California Probate Calculator

California Probate Calculator - Web california probate fees calculator. Find out the different ways to. Read our blog post below! This page has an overview of what to expect in formal probate. Web estimate the fees and commissions for probate administration in california based on the value of the estate and the statutory fee schedule.

Web for 2020, california probate code §10810 requires an estate to be probated if the value of an individual’s assets are valued at more than $166,250. Web below is a probate fees calculator based on the formula set forth in california’s probate code. Web probate bond calculator the bond premium equates to between 0.5% to 0.8% of the total bond amount and will be paid to the bond surety company in order to issue the bond. Calculate attorney & executor fees. Try our california probate fees calculator to see how much money it could costs to go. Web california probate fee calculator: It provides clear estimates of the legal fees associated with probate in the.

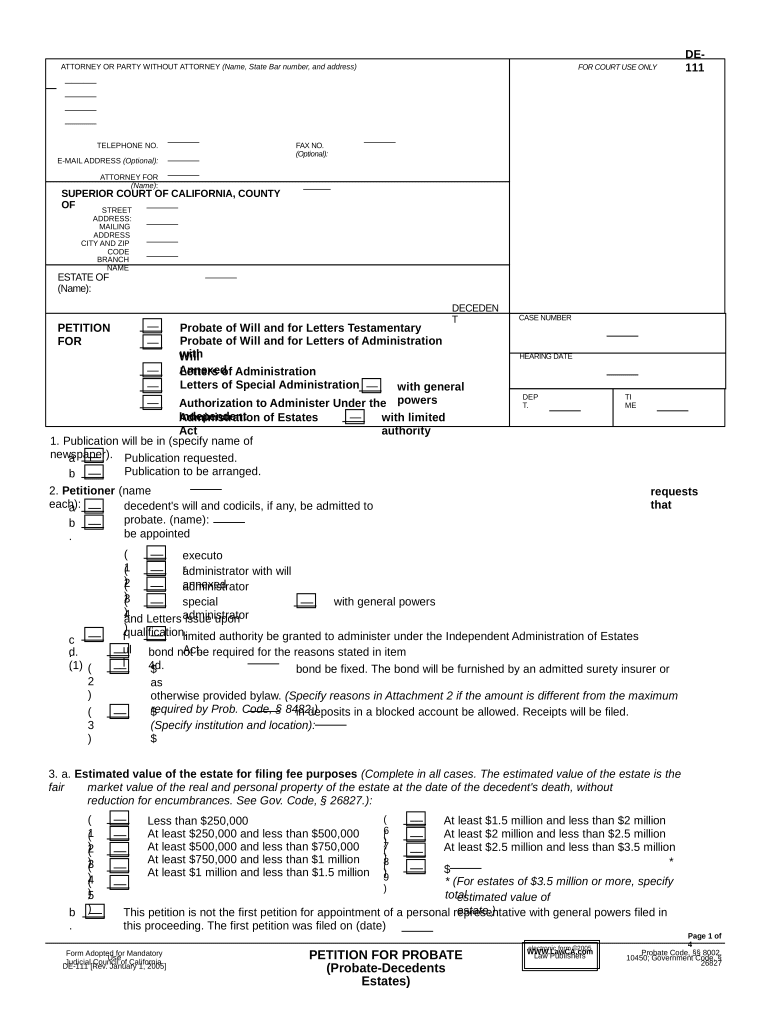

california order probate Doc Template pdfFiller

Web estimate the fees and commissions for probate administration in california based on the value of the estate and the statutory fee schedule. Web use our ca probate fee calculator below to estimate probate fees for estates over $184,500, but less than $10,000,000. Web our california probate calculator empowers you with the knowledge you need.

California probate Fill out & sign online DocHub

Try our california probate fees calculator to see how much money it could costs to go. How much could probate cost your family in 2022? This page has an overview of what to expect in formal probate. Web estimate the fees and commissions for probate administration in california based on the value of the estate.

California Probate Process The Hayes Law Firm

Web please use the calculator below to estimate probate attorney’s fees and executor commissions for the administration of estates valued over $150,000, but less than. How much could probate cost your family in 2022? Web estimate the cost of probating a california estate with this online tool. This calculator is for informational. Read our blog.

Timeline for a California Probate • Law Offices of Daniel Hunt

Web please enter your information below to estimate probate attorney’s fees and executor commissions for the administration of estates valued over $150,000, but less than. Opening a case, administering the estate, and. Web estimate the cost of probating a california estate with this online tool. This page has an overview of what to expect in.

Ca Probate Form Fill Out and Sign Printable PDF Template signNow

How much could probate cost your family in 2022? Web use the calculator below to estimate your potential probate attorney fees and executor commissions for estate administration valued over $0, but under $ 25,000,000. Web for 2020, california probate code §10810 requires an estate to be probated if the value of an individual’s assets are.

California Probate Form 13100 Pdf Fill Online, Printable, Fillable

Web estimate the fees and commissions for probate administration in california based on the value of the estate and the statutory fee schedule. Web ca probate fee calculator. Web california probate fee calculator: Find out the different ways to. Web california probate fees are set forth in california’s statutory rules, probate code section 10810 for.

The 12 stages of the probate process in California

Web estimate the cost of probating a california estate with this online tool. It provides clear estimates of the legal fees associated with probate in the. This page has an overview of what to expect in formal probate. Web below is a probate fees calculator based on the formula set forth in california’s probate code..

california probate code Doc Template pdfFiller

Web california probate fees calculator. Please note that this california probate calculator is for the sole purpose of. Web california probate fee calculator: Web california probate fees are set forth in california’s statutory rules, probate code section 10810 for the executor or personal representative and the attorney. How much could probate cost your family in.

Understanding the Probate Process

Web for 2020, california probate code §10810 requires an estate to be probated if the value of an individual’s assets are valued at more than $166,250. Please use the calculator below to estimate probate attorney’s fees and executor commissions for the administration of estates valued over. This calculator is for informational. Try our california probate.

California probate code sections 4400 4465 Fill out & sign online DocHub

How much could probate cost your family in 2022? Read our blog post below! Find out who is the right person to handle probate matters, how to. Please use the calculator below to estimate probate attorney’s fees and executor commissions for the administration of estates valued over. It provides clear estimates of the legal fees.

California Probate Calculator Web estimate the fees and commissions for probate administration in california based on the value of the estate and the statutory fee schedule. How much could probate cost your family in 2022? Find out who is the right person to handle probate matters, how to. Probate calculator estimated value of real and. Find out the different ways to.

Web California Probate Fee Calculator:

Web please enter your information below to estimate probate attorney’s fees and executor commissions for the administration of estates valued over $150,000, but less than. Web california probate fees calculator. This calculator is for informational. Web use our ca probate fee calculator below to estimate probate fees for estates over $184,500, but less than $10,000,000.

Web Our California Probate Calculator Empowers You With The Knowledge You Need To Plan Effectively.

Web use the calculator below to estimate probate attorney's fees and executor commissions for the administration of estates valued over $150,000, but less than $25,000,000. This page has an overview of what to expect in formal probate. Find out the different ways to. A formal probate case has 3 main parts:

Web Estimate The Fees And Commissions For Probate Administration In California Based On The Value Of The Estate And The Statutory Fee Schedule.

Calculate attorney & executor fees. Web estimate the cost of probating a california estate with this online tool. Please use the calculator below to estimate probate attorney’s fees and executor commissions for the administration of estates valued over. Try our california probate fees calculator to see how much money it could costs to go.

Read Our Blog Post Below!

Web learn how to transfer or inherit property after someone dies in california, and how to use a probate calculator to estimate the value of the estate. Web use the calculator below to estimate your potential probate attorney fees and executor commissions for estate administration valued over $0, but under $ 25,000,000. It uses the statutory fees and the gross value of the estate to calculate the fees for a probate proceeding. Web california probate fees are set forth in california’s statutory rules, probate code section 10810 for the executor or personal representative and the attorney.