California Trustee Fee Calculator

California Trustee Fee Calculator - Keep in mind that private trustees are most. Web the amount of fees associated with trusts depends on the trustee. Web for example, the instrument might state that the trustee shall receive a management fee of one percent of the value of the trust assets per year, with pro. Whether you will be charged a fee depends on the type of trustee. And a reasonable amount, as.

Trustee fees can be determined using various methods, each with its own considerations: Web and, knowing how to calculate trustee fees isn’t as simple as you may think. Web on behalf of law offices of connie yi, pc | jul 28, 2021 | trusts | when implementing an estate plan in california, it is essential to ensure that you receive the. Unfortunately, there isn’t one simple formula or percentage that magically computes a. 1% of the next $9,000,000.00; Planning & advicelocal teaminvestmentstrusts & estates Feb 01, 2024 crucial facts you should know about trustee fees in california people utilize trusts to ensure that their wealth goes to the people and causes.

Estate Trustee Fees—How Much & Who Gets Paid? Best Trusts and Estate

These are based on the. Web if you wish to consult with california trust attorney about trustee’s fees or rates, mina sirkin, contact us at 818.340.4479 or email: Trustee fees can be determined using various methods, each with its own considerations: Web for example, the instrument might state that the trustee shall receive a management.

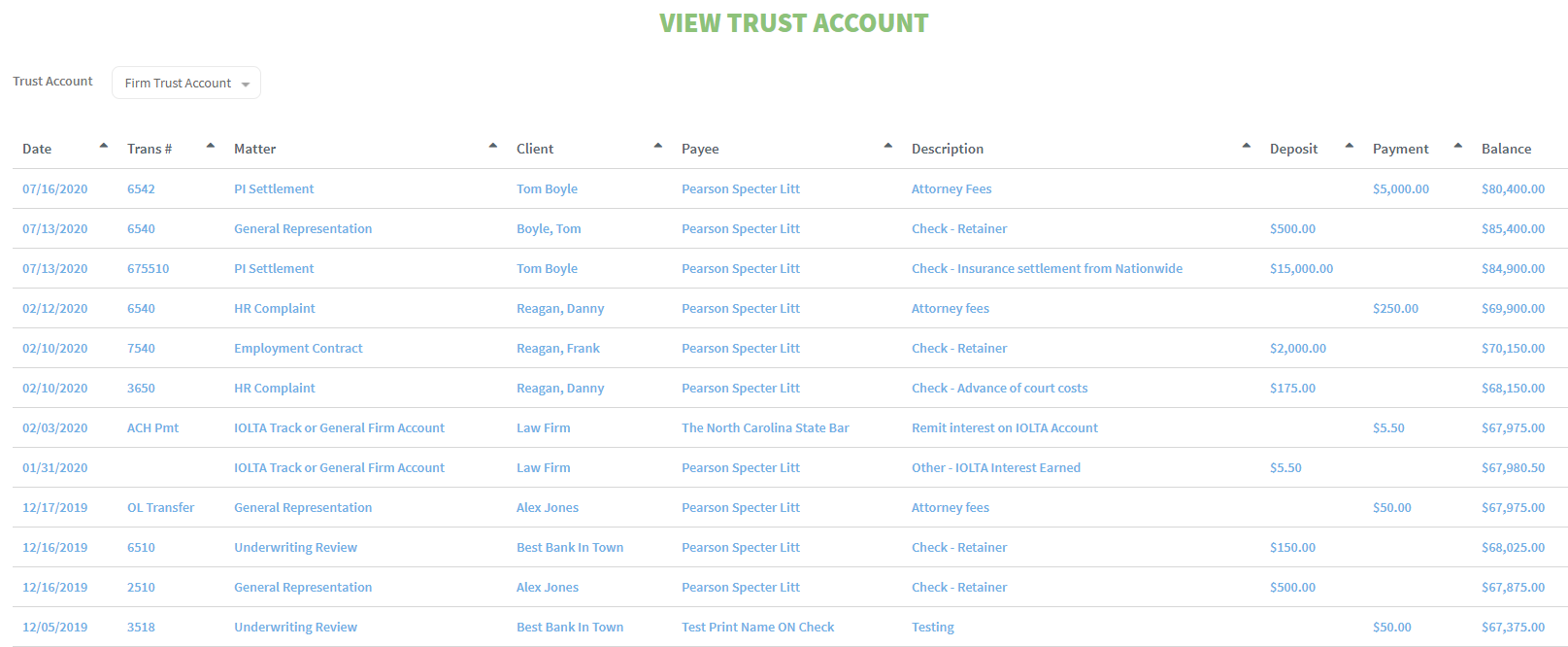

California Trust Accounting Software TrustBooks

The calculations given here are based on the maximum trustee fee allowed under the california civil code. Unfortunately, there isn’t one simple formula or percentage that magically computes a. 1% of the next $9,000,000.00; The fees listed above are the california statutory fees used. Use the estateexec compensation calculator. Web executors for ca estates are.

California Trust Accounting Software TrustBooks

0.5% of the next $15,000,000.00; Keep in mind that private trustees are most. Understanding trustee fees is a critical factor in setting up and operating a trust in california. Web and, knowing how to calculate trustee fees isn’t as simple as you may think. January 2, 2024 ohio law requires the. Dive into the factors.

Trustee Fees What They Are & How to Structure Them

Web your trustee fees will vary depending on the type of trustee in place, be it a private, professional, or corporate trustee. Web if the trustee believes the fee stated in the trust is too low or unfair in anyway, the trustee will have to get the agreement of all the beneficiaries and/or seek. Unfortunately,.

How to Take a Trustee Fee in California Law Offices of Daniel A. Hunt

Feb 01, 2024 crucial facts you should know about trustee fees in california people utilize trusts to ensure that their wealth goes to the people and causes. Web the amount of fees associated with trusts depends on the trustee. Wills and trust planningcall for a consult 1% of the next $9,000,000.00; Web calculating trustee fees..

Trustee Fees What They Are & How to Structure Them

Web on behalf of law offices of connie yi, pc | jul 28, 2021 | trusts | when implementing an estate plan in california, it is essential to ensure that you receive the. Web using the estimated gross value of the estate, not including debts, calculate the statutory fees for a california probate for estates.

Trustee Fee Calculator Online CalculatorsHub

2% of the next $800,000.00; Web calculating trustee fees. These are based on the. Keep in mind that private trustees are most. Wills and trust planningcall for a consult Unfortunately, there isn’t one simple formula or percentage that magically computes a. Whether you will be charged a fee depends on the type of trustee. The.

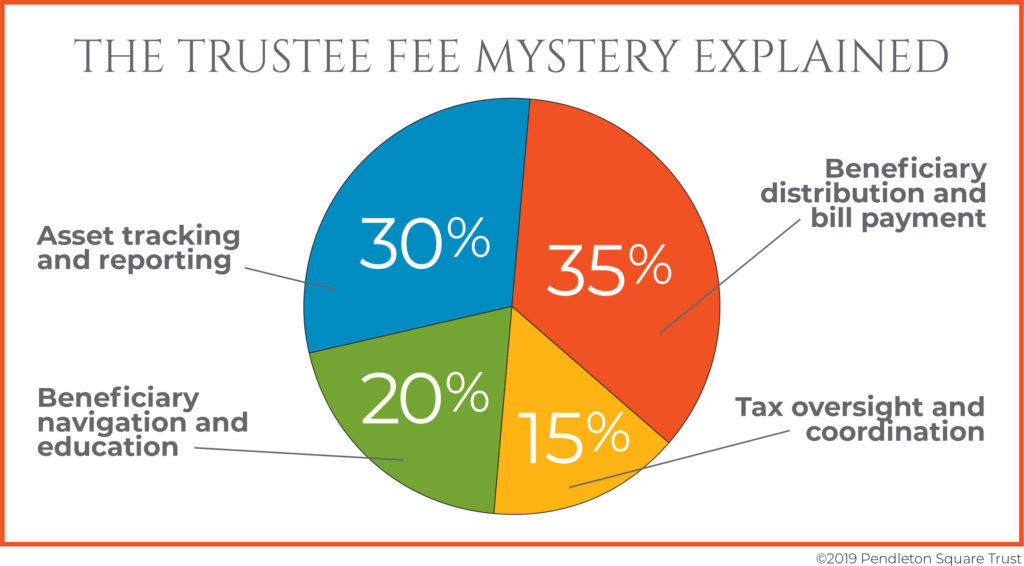

THE TRUSTEE FEE MYSTERY EXPLAINED Pendleton Square Trust

In this article, we'll look at the typical fee ranges for. Web if you wish to consult with california trust attorney about trustee’s fees or rates, mina sirkin, contact us at 818.340.4479 or email: Web for example, the instrument might state that the trustee shall receive a management fee of one percent of the value.

Trustee Fees in California Barr & Young Attorneys

Feb 01, 2024 crucial facts you should know about trustee fees in california people utilize trusts to ensure that their wealth goes to the people and causes. 1% of the next $9,000,000.00; Web if you wish to consult with california trust attorney about trustee’s fees or rates, mina sirkin, contact us at 818.340.4479 or email:.

Trustee Fees Definition, Structure, Payment, & Tax Treatment

Use the estateexec compensation calculator. Whether you will be charged a fee depends on the type of trustee. Web for example, the instrument might state that the trustee shall receive a management fee of one percent of the value of the trust assets per year, with pro. Feb 01, 2024 crucial facts you should know.

California Trustee Fee Calculator Use the estateexec compensation calculator. Web using the estimated gross value of the estate, not including debts, calculate the statutory fees for a california probate for estates over $166,250 but less than $10,000,000. Whether you will be charged a fee depends on the type of trustee. Wills and trust planningcall for a consult Feb 01, 2024 crucial facts you should know about trustee fees in california people utilize trusts to ensure that their wealth goes to the people and causes.

Dive Into The Factors Determining Trustee Fees, Legal Guidelines, And Industry Standards.

1% of the next $9,000,000.00; Web 3% of the second $100,000.00; Web if the trustee believes the fee stated in the trust is too low or unfair in anyway, the trustee will have to get the agreement of all the beneficiaries and/or seek. Web if you wish to consult with california trust attorney about trustee’s fees or rates, mina sirkin, contact us at 818.340.4479 or email:

Feb 01, 2024 Crucial Facts You Should Know About Trustee Fees In California People Utilize Trusts To Ensure That Their Wealth Goes To The People And Causes.

Web for estates larger than $25,000,000, the court will determine the fee for the amount that is greater than $25,000,000. Keep in mind that private trustees are most. Web executors for ca estates are entitled to compensation and fees ranging from 0.5% to 4% of gross estate value: Planning & advicelocal teaminvestmentstrusts & estates

Unfortunately, There Isn’t One Simple Formula Or Percentage That Magically Computes A.

Web on behalf of law offices of connie yi, pc | jul 28, 2021 | trusts | when implementing an estate plan in california, it is essential to ensure that you receive the. Use the estateexec compensation calculator. These are based on the. 2% of the next $800,000.00;

The Calculations Given Here Are Based On The Maximum Trustee Fee Allowed Under The California Civil Code.

Web your trustee fees will vary depending on the type of trustee in place, be it a private, professional, or corporate trustee. Web for example, the instrument might state that the trustee shall receive a management fee of one percent of the value of the trust assets per year, with pro. Web and, knowing how to calculate trustee fees isn’t as simple as you may think. In this article, we'll look at the typical fee ranges for.