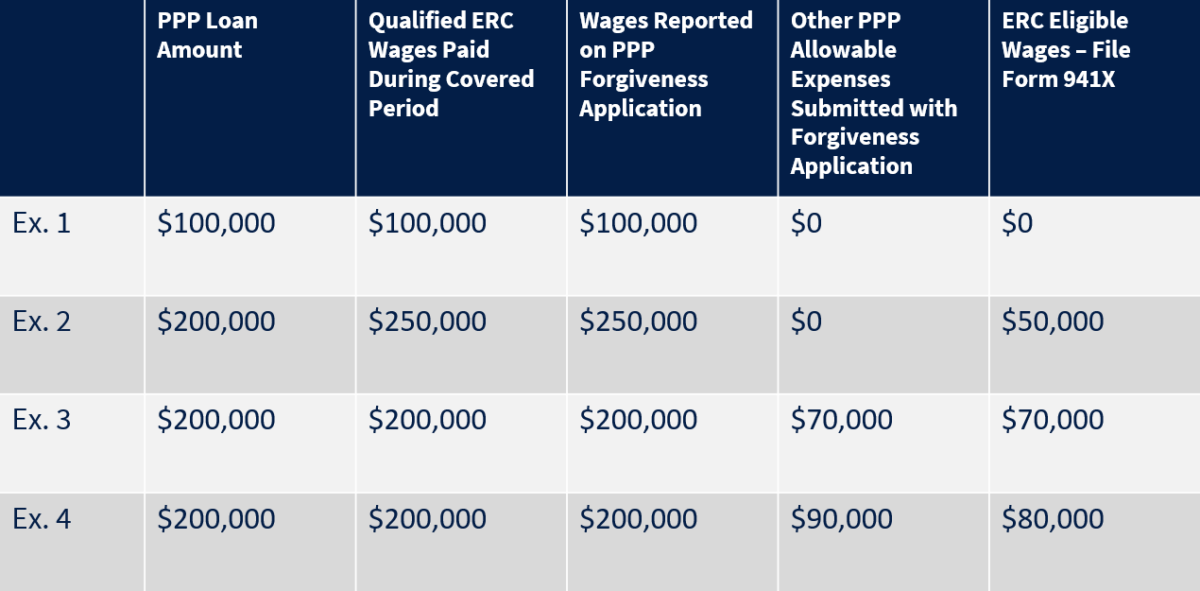

Web how to calculate erc with ppp: Web in this post, we’re going to look at erc and ppp interaction to help you determine if you qualify for a tax credit refund after receiving a ppp loan. How to calculate the employee retention credit for 2020, the employee retention credit is. For 2020, an eligible employer is entitled to a. Web erc employee retention credit extension. If paid salary, enter in the salary amount for the rate. Web the total erc benefit per employee can be up to $26,000 ($5,000 in 2020 and $7,000 per quarter in 2021).

ERTC with PPP coordination for 2020 & 2021 YouTube

How to calculate the employee retention credit for 2020, the employee retention credit is. The erc calculator will ask questions about the company's gross receipts and employee. Web there are two relevant time periods when calculating the erc: Web in this post, we’re going to look at erc and ppp interaction to help you determine.

Qualifying for Employee Retention Credit (ERC) Gusto

How to calculate the employee retention credit for 2020, the employee retention credit is. The calculation rate for 2020 is 50% percent, rather than the 70% calculation rate used for 2021. Web how to calculate erc with ppp: If paid salary, enter in the salary amount for the rate. Web next, the borrower calculates average.

The Intersection of PPP & ERC How to Get the Most from These Two

The erc calculator will ask questions about the company's gross receipts and employee. Learn more about the interplay. Web there are two relevant time periods when calculating the erc: Web next, the borrower calculates average monthly net profit or gross income by dividing the annual amount by 12 (e.g., $100,000 / 12 = $8,333.33). As.

Employee Retention Credit (ERC) Calculator Gusto

The “large employer” definition changed why you should calculate the erc employee retention. How to calculate the employee retention credit for 2020, the employee retention credit is. Web there are two relevant time periods when calculating the erc: Web interaction between the erc and ppp loan forgiveness how to claim the credit legislation and rules.

PPP Loans vs. Employee Retention Credit in 2023 Lendio

The erc calculator will ask questions about the company's gross receipts and employee. Web in early august 2021, the irs released additional erc guidance on matters including whether the wages of a majority owner of a corporation and their family members can be. How to calculate the employee retention credit for 2020, the employee retention.

ERC Vs PPP 5 Genuine Differences You Should Know

The erc calculator will ask questions about the company's gross receipts and employee. Web april 27, 2021 updated april 27, 2021 cherry bekaert’s tax team hosted a panel discussion on february 9 th about ppp loans and the employee retention credit. Web next, the borrower calculates average monthly net profit or gross income by dividing.

Employee Retention Credit (ERC) Calculator Gusto

Web april 27, 2021 updated april 27, 2021 cherry bekaert’s tax team hosted a panel discussion on february 9 th about ppp loans and the employee retention credit. If paid salary, enter in the salary amount for the rate. Web the amount of wages eligible for the erc will be reduced by the maximum amount.

What Is The Requirement For Ppp Loan

Web the total erc benefit per employee can be up to $26,000 ($5,000 in 2020 and $7,000 per quarter in 2021). If paid salary, enter in the salary amount for the rate. Web next, the borrower calculates average monthly net profit or gross income by dividing the annual amount by 12 (e.g., $100,000 / 12.

Employee Retention Credit IRS Updates Guidance on PPP Coordination

Web interaction between the erc and ppp loan forgiveness how to claim the credit legislation and rules for 2020 and 2021 credit the basics refundable payroll tax credit help. Determine your eligibility for both programs. Web a significant change for 2020 made by the relief act permits eligible employers that received a paycheck protection program.

ERC vs PPP Which is the Right Choice for Your Small Business

Web a significant change for 2020 made by the relief act permits eligible employers that received a paycheck protection program (ppp) loan to claim the employee retention credit, although the same wages cannot be counted both for seeking. Doing the math for 2020. If paid salary, enter in the salary amount for the rate. Now.

Calculating Erc With Ppp Determine your eligibility for both programs. The calculation rate for 2020 is 50% percent, rather than the 70% calculation rate used for 2021. Web in this post, we’re going to look at erc and ppp interaction to help you determine if you qualify for a tax credit refund after receiving a ppp loan. The “large employer” definition changed why you should calculate the erc employee retention. The erc calculator will ask questions about the company's gross receipts and employee.

Now In Addition To Ppp;

Web in early august 2021, the irs released additional erc guidance on matters including whether the wages of a majority owner of a corporation and their family members can be. Web use our tax credit estimator to calculate your potential erc amount. Web in this post, we’re going to look at erc and ppp interaction to help you determine if you qualify for a tax credit refund after receiving a ppp loan. Determine your eligibility for both programs.

Doing The Math For 2020.

Web the total erc benefit per employee can be up to $26,000 ($5,000 in 2020 and $7,000 per quarter in 2021). Web interaction between the erc and ppp loan forgiveness how to claim the credit legislation and rules for 2020 and 2021 credit the basics refundable payroll tax credit help. Web use our simple calculator to see if you qualify for the erc and if so, by how much. Web next, the borrower calculates average monthly net profit or gross income by dividing the annual amount by 12 (e.g., $100,000 / 12 = $8,333.33).

Ppp Recipients Can Still Qualify 2.

Web there are two relevant time periods when calculating the erc: As such, employers are eligible for a credit that is. Web erc employee retention credit extension. Can’t use the same wages though;

How To Calculate The Employee Retention Credit For 2020, The Employee Retention Credit Is.

The erc calculator will ask questions about the company's gross receipts and employee. Web a significant change for 2020 made by the relief act permits eligible employers that received a paycheck protection program (ppp) loan to claim the employee retention credit, although the same wages cannot be counted both for seeking. The “large employer” definition changed why you should calculate the erc employee retention. If paid salary, enter in the salary amount for the rate.