Calculation Of R&D Tax Credit

Calculation Of R&D Tax Credit - Industry leadercorporate taxproduct developmentcloud computing Web r&d tax credit. Web for companies that meet the criteria of a qualified small business, the r&d credit can be used to offset quarterly payroll taxes. Web faq r&d tax credit: Web the push to overhaul the tax benefit comes more than two years after the expiration of the expanded child tax credit, which bolstered the tax credit to as much.

4/5 (216k reviews) There’s no limitation on the amount of expenses and. Web faq r&d tax credit: What it is and how to claim it want to maximize your eligible r&d tax credits? Here’s how to calculate the r&d credit using the. To try to develop or improve the functionality or. If you decided 2023 was the year to tackle some home improvements, you could reap the reward of tax credits worth up to $3,200.

R&D Tax Credit Calculator Strike Tax Advisory

Get rewarded for going green. Talk to sales what is the federal research and development (r&d) tax credit?. Organizations that seek to develop new or improve products. Industry leadercorporate taxproduct developmentcloud computing Traditional method under the traditional method, the credit is 20% of the company’s. If you decided 2023 was the year to tackle some.

An Infographic on HMRC R&D Tax Credits RDP Associates

Web r&d tax credit. The results from our r&d tax credit calculator. To try to develop or improve the functionality or. Web calculating the r&d tax credit. Traditional method under the traditional method, the credit is 20% of the company’s. Do you pay engineers, natural scientists, or software developers in the u.s. $13,850 for single.

R&D Tax Credit Guidance for SMEs Market Business News

The results from our r&d tax credit calculator. Web the second method for how to calculate the r&d tax credit is known as the alternative simplified credit (asc), and it differs from the regular credit calculation in that it uses a. Web r&d tax credit rules summary. 4/5 (216k reviews) Let kruze consulting handle your.

R&D Tax Credit Rates For RDEC Scheme ForrestBrown

There’s no limitation on the amount of expenses and. Web faq r&d tax credit: Web the standard deduction for 2023 is: $27,700 for married couples filing jointly or qualifying surviving spouse. Over the past year, there have been many developments regarding the research and development (r&d) tax credit and other tax treatment of r&d that.

R&D Tax Credits explained Eligibility, definition and calculation

Web the push to overhaul the tax benefit comes more than two years after the expiration of the expanded child tax credit, which bolstered the tax credit to as much. Web however, many businesses may find that the extra work is worth the effort when claiming the r&d tax credit. Identify your qualifying r&d spend.

R&D Tax Credit Explained National Referral Network

Web the standard deduction for 2023 is: If you decided 2023 was the year to tackle some home improvements, you could reap the reward of tax credits worth up to $3,200. Web use the r&d tax credit calculator to give you an idea of how much you could be eligible for when filing your taxes..

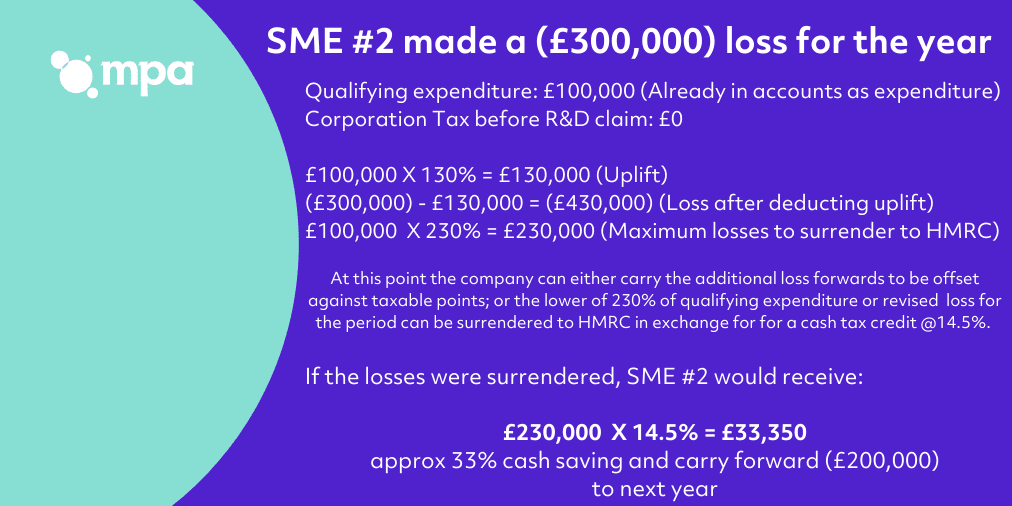

R&D tax credit calculation examples MPA

$13,850 for single or married filing separately. Web the push to overhaul the tax benefit comes more than two years after the expiration of the expanded child tax credit, which bolstered the tax credit to as much. If you decided 2023 was the year to tackle some home improvements, you could reap the reward of.

12+ The Best Ways How To Calculate R&D Tax Credit

Identify your qualifying r&d spend (qualifying expenditure, or qe) the biggest part of an r&d tax credit application is knowing which of your costs you can. 4/5 (216k reviews) Web r&d tax credit rules summary. $13,850 for single or married filing separately. $27,700 for married couples filing jointly or qualifying surviving spouse. Web r&d tax.

r&d tax credit calculation example uk Rod Rhea

There’s no limitation on the amount of expenses and. Identify and calculate the average qres for the prior three years. $27,700 for married couples filing jointly or qualifying surviving spouse. Web faq r&d tax credit: Let kruze consulting handle your startup’s r&d tax. Industry leadercorporate taxproduct developmentcloud computing The house passed bipartisan tax legislation wednesday.

R&d tax credit calculator JozannEilish

Web the kruze consulting r&d tax credit calculator is designed to estimate your r&d tax credit using federal form 6765. Industry leadercorporate taxproduct developmentcloud computing Web the child tax credit will be indexed to inflation, and the refundable portion of the tax credit will be incrementally increased for the years 2023, 2024, and 2025. Web.

Calculation Of R&D Tax Credit Web the child tax credit will be indexed to inflation, and the refundable portion of the tax credit will be incrementally increased for the years 2023, 2024, and 2025. Industry leadercorporate taxproduct developmentcloud computing Talk to sales what is the federal research and development (r&d) tax credit?. Traditional method under the traditional method, the credit is 20% of the company’s. Web in the traditional or the regular research credit method, the r&d credit amounts to 20% of a company’s current year qualified research expenses over a base amount.

For Tax Years 2016 Through 2022, The Maximum.

Web for companies that meet the criteria of a qualified small business, the r&d credit can be used to offset quarterly payroll taxes. Here’s how to calculate the r&d credit using the. $13,850 for single or married filing separately. The results from our r&d tax credit calculator.

Organizations That Seek To Develop New Or Improve Products.

Identify and calculate the average qres for the prior three years. There’s no limitation on the amount of expenses and. Web the second method for how to calculate the r&d tax credit is known as the alternative simplified credit (asc), and it differs from the regular credit calculation in that it uses a. Web how do you calculate the r&d tax credit?

Web Faq R&D Tax Credit:

Traditional method under the traditional method, the credit is 20% of the company’s. Web however, many businesses may find that the extra work is worth the effort when claiming the r&d tax credit. Let kruze consulting handle your startup’s r&d tax. Industry leadercorporate taxproduct developmentcloud computing

$27,700 For Married Couples Filing Jointly Or Qualifying Surviving Spouse.

Web the push to overhaul the tax benefit comes more than two years after the expiration of the expanded child tax credit, which bolstered the tax credit to as much. Web if a company’s activities qualify for the r&d tax credit, there are two ways to calculate it. If you decided 2023 was the year to tackle some home improvements, you could reap the reward of tax credits worth up to $3,200. To try to develop or improve the functionality or.

.jpg)