Capital Gains Investment Property Calculator

Capital Gains Investment Property Calculator - Web many people know the basics of the capital gains tax. Above that income level, the rate goes up to 20 percent. Web you’ll pay 15 percent on capital gains if your income ranges from $44,626 to $492,300. For example, if you purchased an investment property for $100,000 plus $5,000 in closing costs, and then added $20,000 in improvements over the years, your. Capital gains taxes also don’t apply to.

This includes the purchase price,. Hanging onto an investment for more than a year can lower your capital gains taxes significantly. Web you’ll pay 15 percent on capital gains if your income ranges from $44,626 to $492,300. Web the capital gains tax calculator can also help you with your tax planning to find out if you have a capital gain or loss and compare your tax outcome of a short term. As with all other tax brackets, the government only taxes the amount that exceeds this. Capital gains taxes also don’t apply to. Say you bought 500 shares of the xyz fund 10 years ago for $10 per share for a total cost of $5,000 (for the sake of.

Capital Gains Calculator For Property 2021 ★ Know Your Tax Liability

Web the capital gains tax calculator can also help you with your tax planning to find out if you have a capital gain or loss and compare your tax outcome of a short term. For example, if you purchased an investment property for $100,000 plus $5,000 in closing costs, and then added $20,000 in improvements.

What is Capital Gains Yield? Formula + Calculator

$70,000 (gains) − $4,500 (losses) = $65,500; Web $59,750 for head of household. Web access capital gains tax calculators, 1031 identification/closing deadline calculators, commercial real estate analysis spreadsheets, and more. For example, if you purchased an investment property for $100,000 plus $5,000 in closing costs, and then added $20,000 in improvements over the years, your..

Capital Gain Tax on Sale of Property Short Term and Long Term Capital

Web capital gains tax: $70,000 (gains) − $4,500 (losses) = $65,500; Web the capital gains tax calculator can also help you with your tax planning to find out if you have a capital gain or loss and compare your tax outcome of a short term. Calculate your capital gains tax. Above that income level, the.

Capital Gains Yield (Meaning, Formula) How to Calculate?

Web capital gains tax: Gains on the sale of personal or investment property held for more than one year are taxed at favorable. Web capital gains tax calculator selling your property? When calculating your tax on the appreciated value of the asset you’re selling, be sure to include any. Web use this tool to estimate.

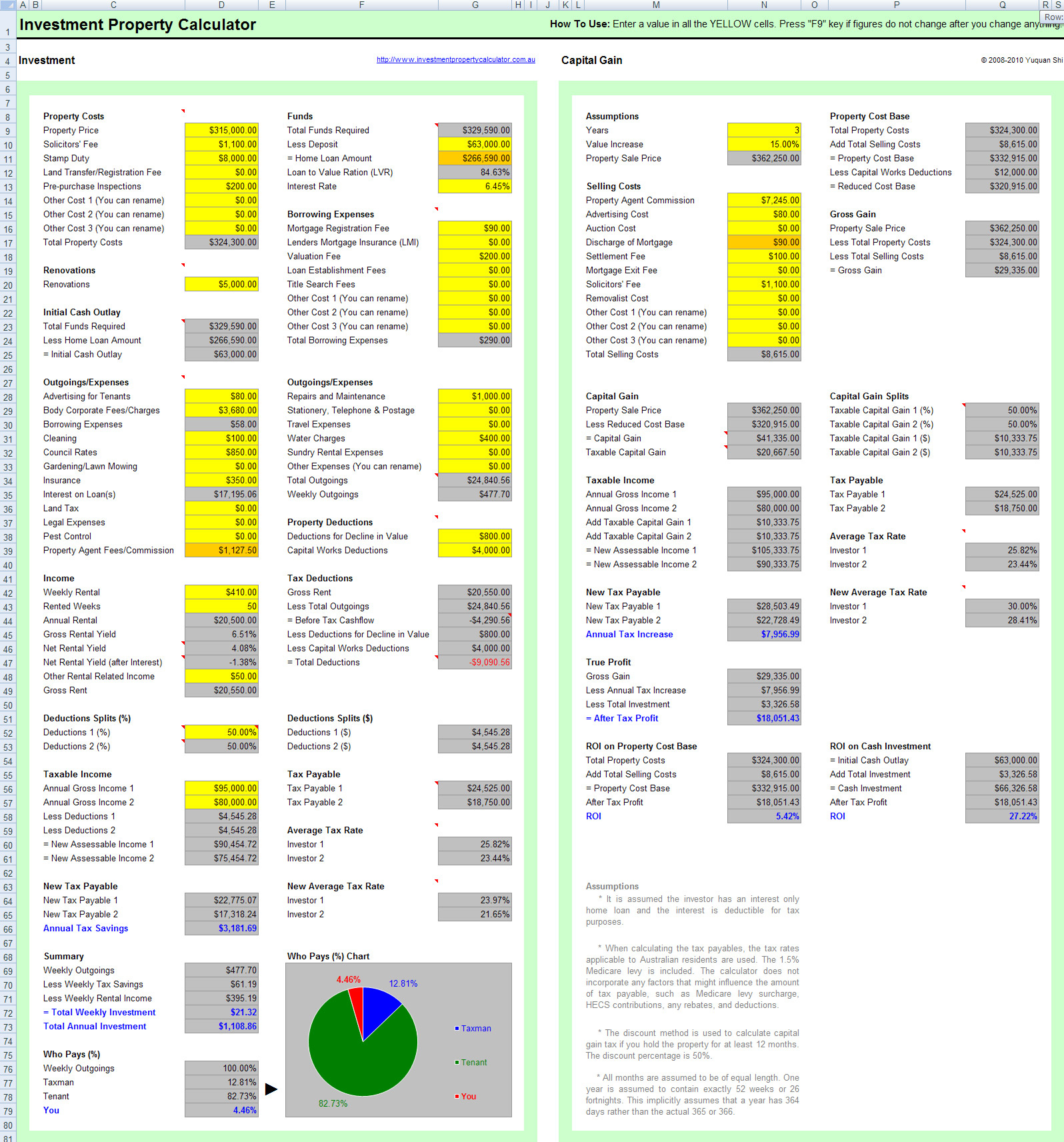

Capital Gains Tax Spreadsheet Australia Inside Free Investment Property

Gains on the sale of personal or investment property held for more than one year are taxed at favorable. For example, if you purchased an investment property for $100,000 plus $5,000 in closing costs, and then added $20,000 in improvements over the years, your. Web tips for lowering capital gains taxes. This calculator will help.

Real Estate Capital Gains Tax Calculator Guide Mashvisor

For example, if you purchased an investment property for $100,000 plus $5,000 in closing costs, and then added $20,000 in improvements over the years, your. Webull.com has been visited by 100k+ users in the past month Web rhi also had a capital gain of $70,000 on her investment property (see previous example). This calculator will.

How to Calculate Capital Gains Tax on Real Estate Investment Property

As with all other tax brackets, the government only taxes the amount that exceeds this. $70,000 (gains) − $4,500 (losses) = $65,500; Say you bought 500 shares of the xyz fund 10 years ago for $10 per share for a total cost of $5,000 (for the sake of. Web tips for lowering capital gains taxes..

Free Land Capital Gains Tax Calculator

Web rhi also had a capital gain of $70,000 on her investment property (see previous example). As with all other tax brackets, the government only taxes the amount that exceeds this. Calculate your capital gains tax. Hanging onto an investment for more than a year can lower your capital gains taxes significantly. Gains on the.

Capital Gain Formula Calculator (Examples with Excel Template)

As with all other tax brackets, the government only taxes the amount that exceeds this. Web use this tool to estimate capital gains taxes you may owe after selling an investment property. $70,000 (gains) − $4,500 (losses) = $65,500; When calculating your tax on the appreciated value of the asset you’re selling, be sure to.

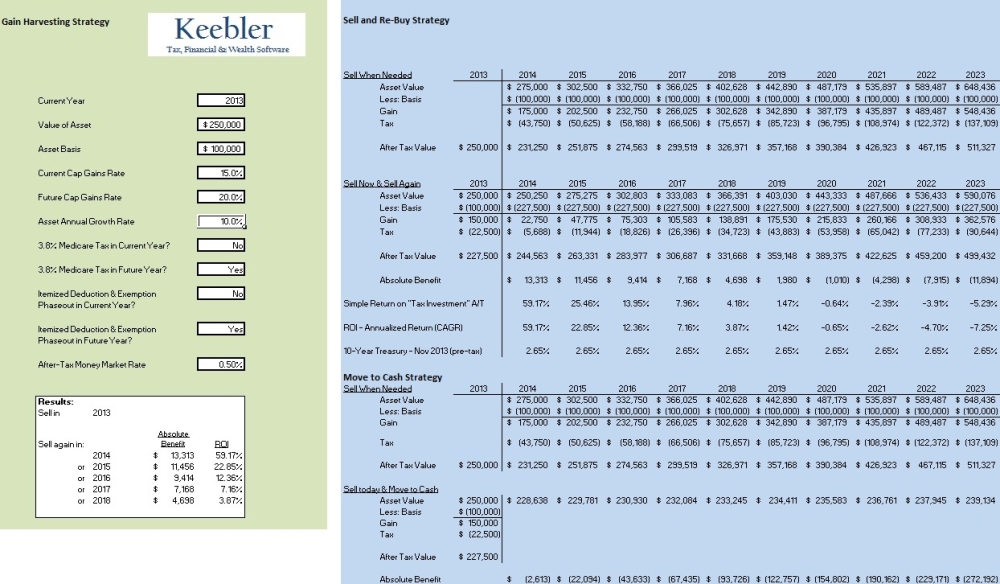

Capital Gains Harvesting Calculator Ultimate Estate Planner

Say you bought 500 shares of the xyz fund 10 years ago for $10 per share for a total cost of $5,000 (for the sake of. $70,000 (gains) − $4,500 (losses) = $65,500; Web you’ll pay 15 percent on capital gains if your income ranges from $44,626 to $492,300. Web access capital gains tax calculators,.

Capital Gains Investment Property Calculator Web access capital gains tax calculators, 1031 identification/closing deadline calculators, commercial real estate analysis spreadsheets, and more. $70,000 (gains) − $4,500 (losses) = $65,500; Web you’ll pay 15 percent on capital gains if your income ranges from $44,626 to $492,300. Webull.com has been visited by 100k+ users in the past month When calculating your tax on the appreciated value of the asset you’re selling, be sure to include any.

This Calculator Will Help You.

To get started, simply enter key details about your investment property in our capital gains calculator. Web you’ll pay 15 percent on capital gains if your income ranges from $44,626 to $492,300. Depending on your taxable income you may have to pay capital gains tax (cgt) on the sale. How it works, rates and calculator.

Rhi Has A Capital Gain.

Web capital gains tax calculator selling your property? Webull.com has been visited by 100k+ users in the past month When calculating your tax on the appreciated value of the asset you’re selling, be sure to include any. Web rhi also had a capital gain of $70,000 on her investment property (see previous example).

Calculate Your Capital Gains Tax.

Hanging onto an investment for more than a year can lower your capital gains taxes significantly. Web the capital gains tax calculator can also help you with your tax planning to find out if you have a capital gain or loss and compare your tax outcome of a short term. Web use this tool to estimate capital gains taxes you may owe after selling an investment property. As with all other tax brackets, the government only taxes the amount that exceeds this.

Web Forbes Advisor's Capital Gains Tax Calculator Helps Estimate The Taxes You'll Pay On Profits Or Losses On Sale Of Assets Such As Real Estate, Stocks & Bonds For The.

Web $59,750 for head of household. Web capital gains tax: Capital gains tax is the tax paid. Web enter your investment property details.