California Nanny Tax Calculator

California Nanny Tax Calculator - Web use the free nanny tax calculator from care.com homepay to see your 2022 nanny payroll, budget and tax breaks. Web use the nanny tax calculator to: Web calculate your nanny’s tax withholdings. This may vary if you have previous employees. Web household employer if you pay wages to people who work in or around your home, you may be considered a household employer.

Web form 1099 is only for payment made in connection with a trade or business. Web household employer if you pay wages to people who work in or around your home, you may be considered a household employer. Web the 2024 state minimum wage rate in california is $16/hour for all employers. Our free nanny tax calculator can help you estimate your tax obligations as an employer. Compare rates, get tax breaks and avoid penalties. Poppins payroll ® happily presents an easier way to handle taxes and payroll for nannies, housekeepers, senior. Verify how much you paid your.

Guide to Nanny Taxes

Compare rates, get tax breaks and avoid penalties. Web california income tax rate: Web the nanny tax calculator for 2015 and 2016 taxes you will need to enter your nanny’s gross weekly pay and the number of weeks you paid your nanny. Customize using your filing status, deductions, exemptions and more. You need to accurately.

How to Calculate Your Nanny Taxes

Web california income tax rate: Customize using your filing status, deductions, exemptions and more. Web household employer if you pay wages to people who work in or around your home, you may be considered a household employer. Web what is the nanny tax? Census bureau) number of cities that have local income taxes: The nanny.

How to Calculate Nanny Taxes (2023) LetCalculate

With a nanny tax calculator, you can: You must withhold 7.65 percent of their wages for social security and medicare (fica) taxes. Web calculate your nanny’s tax withholdings. Web the nanny tax calculator for 2015 and 2016 taxes you will need to enter your nanny’s gross weekly pay and the number of weeks you paid.

Lavonia

You must withhold 7.65 percent of their wages for social security and medicare (fica) taxes. Poppins payroll ® happily presents an easier way to handle taxes and payroll for nannies, housekeepers, senior. Census bureau) number of cities that have local income taxes: Customize using your filing status, deductions, exemptions and more. Web california requires a.

Nanny Taxes Guide How to Easily File for 20202021 Sittercity

Web use the free nanny tax calculator from care.com homepay to see your 2022 nanny payroll, budget and tax breaks. Web form 1099 is only for payment made in connection with a trade or business. Web nanny tax calculator. Our free nanny tax calculator can help you estimate your tax obligations as an employer. With.

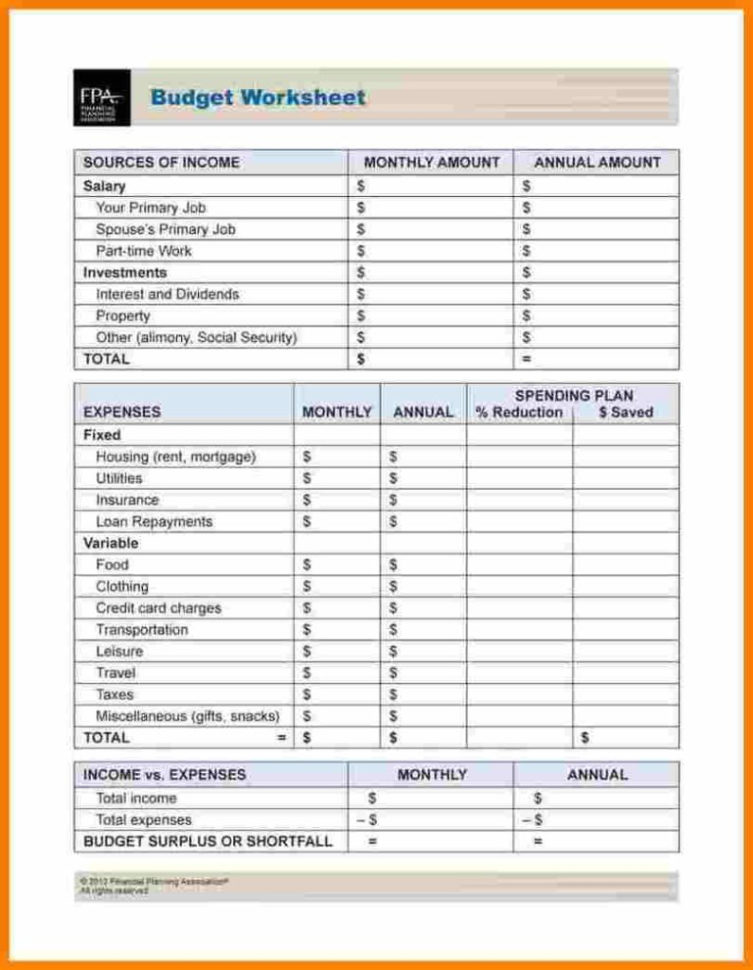

Nanny Tax Calculator Spreadsheet —

Web find out how much you'll pay in california state income taxes given your annual income. Web what is the nanny tax? Web nanny tax calculator. Web form 1099 is only for payment made in connection with a trade or business. Census bureau) number of cities that have local income taxes: Care.com has been visited.

Nanny Taxes Explained TL;DR Accounting

Web the 2024 state minimum wage rate in california is $16/hour for all employers. Web use the nanny tax calculator to: Web calculate and track payroll: Web household employer if you pay wages to people who work in or around your home, you may be considered a household employer. It’s also helpful for you to.

5 Answers You Need When Using a Nanny Tax Calculator

Web calculate and track payroll: Refer to the table below for a list of workers. Web nanny tax calculator. Web california income tax rate: Web use the free nanny tax calculator from care.com homepay to see your 2022 nanny payroll, budget and tax breaks. You must withhold 7.65 percent of their wages for social security.

Nanny taxes and payroll Stepbystep instructions for setting it up

Census bureau) number of cities that have local income taxes: With a nanny tax calculator, you can: Compare rates, get tax breaks and avoid penalties. Customize using your filing status, deductions, exemptions and more. Refer to the table below for a list of workers. Care.com has been visited by 100k+ users in the past month.

Nanny Pay Calculator Save Time! Nanny Parent Connection

Web what is the nanny tax? This may vary if you have previous employees. It’s also helpful for you to see what. Your nanny can also use the tool to determine their. Customize using your filing status, deductions, exemptions and more. With a nanny tax calculator, you can: Web 2023 payroll tax rates, taxable wage.

California Nanny Tax Calculator With the minimum wage in california being $15.50 per hour, you can expect to pay a hourly rate between $15.50. Unemployment insurance (ui) • the 2023 taxable wage limit is $7,000 per employee. Web find out how much you'll pay in california state income taxes given your annual income. Web what is the nanny tax? Web california requires a new employer state unemployment insurance tax of 3.4% for the first $7,000 wages paid to each employee.

This May Vary If You Have Previous Employees.

Our free nanny tax calculator can help you estimate your tax obligations as an employer. Compare rates, get tax breaks and avoid penalties. California local minimum wage rates for household employees these california cities have a. Web calculate and track payroll:

Customize Using Your Filing Status, Deductions, Exemptions And More.

Web the average cost of a nanny in california is $18.99 per hour. Web the easiest way for you to estimate your nanny tax obligation is to use a nanny tax calculator. Care.com has been visited by 100k+ users in the past month Web what is the nanny tax?

With A Nanny Tax Calculator, You Can:

Web nanny tax calculator. They do not apply to household employment. Web find out how much you'll pay in california state income taxes given your annual income. Web the nanny tax calculator for 2015 and 2016 taxes you will need to enter your nanny’s gross weekly pay and the number of weeks you paid your nanny.

Refer To The Table Below For A List Of Workers.

It’s also helpful for you to see what. Web household employer if you pay wages to people who work in or around your home, you may be considered a household employer. Web use the nanny tax calculator to: Web the 2024 state minimum wage rate in california is $16/hour for all employers.