Calculating R&D Tax Credit

Calculating R&D Tax Credit - Web calculating the r&d tax credit using the alternative simplified credit (asc) approach consists of four steps: Multiply that average by 50%. Web here is a quick overview of what you need to know about the r&d tax credit: Over the past year, there have been many developments regarding the research and development (r&d) tax credit and other tax treatment of r&d that can. Organizations that seek to develop new or improve products.

Over the past year, there have been many developments regarding the research and development (r&d) tax credit and other tax treatment of r&d that can. Web use the r&d tax credit calculator to give you an idea of how much you could be eligible for when filing your taxes. Wondering how to calculate the r&d tax credit? Organizations that seek to develop new or improve products. Web follow these steps for regular research credit calculation: Web r&d tax credit calculator | clarus r+d estimate your r&d tax credit see if you qualify and estimate your potential benefit with our r&d tax credit calculator. Identify your qualifying r&d spend (qualifying expenditure, or qe) the biggest part of an r&d tax credit application is knowing which of your costs you can.

R&D Tax Credit Claim Template For Smes

Organizations that seek to develop new or improve products. Total the qres for the current tax year. Web how do you calculate the r&d tax credit using the alternative simplified credit method? Generally, for startups five years old or. One of the leading reasons. Tax preparation · tax planning · small business taxes · taxation.

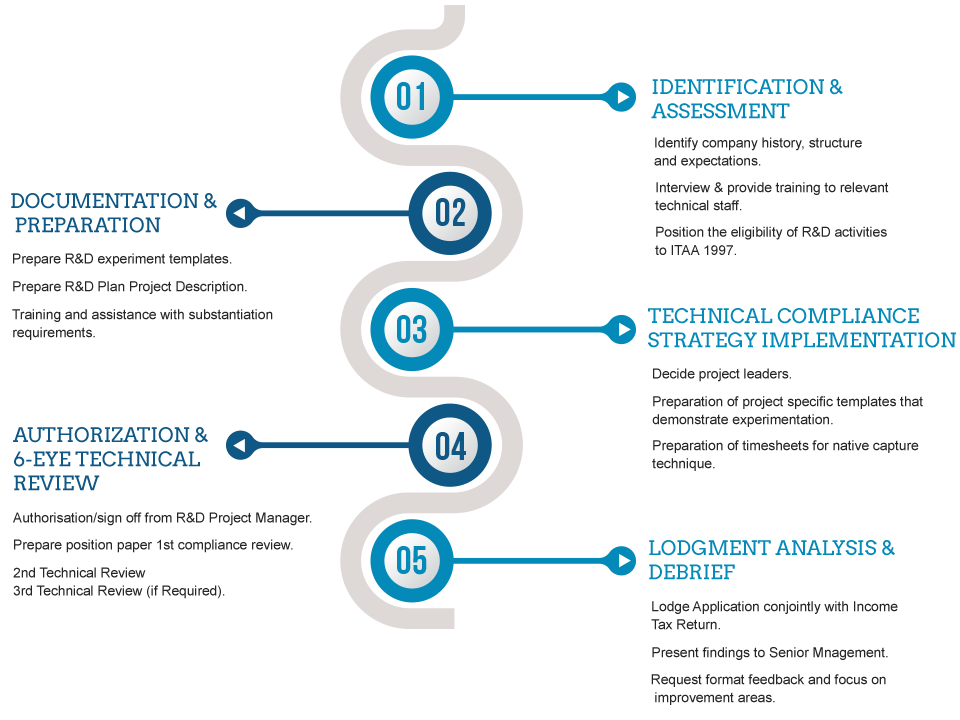

How To Be Proactive With R&D Tax Credits Accountants Guide

Calculate the fixed base percentage. Web here is a quick overview of what you need to know about the r&d tax credit: R&d tax credit calculation using the traditional method is based on 20% of a company's current year qres over a base amount. Identify your qualifying r&d spend (qualifying expenditure, or qe) the biggest.

An Infographic on HMRC R&D Tax Credits RDP Associates

Web how to fill out form 6765 to document their qualified r&d expenses, businesses must complete the four basic sections of form 6765: Web the r&d tax credit is for taxpayers that design, develop, or improve products, processes, techniques, formulas, or software. Over the past year, there have been many developments regarding the research and.

Calculating the R&D Tax Credit

Total the qres for the current tax year. Organizations that seek to develop new or improve products. Web who is eligible for the r&d tax credit? Identify and calculate the average qres for the prior three years. Since the r&d tax credit was first introduced in 1981, both republican and democratic administrations have revised and.

The R&D Tax Credit Process 5 Easy Steps Swanson Reed UK

Web the r&d tax credit calculator is best viewed in chrome or firefox. Web how to claim the r&d tax credit. One of the leading reasons. Web use the r&d tax credit calculator to give you an idea of how much you could be eligible for when filing your taxes. Web r&d tax credit calculator.

R&D Tax Credit Rates For RDEC Scheme ForrestBrown

Organizations that seek to develop new or improve products. R&d tax credit calculation using the traditional method is based on 20% of a company's current year qres over a base amount. Web the r&d tax credit calculator is best viewed in chrome or firefox. Generally, for startups five years old or. First, determine if your.

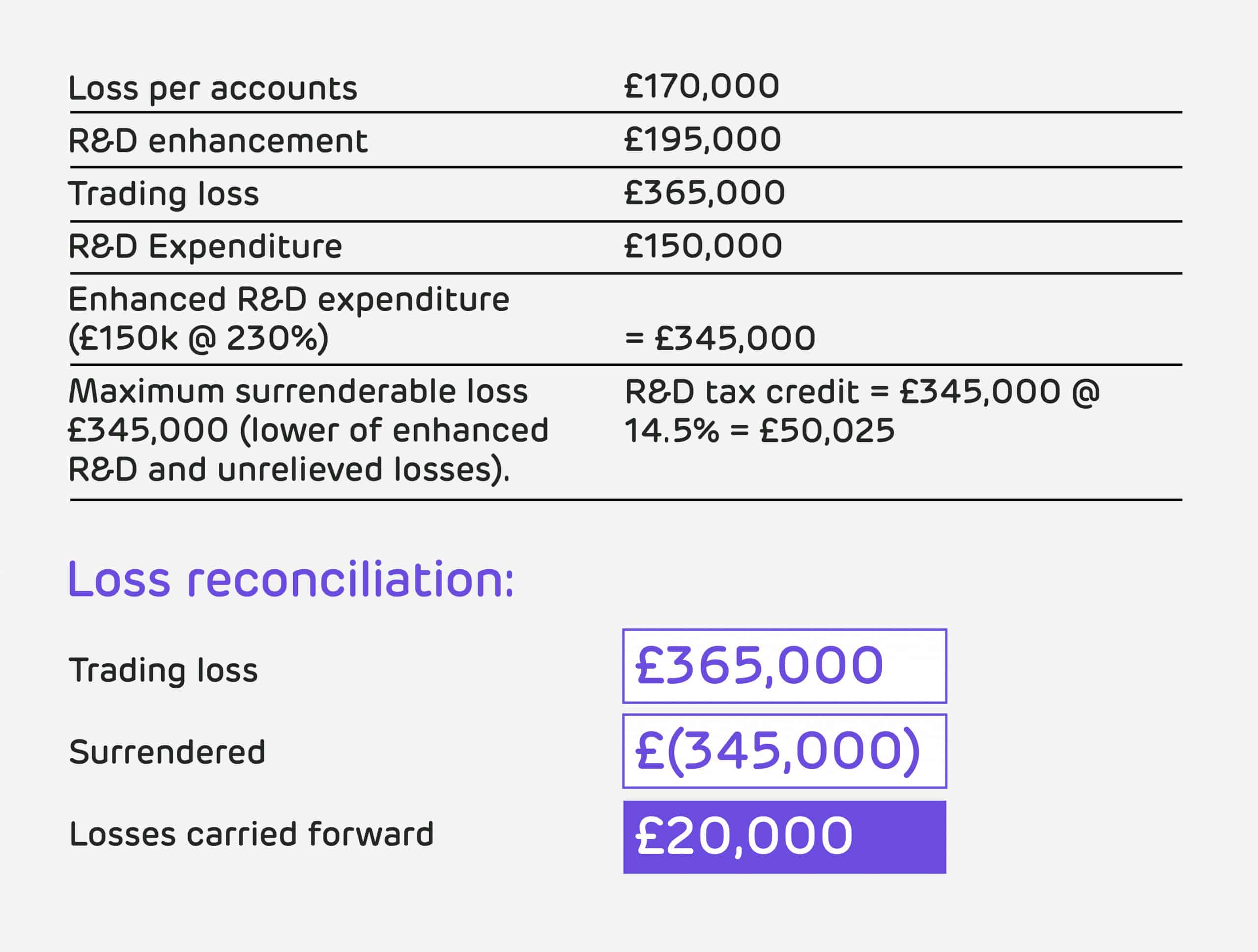

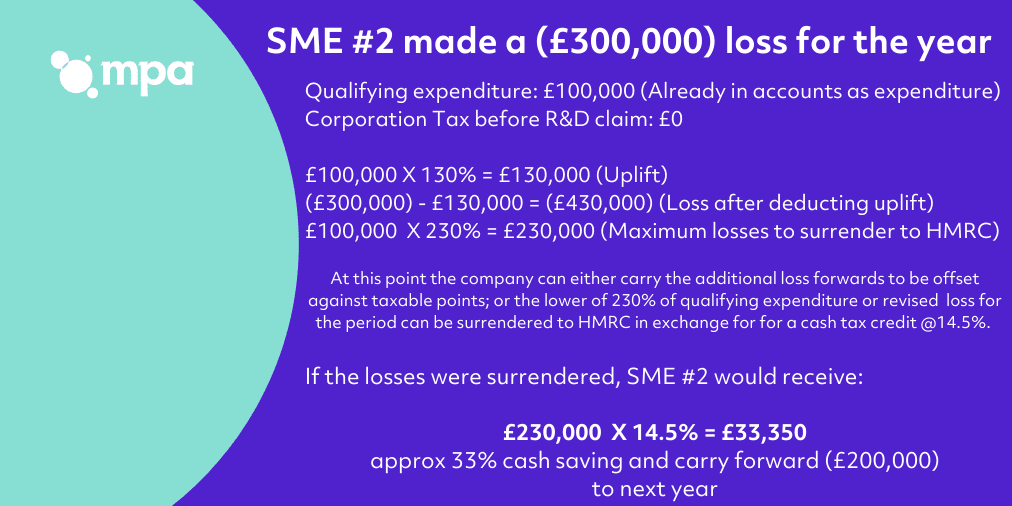

R&D tax credit calculation examples MPA

Web the quick answer the research and development tax credit (r&d credit) is a general business credit available to businesses that created or improved a product or. Web the r&d tax credit calculator is best viewed in chrome or firefox. Wondering how to calculate the r&d tax credit? Web who is eligible for the r&d.

Are You Eligible For R&D Tax Credit? Find out using this infographic

Web who is eligible for the r&d tax credit? Web how to claim the r&d tax credit. Web r&d tax credit calculator | clarus r+d estimate your r&d tax credit see if you qualify and estimate your potential benefit with our r&d tax credit calculator. Figure the company’s average qualified research expenses (qres) for the.

r&d tax credit calculation example uk Rod Rhea

Web the r&d tax credit calculator is best viewed in chrome or firefox. R&d tax credit calculation using the traditional method is based on 20% of a company's current year qres over a base amount. R&d tax credit calculator 1. Average the company’s qualified research expenses (qres) over. First, determine if your business is eligible..

R&D Tax Credit Rates For RDEC Scheme ForrestBrown

Generally, for startups five years old or. First, determine if your business is eligible. Web how do you calculate the r&d credit? Even if the us senate passes the bipartisan business tax bill the house ok’d last week, companies will still. R&d tax credit calculator 1. Multiply that average by 50%. Web the r&d tax.

Calculating R&D Tax Credit Even if the us senate passes the bipartisan business tax bill the house ok’d last week, companies will still. Tax preparation · tax planning · small business taxes · taxation · loans First, determine if your business is eligible. Organizations that seek to develop new or improve products. R&d tax credit calculator 1.

Web How To Calculate R&D Tax Credits.

Since the r&d tax credit was first introduced in 1981, both republican and democratic administrations have revised and extended it numerous. One of the leading reasons. Total the qres for the current tax year. It’s calculated on the basis of increases in research.

Web The Quick Answer The Research And Development Tax Credit (R&D Credit) Is A General Business Credit Available To Businesses That Created Or Improved A Product Or.

The results from our r&d tax credit calculator are only estimated figures and. Web follow these steps for regular research credit calculation: Identify your qualifying r&d spend (qualifying expenditure, or qe) the biggest part of an r&d tax credit application is knowing which of your costs you can. Section a is used to claim the regular.

Web Here Is A Quick Overview Of What You Need To Know About The R&D Tax Credit:

Web use the r&d tax credit calculator to give you an idea of how much you could be eligible for when filing your taxes. Web alternative simplified credit method. Web the r&d tax credit calculator is best viewed in chrome or firefox. Web how to fill out form 6765 to document their qualified r&d expenses, businesses must complete the four basic sections of form 6765:

Multiply That Average By 50%.

Web how do you calculate the r&d credit? Web how do you calculate the r&d tax credit using the alternative simplified credit method? Web estimate your federal and state r&d tax credit with our free tax credit calculator. Identify and calculate the average qres for the prior three years.