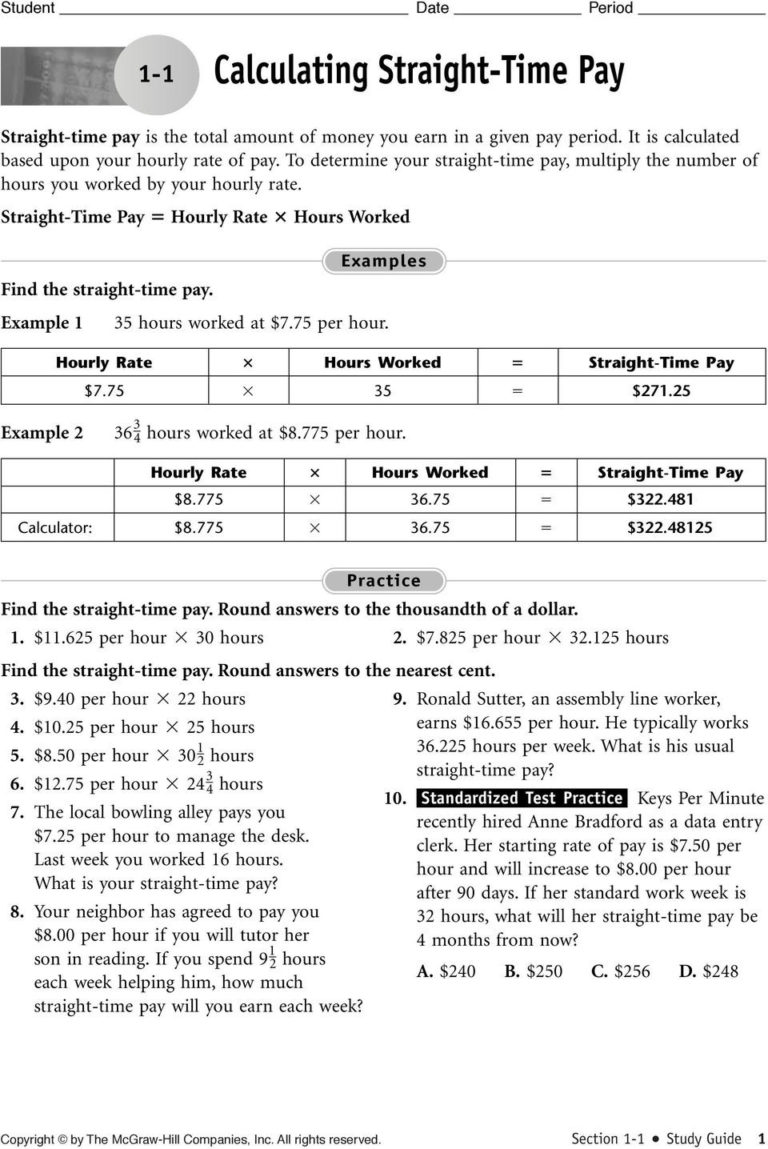

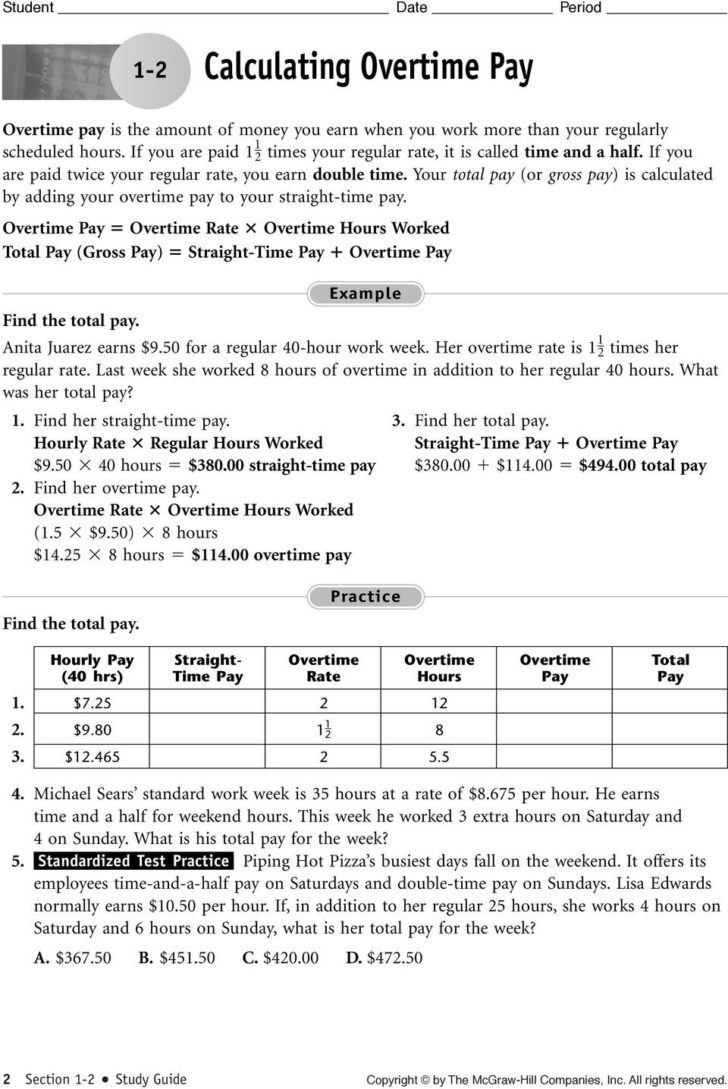

Calculating Overtime Pay Worksheet

Calculating Overtime Pay Worksheet - What is jane paid on days in which she. One week, manuel worked his regular 40 hours and 5.75 hours of overtime. Record the net pay below. $13.10 x 12 hours = $157.20. Web $10 x 0.5 = $5 more per overtime hour.

$14.77 x 1.5 = overtime pay of $22.16 per hour; Web overtime pay $158.40 (12 x $13.20) gross pay $510.40 ($352 +$158.40) assume that the required income withholdings are 27% of the total. Topics covered on this assessment include a type of compensation and. Web once you know how many hours you owe them, here’s how you calculate the money you owe: Record the net pay below. Under the flsa, overtime pay is additional compensation (i.e., premium pay) that employers must pay to nonexempt employees who work more than 40 hours in a. $650 ÷ 44 hours = regular rate of $14.77;

FREE 15+ Overtime Worksheet Templates in PDF MS Word Excel

Web overtime pay $158.40 (12 x $13.20) gross pay $510.40 ($352 +$158.40) assume that the required income withholdings are 27% of the total. Web the result is the smaller of two options: Formulas for calculating earnings hours worked x hourly rate = regular pay overtime hours worked x overtime rate =. Topics covered on this.

FREE 15+ Overtime Worksheet Templates in PDF MS Word Excel

Web overtime pay $158.40 (12 x $13.20) gross pay $510.40 ($352 +$158.40) assume that the required income withholdings are 27% of the total. One week, manuel worked his regular 40 hours and 5.75 hours of overtime. To calculate ot (overtime), g5 contains: What is jane paid on days in which she. Ace the quiz by.

Timesheet overtime calculation formula Excel formula Exceljet

2 h = ∗ h = $12.00 ∗ 39.5 h = $474.00 if you are paid $14.40 per hour, how many hours must you work to earn $550.00 per week? Web to calculate the monthly overtime pay, follow these steps: Web once you know how many hours you owe them, here’s how you calculate the.

FREE 15+ Overtime Worksheet Templates in PDF MS Word Excel

Web overtime pay $158.40 (12 x $13.20) gross pay $510.40 ($352 +$158.40) assume that the required income withholdings are 27% of the total. 2 h = ∗ h = $12.00 ∗ 39.5 h = $474.00 if you are paid $14.40 per hour, how many hours must you work to earn $550.00 per week? Overtime pay.

FREE 15+ Overtime Worksheet Templates in PDF MS Word Excel

Web determining the workweek. Web work out your overtime with our overtime calculator. Hourly wage only a nonexempt employee is paid $20 per hour and receives no other forms of compensation. Calculating gross pay with overtime name:______________ anita is paid her regular wage for an 8 hour day from monday to friday. $14.77 x 1.5.

10+ Overtime Calculator Templates

One week, manuel worked his regular 40 hours and 5.75 hours of overtime. Web work out your overtime with our overtime calculator. Regular pay rate x 40 hours = regular pay step 2. Multiply the overtime hourly rate by the number of overtime hours the employee. Overtime pay of $15 × 5 hours × 1.5.

Calculating Overtime Pay Worksheet —

2 h = ∗ h = $12.00 ∗ 39.5 h = $474.00 if you are paid $14.40 per hour, how many hours must you work to earn $550.00 per week? To calculate ot (overtime), g5 contains: In one workweek, they work 50 hours. Gross pay with overtime 1. A workweek is a period of seven..

FREE 15+ Overtime Worksheet Templates in PDF MS Word Excel

A workweek is a period of seven. Multiply the overtime hourly rate by the number of overtime hours the employee. One week, manuel worked his regular 40 hours and 5.75 hours of overtime. Record the net pay below. Web to calculate the monthly overtime pay, follow these steps: Web the result is the smaller of.

Calculating Overtime Pay Worksheet —

A workweek is a period of seven. $22.16 x 4 hours = total overtime due of $88.64;. She is paid time and a half for. Topics covered on this assessment include a type of compensation and. Web overtime pay $158.40 (12 x $13.20) gross pay $510.40 ($352 +$158.40) assume that the required income withholdings are.

FREE 15+ Overtime Worksheet Templates in PDF MS Word Excel

Web this is calculated by dividing the total pay for employment (except for the statutory exclusions noted above) in any workweek by the total number of hours actually worked. $650 ÷ 44 hours = regular rate of $14.77; Web $10 x 0.5 = $5 more per overtime hour. Multiply the overtime hourly rate by the.

Calculating Overtime Pay Worksheet Web to calculate the monthly overtime pay, follow these steps: A workweek is a period of seven. Topics covered on this assessment include a type of compensation and. Web work out your overtime with our overtime calculator. Gross pay with overtime 1.

0.5 X $26.20 = $13.10.

In one workweek, they work 50 hours. Topics covered on this assessment include a type of compensation and. Web to calculate the monthly overtime pay, follow these steps: $14.77 x 1.5 = overtime pay of $22.16 per hour;

Overtime Pay Of $15 × 5 Hours × 1.5 (Ot Rate).

Under the flsa, overtime pay is additional compensation (i.e., premium pay) that employers must pay to nonexempt employees who work more than 40 hours in a. One week, manuel worked his regular 40 hours and 5.75 hours of overtime. 2 h = ∗ h = $12.00 ∗ 39.5 h = $474.00 if you are paid $14.40 per hour, how many hours must you work to earn $550.00 per week? To calculate ot (overtime), g5 contains:

Web $10 X 0.5 = $5 More Per Overtime Hour.

Web pay double time or 2 times an employee’s regular pay. Gross pay with overtime 1. Web overtime pay $158.40 (12 x $13.20) gross pay $510.40 ($352 +$158.40) assume that the required income withholdings are 27% of the total. A workweek is a period of seven.

This Shows You The Total Pay You Are Due Of Regular Time And Overtime.

$650 ÷ 44 hours = regular rate of $14.77; $13.10 x 12 hours = $157.20. Record the net pay below. Regular pay rate x 40 hours = regular pay step 2.